The former SEC chair said in an interview with CNBC that the approval of a spot Bitcoin ETF is inevitable, and “there's nothing left to decide.” Jay Clayton's confident statement hints at an imminent breakthrough in the regulatory environment for Bitcoin-related financial products. It also aligns with the growing sentiment within the Bitcoin community, eagerly anticipating the approval.

CNBC reported that the SEC’s approval could occur as soon as Wednesday, with VanEck CEO suggesting that trading could go live on Thursday.

Meanwhile, the current SEC chair, Gary Gensler, added some fuel to the ‘rug pull of the decade’ concerns, posting another warning against investing in crypto, where he highlighted the risks involved — a stance that some interpret as a potential sign of 'capitulation.’

(Thread)

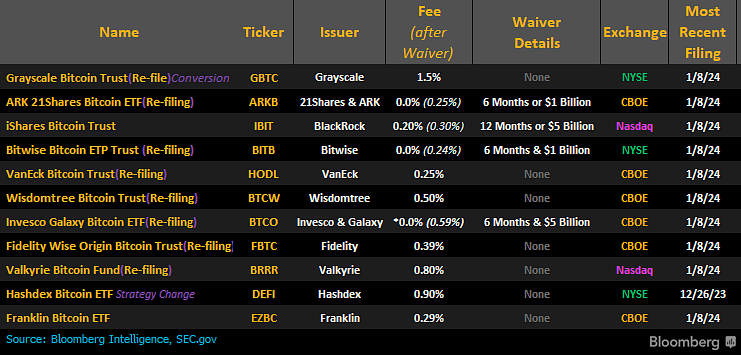

In the meantime, competition over fee sizes has already begun among ETF applicants, as many crypto and TradFi analysts noted. Below are some of the management fees that ETF providers have revealed.

(Source: James Seyffart, Bloomberg)

As VanEck’s advisor Gabor Gurbacs pointed out:

The incentive for the ETF issuers is to get as much bitcoin as quickly as possible at launch, so the pricing structures are coming in low: 0.25% is the same as 0.5% if the price of bitcoin doubles.

“Bitcoin ETFs are coming in with pricing structures in the low double digit range and many with waivers and discounts.

This clearly benefits the holders. However, it scares me when little to no money is made. Issuers will look elsewhere to make money (securities lending, trading, etc).

I personally just like an upfront higher fees with clear and sustainable incentives. If possible a deep look into total cost of ownership. But that’s not how the ETF pricing battles go. People like to see low numbers,” – Gabor Gurbacs

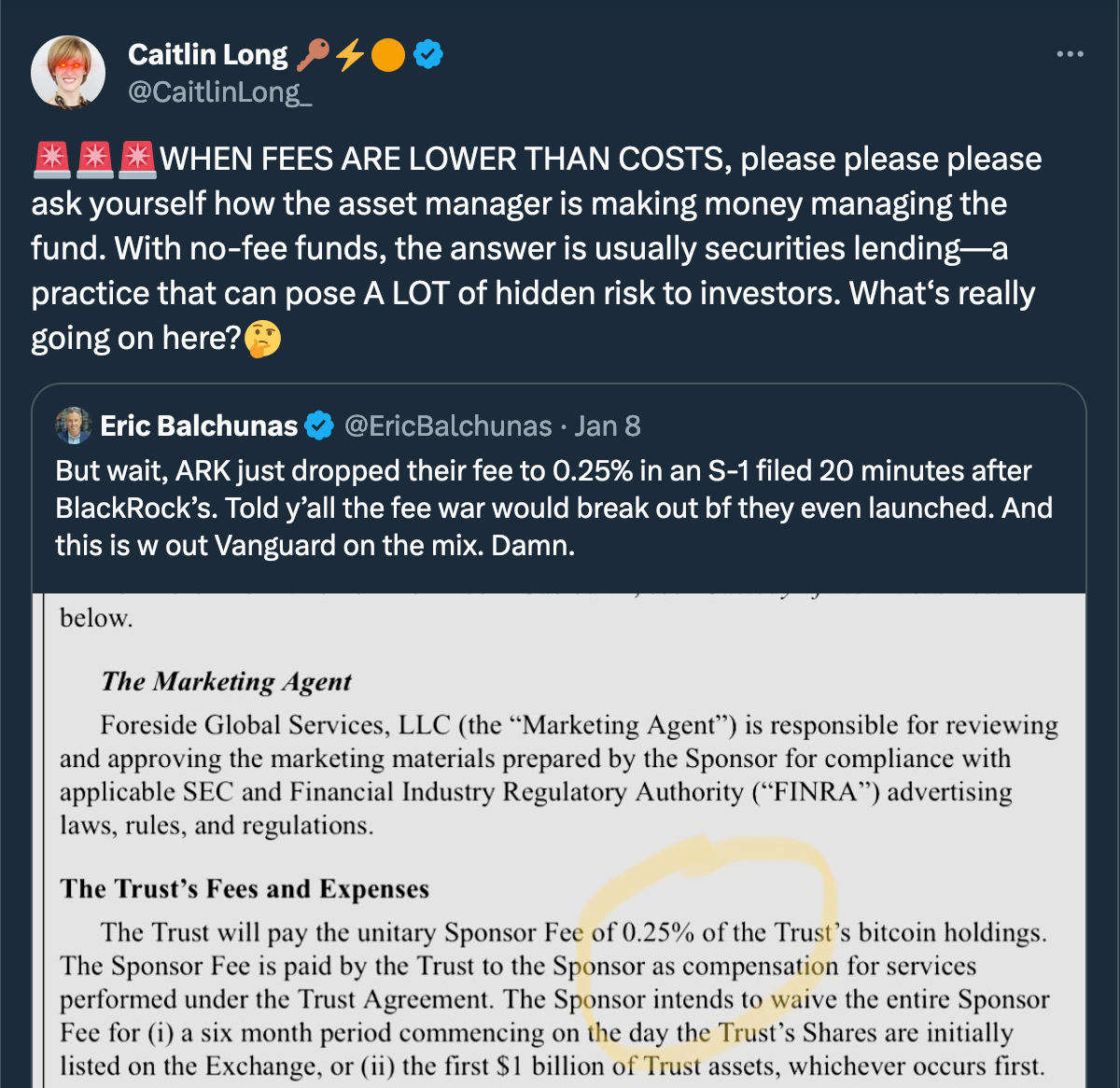

We’re currently witnessing an unprecedented situation where 11-14 issuers are launching at once and forced to compete. Having set their fee structures, they are now expected to hit the advertising hard. This appears promising for crypto in the mid-term, though it comes with a downside, as explained by Caitlin Long in a Forbes article.

(Thread)

Caitlin's key point is that the ETF acts as a double-edged sword regarding financialization. Initially tied to the fees debate, its role expands significantly once lending enters the picture. Big players are expected to engage in lending to boost their earnings, adding another layer of complexity to the landscape:

“That brings us to the second—and negative—definition of financialization, which I’ll refer to as ‘leverage-based financialization.’ This is the process of creating something out of nothing,” – Caitlin Long, Forbes

That’s the price of Wall Street’s capital inflow — hugely net-positive in the mid-term, yet it comes with a substantial downturn and, in the longer term, could even pose an existential threat in the hypothetical extreme scenario outlined by Arthur Hayes in his recent post.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.