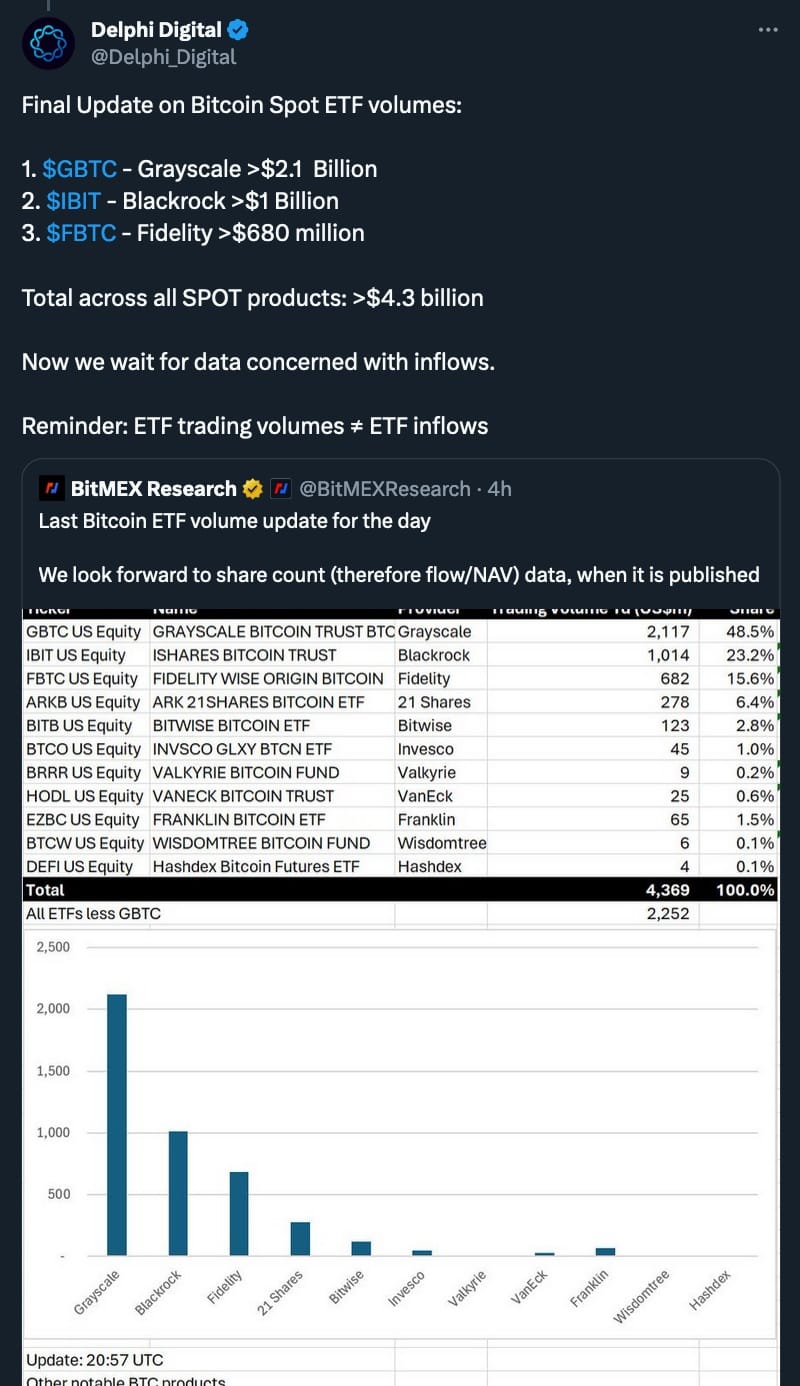

After a long battle, the SEC formally approved 11 Bitcoin spot ETFs for retail investors on Wednesday, marking a significant milestone for the crypto market. Trading started on Thursday, with an initial surge in volume that exceeded $1 billion within minutes. By the end of the first day, however, it settled at approximately $2.6 billion.

(X post)

An ETF, or exchange-traded fund, is a financial instrument whose value is directly tied to an external asset, like a commodity, stock, or a group of assets. ETFs are traded on stock exchanges, similar to individual stocks, allowing investors to buy and sell shares.

The approval of Bitcoin spot ETFs marks a pivotal moment, potentially normalizing and popularizing Bitcoin as an investment for a wider audience. Given the extensive integration of ETFs in mainstream finance, many investors might indirectly participate in it without even knowing — through mutual funds, pensions, etc., all of which often include popular ETFs in their portfolios. This could presumably lead to widespread investment in Bitcoin, positively impacting its public perception and financial valuation.

Against this backdrop, Bitcoin’s price has briefly approached $49,000 for the first time since 2021 before settling back down to ~$46,000 at the time of writing, where it continues to consolidate with long wicks in both directions.

On higher timeframes, however, the overall uptrend appears solid, with a breakout from the short bullish flag pattern. If not invalidated, that trend can propel bitcoin’s price to the mid-50,000s and further, as fears about the “sell the news” event dissipate, K33 Research analysts noted.

“I truly believe that the massive leverage flush last week on the Matrixport report and the fake news of the ETF approval two days ago took the wind out of the sails of the big news event - which is not a bad thing. … Either way, this party is just getting started, and I anticipate a slow grind up for Bitcoin, with all of the volatility and major dips we have already gotten in the past,” — Scott Melker, The Wolf Den.

In other [not so] surprising developments, Ethereum completely stole the show, with the ETH price diverging sharply from bitcoin amid speculation over potential Ethereum ETF approval in May.

One certainty about ‘crypto natives’ is that they love to search for the next narrative, and regarding potential spot ETFs, ETH is the obvious choice. After the historic approval of a Bitcoin spot ETF on Wednesday, analysts are now suggesting the spot ETH ETF could be imminent.

ETH/BTC 1W chart (Source: The Wolf Den newsletter)

ETH/USD 3D chart (Source: Peter Brandt in X)

Ethereum could melt faces for the next few months, playing catch-up and then some. However, Ethereum is not the only one that went up — altcoins generally performed well vs. Bitcoin. Given Ethereum’s role as a bellwether for the entire altcoin market, one may expect huge moves across the board.

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.