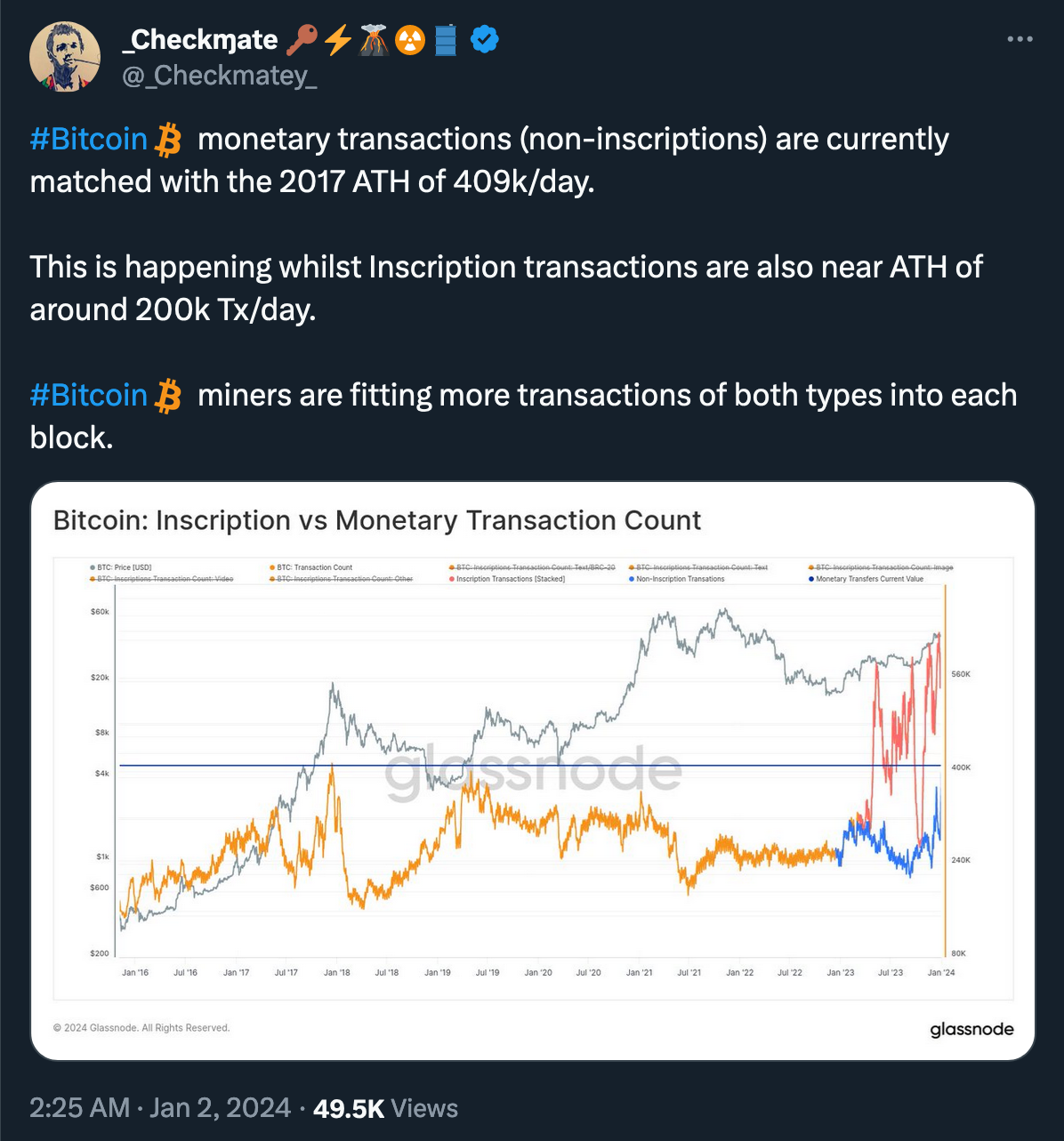

On-chain data shows both Inscription and monetary-related Bitcoin transactions are nearing their all-time highs. This rise in Bitcoin transfers, along with a surge in BTC price, has resulted in increased revenues for miners who reinvest these profits in purchasing more equipment in the face of the upcoming halving event and in anticipation of the potential ‘fee flippening.’

Inscriptions, which had previously lost interest, are now seeing renewed and relatively sustained activity among blockchain users. Additionally, there has been a significant increase in monetary transactions on the Bitcoin network. This surge, largely attributed to the price rally, reached the previous all-time high of 409,000 daily transactions recorded in 2017.

(Source)

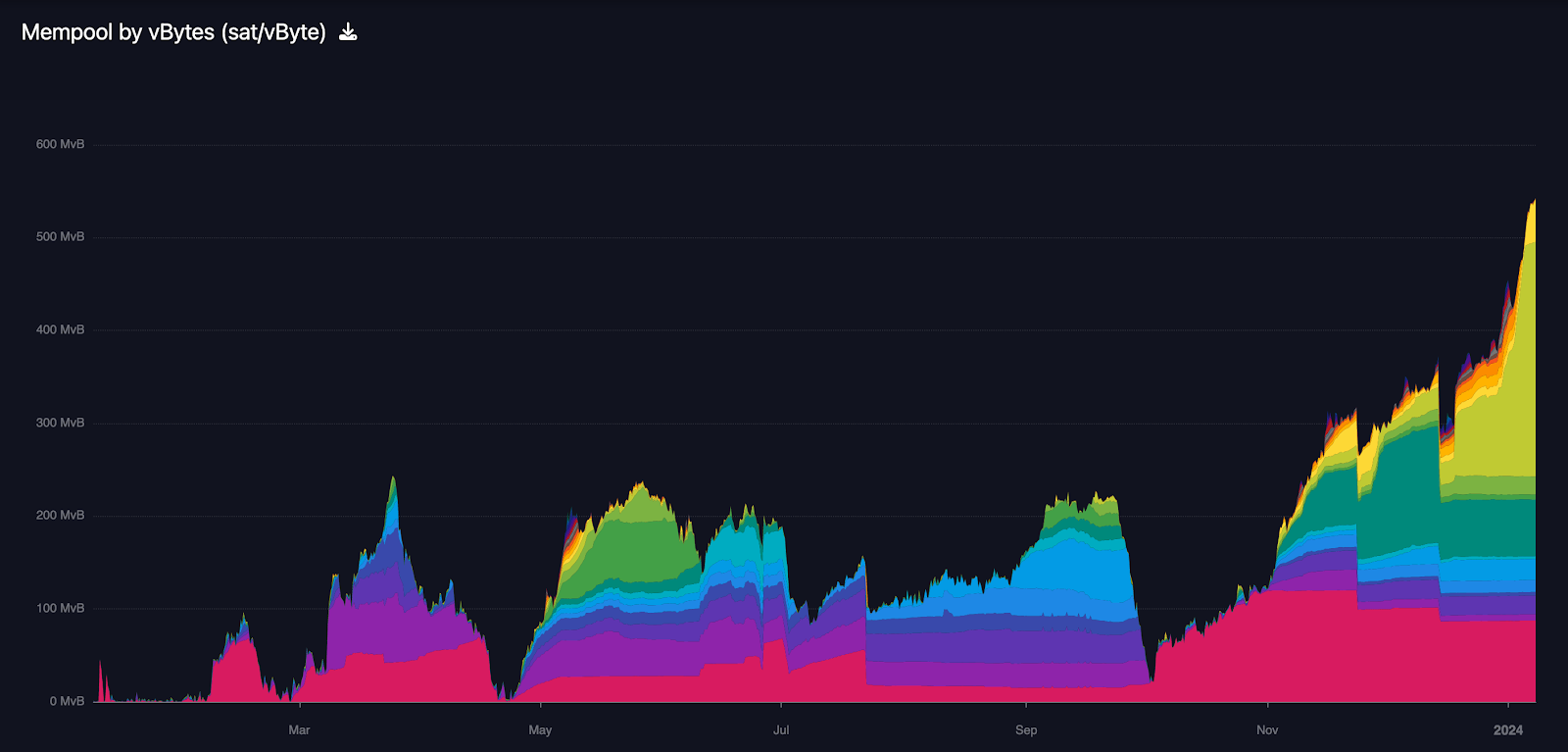

Inscription transactions, inherently different from standard token transfers on the blockchain, also generate revenue for miners through transfer fees. With limited blockchain capacity, miners prioritize transactions with higher fees. Thus, during periods of high network traffic, those seeking to avoid their transactions stuck in the mempool for a long time have no choice but to pay competitive fees, contributing to an increase in the average fee across the network.

(Source: mempool.space)

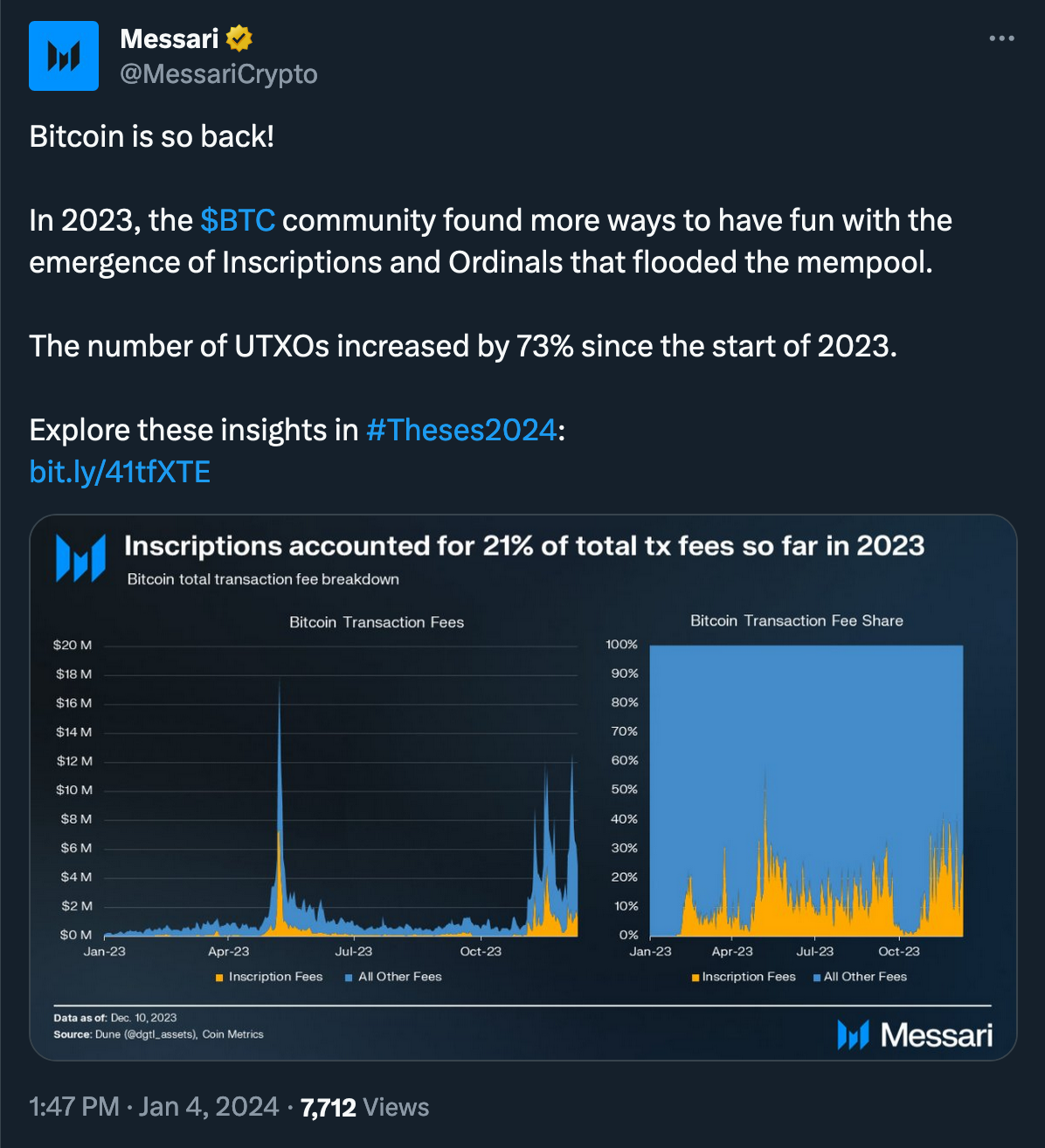

So far in the history of Bitcoin, miners have primarily relied on block rewards for revenue, as transaction fees have generally been low. However, with the rise of Inscriptions, fee revenue is finally gaining some balance.

A major concern about Bitcoin's long-term security model, specifically whether transaction fees alone can sufficiently incentivize miners, has been mitigated by recent developments. Lately, transaction fee rewards have surpassed mining subsidies multiple times, and in December, fees were double the block reward. And we’re still in the early stages of Bitcoin's halving schedule.

(Marathon’s press release, deleted since then, though)

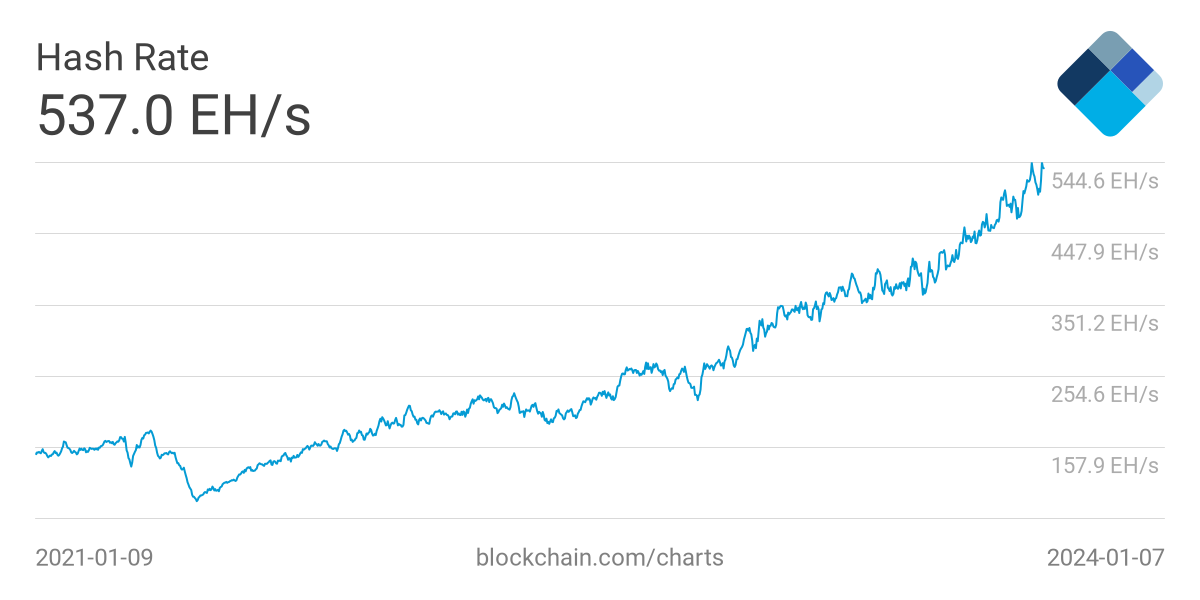

With the upcoming Bitcoin halving, miners are prepping by investing in more efficient machines, resulting in Bitcoin’s hash rate continuing to make new all-time highs.

(Source: Blockchain.com)

In light of the expected 'fee flippening,' where network commissions per block are projected to surpass the block subsidy in the next halving cycle consistently, mining might seem undervalued. Expectations of Bitcoin's value going ‘to the moon’ exceeding $100k further fuel this perspective, making it look like one should go all in on Bitcoin miners immediately.

However, the cost of transactions in such a scenario will rise above $200, leading to no one will use Bitcoin unless absolutely necessary. Thus, although the trajectory of mining growth appears promising, its development is unlikely to be straightforward and predictable. It's important to avoid overly simplistic narratives; in the end, the market will inevitably resolve these current tensions in one way or another.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.