Bitcoin spot ETFs might finally start trading in the U.S. as soon as next week, after the decade-long road to SEC’s approval. Opinions about the impact of a Bitcoin ETF on the crypto market vary widely, ranging from a monumental influx of Wall Street money to nothing extraordinary at all, depending on whom you ask. So what’s to be expected? Will they or won’t they? And what could happen in each scenario?

Decrypt outlined three possible scenarios in a recent post.

1. Bitcoin ETF Doesn’t Get Approved

Gensler is executing a ‘rug pull of the decade’ after all—technically, it is still possible. Despite the general consensus that ETF approval has become a ‘political necessity’ for the SEC, with a 90% chance of that happening by January 10, Markus Thielen, an analyst at Jihan Wu’s Matrixport, expects, also based on political reasoning, that the SEC will reject all the Bitcoin spot ETFs again:

“The current five-person voting Commissioners leadership critical for the ETF approval of the SEC is dominated by Democrats. SEC Chair Gensler is not embracing crypto in the US. … Based on Gensler’s comments in December 2023, he still sees this industry in need of more stringent compliance. From a political perspective, there is no reason to approve a Bitcoin Spot ETF that would legitimize Bitcoin as an alternative store of value,” — Matrixport report.

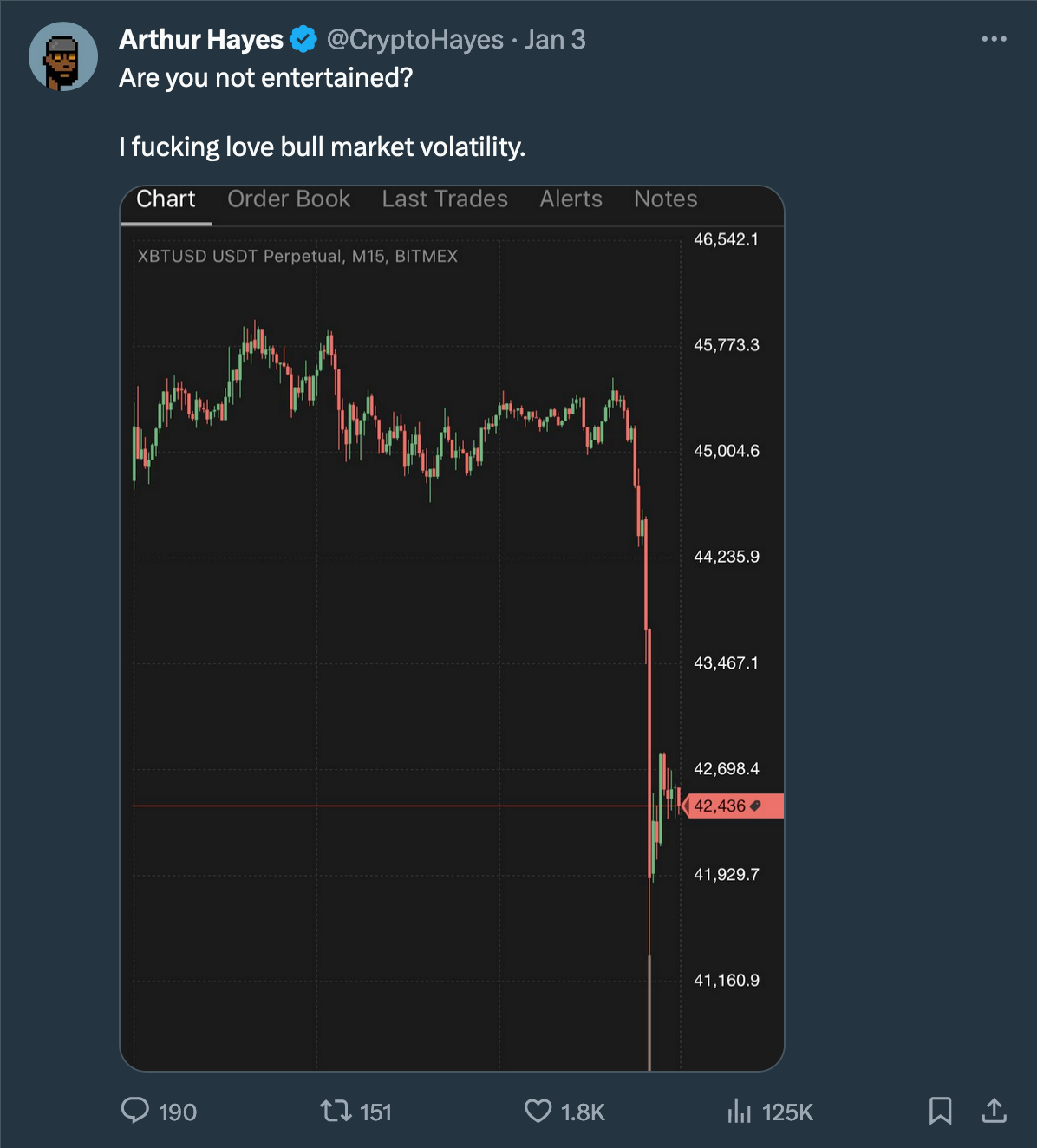

In that scenario, the crypto market is unlikely to respond favorably to the news. We got a glimpse of the potential carnage this Wednesday when the price of Bitcoin crashed by approximately 8% within minutes.

2. One Bitcoin ETF Issuer ‘Steals the Show'

The SEC is reviewing applications for Bitcoin spot ETFs from 14 high-profile firms, including the likes of BlackRock, WisdomTree, VanEck, and other Wall Street ‘baldies.’ Numerous TradFi analysts have suggested that a lot of ETFs could be approved on the same day, and if that happens, interest could be distributed across these different offerings.

However, there is also the possibility of Grayscale getting the green light to convert its popular Bitcoin Trust (GBTC) into a spot ETF concurrently. If this happens, it could ‘steal the show,’ as Decrypt puts it, significantly catching investors’ attention and potentially overshadowing other launches.

“If GBTC is included in that initial launch, it could get all the volume because there are a lot of people who are already in it that may want to unload it,” — Dave Nadig of data analytics company (Source).

Currently, only accredited investors can directly put cash into GBTC, although GBTC shares are readily available on the secondary market. But if the fund turns into an ETF, all investors with access to U.S. markets will be able to buy and sell shares of the ETF in real time.

3. ETFs Are Approved, But Don’t End Up Doing Very Well

Experts widely agree that Bitcoin spot ETF will probably perform well over the long term. In the short term, however, the concurrent launch of numerous ETFs, with investments being distributed among them, could result in quiet initial trading days, which may disappoint many retail investors.

However, throughout 2024, if approved, these Bitcoin ETF products are likely to attract significant capital. “There is demand for these products,” James Seyffart from Bloomberg Intelligence emphasizes. “There’s a reason so many issuers are trying to get a piece of the action.”

To sum it up, even with the bunch of Bitcoin spot ETF applications approved, the near-term result for the crypto market may not be so shiny and disappoint many. However, the short-term price action of bitcoin is a non-story in the larger perspective. Whether the price rises or falls by thousands of dollars on decision day, such movements will look like a minor blip on the chart over a year or two.

“Most of the public conversation is focused on the primary flows from retail and institutions into the bitcoin ETF. Those flows will be measured in tens of billions of dollars in the coming years. But another area of fresh demand will be what I call “secondary flows.” These are inflows to the ETF that will come from other publicly traded funds,” – Anthony Pompliano.

Among other “thoughts on the Bitcoin ETF that no one is talking about,” Anthony Pompliano brought up in a recent post, he pointed out that the crypto Twitter/X will also change once the ETFs are approved. “We have never had large financial institutions spending hundreds of millions of dollars to market Bitcoin to their clients.”

However, all investors who thought it would be as easy as “go long with leverage into the ETF approval” might be in for a big surprise. Bitcoin has had an impressive financial performance without the sustained support of major financial institutions allocating to the asset. That is going to change with endowments, pension funds, insurance companies, sovereign wealth funds, and other large organizations buying the spot ETF.

The benefit from this will be that Bitcoin is less likely to experience large 80% drawdowns in the future. The downside is that some of Bitcoin's volatility will be taken away, which implies it is unlikely to be as asymmetric to the upside as well. Bitcoin will likely continue to perform very well but don’t anticipate the asset going to $1 million overnight.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.