Richard Byworth, managing partner at SyzCapital, has sparked rumors suggesting that Bitcoin ETFs listed in Hong Kong may soon be available to investors from mainland China.

The recent launch of spot Bitcoin and Ether ETFs in Hong Kong on April 30 has created new avenues for Asian traders. Despite the disappointing first trading week for Hong Kong-based spot ETFs, Hong Kong’s proximity to China has fueled discussions on whether these ETFs could be accessible to mainland Chinese investors.

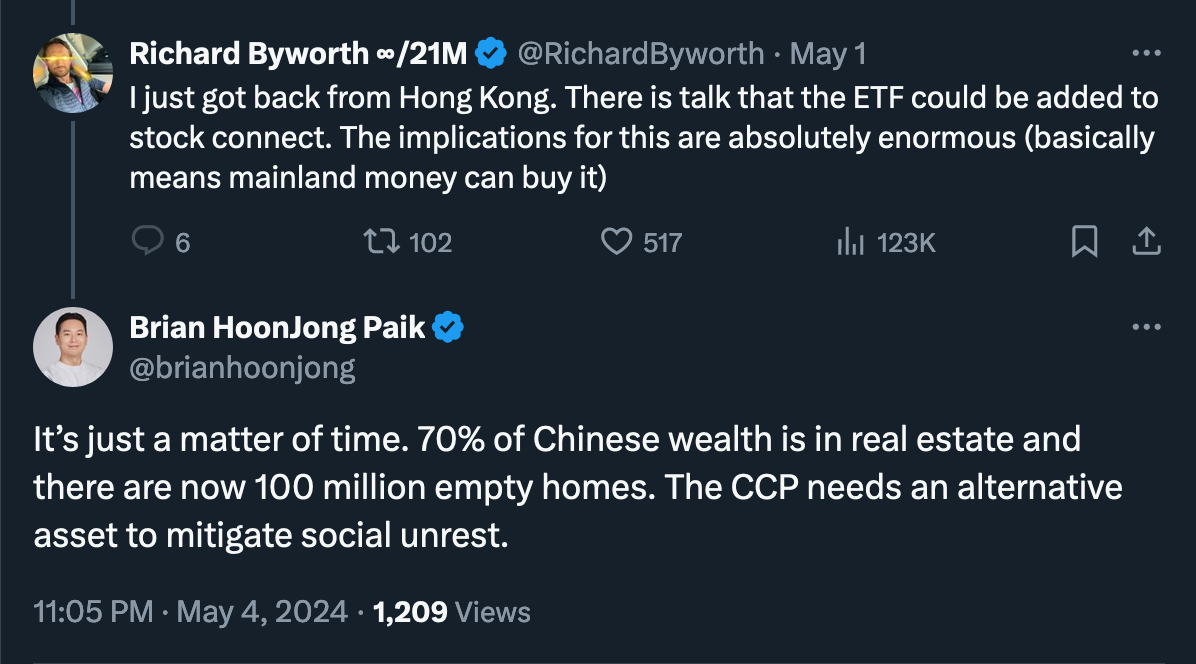

Byworth mentioned in response to Samson Mow on X that 'there is talk' about these new spot Bitcoin ETFs could be added to Stock Connect, a system that allows qualified investors from one market to access eligible shares in another market within a predefined quota.

Amid these rumors, Brian HoonJong Paik, a co-founder of SmashFi, qualified this as a common misconception, as if mainland Chinese investors are currently restricted from investing in ETFs available on the Hong Kong Stock Exchange.

(X post)

In his X post, Paik listed several trade arrangements between Shanghai and Hong Kong markets that already facilitate a robust flow of mainland capital into Hong Kong’s markets:

- Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect

- Qualified Domestic Institutional Investor (QDII) Scheme

- Individual Investments through Brokers

- Mutual Recognition of Funds (MRF) between Hong Kong and Mainland China

"These mechanisms make the Hong Kong stock market one of the most accessible foreign markets for Chinese investors, promoting financial integration between the Mainland and Hong Kong. Excluding only the Bitcoin ETF would likely cause significant repercussions among both institutional and retail investors in both China and Hong Kong," — Brian HoonJong Paik on X.

In 2021, China banned Bitcoin mining and prohibited foreign cryptocurrency exchanges from servicing mainland customers. Despite these strict regulations, persistent rumors suggest that enforcement may be lax. Moreover, Chinese courts have deemed BTC legal property in several jurisdictions.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.