The U.S. Securities and Exchange Commission has delayed decision-making on two proposed spot Ethereum exchange-traded funds (ETFs) by Franklin Templeton and Grayscale, pushing the decision deadline to June 11. After that, the SEC may either approve, disapprove, or initiate further proceedings. Meanwhile, the market optimism for a spot Ethereum ETF approval has fallen significantly over the past few months.

(Thread)

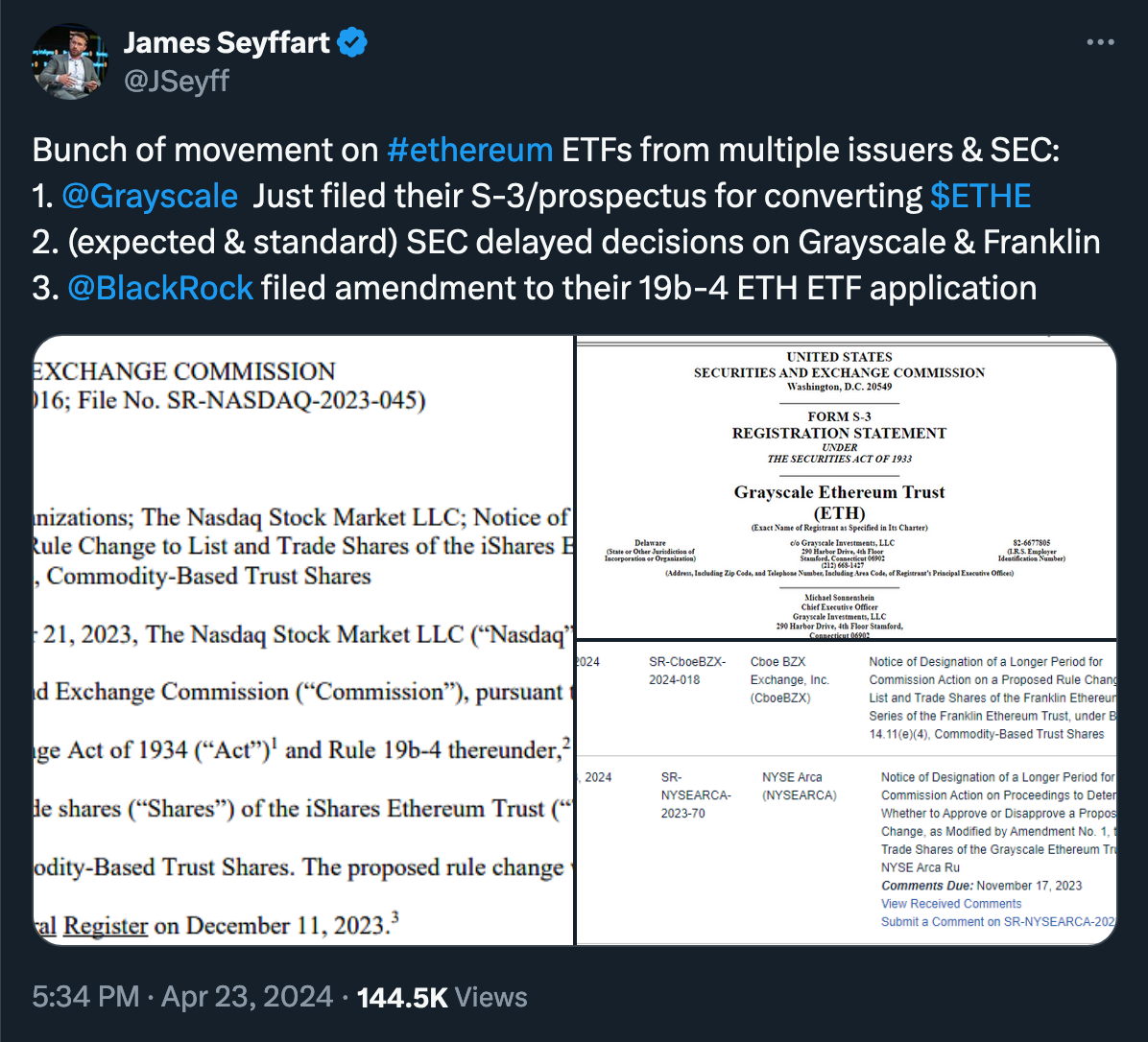

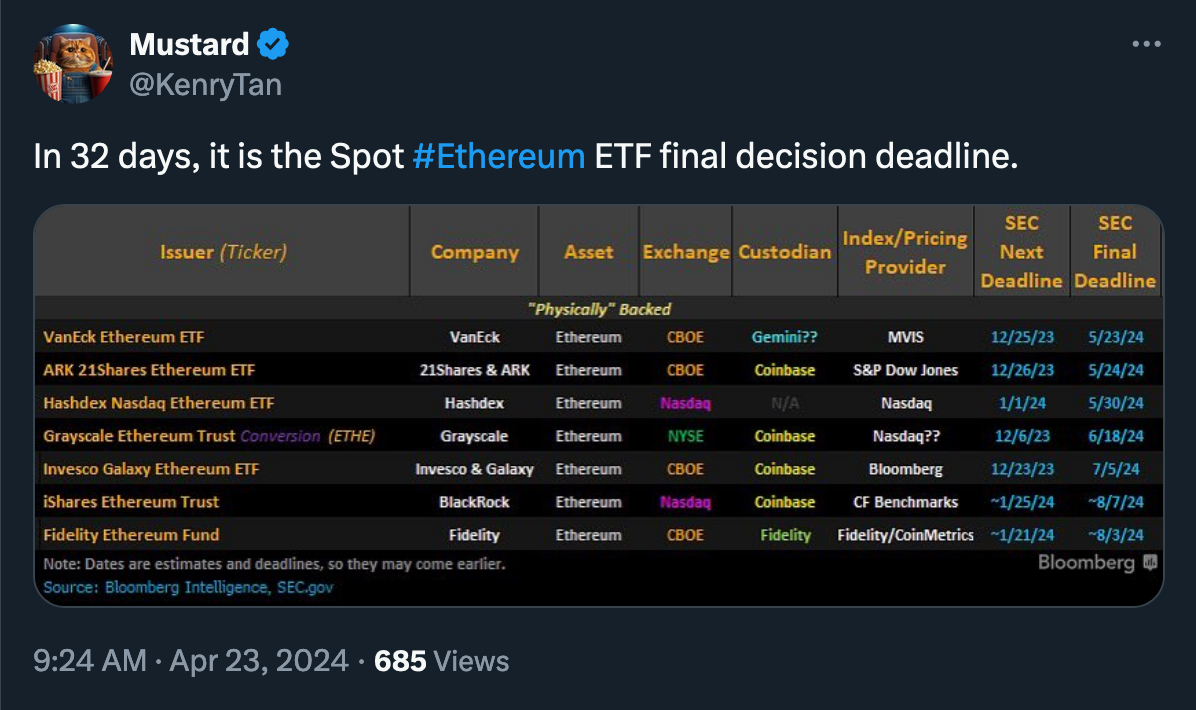

The SEC has delayed decision-making on the next steps for two proposed spot #Ethereum ETFs by Franklin Templeton and Grayscale. The agency pushed its timeline to decide to June 11 and June 23, 2024, for Franklin Templeton's and Grayscale's Ether spot ETFs correspondingly. In that deadlines, the SEC could approve or disapprove or institute proceedings corresponding proposals, the SEC said in its filing (PDF) on Tuesday.

"The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein." (SEC's filing, PDF)

(Thread)

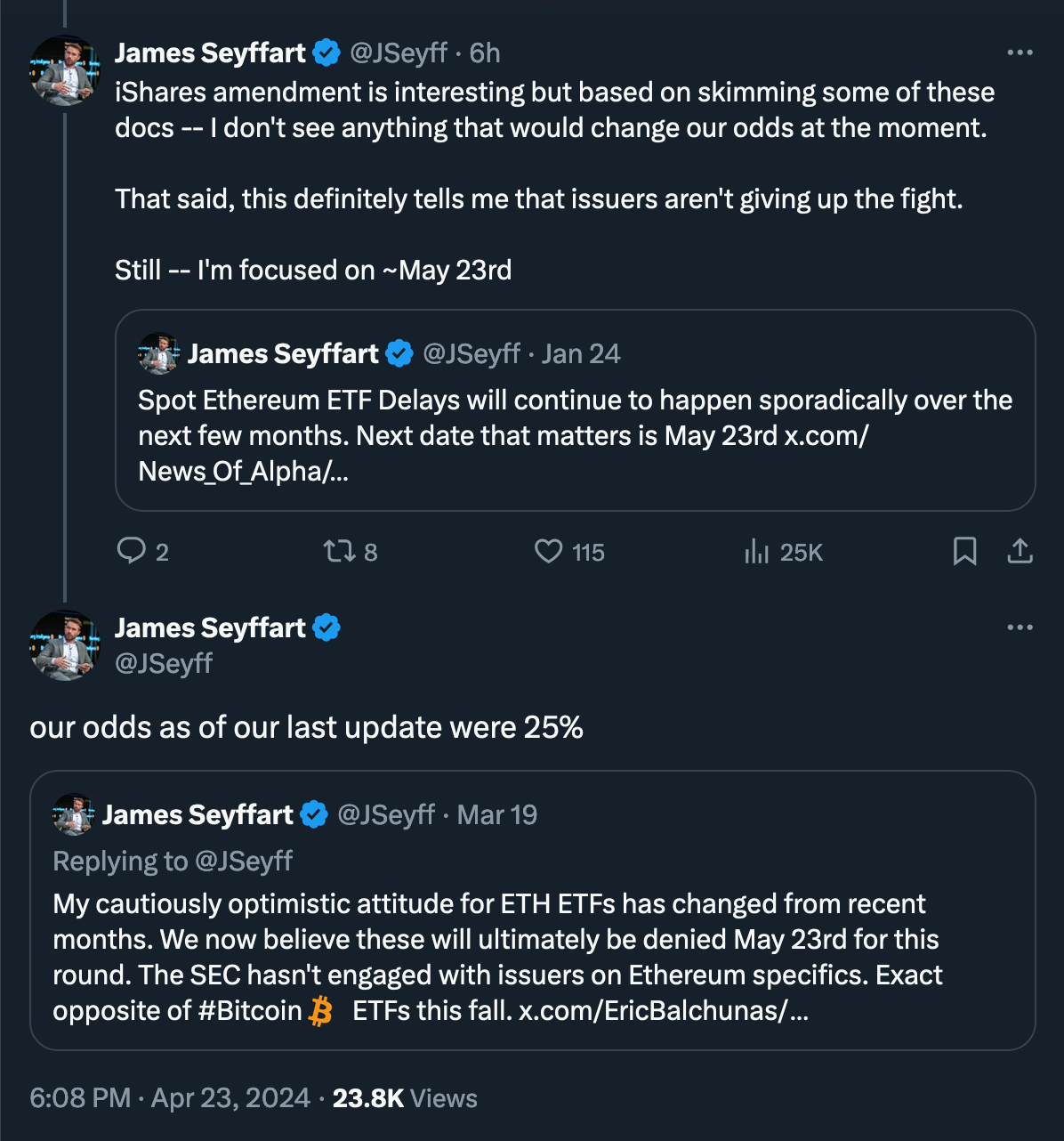

Earlier, the SEC delayed decisions on other spot Ethereum ETF applications, including the ones from VanEck and BlackRock. Meanwhile, optimism on the crypto market for the SEC approving such a product has steadily fallen over the past few months from ~75% to 11-16%.

JPMorgan estimates the likelihood of the spot Ether ETFs approval in May at "no more than 50%," Eric Balchunas, Senior ETF Analyst at @Bloomberg, suggests a 25% chance; finally, a prediction market on Polymarket assesses odds for approval in 11% (as per tweet above) to 16% at the time of writing.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.