The United States Securities and Exchange Commission (SEC) has filed a lawsuit against Binance with its CEO, Changpeng Zhao (CZ), and its affiliated companies, accusing them of numerous violations. The SEC alleges that Binance mishandled customer funds, engaged in misleading practices toward investors and regulators, and violated securities rules.

In total, the company and its founder face 13 federal charges. Binance and its affiliate BAM Trading have been accused of being involved in deceptive practices and redirecting funds to a separate investment fund owned by CZ.

According to the SEC, Binance and BAM Trading operated as an unregistered securities exchange, broker-dealer, and clearing agency. Additionally, they are accused of unlawfully selling unregistered securities, including $BNB and $BUSD, without adhering to the appropriate regulatory framework.

SEC Chair Gary Gensler strongly condemned Binance, accusing the exchange of participating in an "extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law." One senior executive allegedly told a compliance officer that the company operated "as a fking unlicensed securities exchange in the USA bro."

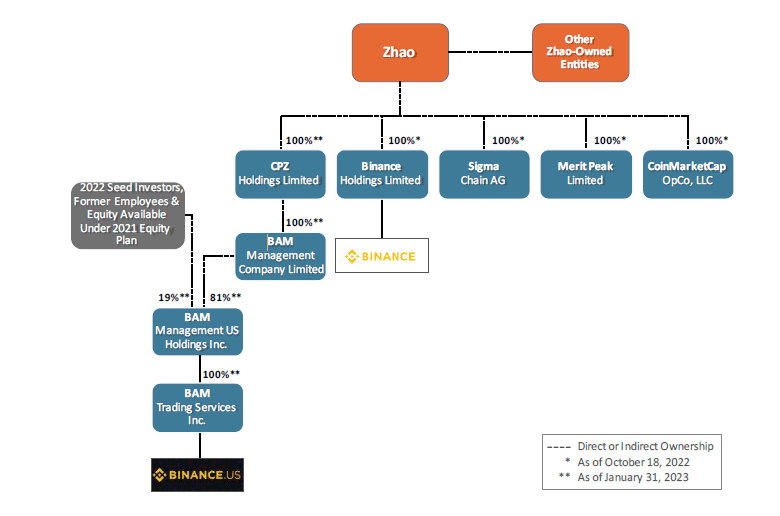

Ownership structure under Binance CEO Zhao, according to SEC (Source, PDF)

The lawsuit also includes references to the "Tai Chi" documents initially reported by Forbes in 2020. These documents outlined a purported plan for Binance to strategically exit the U.S. market while retaining a presence through an affiliated entity.

Additionally, the SEC asserts that Binance.US misrepresented its efforts to prevent market manipulation and enabled wash trading through an undisclosed trading firm referred to as "market-making," which is also owned by CZ.

Overview of Allegations

The SEC alleges that Binance and Zhao worked to subvert their own controls to allow high net worth U.S. investors and customers to continue trading on Binance's unregulated international exchange. One senior executive allegedly told a compliance officer that the company was operating as an unlicensed securities exchange in the USA. Furthermore, the SEC claims that Binance created Binance.US as a shield for the main company and Zhao, to reveal, retard, and resolve law enforcement targets and insulate Binance.

Binance's Revenue and U.S. Customers

According to the SEC's complaint, Binance earned $11.6 billion in revenue from June 2018 through July 2021, most of which came from transaction fees. Since its inception, the exchange has worked to entice U.S. customers, at the direction and control of its founder Zhao. Binance knew that tens of thousands of customers were in the U.S. but chose not to act, the SEC alleged, despite federal law barring the unregistered offer and sale of securities. Binance's ultimate compliance, in 2019, was largely a public show, the SEC complaint continues.

Evasion Plan for High Net Worth Customers

The SEC alleges Zhao ordered the creation of an evasion plan for high net worth customers, using a VPN service to hide their U.S. location and submitting compliance documents to obscure their country of origin. CNBC previously reported on how Binance employees encouraged users to evade the exchange's "know your customer" systems through VPNs.

Market-Making Companies Controlled by Zhao

The SEC also alleged that Binance and Zhao used market-making companies that they controlled to inflate trading prices and profit off their customers. Merit Peak and Sigma Chain allegedly acted as "market makers" for Binance's two platforms, meaning they were always available to fill a customer order to buy or sell a crypto asset. However, the SEC complaint highlighted multiple issues with the two companies' roles, as they were both beneficially owned by Zhao and collected tens of billions of dollars of customer money. The firms also mixed customer funds with Binance's money, similar to allegations against bankrupt crypto exchange FTX.

Wash Trading Allegations

Most damaging to investors, Merit Peak and Sigma Chain allegedly engaged in "wash trading," trading with themselves to artificially prop up the price of crypto assets. Sigma Chain collected $190 million for its beneficial owner Zhao, the SEC alleged. The "proprietary trading firm" then spent $11 million to purchase a "yacht," the complaint said.

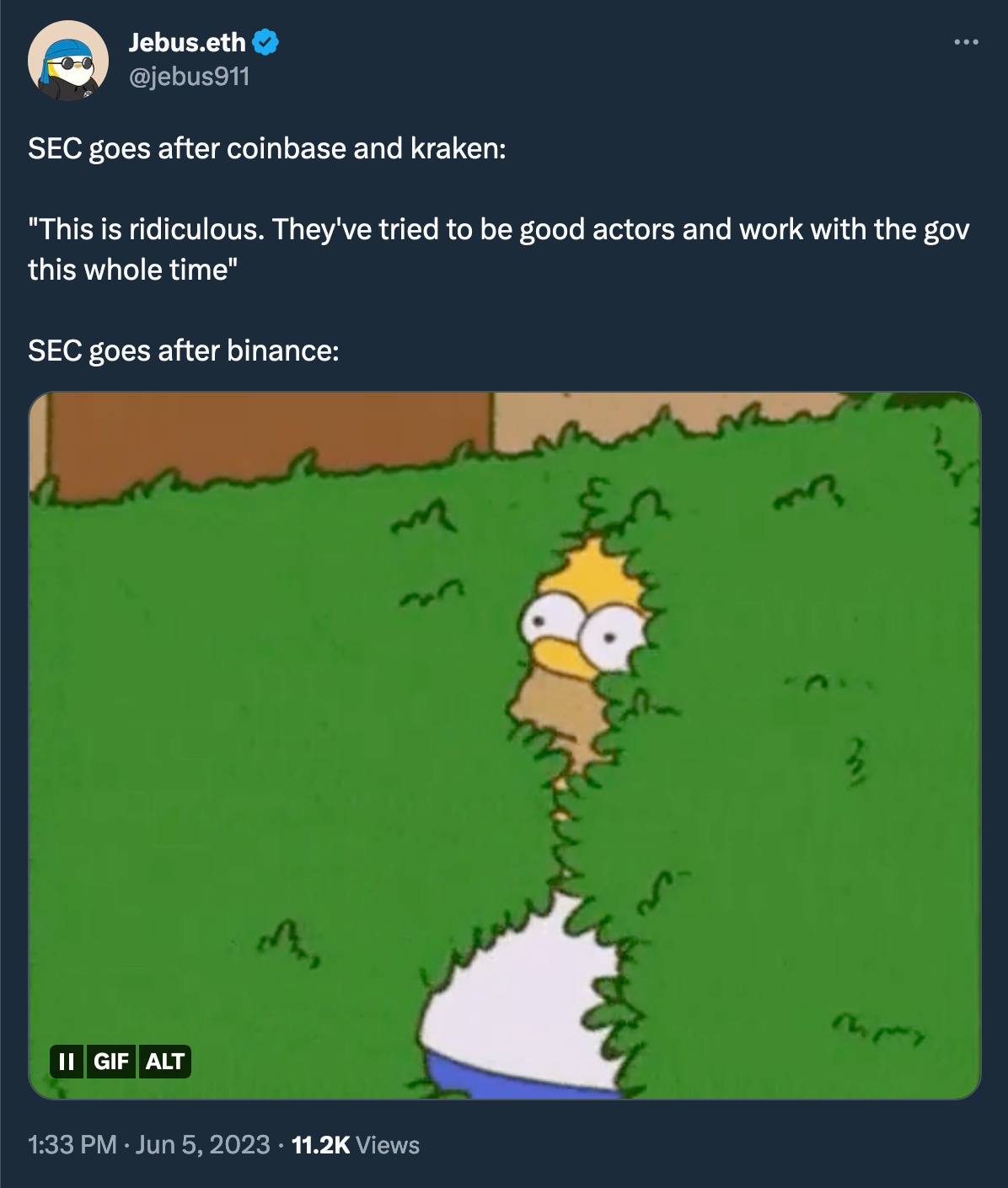

This SEC lawsuit follows a similar legal action taken by the Commodity Futures Trading Commission in March, amplifying the regulatory scrutiny surrounding Binance and its activities.

If the SEC's lawsuit proves successful, it could potentially result in Binance and CZ being barred from conducting business within the United States.

Binance issued a statement in its blog vehemently denying any wrongdoing and criticized the SEC's actions as misguided. The company expressed solidarity with other crypto projects facing similar regulatory actions and vowed to vigorously defend their business and the industry as a whole.

Notably, the lawsuit mentions ten altcoins as unregistered securities: $SOL, $ADA, $MATIC, $FIL, $ATOM, $SAND, $MANA, $ALGO, $AXS, and $COTI, with a total market capitalization of over $115 billion.

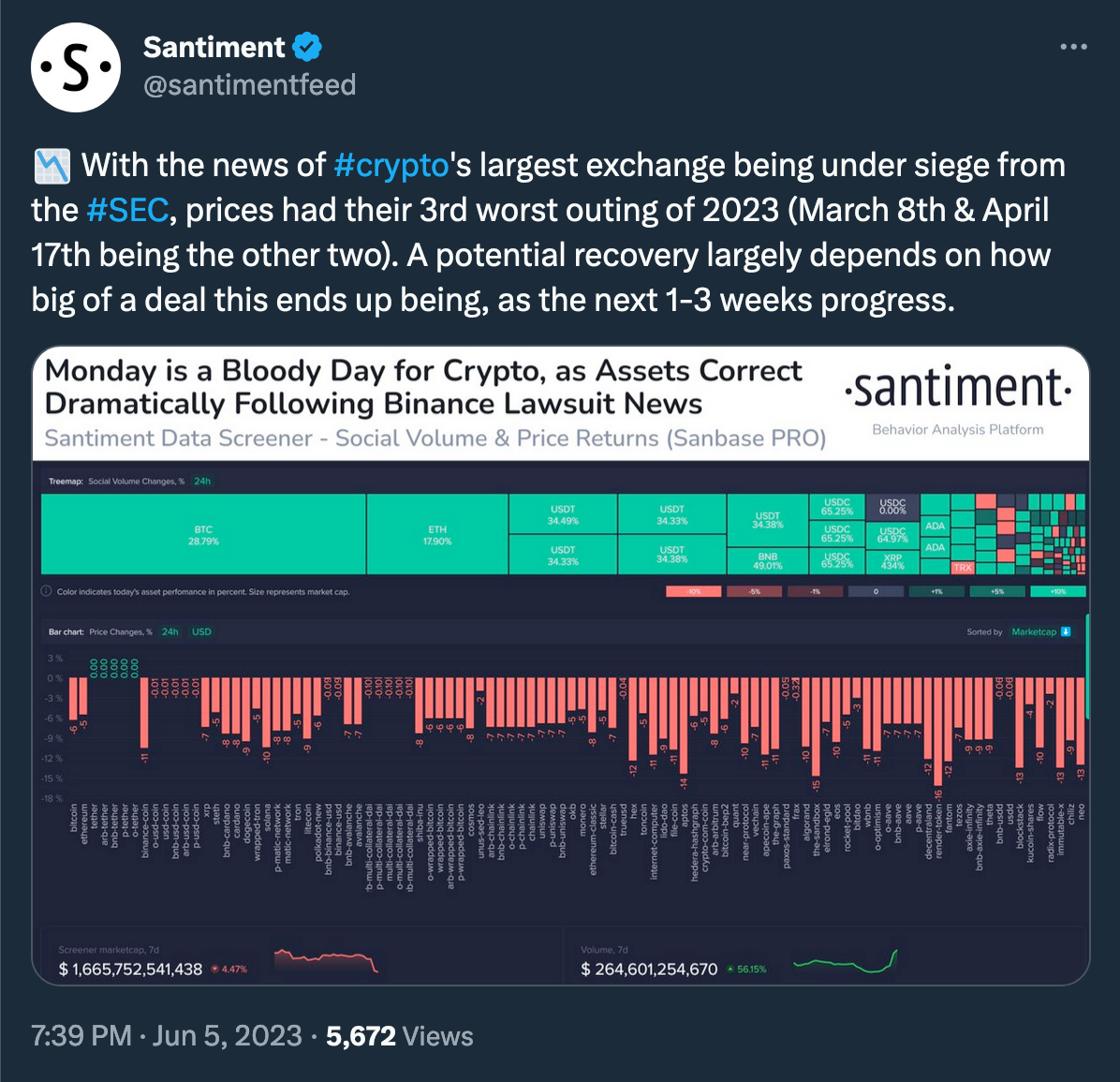

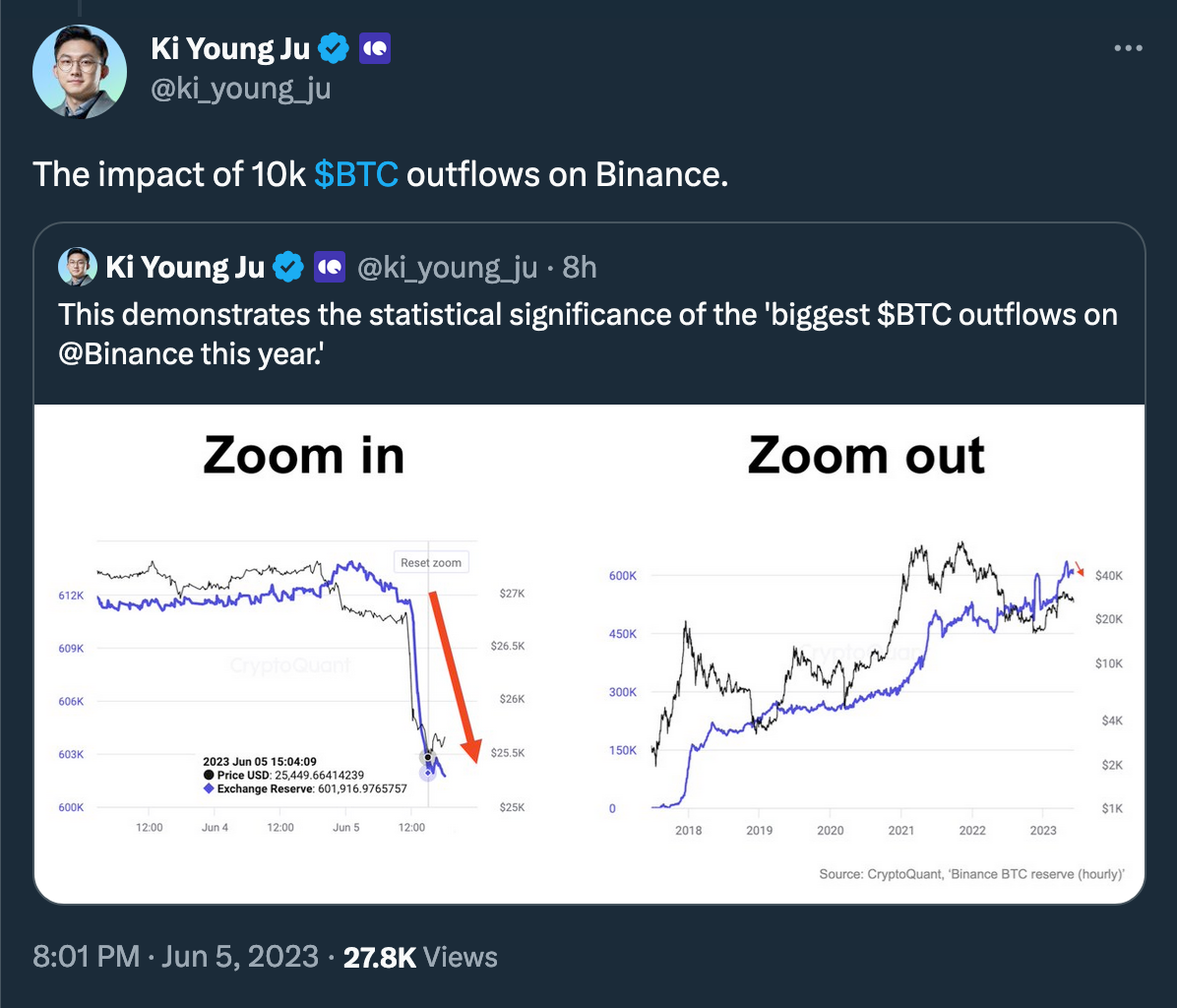

As for the market reaction, it turned out to be very restrained for now (thread):

Actually, this could still prove to be a retest of support and a good buying opportunity, which should become clear in the next 1-3 weeks, according to Santiment: