Only a few miners may survive the profitability crunch due to the upcoming Bitcoin halving event. In recent weeks, major miners have been selling off their bitcoins, adding to several other downward pressure factors in the crypto markets. But why?

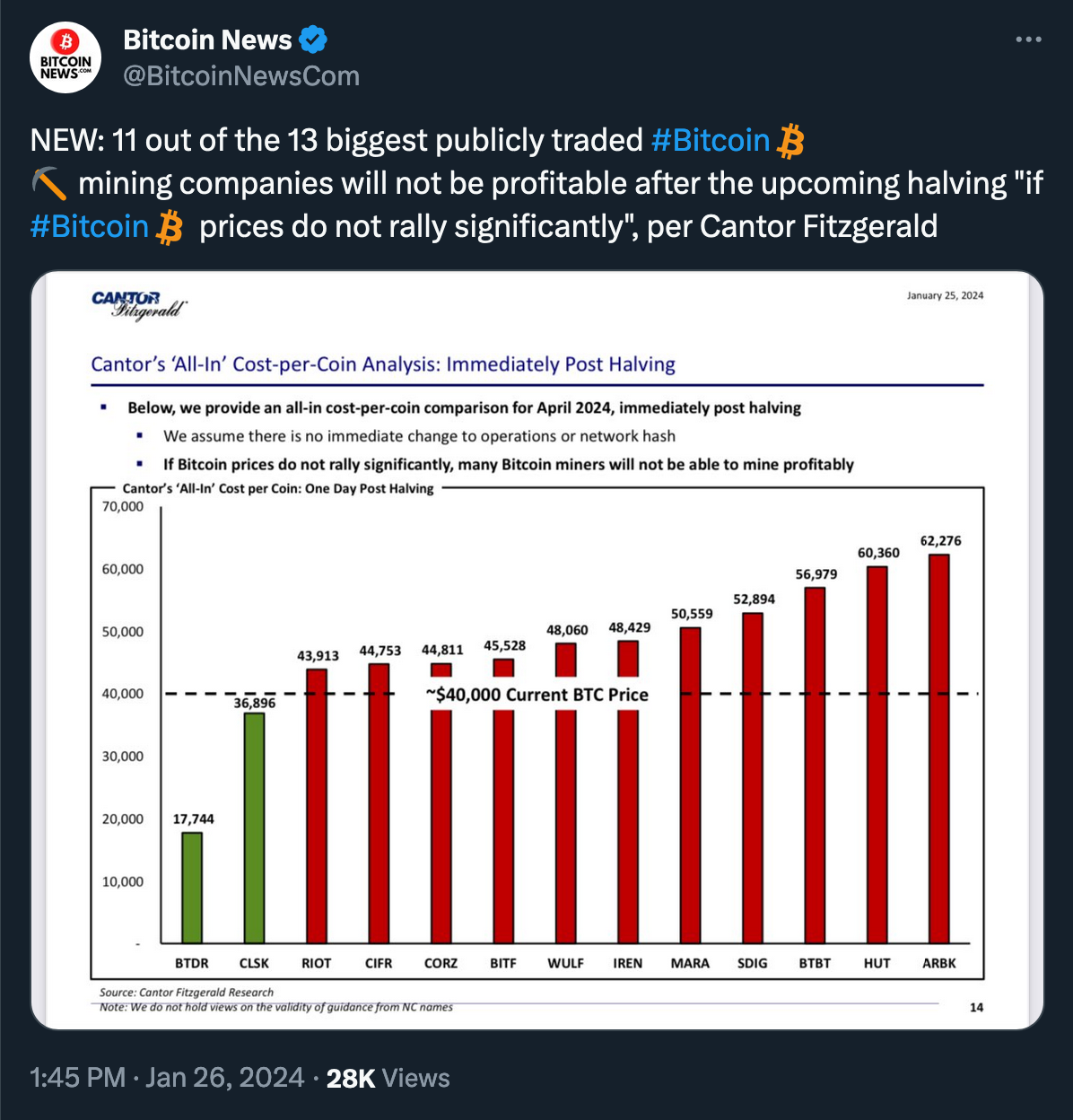

As the fourth Bitcoin halving approaches, expected to hit on April 20, Cantor Fitzgerald researchers predict a severe impact this event might have on the profitability of major publicly traded Bitcoin miners. Out of thirteen public miners, including prominent ones like Argo Blockchain and Hut 8 Mining, eleven may struggle to maintain profitability.

The impending halving will slash a block subsidy miners receive by half – an integral mechanism in BTC’s design to preserve its scarcity. While halvings are generally viewed as a long-term bullish catalyst for BTC’s price, they pose immediate challenges for mining operations, especially those with substantial overheads… If only Bitcoin prices do not rally significantly.

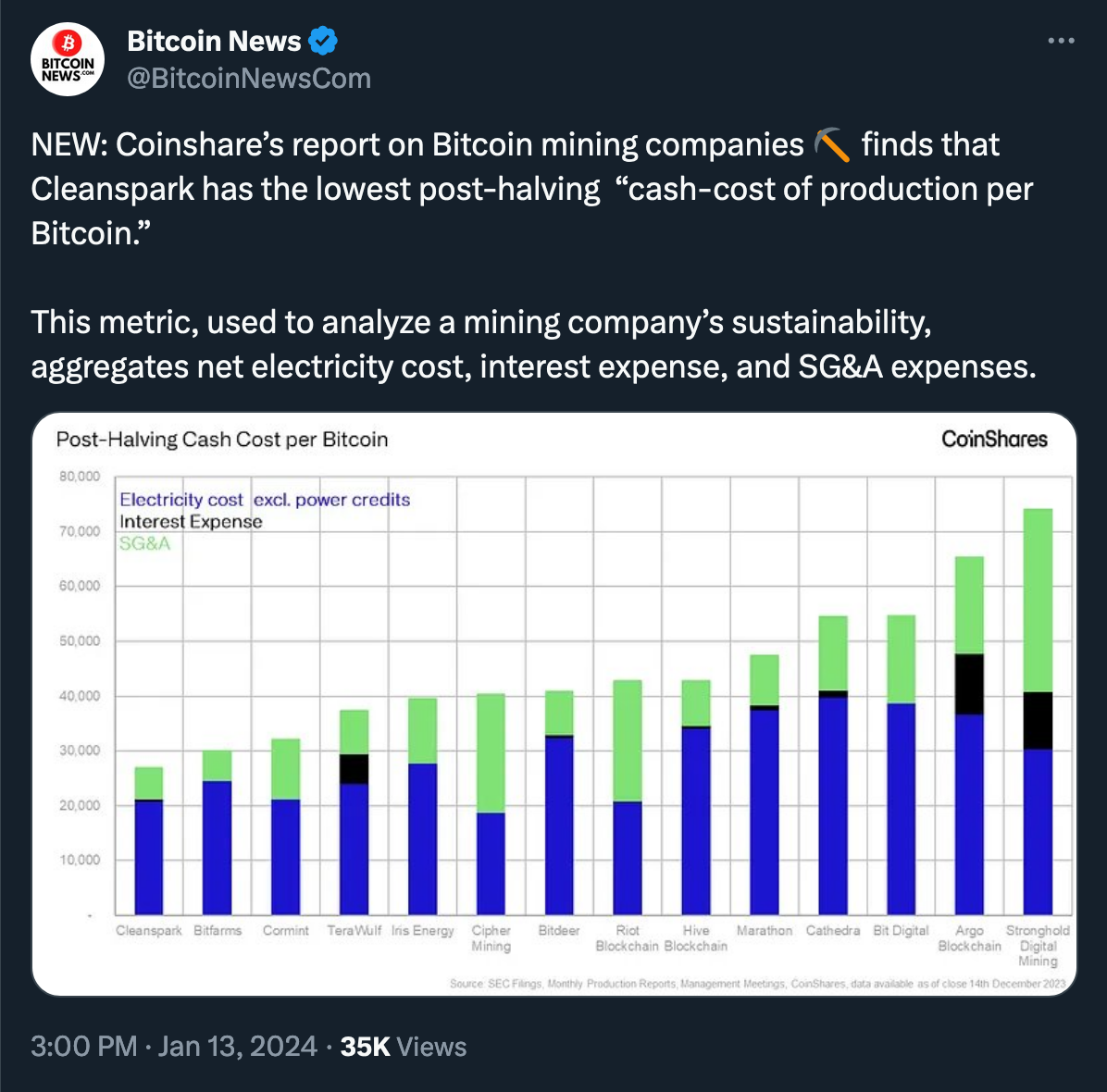

Cantor Fitzgerald’s analysts estimate that only two miners, Bitdeer and CleanSpark, due to their lower 'all-in' costs per Bitcoin — $17,774 and $36,896, respectively — might sustain profitability under the new reward structure, assuming BTC’s price remains above the $40,000 mark.

In contrast, Argo Blockchain (ARBK) and Hut 8 Mining (HUT) are flagged as the most at-risk entities, with post-halving estimated costs per bitcoin exceeding $60,000. Other major mining industry players, like Marathon Digital (MARA) and Riot Blockchain (RIOT), valued at $3.62 billion and $2.19 billion, respectively, may also struggle to maintain profitability, with predicted cost to produce a single BTC post-halving at roughly $50,559 for Marathon and $43,913 for Riot.

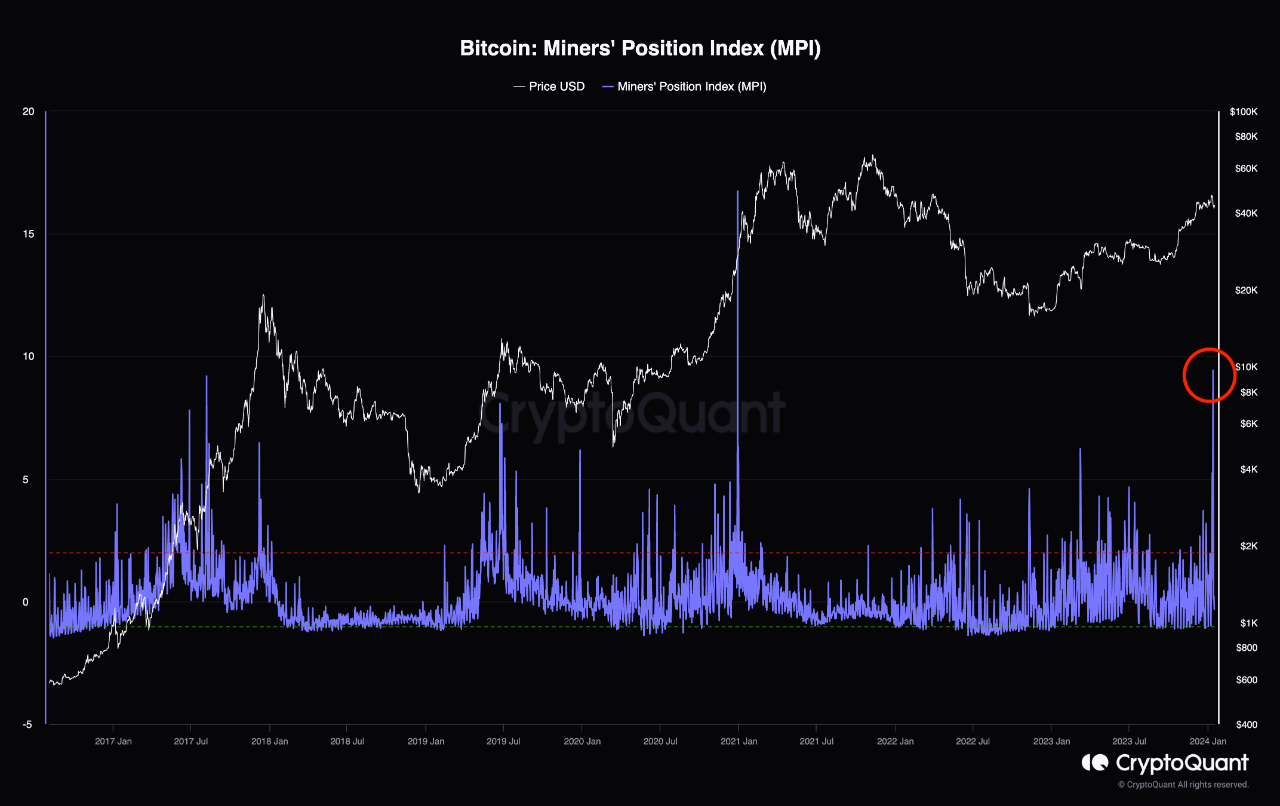

Recently, Bitcoin miners have reportedly been selling their coins, as indicated by a sharp increase in the Miners’ Position Index (MPI), signifying heightened selling activity.

(Source: CryptoQuant)

Another related metric, the ‘miner reserve,’ tracks the total amount of Bitcoin held in miners’ wallets.

(Source: CryptoQuant)

This metric (see the chart above) has recently undergone a noticeable drawdown that reportedly coincides with a rise in the miner-to-exchange flow indicator, which tracks the on-chain transfer of coins from miners to centralized exchanges, typically for selling purposes.

This selling appears to be a strategic move to cover operational costs and prepare for future investments, rather typical for miners ahead of halving events.

“To stay competitive in this evolving landscape, miners are compelled to invest in new, more efficient mining equipment and technologies. Selling a portion of their Bitcoin reserves provides the necessary capital for these investments,“ – CryptoQuant quicktake.

In the short term, the increased selling pressure from miners might affect Bitcoin's price. Longer-term, however, the cost of mining has historically provided support for Bitcoin’s valuation, while the reduction in issuance due to halving events has historically been an important driver of price appreciation within Bitcoin's four-year market cycles.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.