Bitcoin dropped below $40,000 these days, continuing a decline that began around the time spot Bitcoin ETFs were approved. Notably, the defunct crypto exchange FTX has contributed significantly to this price dump.

(Source)

A few days ago, CryptoQuant CEO Ki Young Ju highlighted a discrepancy between on-chain data and the off-chain disclosures made by the Grayscale Bitcoin Trust (GBTC).

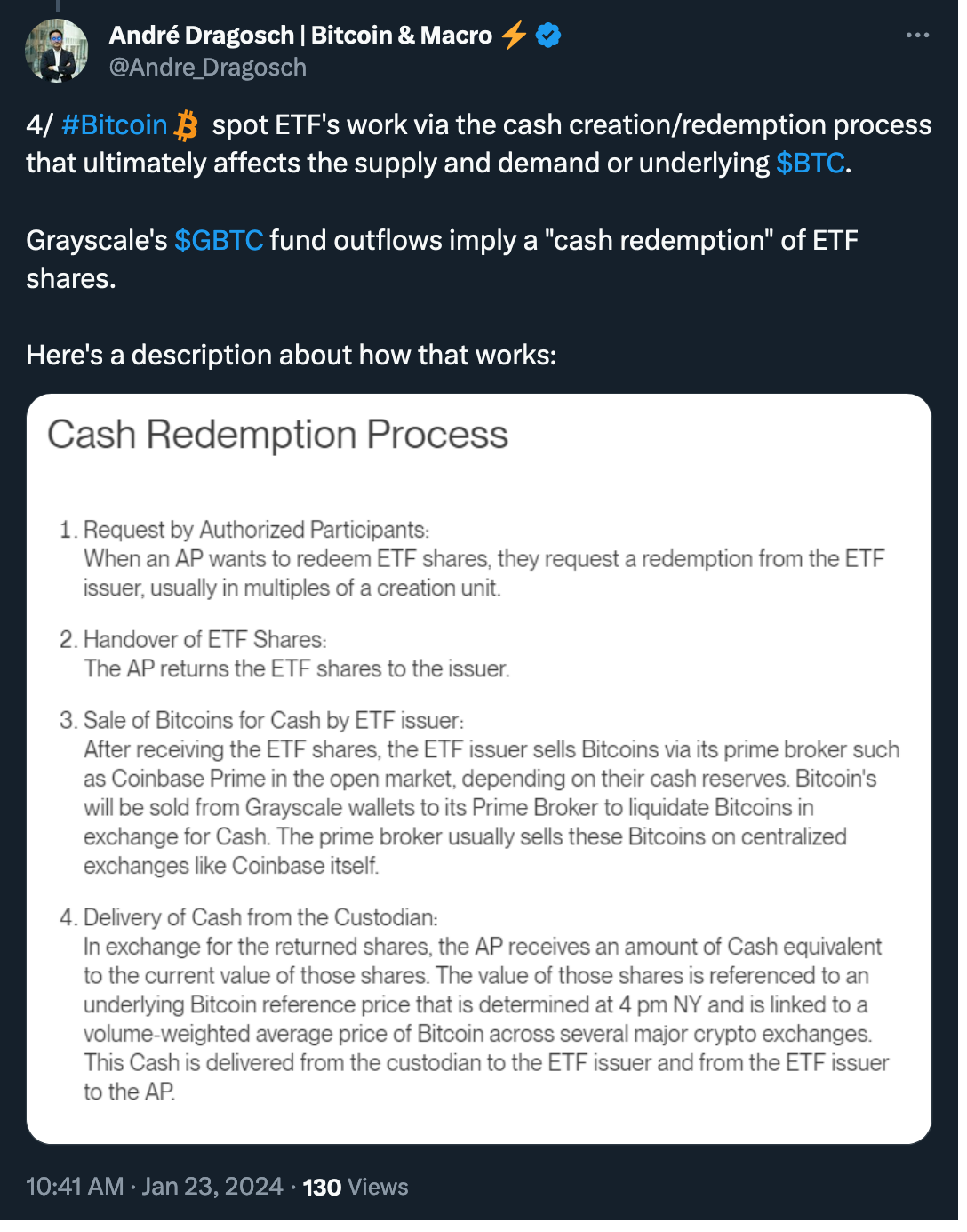

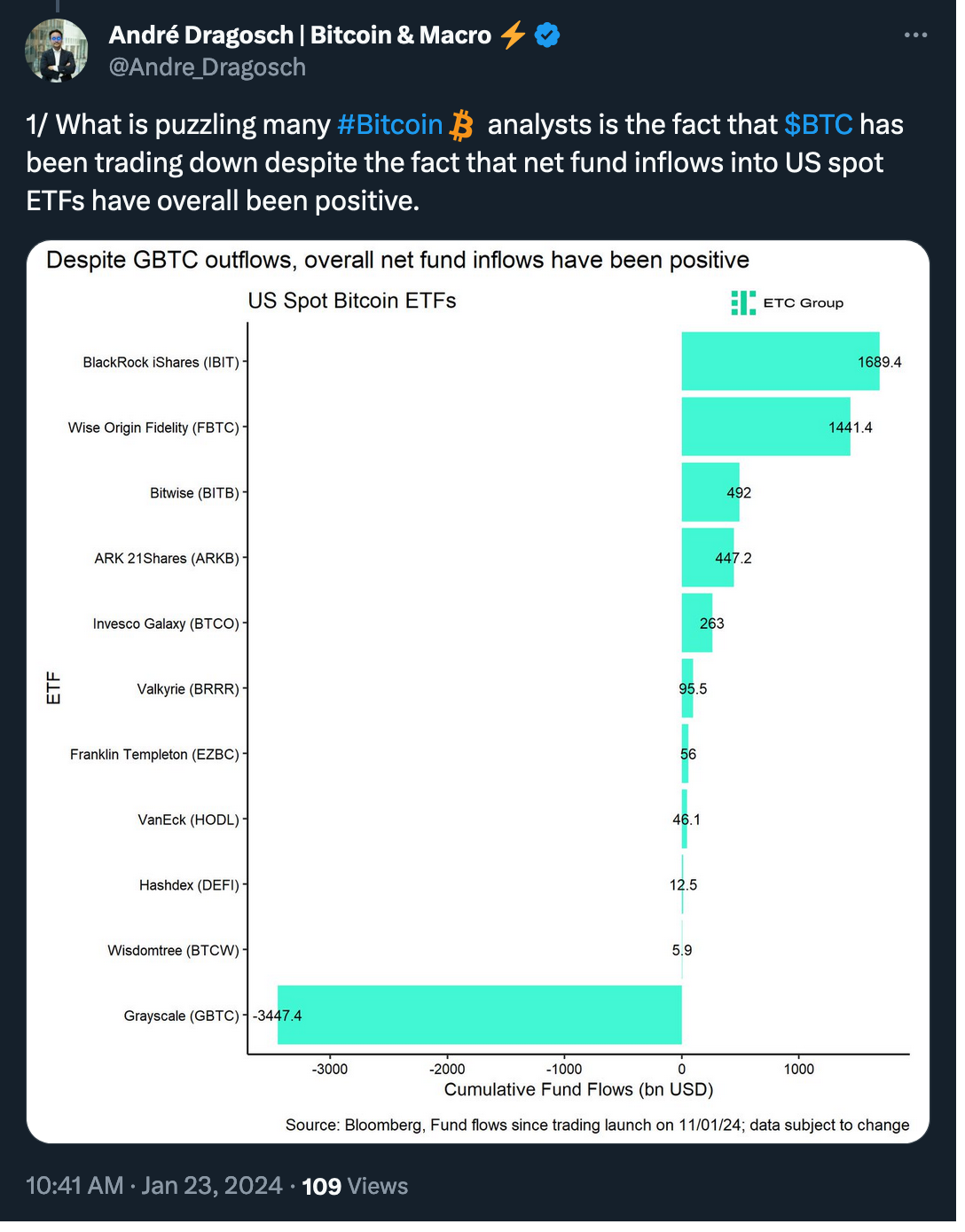

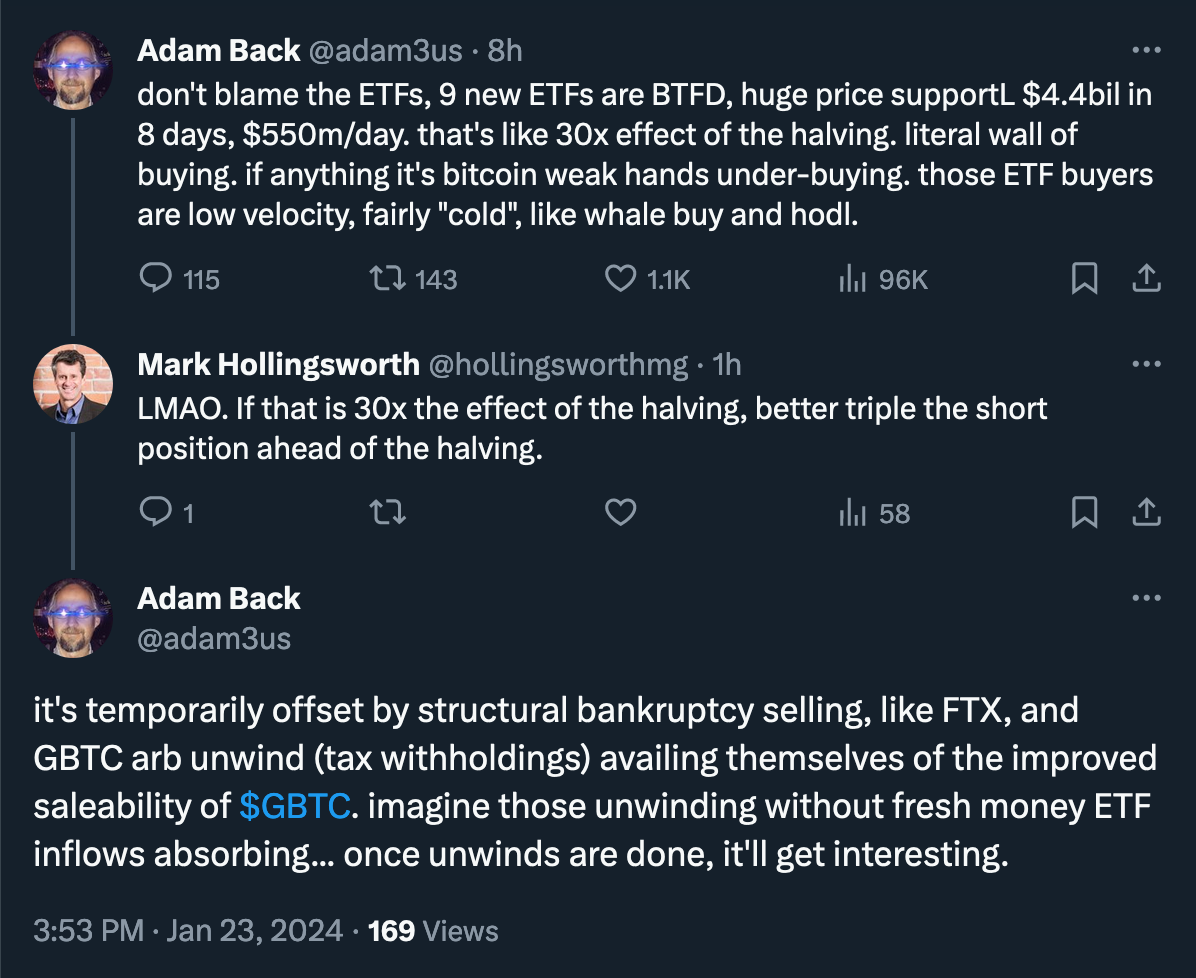

While new spot Bitcoin exchange-traded funds from BlackRock, Fidelity, and the like have seen inflows, billions of dollars in bitcoin were pulled out from GBTC after its recent conversion to an ETF. A significant portion of this withdrawal reportedly was attributed to FTX's bankruptcy estate offloading 22 million shares.

According to Bloomberg, FTX sold most of its GBTC after the Bitcoin ETF conversion, largely contributing to Grayscale’s ongoing BTC sales in a bid to fulfill these redemptions.

Like every other GBTC investor, FTX is thought to have been taking profits since the fund traded at a discount to BTC up until the Bitcoin ETF conversion. Considering FTX is in the process of repaying its customers, the company would have liquidated its GBTC holdings sooner rather than later.

Alameda Research, FTX’s sister company, has also been busy in the market as of late, possibly to aid FTX's repayment plan. NewsBTC has previously reported significant crypto transfers by Alameda to Binance, suggesting a potential sell-off was on the horizon.

(Thread)

Alistair Milne on Twitter listed large holders and the fate of their GBTC balances. When GBTC traded at a significant premium, these players could profit by creating GBTC shares at net asset value and shorting GBTC at the premium. They ended up holding a massive amount of GBTC, which they are now liquidating.

(Thread)

(Thread)

In theory, with FTX's holdings sold, the selling pressure might lessen, as a bankruptcy estate's liquidation is a relatively unique event.

“It’s impossible to know when the outflows from Grayscale will end. It’s impossible to know if these outflows will find a new home as inflows. It’s impossible to know the material impact of the spot ETFs on the market. Regarding ETF capital flow dynamics, the list of ‘unknowns’ is infinitely long,” — The Wolf Den newsletter.

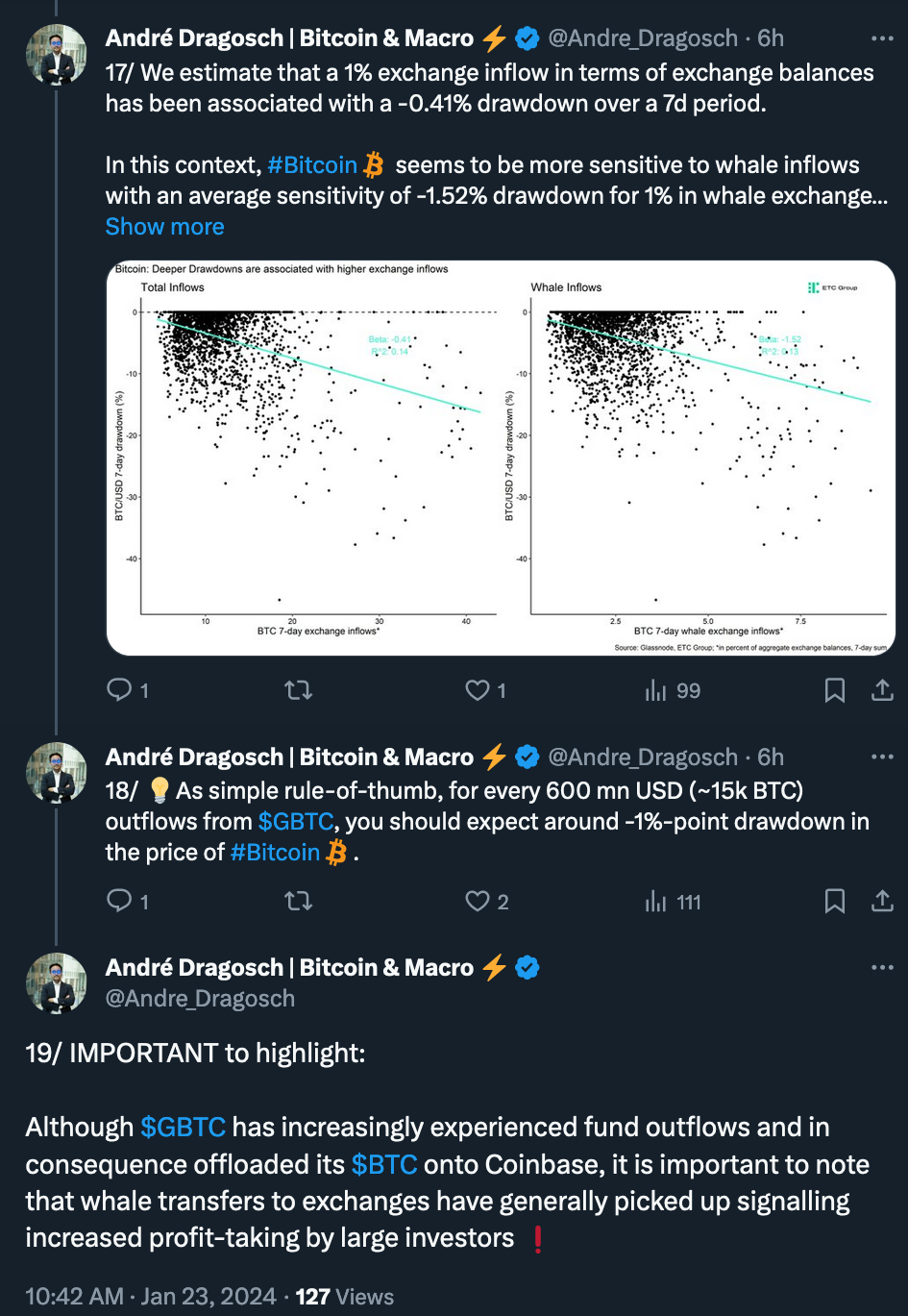

Grayscale still has over $21 billion in assets under management (AUM) and a BTC holding of over 558,000, meaning a selling pressure of such magnitude could have severe implications for Bitcoin and the broader crypto market.

“What I do know is how to act on a bull market dip and I can impart this knowledge to all of you. … Dips are for buying,” — The Wolf Den newsletter.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.