The crypto community is on high alert as the Mt. Gox trustee moves forward with repaying creditors. This development potentially signals a substantial influx of Bitcoin and Bitcoin Cash (BCH) into the market, coinciding with Grayscale's ongoing sell-off.

The crypto market has recently entered a turbulent zone, with a sharp decline from near two-year highs following the long-awaited U.S. spot Bitcoin ETFs approval. Much of this selling pressure is linked to the sell-off in Grayscale’s Bitcoin Trust (GBTC) shares, with FTX accounting for half of that volume.

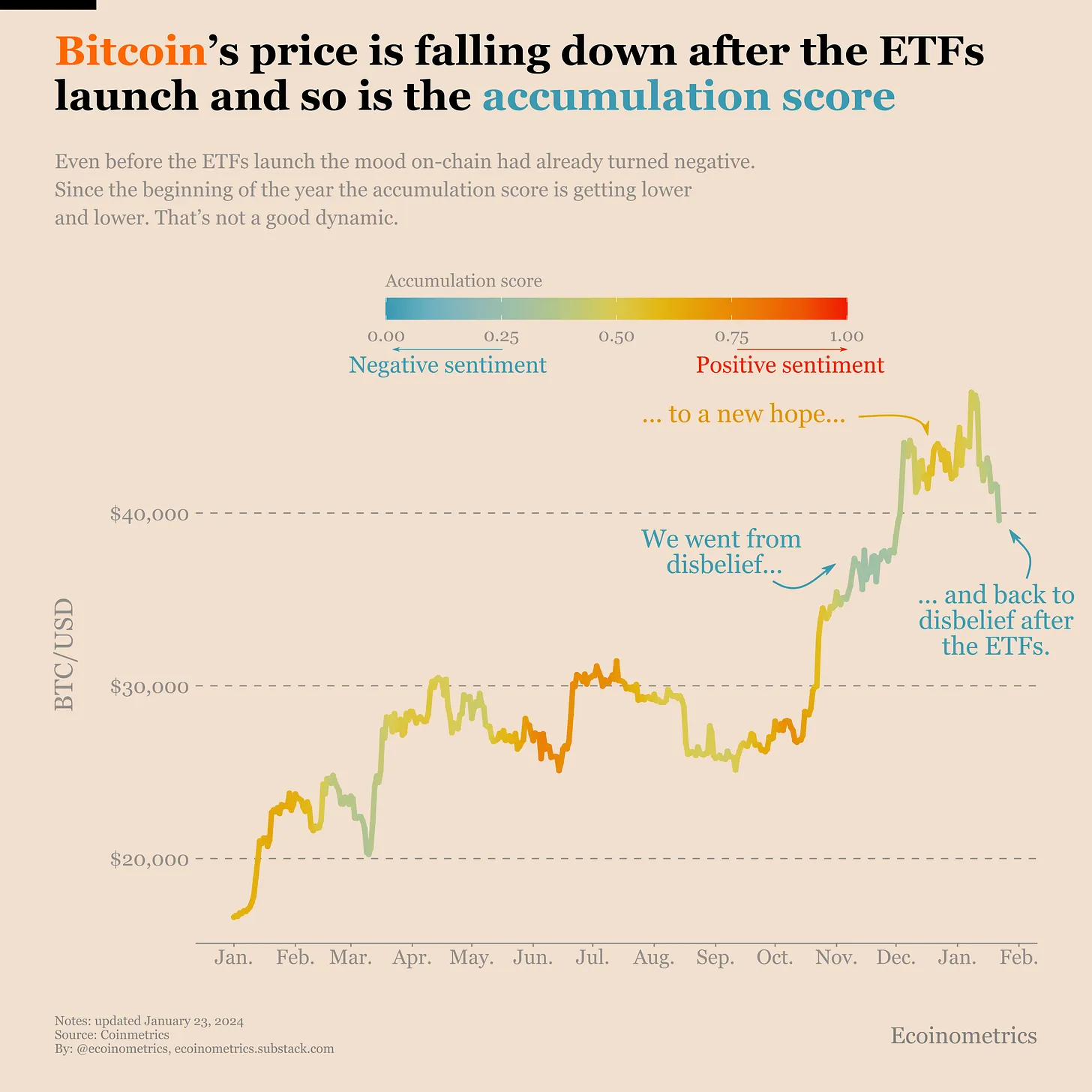

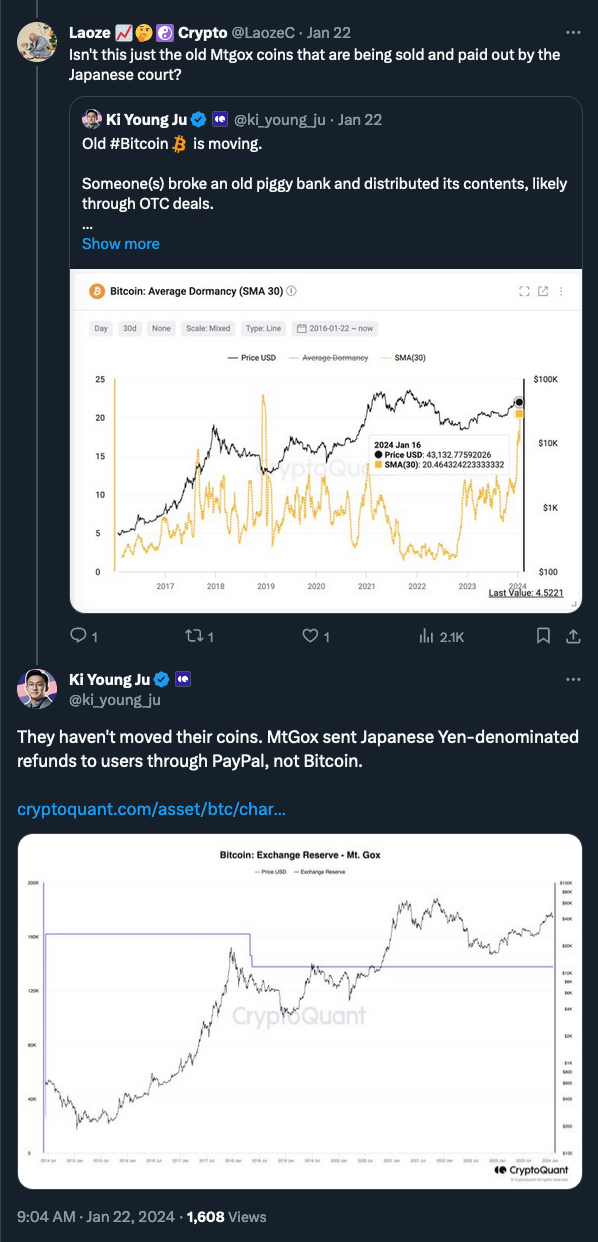

Despite this widely accepted explanation, CryptoQuant's CEO questions this thesis, highlighting the derivatives-driven nature of the current market decline. Meanwhile, other researchers, such as Ecoinometrics, have also noted the on-chain weakness of Bitcoin post-ETF approval.

(Source)

(Source: Ecoinometrics)

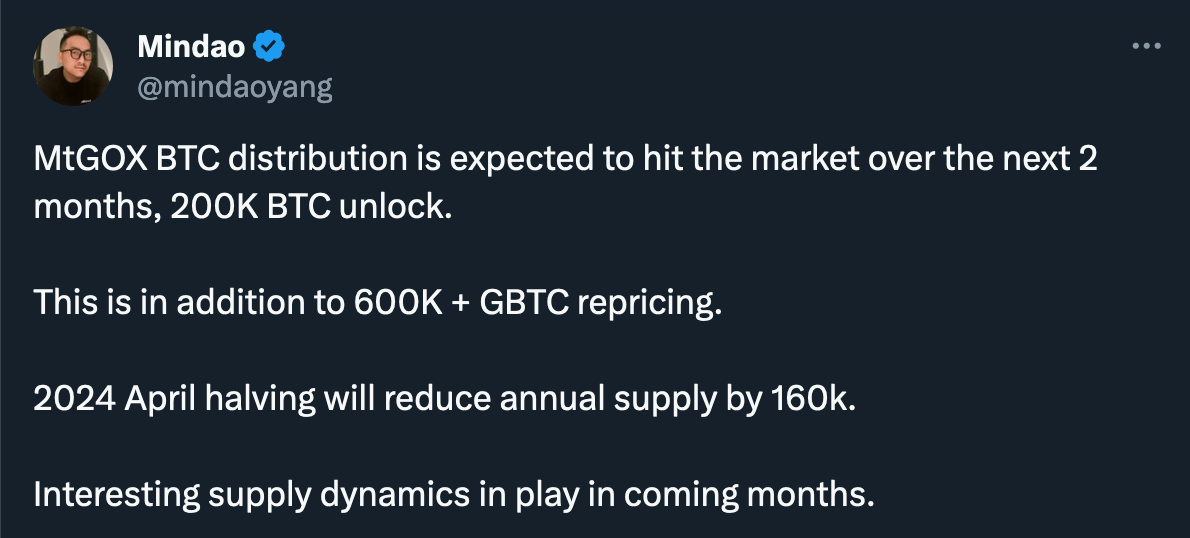

Grayscale reportedly has enough GBTC to sustain its current sales rate ‘for another 60 days straight.’ Besides that factor, In addition to regular profit-taking, as evidenced on-chain, the recent confirmation of large-scale repayments from Mt. Gox involving 200,000 Bitcoin introduces a new potential source of downward pressure on the market."

(Source)

Founded in 2010, Mt. Gox was the world's largest Bitcoin exchange, handling about 70% of all BTC transactions before suffering a catastrophic in 2014, which led to 850,000 BTC lost in the hack and one of the most significant bankruptcies in the crypto space.

The Mt. Gox trustee has now started verifying eligible repayment clients. Estimates of the total Bitcoin to be released range from 142,000 to 200,000 BTC, with an additional 143,000 BCH and 69 billion Japanese yen adding complexity to the situation.

(Source)

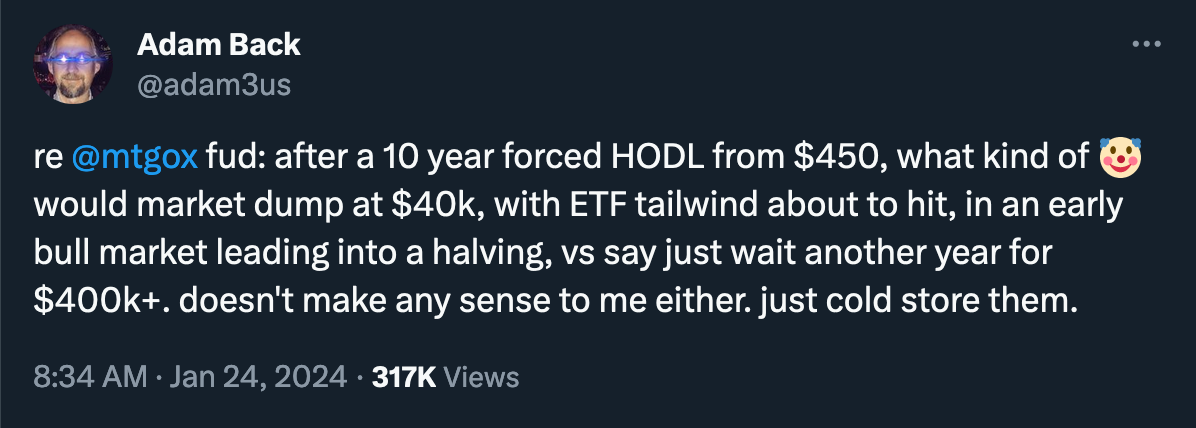

In contrast to the FTX bankruptcy approach in the U.S., where cryptocurrencies are converted to USD for legal expenses, Mt. Gox has opted to retain Bitcoin. This approach has led some experts, such as Blockstream CEO Adam Back, to remain skeptical about the likelihood of a market dump of BTC by Mt. Gox creditors.

As the crypto community anticipates the potential market impact of this significant fund release, analysts are closely monitoring the situation and awaiting further details from Mt. Gox. The coming months are critical as the countdown to the potential release of at least 142,000 BTC begins, which could significantly affect the Bitcoin price.

As Adam Back has noted, commenting on the GBTC sell-off, “Imagine those unwinding without fresh money ETF inflows absorbing.”

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.