Elliptic, a blockchain analytics and compliance firm, has outlined five key issues likely to shape the crypto regulatory landscape this year, highlighting stablecoins as a topic that will dominate the regulatory agenda in 2024 ‘like never before.’

(Thread)

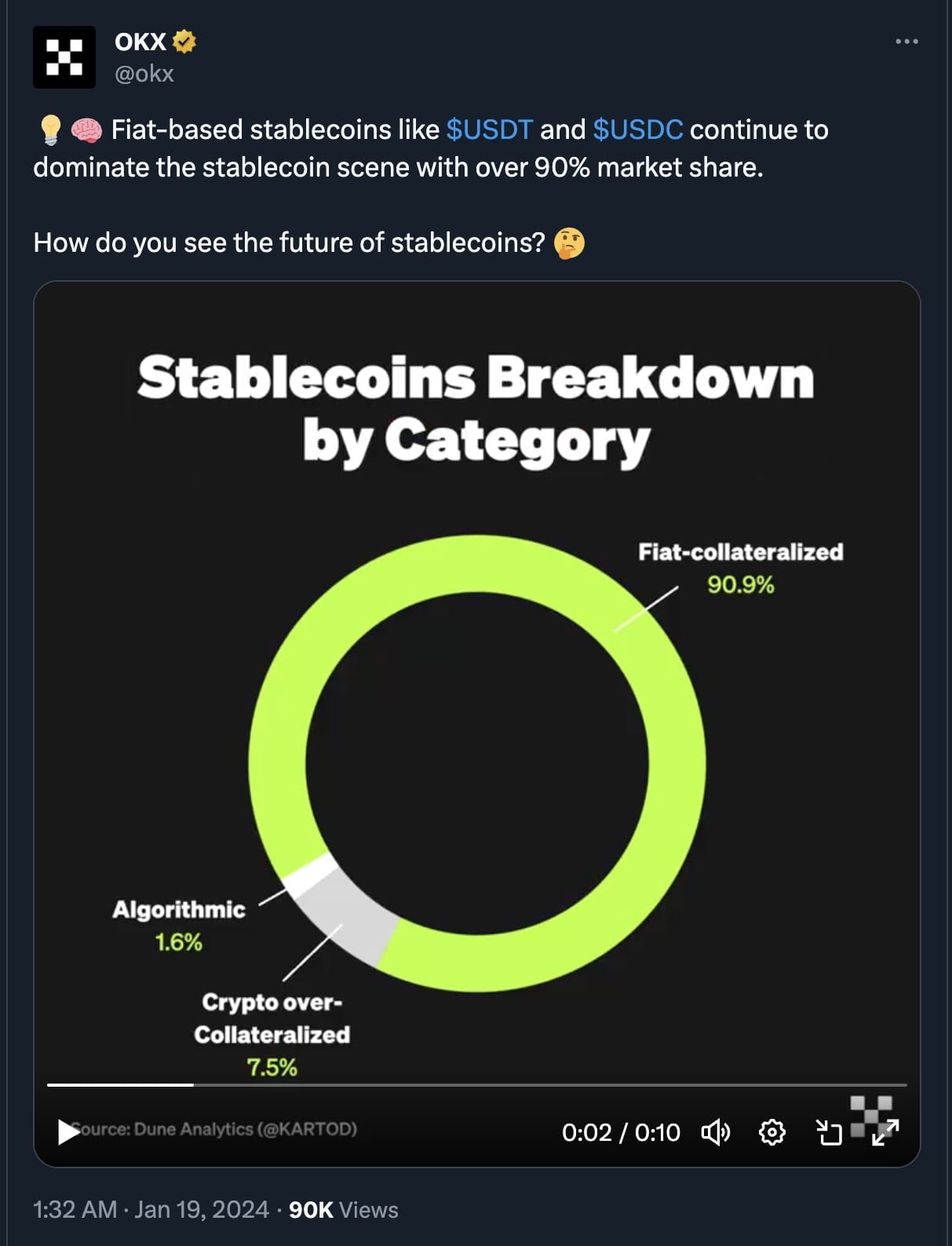

An increasingly important role stablecoins play in payments and finance has resulted in growing scrutiny from regulators and policymakers in recent years. The interest intensified following Mark Zuckerberg's announcement in 2019 about Meta’s (formerly Facebook) stablecoin project. The 2022 collapse of the Terra UST stablecoin further accelerated regulatory urgency.

In 2024, Elliptic analysts expect an unprecedented regulatory focus on stablecoins, significantly impacting the sector. New legal and regulatory requirements for stablecoin issuers will be implemented in major financial centers throughout the year.

(X post)

From July 2024, the EU's Markets in Crypto Assets (MiCA) regulation will mandate comprehensive requirements for stablecoin issuers in the EU, including maintaining reserves, ensuring token holder redemption rights, and safeguarding and segregating assets - among other obligations.

Other jurisdictions are also advancing similar regulations. Singapore has already established a regulatory framework for stablecoin issuers, and the UK and Hong Kong are planning legislative updates for stablecoin regulation. The Bank of England is also addressing the risks related to systemic payment stablecoins that could have wider implications for financial markets, given their size and scale.

(Thread)

The rollout of these and other frameworks worldwide will provide more clarity and set new standards for stablecoin issuers while subjecting them to heightened regulatory scrutiny and a rigorous level of oversight.

As a notable exception to this global trend towards clearer regulations, the US stablecoin policy remains unclear. While Congress deliberates various draft laws for a national regulatory framework, their progress seems unlikely amidst partisanship during an election year.

In the absence of legislative action, there's speculation about whether US regulators might intervene through the Financial Stability Oversight Council (FSOC) – a much blunter instrument that would only convince participants in the crypto space that the US is not a favorable environment for stablecoin-related innovations.

(Thread)

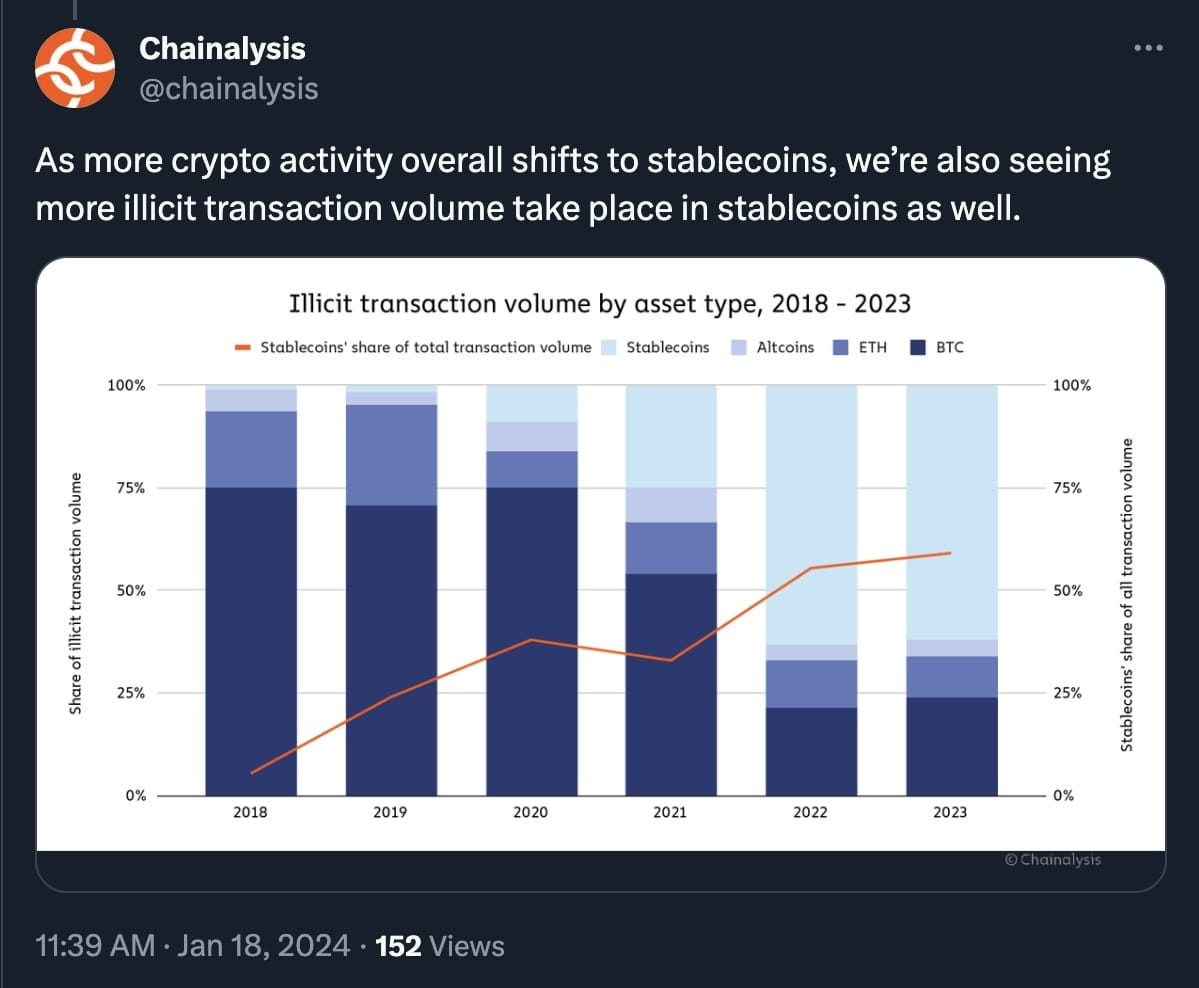

Additionally, 2024 will likely see a focus on the financial crime risks associated with stablecoins. A report (PDF) from the United Nations Office on Drugs and Crime suggests stablecoins play a significant role in money laundering, particularly in China and Southeast Asia.

As scrutiny intensifies, businesses planning to launch stablecoins to harness the many related opportunities will need to manage associated risks effectively and leverage the transparency of blockchain data to meet regulatory requirements.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.