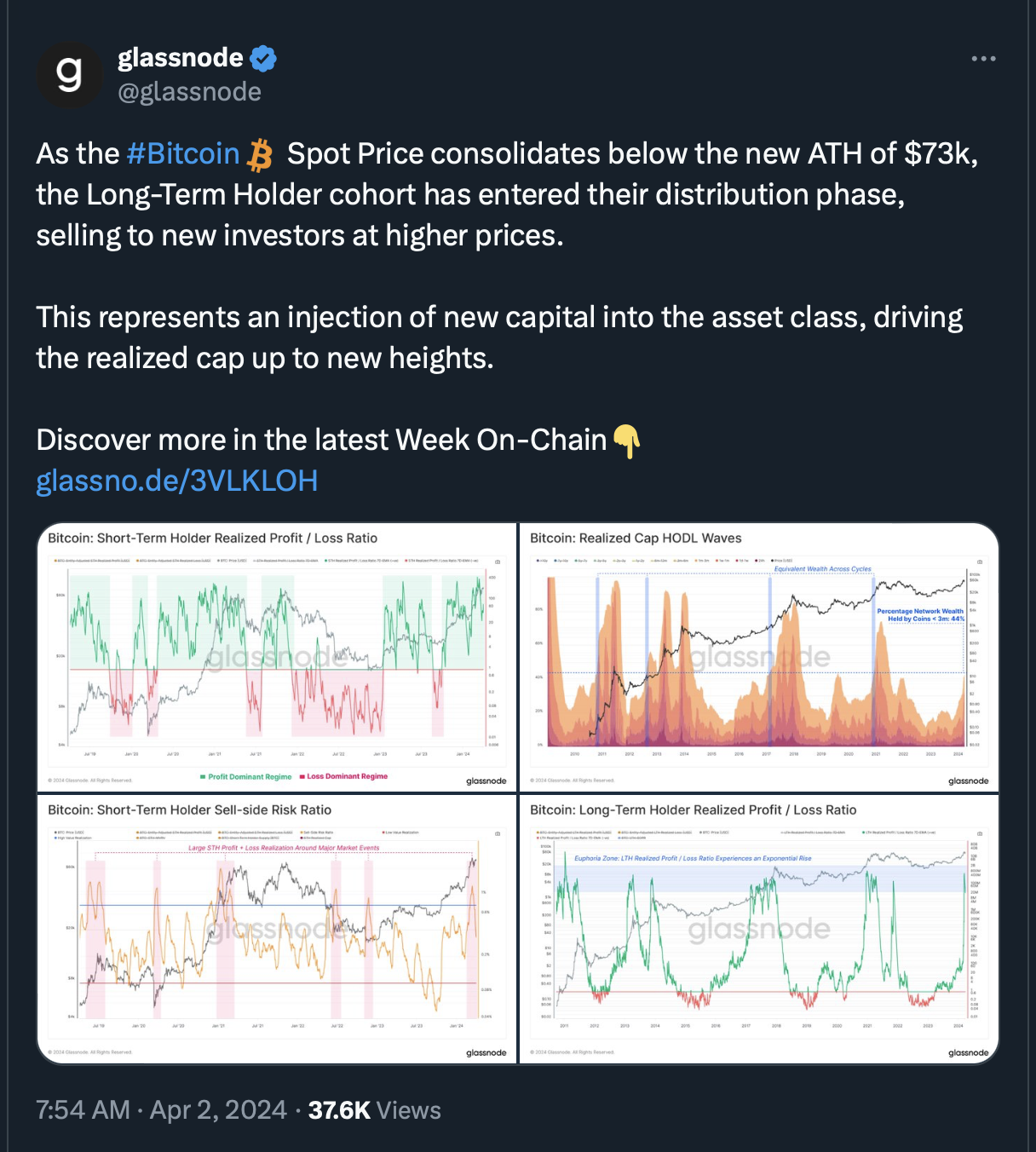

Profit-taking continues to dominate investor behavior these weeks while the market continues to consolidate near all-time highs. Meanwhile, capital inflows into Bitcoin reportedly recovered, but spot ETF activity has slowed since its peak in March.

The decisive break above Bitcoin's previous cycle's ATH in March initiated a new phase of price discovery but also motivated market participants to take some profits. Long-term holders have ramped up their overall distribution pressure, resulting in coins generally being revalued from a lower to a higher cost basis. These coins changing hands can also be seen as evidence of new demand and liquidity being injected into the market.

(Source)

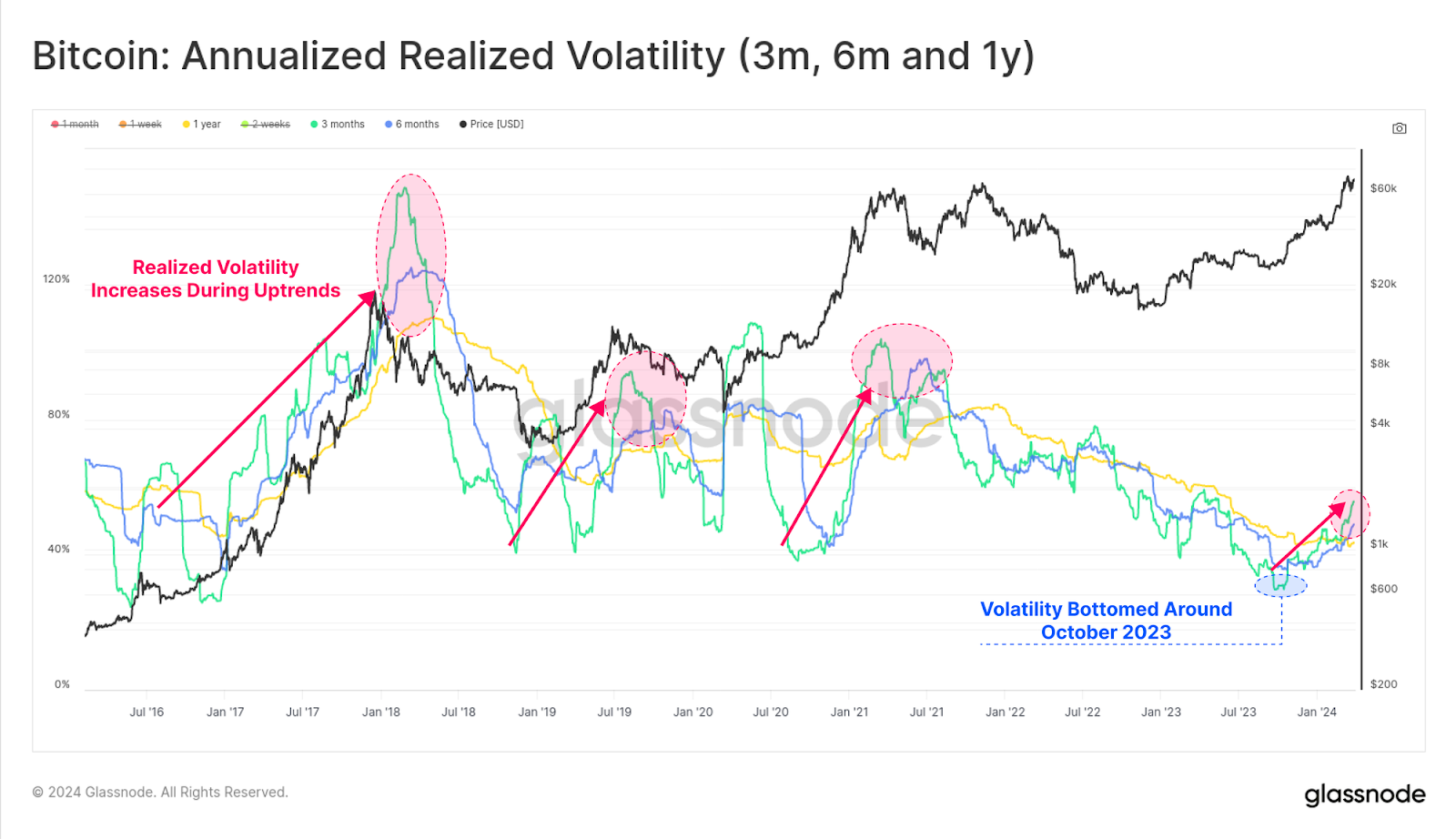

Historically, in Bitcoin cycles, an increase in new demand often comes alongside a heightened appetite for speculation, resulting in greater market volatility, typical of macro up-trends observed in previous Bitcoin cycles.

(Source)

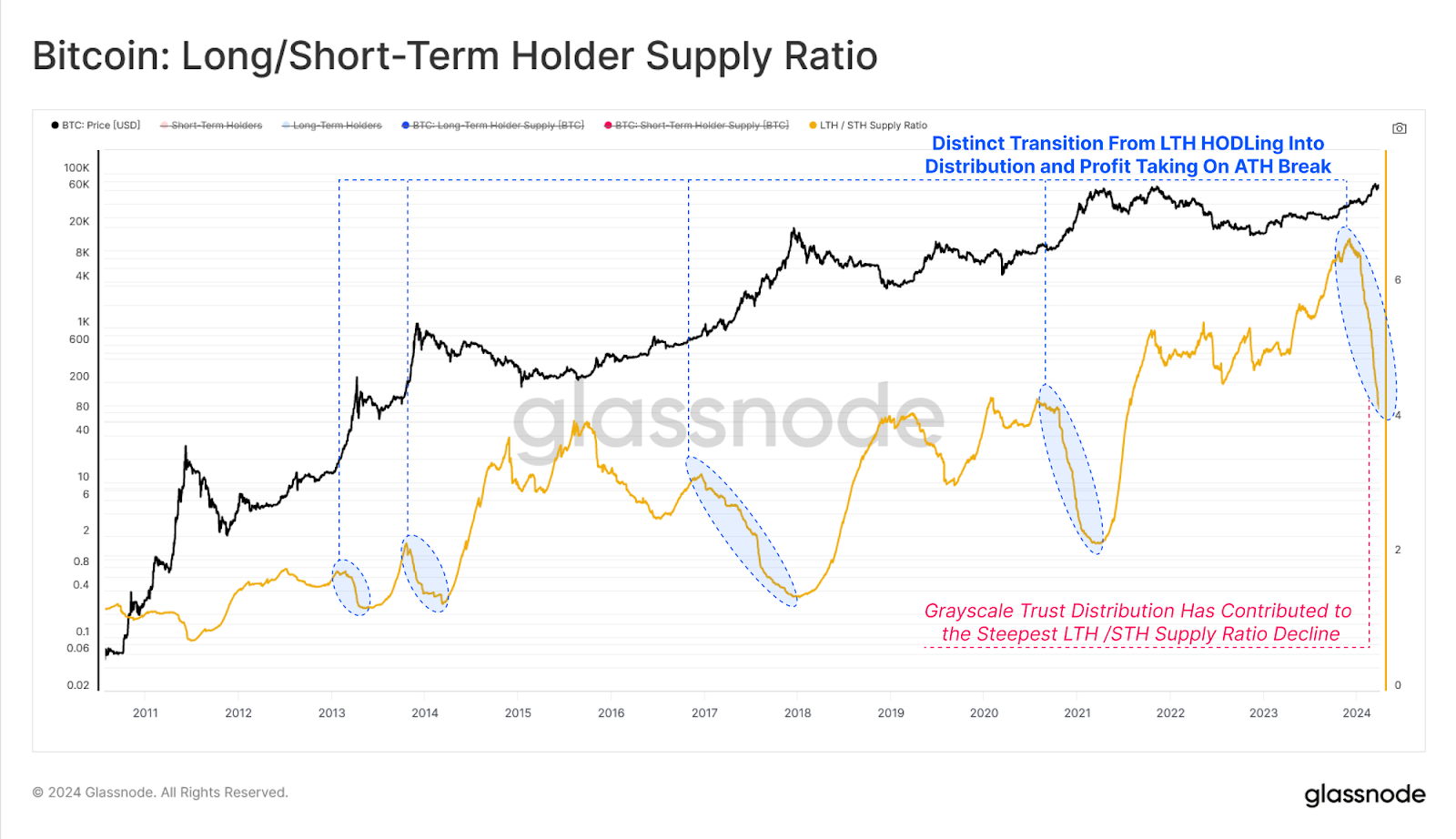

Glassnode analysts also noted a narrowing gap between Long-Term and Short-Term Holder supply. This convergence has also translated into a significant decline in the Long/Short-Term Supply Ratio, again reflecting the market's tilt toward distribution, profit-taking, and speculative trading.

(Source)

This shift in market dynamics is in line with the Bitcoin market's cyclical nature. Meanwhile, in the context of previous cycles, the current distribution does not suggest we are at the cycle's peak.

As noted by many experts and corroborated by our earlier reports, Bitcoin’s breakouts to new all-time highs are historically bullish. However, this does not exclude the occurrence of imminent market consolidations and corrections, which are essential for sustainable growth.

Therefore, the inevitable profit-taking at record highs and a distinct shift in investor behavior patterns, as detailed in the latest Glassnode report, should hardly be considered a sign of a cycle peak. Rather, it represents a period of healthy consolidation that may extend over some time, though.

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.