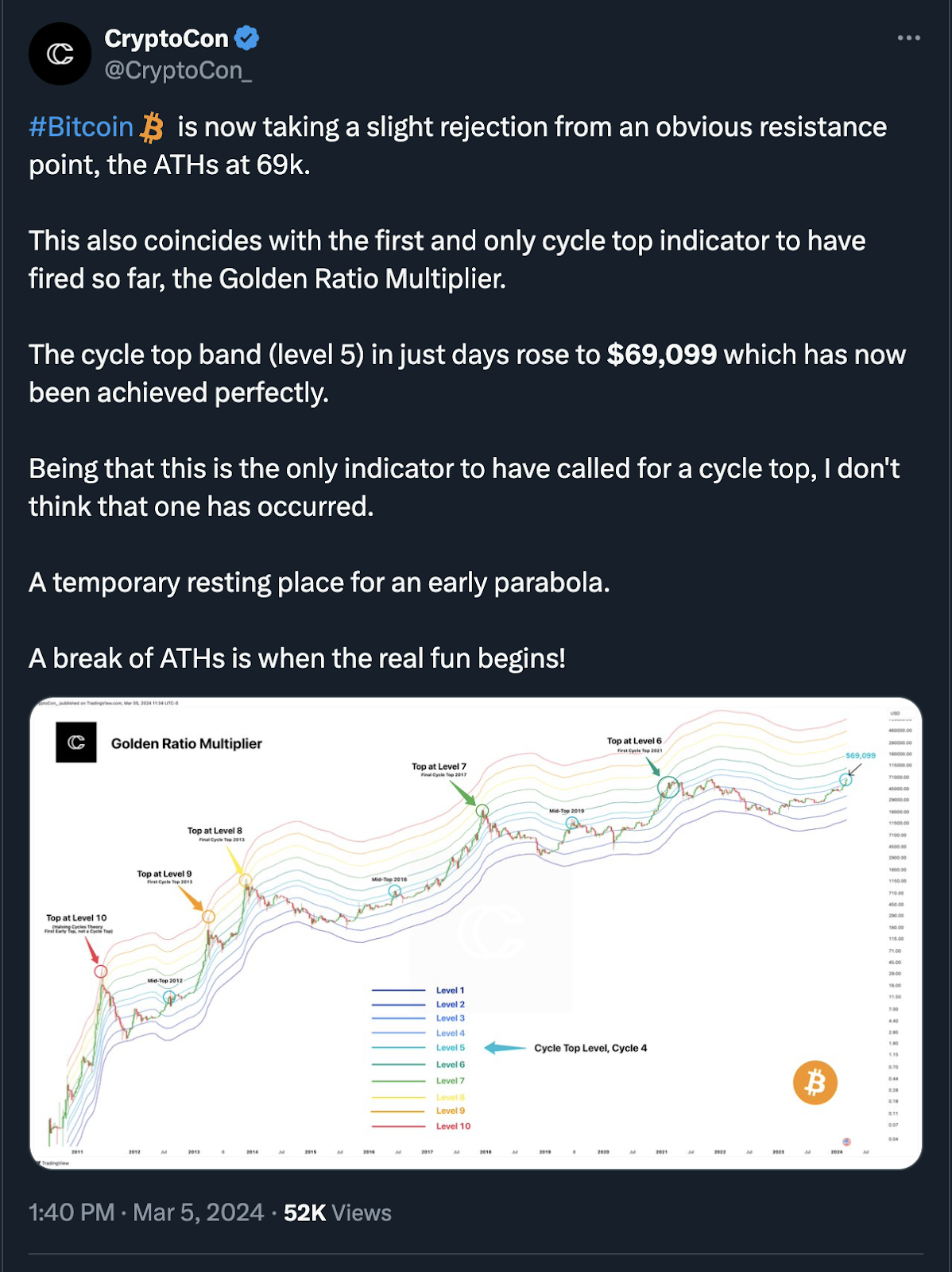

Massive ETF flows have propelled Bitcoin's value upward by more than 50% in a month, setting a new all-time high, after which the price is now taking a moderate rejection from an obvious resistance area, both technical and psychological.

Price reaching an all-time high zone tends to have powerful psychological implications. It's reasonable to anticipate a decent profit-taking at these levels, setting the natural conditions for a healthy price consolidation.

For Charles Edwards of Capriole Investments, any consolidation above the monthly level at $56K is extremely bullish; some volatility is totally expected and welcomed, with one or more retests of $56-58k support before continuation. This could unfold rapidly, or it may take several months.

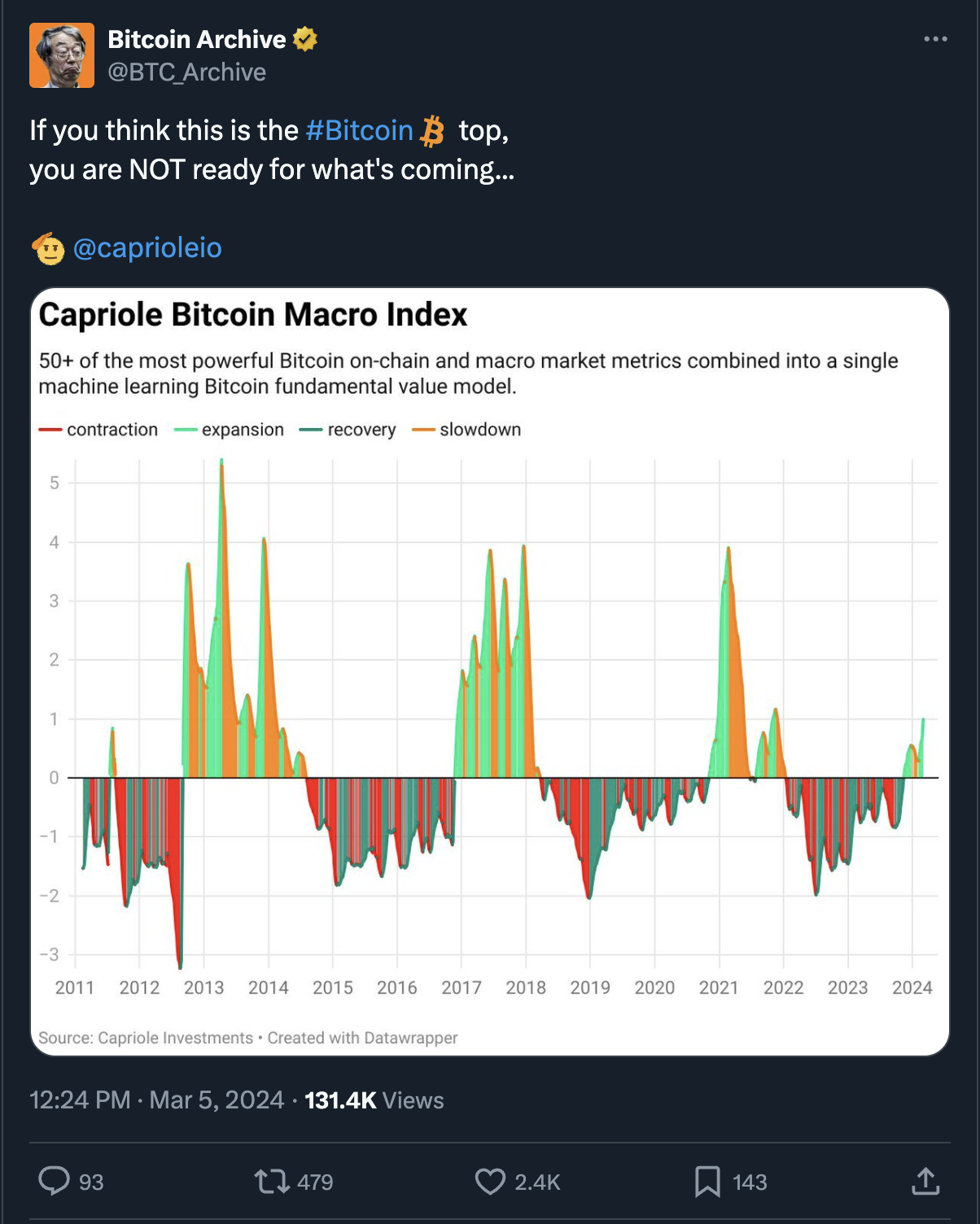

At pivotal inflections, fundamentals and on-chain data can help us understand which way the probabilities are skewed.

“Bitcoin Fundamentals continue a hell-bent rally at the fastest on-chain growth rates we have seen in years. This is very bullish and supports sustained higher prices for Bitcoin going forward. It is clear that the Bitcoin ETFs unlocked fresh demand and so far this demand has broadly been trending up and is reflecting in on-chain growth across a variety of metrics. Today the fundamentals tell us that any price dips are cyclical buying opportunities.” (Charles Edwards for Capriole Investments blog)

When you zoom out to the monthly chart, it looks even more insane, like a V-shaped correction.

“If previous non-crypto-related ETFs can teach us anything, it is that real growth after an ETF approval can be a multi-year process,” Chainlink co-founder Sergey Nazarov for Blockworks.

There might be bumps in the road, and it may take a while to move up further. But what seems clear to me is that I wouldn’t bet against this trend even with the worst enemy’s money.

Some crypto experts also point towards a potential for the massive altcoin run. Memecoins have already pumped high, though, which used to be a sign of an impending market correction. Although intuitively, memecoins may have now taken on a much more decent role in a crypto market, ascending in the capital allocation chain.

The remarkable growth in on-chain fundamentals and robust ETF flows suggest that Bitcoin is just warming up for a strong 2024. Heightened volatility is expected at all-time highs, likely followed by some consolidation in the $56K to $60K range. If it occurs before the April halving event, a major breakout will likely be driven by strong ETF inflows and perhaps some major announcements.

---

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.