With all the differences between the mechanics of over-collateralized stablecoins like $DAI vs. algorithmic stables like $LUNA/$UST, there has been a surge in the “DAI is the new UST” narrative across the crypto community. What's going on there? What has MakerDAO done to set the Web3 community against itself? Is it time to short $DAI, and what role does AAVE play in this?

The story begins on March 12, when Rune, the co-founder and thought leader of MakerDAO, posted on the governance forum updates (1, 2) regarding the Endgame plan. These updates included, among other things, the integration of shiny new USDe/sUSDe from Ethena, suggesting the use of Ethena's stablecoin as collateral for DAI.

On March 14, Rune also initiated a discussion on the forum about the risks of $USDe, consisting of a three-paragraph post from Rune and comments from Ethena Labs. Subsequently, assessments of USDe risks from consultants appeared on the forum, followed by another evaluation a week later.

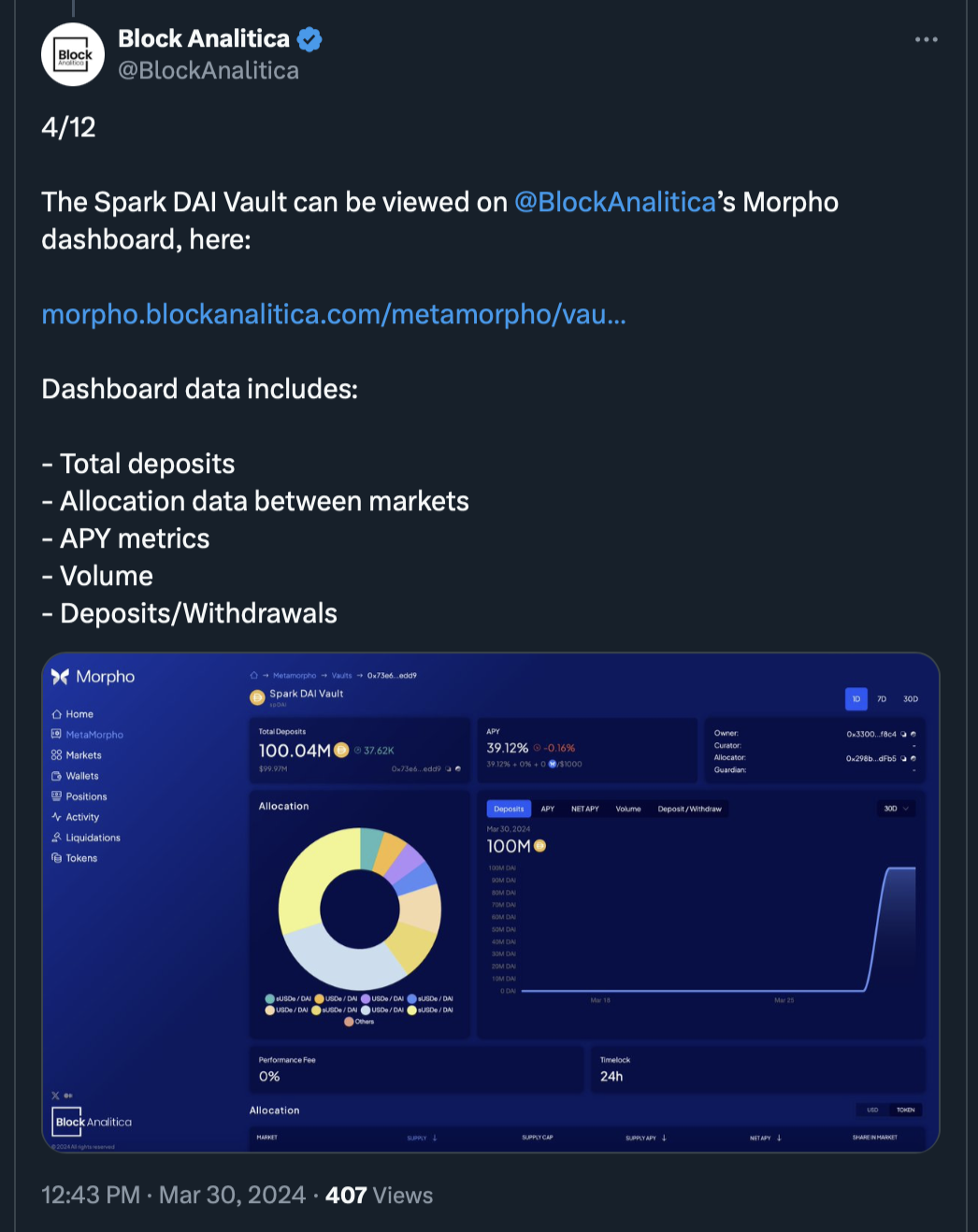

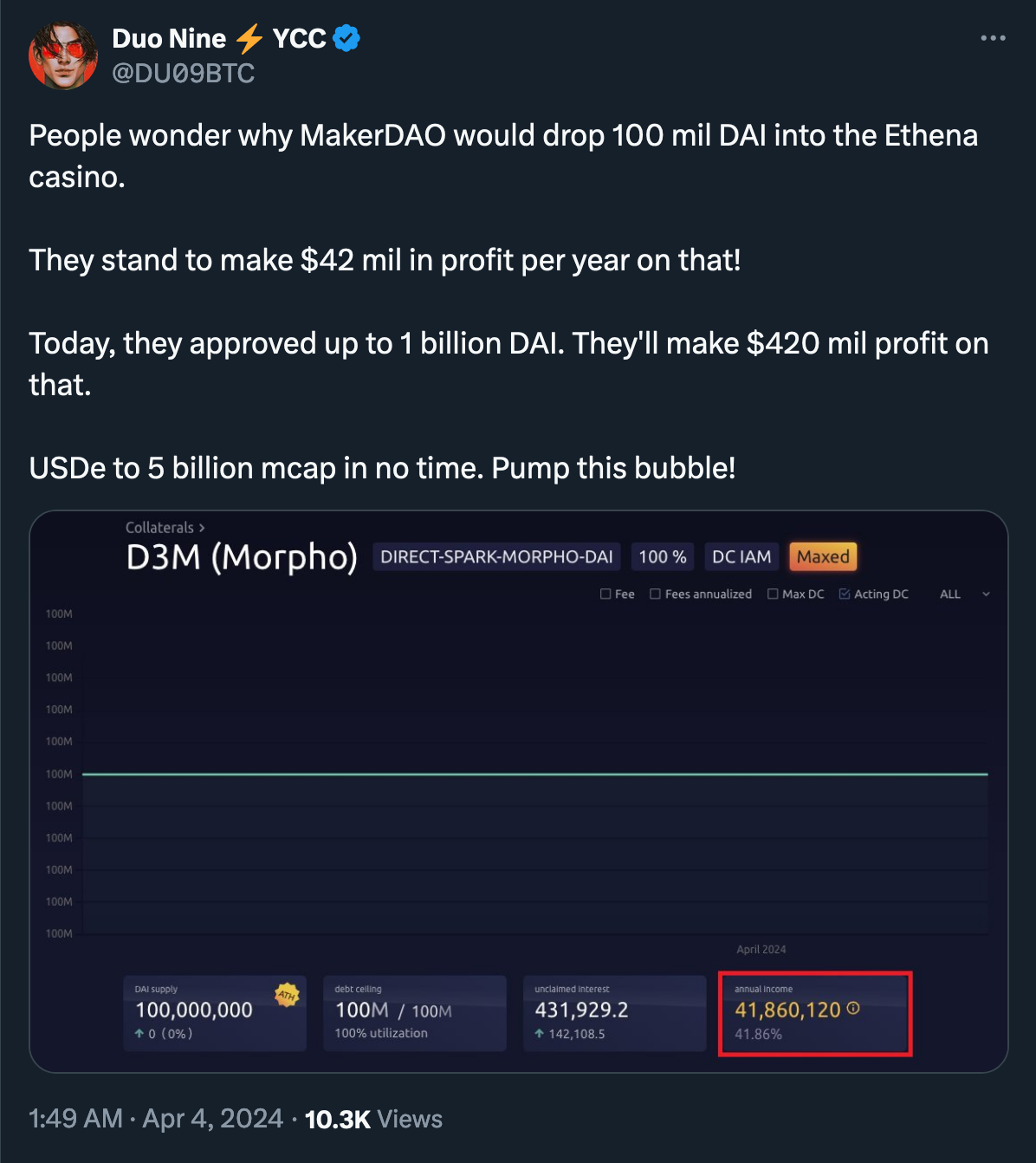

On March 22, a proposal regarding the vault parameters for USDe/sUSDe was published on the same forum, with a proposed cap of 100m DAI. By March 28, 100m DAI were minted into the corresponding Spark DAI Morpho Vault.

(Thread)

(Thread)

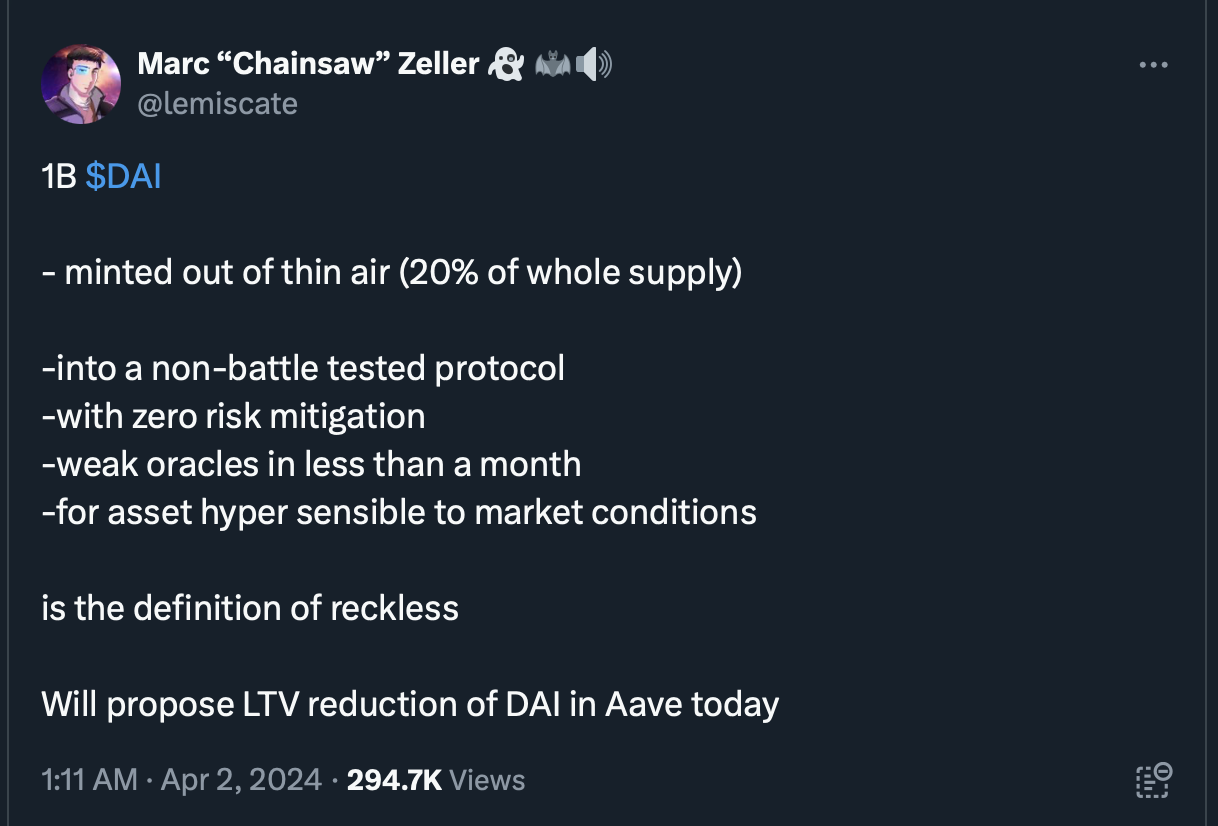

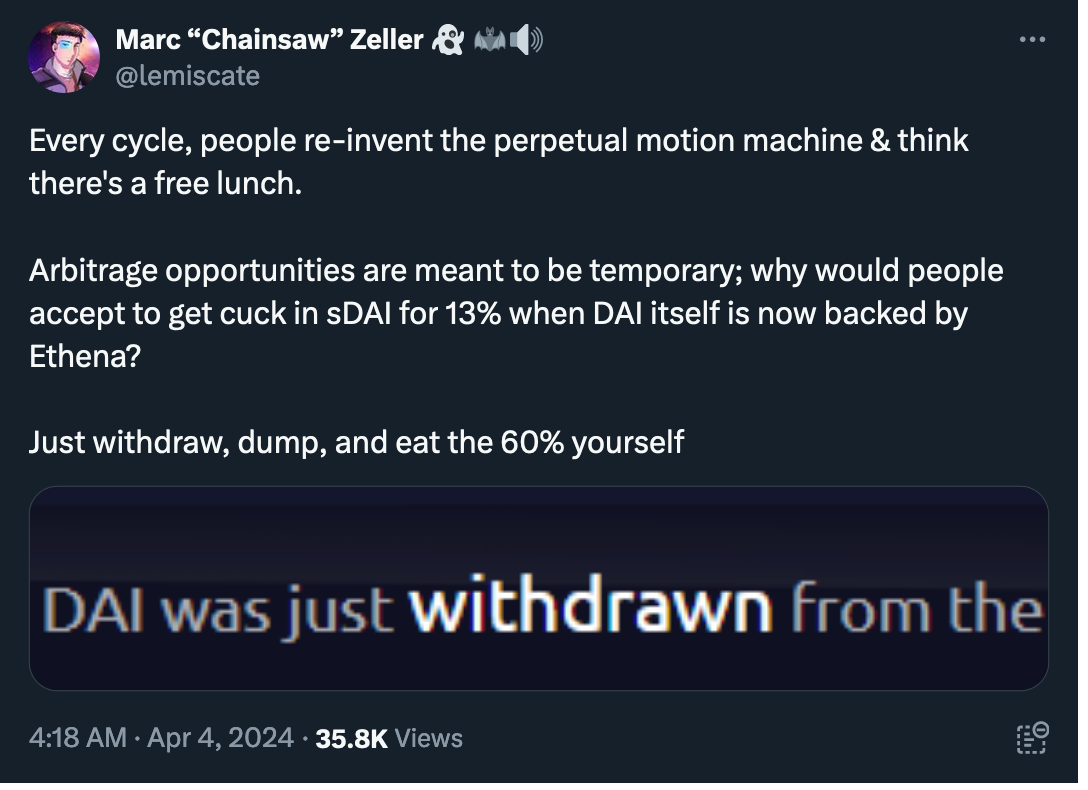

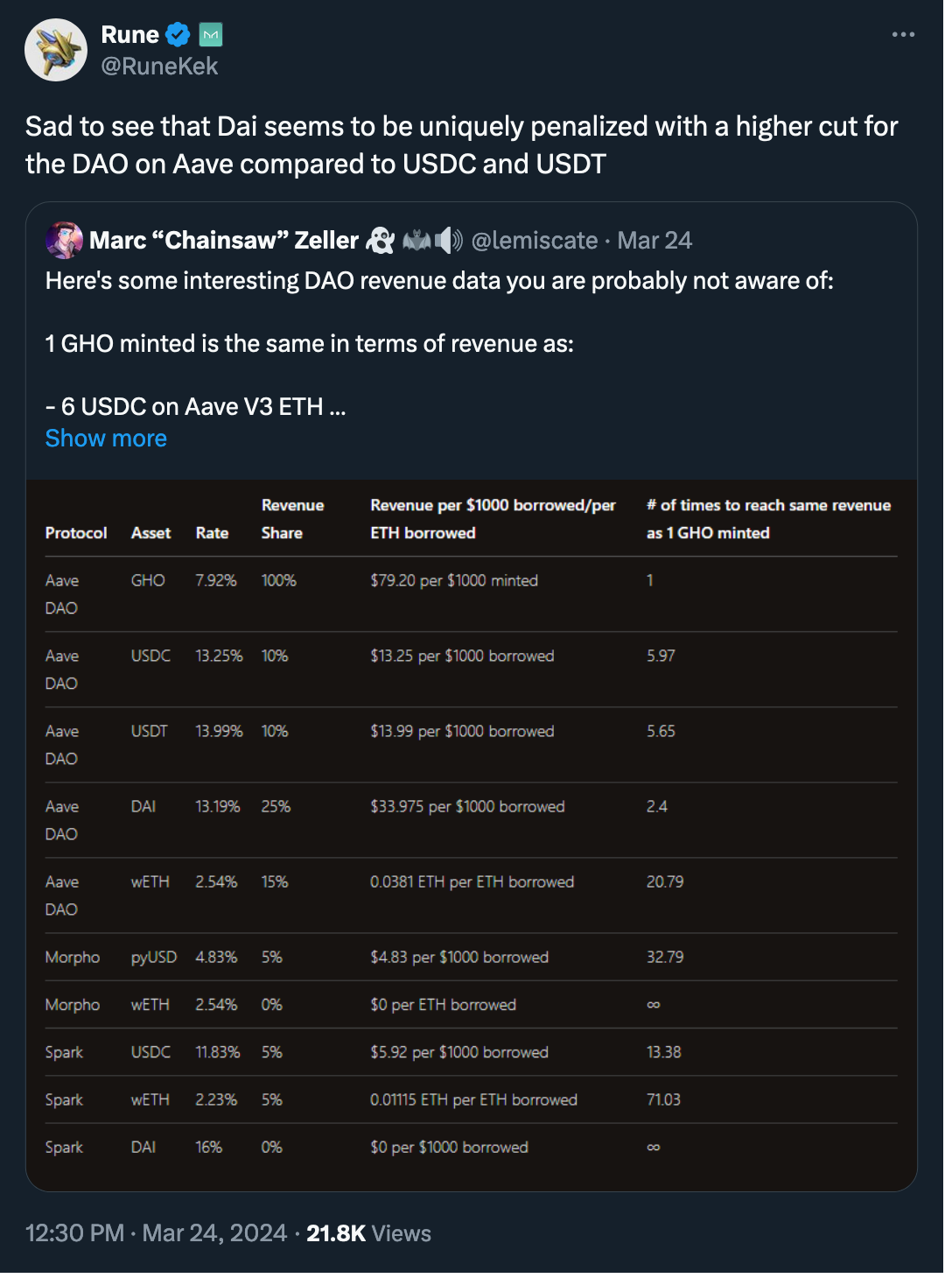

On April 1, a proposal to increase the cap for USDe/sUSDe to 1b DAI was published. Marc Zeller, co-founder and thought leader of AAVE, expressed on X his disapproval of such aggressive onboarding of USDe. Simultaneously, in the LobsterDAO's Telegram channel, he mentioned that the LTV for DAI would be reduced to zero, hinting at a potential de-pegging of DAI.

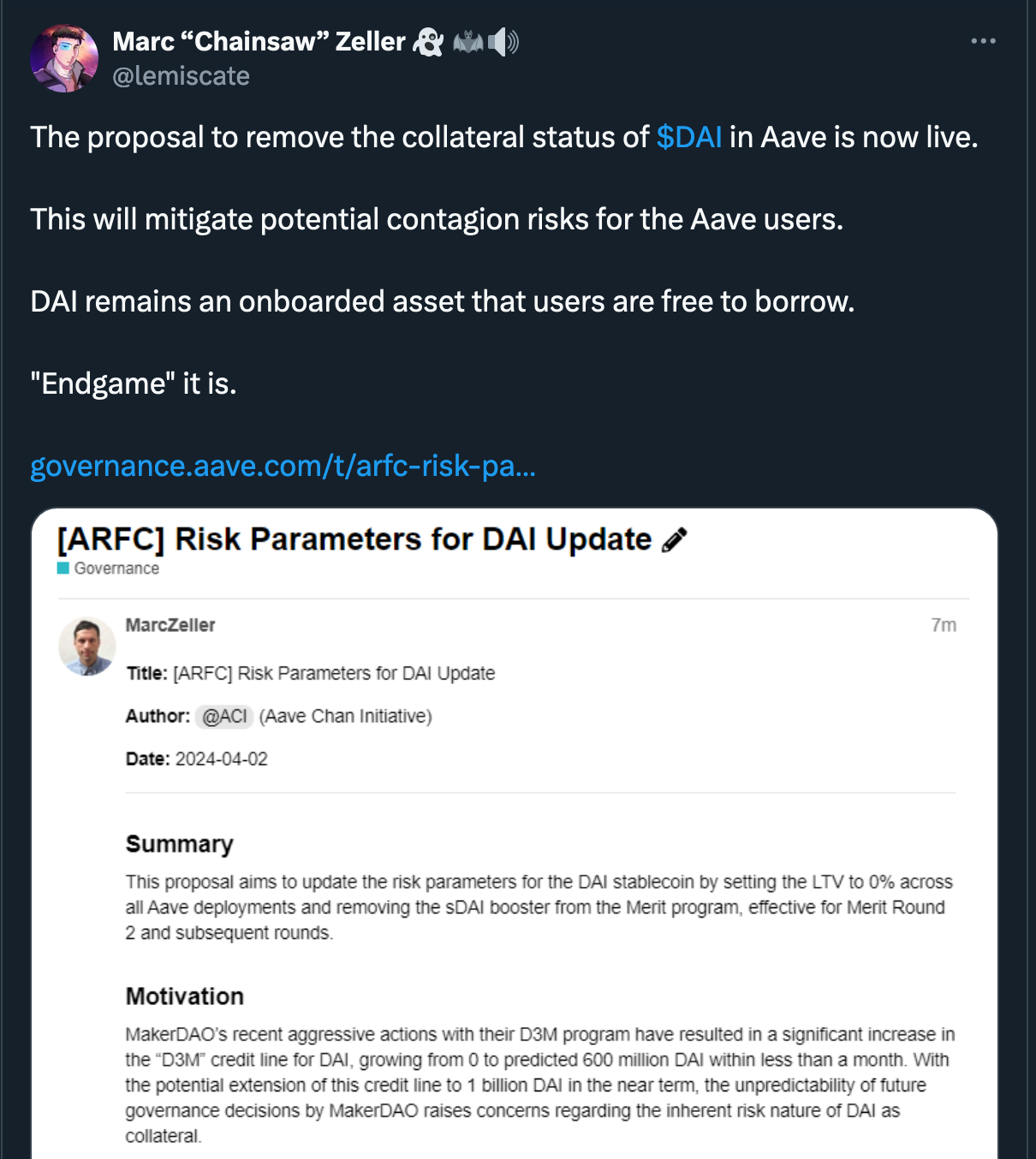

The corresponding proposal appeared on the AAVE governance forum the next day. Nostra (the main lending platform on Starknet) reduced DAI’s cap to zero, and Stani, the co-founder of AAVE, even suggested removing DAI from AAVE entirely.

The discussion that erupted in the LobsterDAO Telegram channel about the risks of USDe and decision-making processes in MakerDAO spread throughout the #DeFi community, and on Wednesday, April 3, an X-space was held with participation from AAVE, MakerDAO, Ethena, and Morpho.

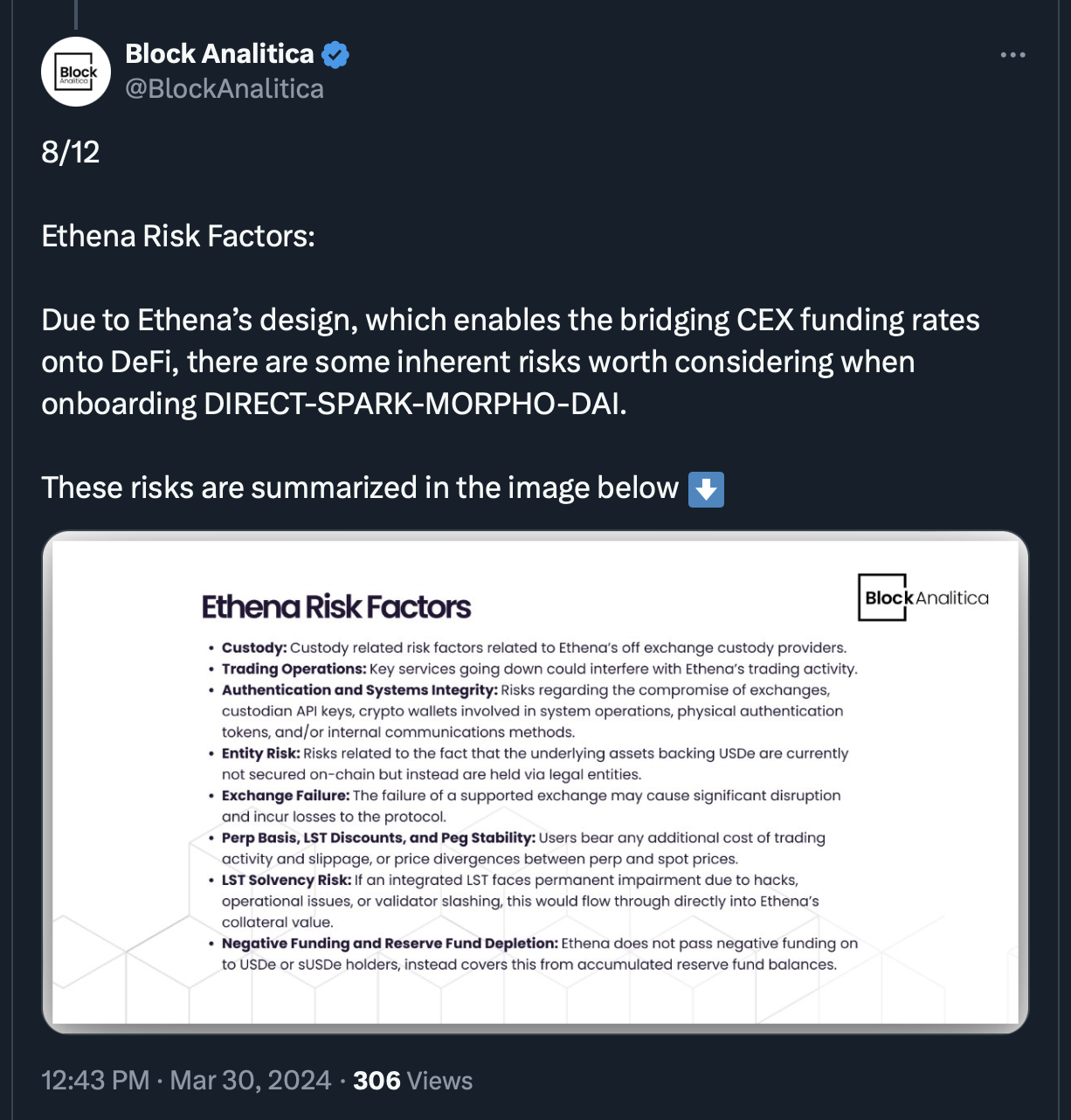

Much of the discussion revolved around the risks and stability of $USDe, a shiny new stablecoin launched by Ethena Labs at the end of last year. Basically, USDe involves off-chain custodians, limited access to mint/redeem USDe, and close interaction with centralized exchanges (see documentation here).

Notably, Ethena:

- Requests that USDe not be called a stablecoin but a synthetic dollar

- Offers a 35% APY on its 'non-stablecoin'

- Attracted $2b in total value locked (TVL) through a combination of aggressive marketing and unusually high rates for a stablecoin

- Distributed ENA through the tokens drop, currently with a fully diluted valuation (FDV) of $17b

(Thread)

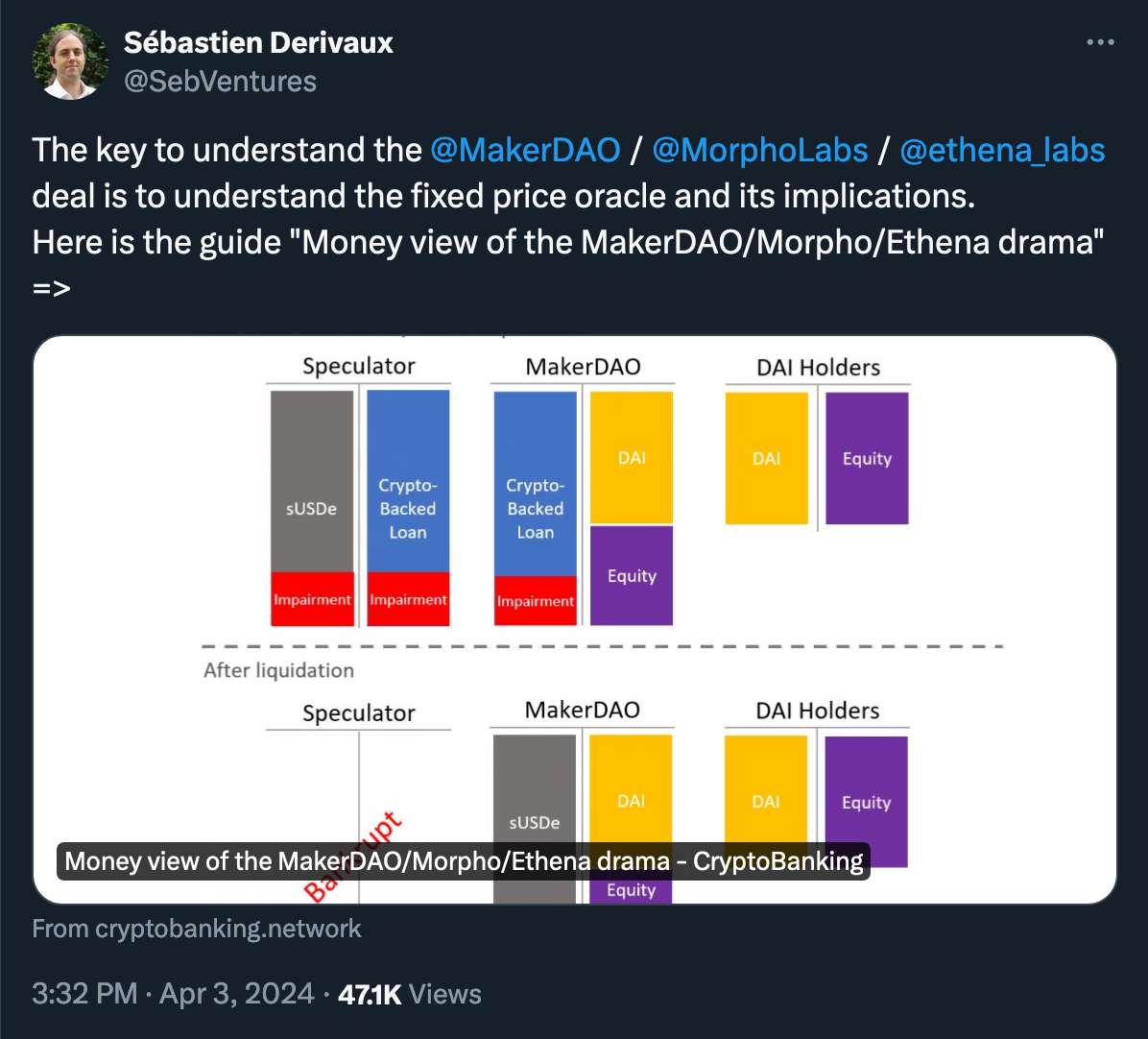

Given the number of trust assumptions in USDe's architecture, making the stability of the primary crypto-native stablecoin (DAI) dependent on USDe to 20% of its collateral might seem really questionable.

The criticism of MakerDAO includes:

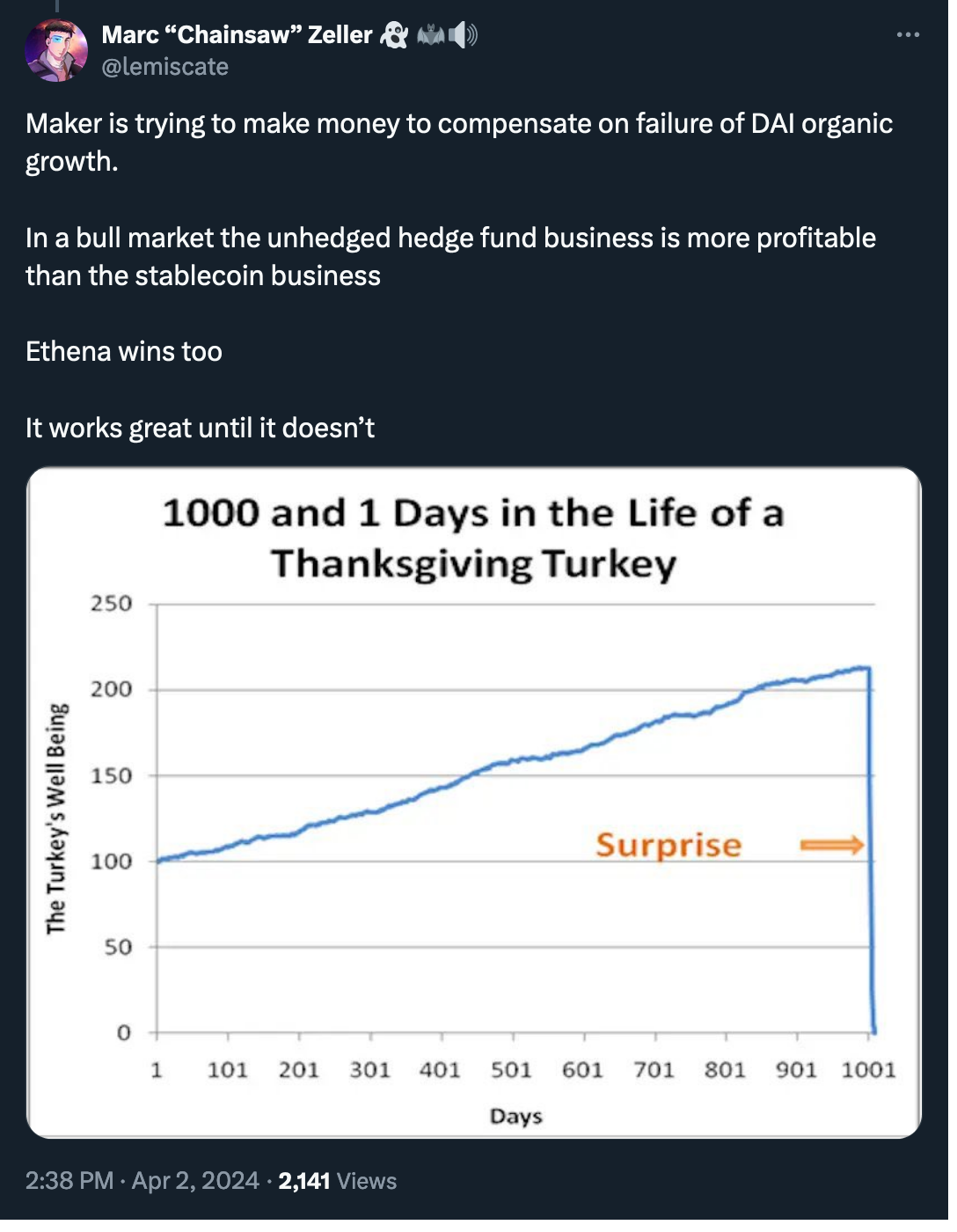

- Too rapid an increase in caps for the stablecoin/synthetic dollar from a new protocol and careless risk management

- The primary users of USDe are degen farmers who will create loop positions with 20x+ leverage, so a deleveraging event is inevitable, and it’s uncertain how severe its impact will be

(Thread)

MakerDAO's response to the criticism roughly includes:

- Assurance that risk management is adequate, as evidenced by reports from MakerDAO's consultants (1, 2)

- AAVE’s (specifically Marc's) reaction is unjustified: why reduce LTV to 0 instead of, say, 60? Why does Marc mention "creating DAI out of thin air" when that is clearly not the case? Why is there even a discussion when no vote to increase the USDe cap has taken place?

The gist of the arguments from the X-space:

Rune (MakerDAO): USDe represents a unique opportunity for a quick profit; we will gain a lot of cash (which we need for various purposes), and our risk assessment is OK.

Marc Zeller (AAVE): “You never fucking liquidated the position in your life; you’re six months old; what the fuck are you talking about?”

(Thread)

The importance of this drama lies in the fact that DAI from MakerDAO is the largest decentralized/algorithmic stablecoin around and a top-4 DeFi protocol with $8b TVL. AAVE, in its turn, is the largest lending/money market and a top-3 DeFi protocol with $10b TVL. Both are critical components of the DeFi ecosystem, and the "war" between these protocols could lead to a major shift within the DeFi landscape, opening opportunities for new projects or severely impacting the markets for existing ones.

At the same time, the rhetoric from Marc Zeller suggests a brewing confrontation, if not an outright war, with potential losers and winners yet to be determined in the DeFi sector.