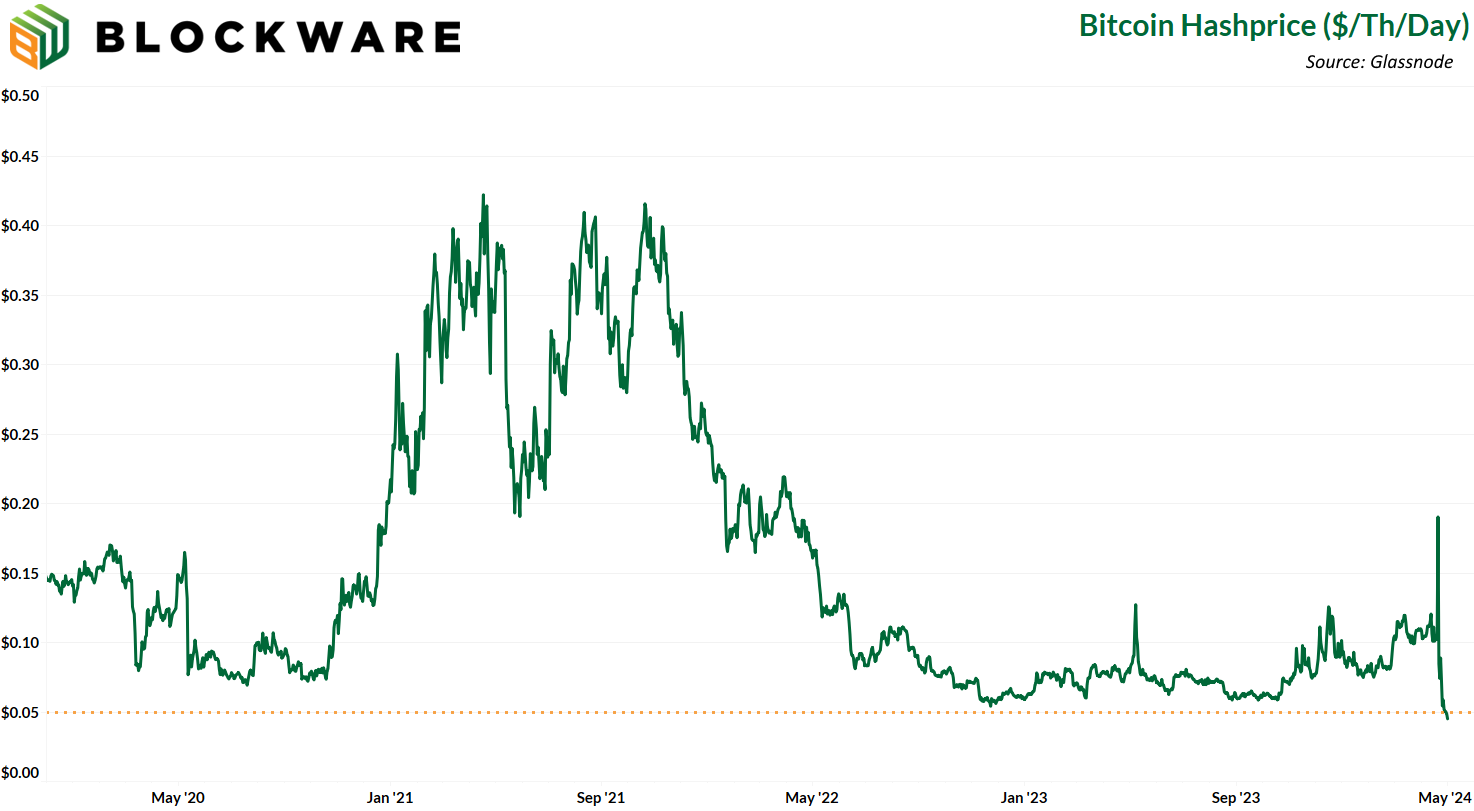

The recent post-halving price dip has placed Bitcoin miners in a tricky position, prompting concerns about potential miner capitulation—where miners might shut down their equipment and operations to avoid mining at a loss. With the block subsidy reduced to 3.125 BTC per block after April halving, Bitcoin miners are being put to the test.

(Source)

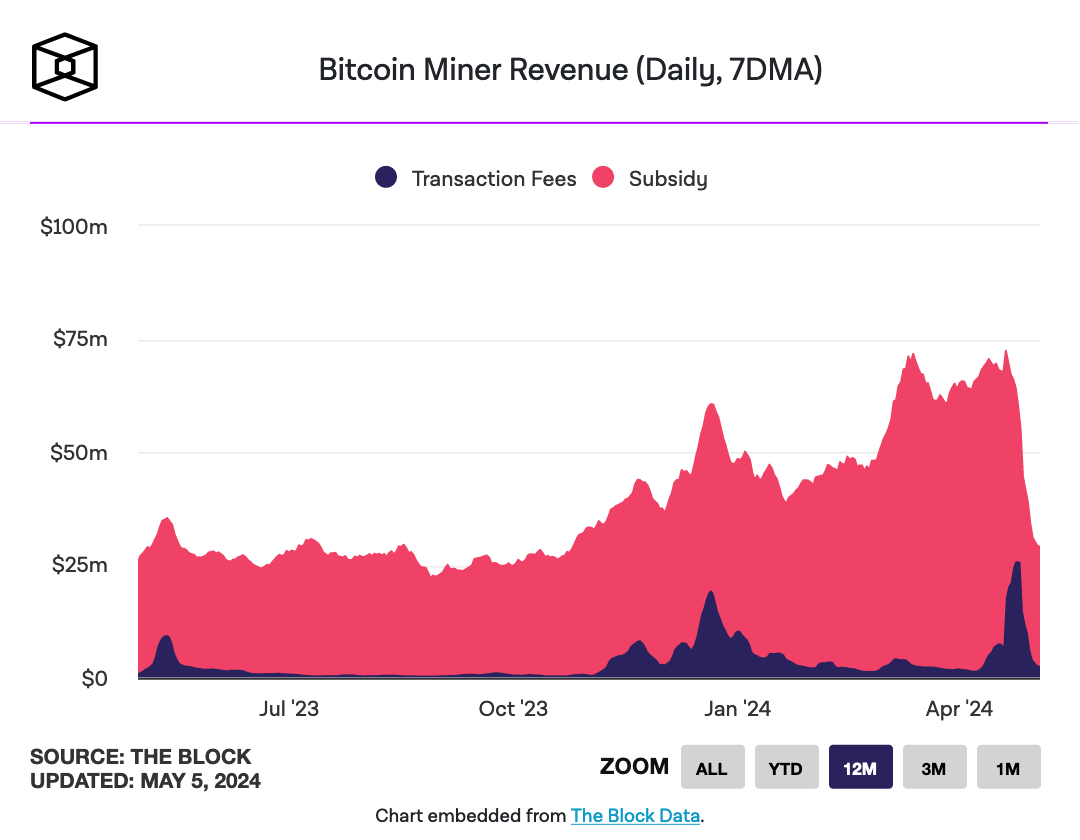

BTC transaction fees skyrocketed amid the absurd Runes surge after the halving, increasing mining difficulty immediately after a halving for the first time in Bitcoin's history. Although these fees have since fallen back to Earth, illustrating the volatile dynamics miners must navigate.

(Source: The Block)

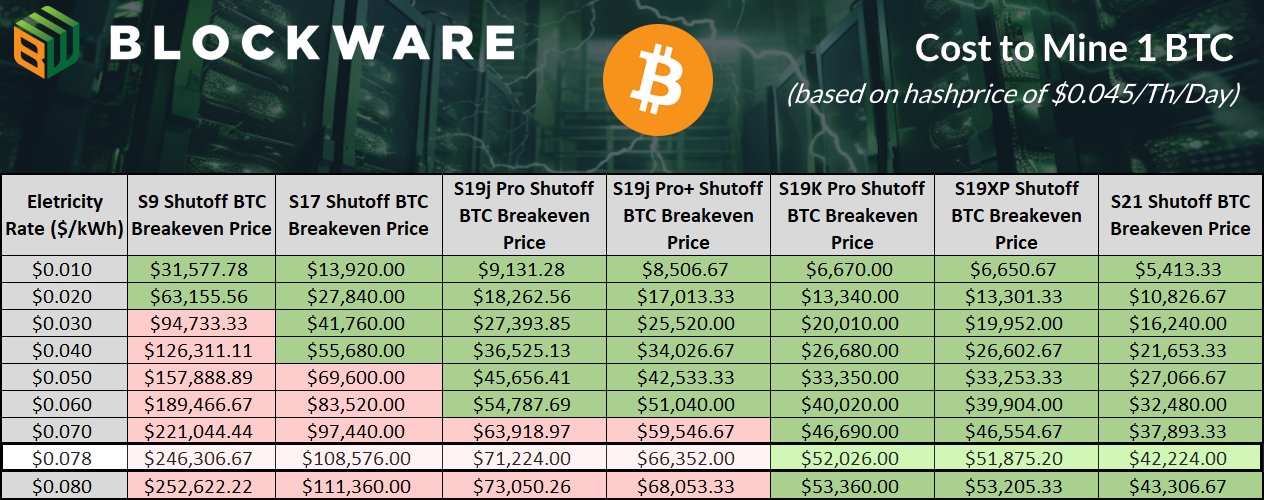

Such intense and direct free-market competition can hardly be found in any other industry. To survive in the market, miners must secure 1) low-cost power and 2) efficient ASICs. Those unable to meet these requirements operate at a loss, with no subsidies or ways to intervene to mitigate that.

That said, the medium-to-long-term outlook for Bitcoin mining is not that bleak. Miners with access to low-cost power and advanced hardware continue to profit. On the other hand, the capitulation of the weakest miners on the network will reduce sell pressure on Bitcoin, potentially leading to an increase in price.

The next projected difficulty adjustment is a decrease of 2.7%, indicating that the majority of miners are still profitable under current conditions, though it strongly depends on the type of ASICs being used.

(Source)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.