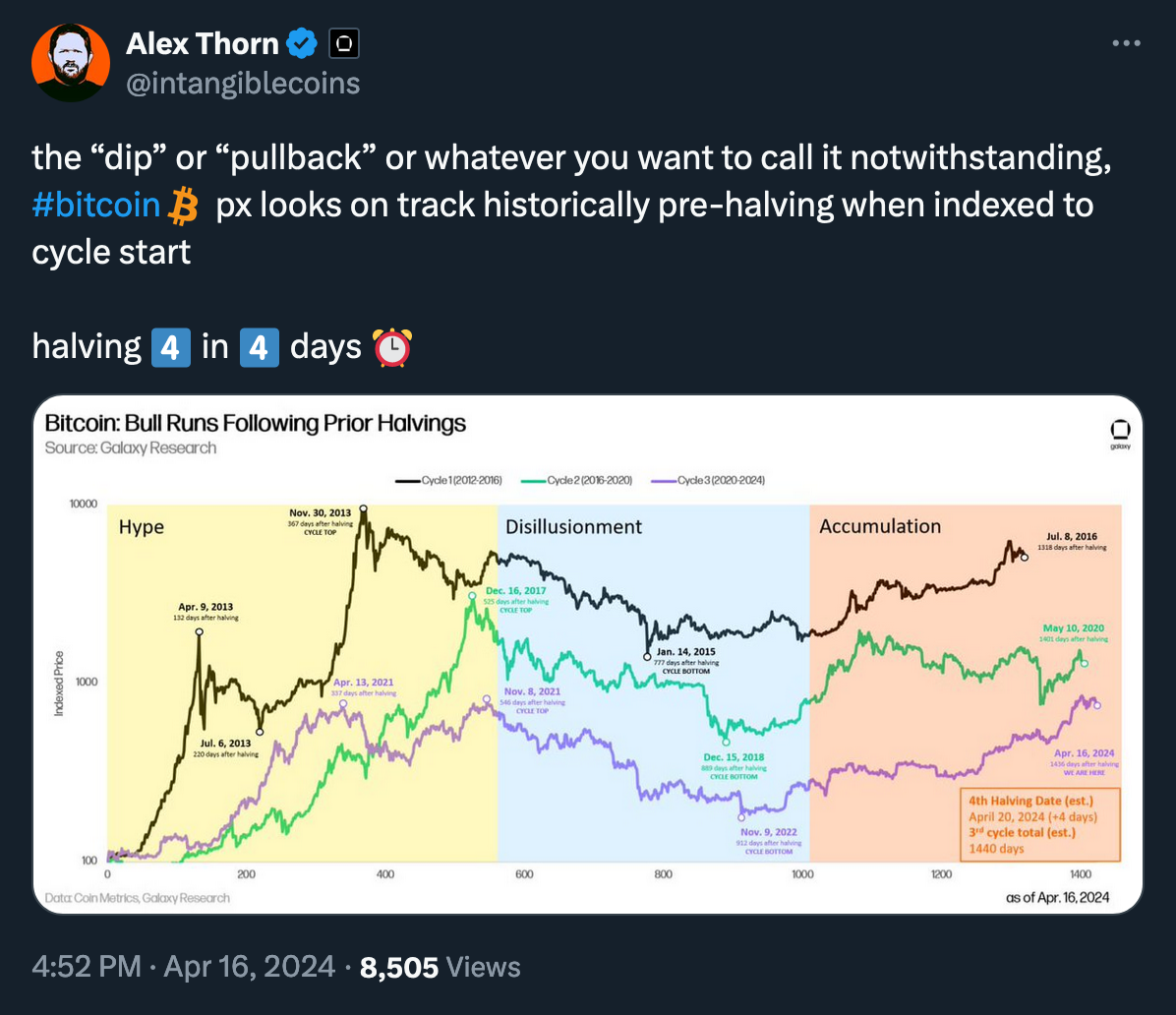

The Bitcoin halving is set to occur in a few hours, reducing the amount of new bitcoin produced each year by $11.5 billion. Historically, halvings have been beneficial for Bitcoin's price, as a reduction in new supply generally leads to higher prices, all other factors being equal.

However, since halving is predetermined and hard-coded into Bitcoin's protocol, the question of whether that particular halving is 'priced in' surfaces in the media every four years. On the other hand, Matt Hougan, the Chief Investment Officer of Bitwise, has argued that many are missing the key impact of the halving: changing the ratio of forced vs. willing sellers in the market.

"...Imagine that new investors coming into the bitcoin market want to buy, on average, 1,000 bitcoin per day. Currently, bitcoin miners produce roughly 900 bitcoin per day. These investors can acquire 90% of their bitcoin from forced sellers and 10% of their bitcoin from willing sellers. After the halving, however, miners will only produce roughly 450 bitcoin per day. With the same demand, new investors will only be able to acquire 45% of their bitcoin from forced sellers, while the remaining 55% must come from willing sellers." (Matt Hougan, Bitwise)

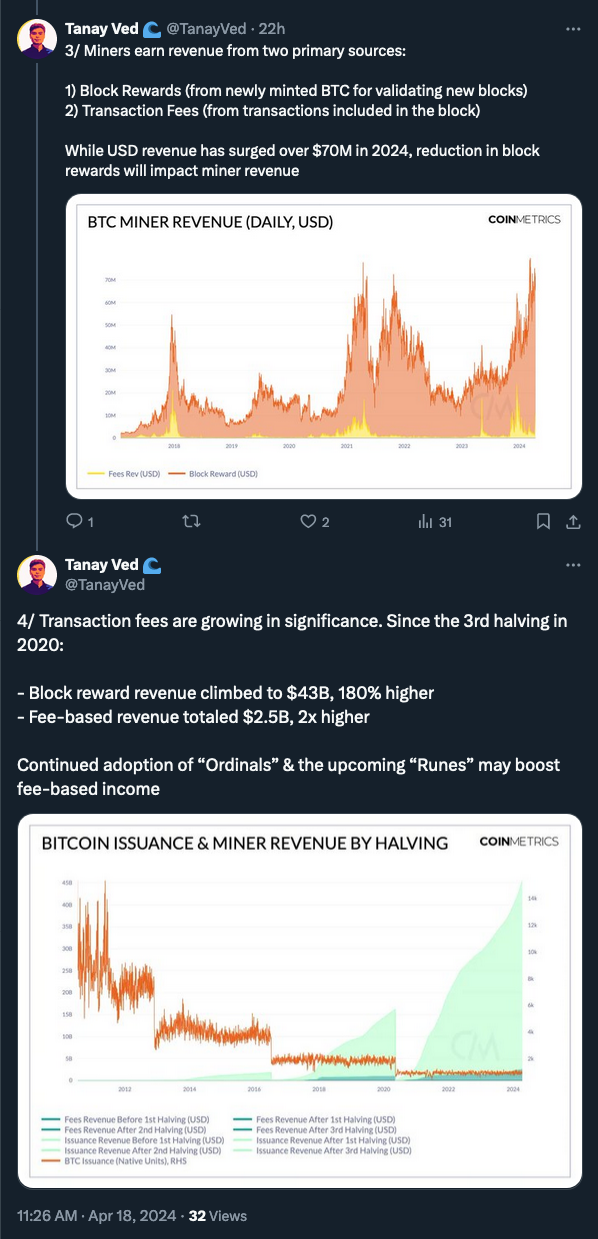

As many have noted, the impending halving poses challenges and opportunities for miners, as evidenced by shifts in miner behavior and industry dynamics. Decreased bitcoin reserves held by miners, coupled with heightened competition and record-high hash rate, underscore the necessity for greater operational efficiency and strategic adaptation.

According to Coindesk, the halving will impact Bitcoin mining in several ways, although it may not significantly affect Bitcoin's price directly:

- Bitcoin’s hashrate will not drop by that much

- High-cost miners will be forced to upgrade fleets

- Miners will be forced to find creative ways to increase profits

- Some miners will diversify away from mining

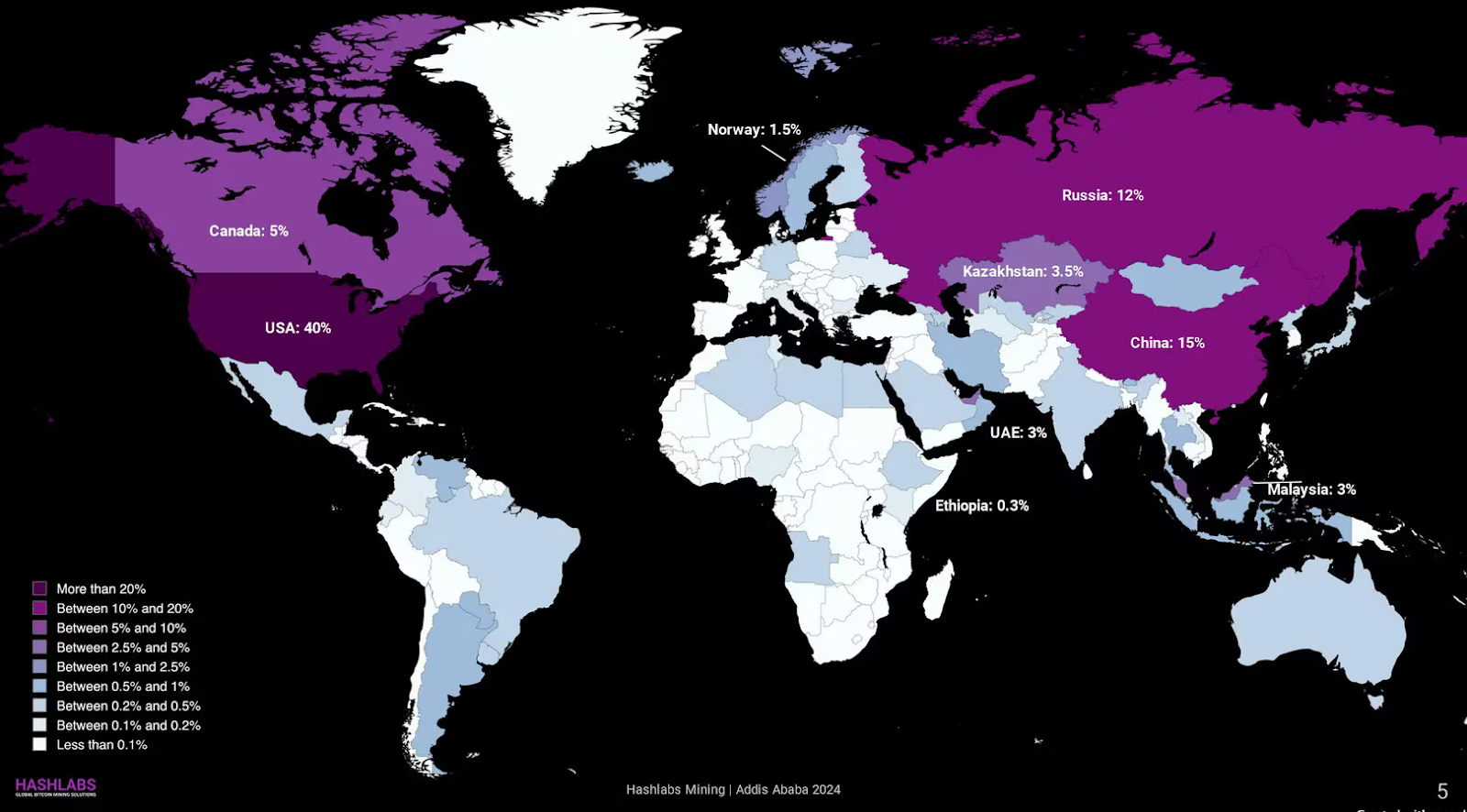

- Bitcoin mining will become more geographically decentralized

(Source: Coindesk)

Some industry experts also expect the halving to contribute to more sustainable BTC mining.

But without a meaningful impact on the price of BTC, can Bitcoin mining remain profitable enough to continue to secure the network? According to data from CryptoQuant CEO Ki Young Ju, bitcoin needs to hold above $80,000 to keep mining profitable post-halving.

So, higher price increases can actually produce the 'hyper-bullish case' for Bitcoin mining, as noted by Blockware Intelligence analysts.

(Thread)

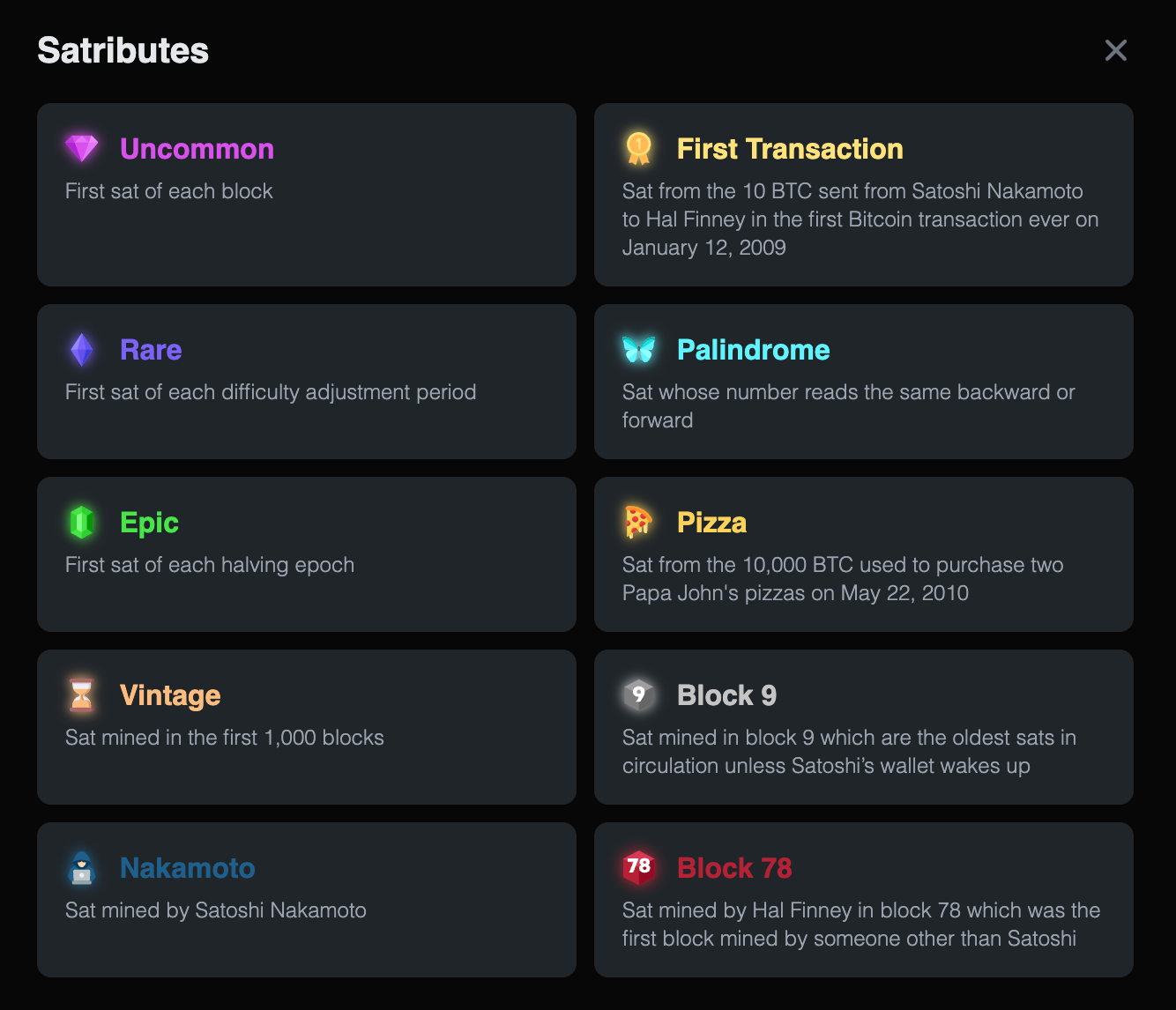

There is significant uncertainty regarding the demand for block space and fee size due to ordinals and the launch of the new Runes protocol by Ordinals creator Casey @Rodarmore, coinciding with the Bitcoin halving event. In light of these developments, many speculate that Bitcoin halving will prompt crypto miners to race for the 'epic sat'—the first satoshi post-halving, which could potentially be worth millions.

A list of popular traits (or “satributes”) an individual satoshi can have. From ord.io. (Source: t4t5.com)

Tristan @t4t5, maker of Ordiscan and a member of @TaprootWizards, has even stated that Bitcoin's halving block will likely be reorged. And for those interested in these developments, Decrypt published a list of 7 Bitcoin Ordinals and Runes projects 'you should know ahead of the halving.'

We will soon discover to what extent these expectations will be fulfilled. Wishing everyone a Happy Halving Day!

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.