Chainalysis, a firm specializing in crypto compliance and blockchain investigations, recently released the first previews of its upcoming yearly Crypto Crime report. As the crypto industry recovers from the blowups of 2022 and matures, evidenced by rising institutional adoption, how have these market developments influenced the crypto crime trends in 2023?

(Thread)

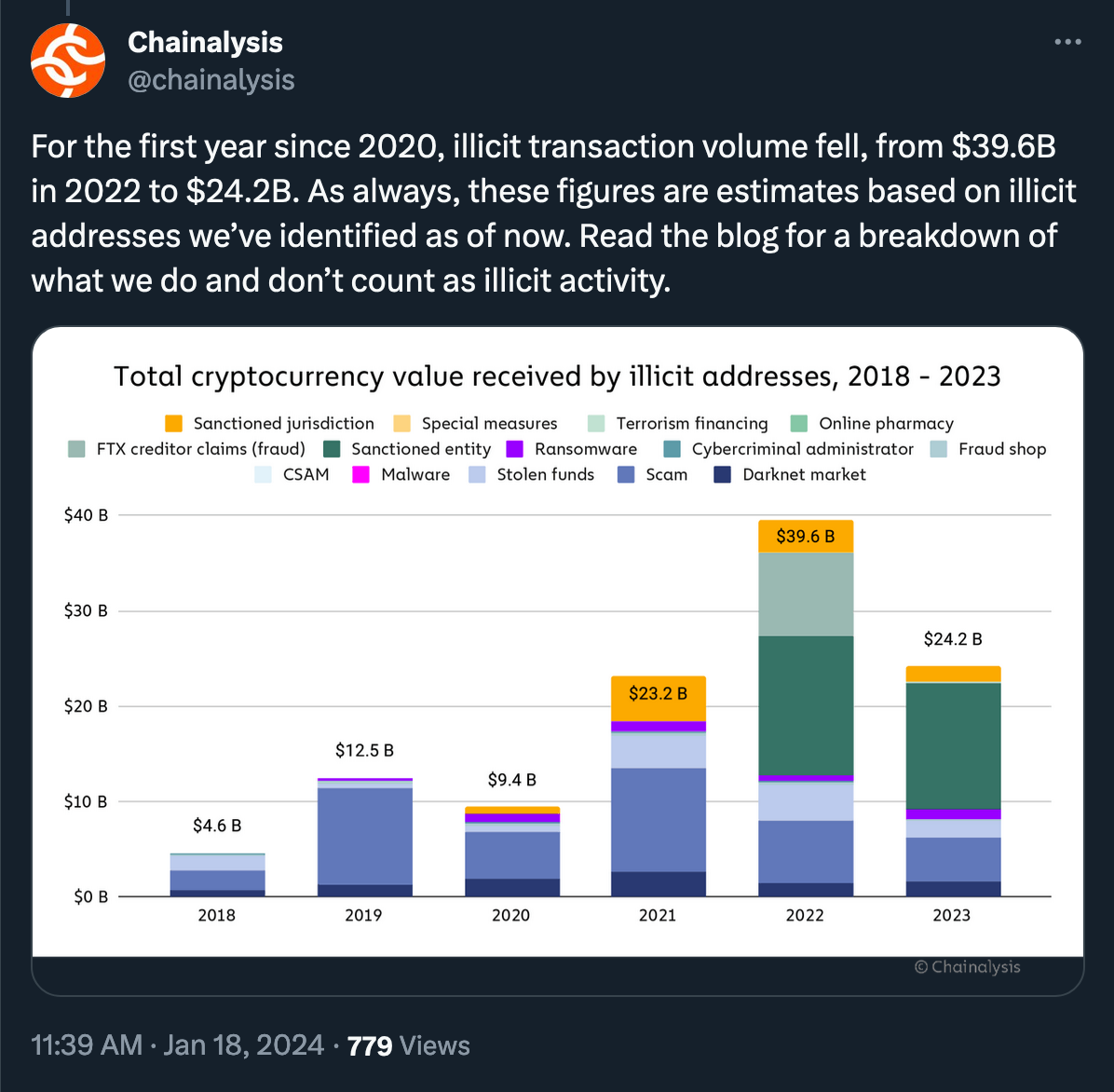

Chainalysis data indicates a notable decline in the value received by illicit cryptocurrency addresses in 2023. The authors of the report caution, however, that presented numbers are ‘almost certainly’ to rise over time. This is attributed to the nature of Chainalysis data, which relies on measurable on-chain activity. As more illicit addresses are identified, their historical activities will be integrated into the estimates, adjusting these numbers upwards.

In addition to the reduction in the absolute value of illicit activity, the share of illicit transactions in the total cryptocurrency transaction volume also fell to 0.34% from 0.42% in 2022.

(Thread)

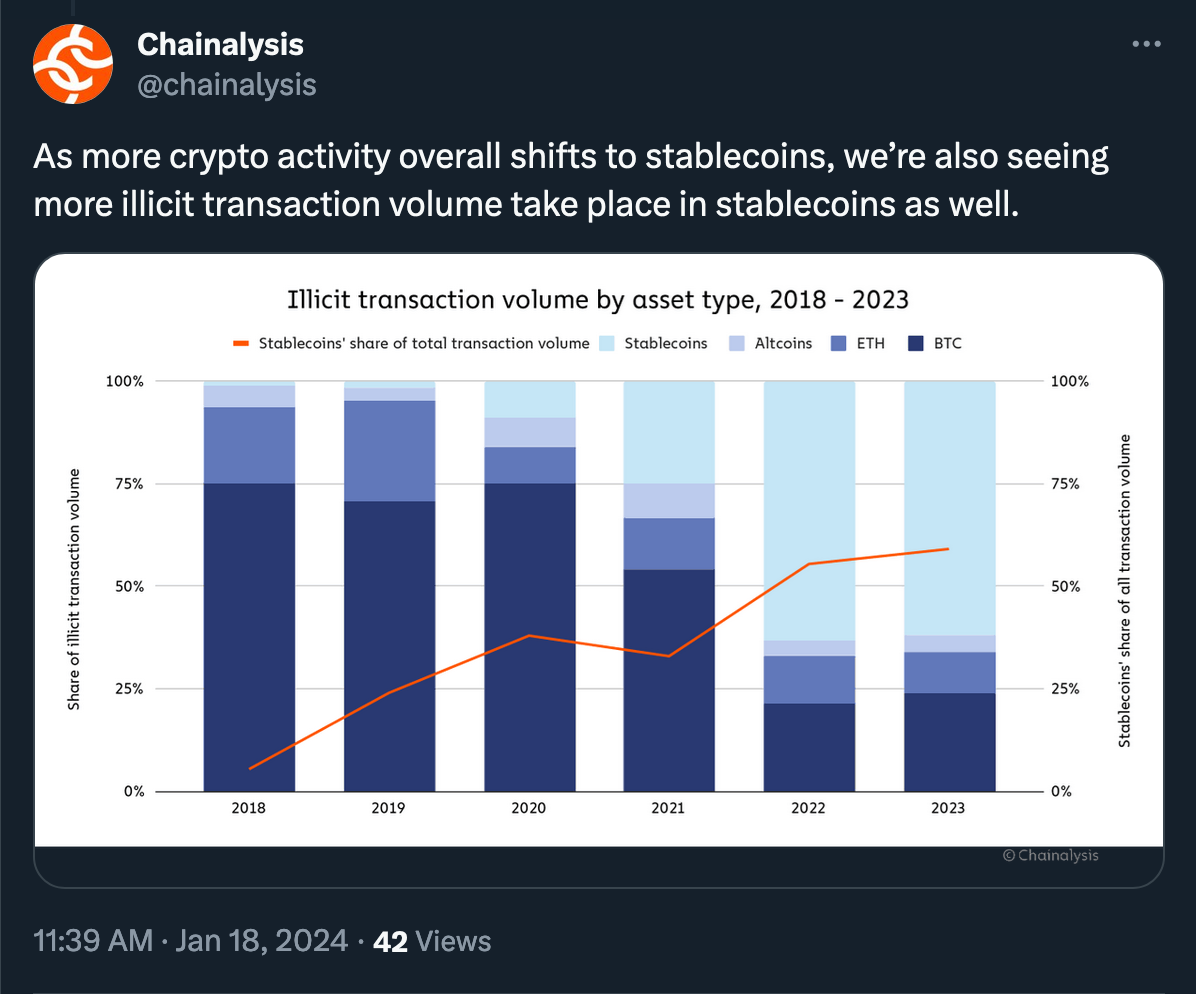

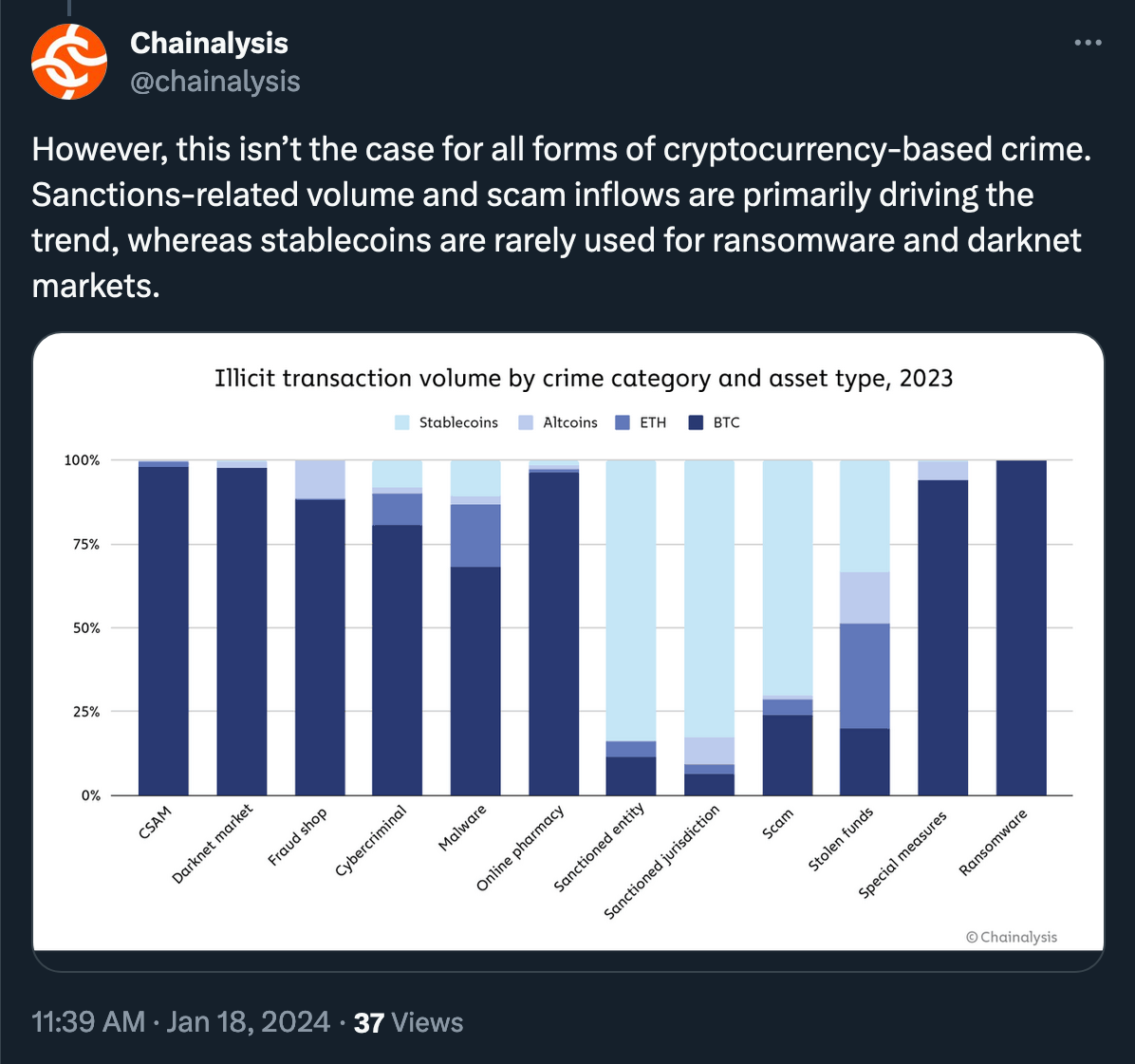

Certain types of illicit cryptocurrency activity, such as darknet market sales and ransomware extortion, still take place mainly in Bitcoin. Other types, like scamming and transactions associated with sanctioned entities, have increasingly moved towards stablecoins. Those also constitute the largest segments of crypto crime by transaction volume, thus significantly influencing the overall trend.

(Thread)

Sanctioned entities, as well as those operating within sanctioned jurisdictions, also have a greater incentive to use stablecoins, as they may face more challenges accessing the U.S. dollar through traditional means yet still want to benefit from the relative stability it provides. On the other hand, stablecoin issuers can freeze funds when detecting their illicit usage, as demonstrated by Tether’s recent moves.

Researchers have identified three key trends defining crypto crime in 2023 that are important to watch.

- Scamming and Stolen Funds both fell significantly, with total illicit revenues for each down 29.2% and 54.3%, respectively, in 2023.Notably, many crypto scammers have now adopted romance scam tactics, targeting individuals and building personal relationships to pitch fraudulent investing opportunities rather than advertising them far and wide. This approach often makes these scams harder to detect.

- Ransomware and darknet market activity on the rise, in contrast with overall trends.In particular, despite the absence of a clear leader to replace the shutdown Hydra, the darknet market sector as a whole is showing signs of recovery, with total revenue climbing back towards its 2021 highs.

- Transactions with sanctioned entities constitute the vast majority of illicit activity, accounting for 61.5% of all illicit transaction volumes in 2023. Most of this volume is driven by services either sanctioned by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) or operating in sanctioned jurisdictions where U.S. sanctions are not enforced. While these services can and have been used for nefarious purposes, it also means that a portion of this transaction volume includes activity from average crypto users who happen to reside in those sanctioned jurisdictions.Obviously, there is no reason to presume that the share of this category of illicit on-chain activity decrease in the future.

For more detailed findings, the Chainalysis blog post offers additional insights, and here, interested readers can sign up to receive a copy of the full 2024 Crypto Crime report.