As the Bitcoin halving event approaches around April 20, the cryptocurrency market is witnessing a flurry of activity that could shape its trajectory for months to come. Key industry figures are sounding alarms over recent trends, pointing to increased selling activity from miners and "whales."

The Bitcoin halving, a key mechanism built into the Bitcoin protocol, occurs approximately every four years or after every 210,000 blocks are mined. For every 210,000 blocks, the reward for mining new blocks halves, meaning Bitcoin miners receive 50% less BTC in block subsidy for verifying transactions and adding them to the blockchain.

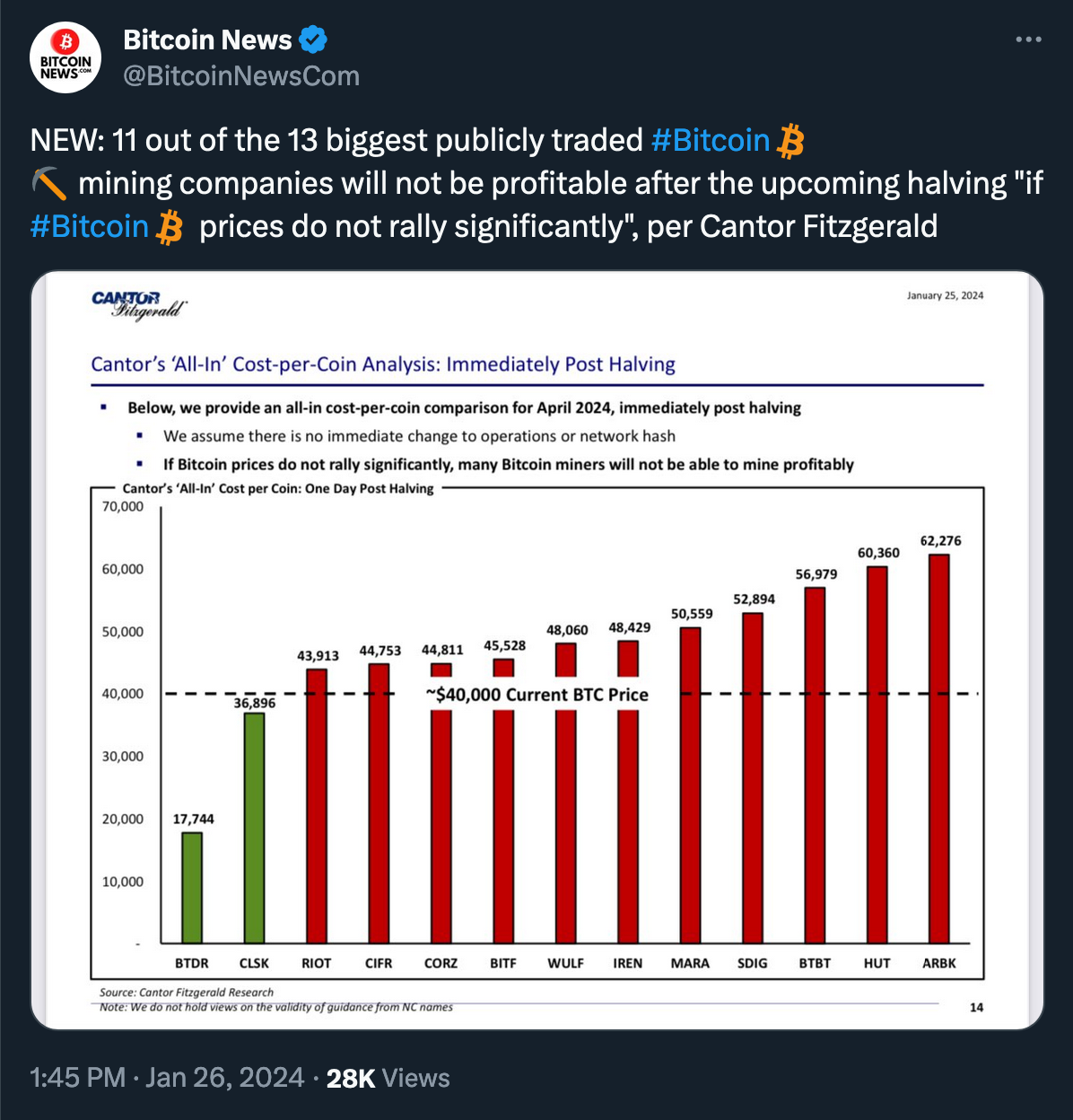

The April 2024 halving will decrease the mining reward to 3.125 BTC per block, posing new challenges for miners and the network as a whole. Up to 20% of the network's hashrate could go offline immediately after halving, according to Galaxy Digital's report.

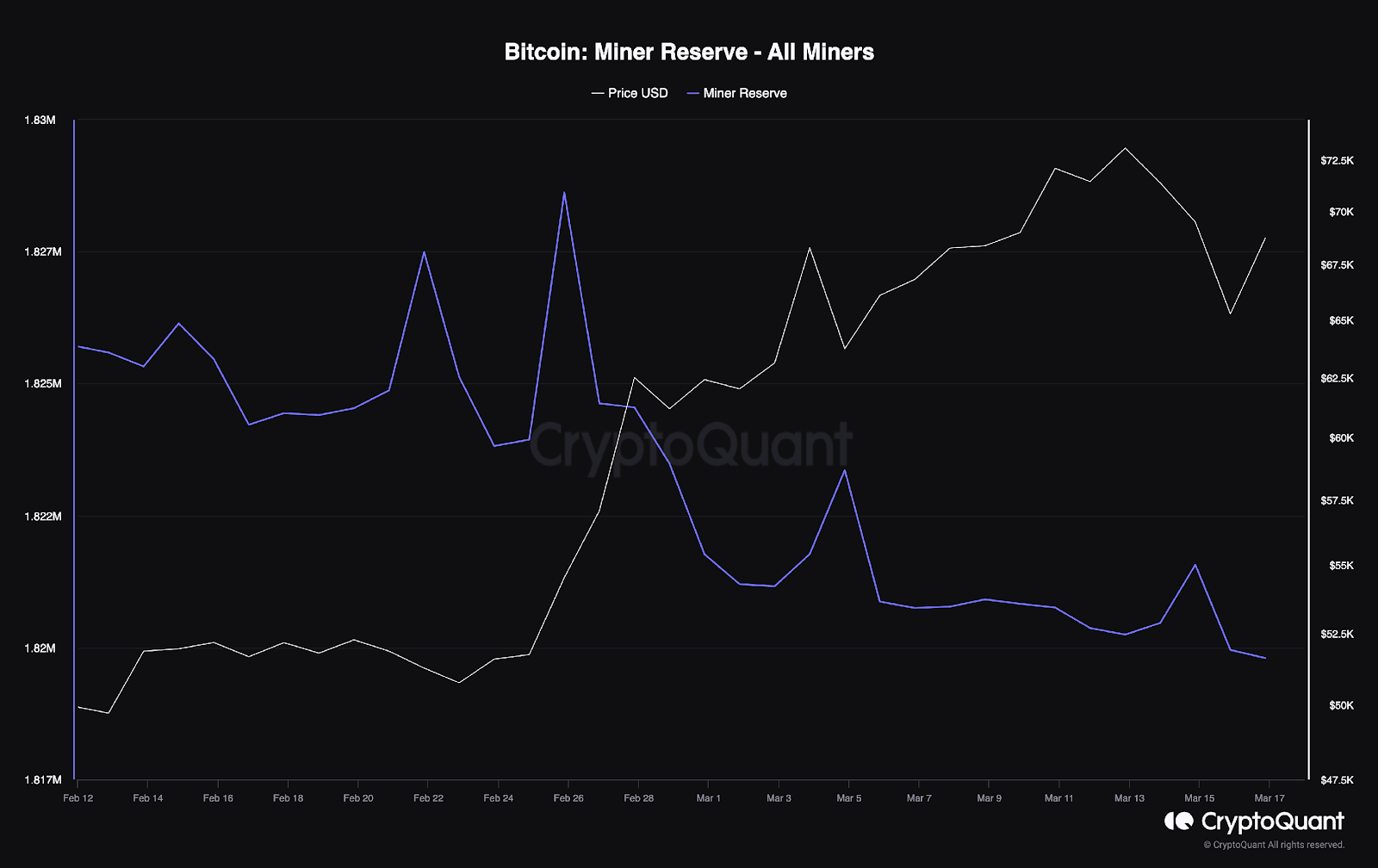

Ki Young Ju, CEO of CryptoQuant, has expressed concerns regarding a noticeable uptick in Bitcoin miners' selling. In the past month alone, they have sold about 6,145 BTC (valued at around $384 million) in anticipation of the upcoming profitability crunch.

Source: CryptoQuant

Additionally, Ali Martinez, an on-chain analyst, has noted that whales with balances of over 1,000 BTC are increasingly liquidating their holdings, with a 4.83% reduction observed in the last two weeks.

This notable sell-off by large stakeholders adds to the selling pressure, potentially impacting Bitcoin’s price. Industry experts predict a corrective move in Bitcoin could reach the $59-58k range, emphasizing, however, that this does not indicate a market peak but rather a necessary adjustment.

"Nothing rallies in a straight line. Not even #BTC. ... No moves without a counter-move. And a counter-move seems to be near." — Jan Happel, CEO of Glassnode, on X.

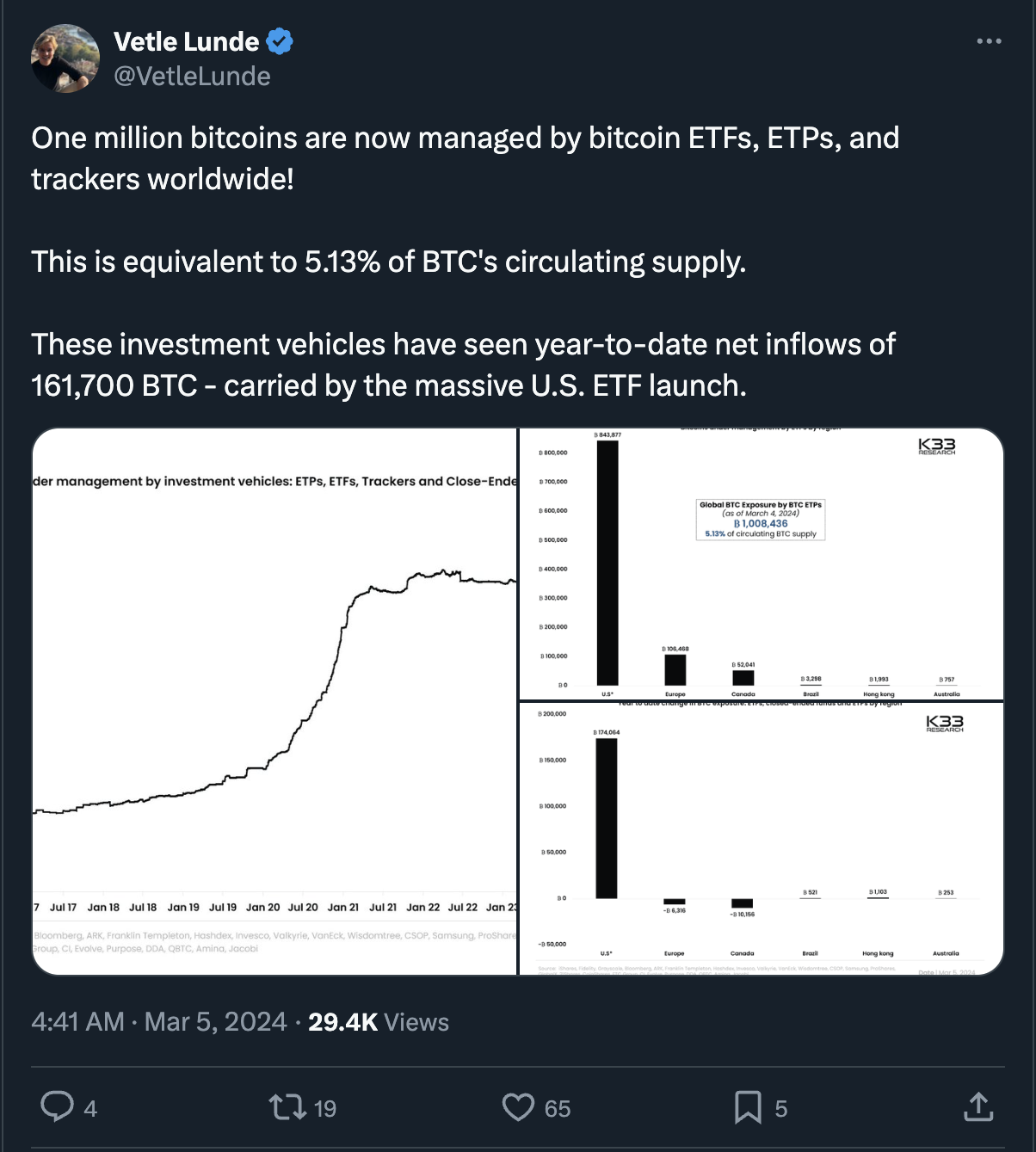

Despite this selling pressure, significant ETF inflows could counterbalance it, stabilizing the market and supporting a continued rally. "Once that [ETF inflows] become negative, then you'll see the first real correction," noted Mike Novogratz of Galaxy Digital in an interview with CNBC.

(X post)

Historical trends also support a bullish mid-term outlook for BTC, suggesting that Bitcoin is far from reaching a market top. Based on its performance trends following previous all-time highs, Bitcoin might reach its next bull market peak between December 2024 and February 2025.

(X post)

So, while short-term challenges are totally expected, industry experts remain generally positive about Bitcoin’s long-term trajectory.

The upcoming weeks seem crucial in determining how Bitcoin can weather the emerging storm of the halving event, with the launch of the new Runes protocol by the creator of Ordinals at the halving will only add to the confusion and expected volatility around this event.

(Source: Blockware Intelligence Newsletter)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.