Only five mining rigs remain profitable as Bitcoin prices fall below $58,000, according to F2Pool. Miners must continually sell their Bitcoin rewards to maintain operations and face significant stress during a market downturn. Proposals are emerging for a new 'HODL_FEE' to bail out Bitcoin miners.

Miners who provide computing power to blockchain networks are facing significant operational costs. The recent decline in Bitcoin's value has strained the operational viability of many mining machines.

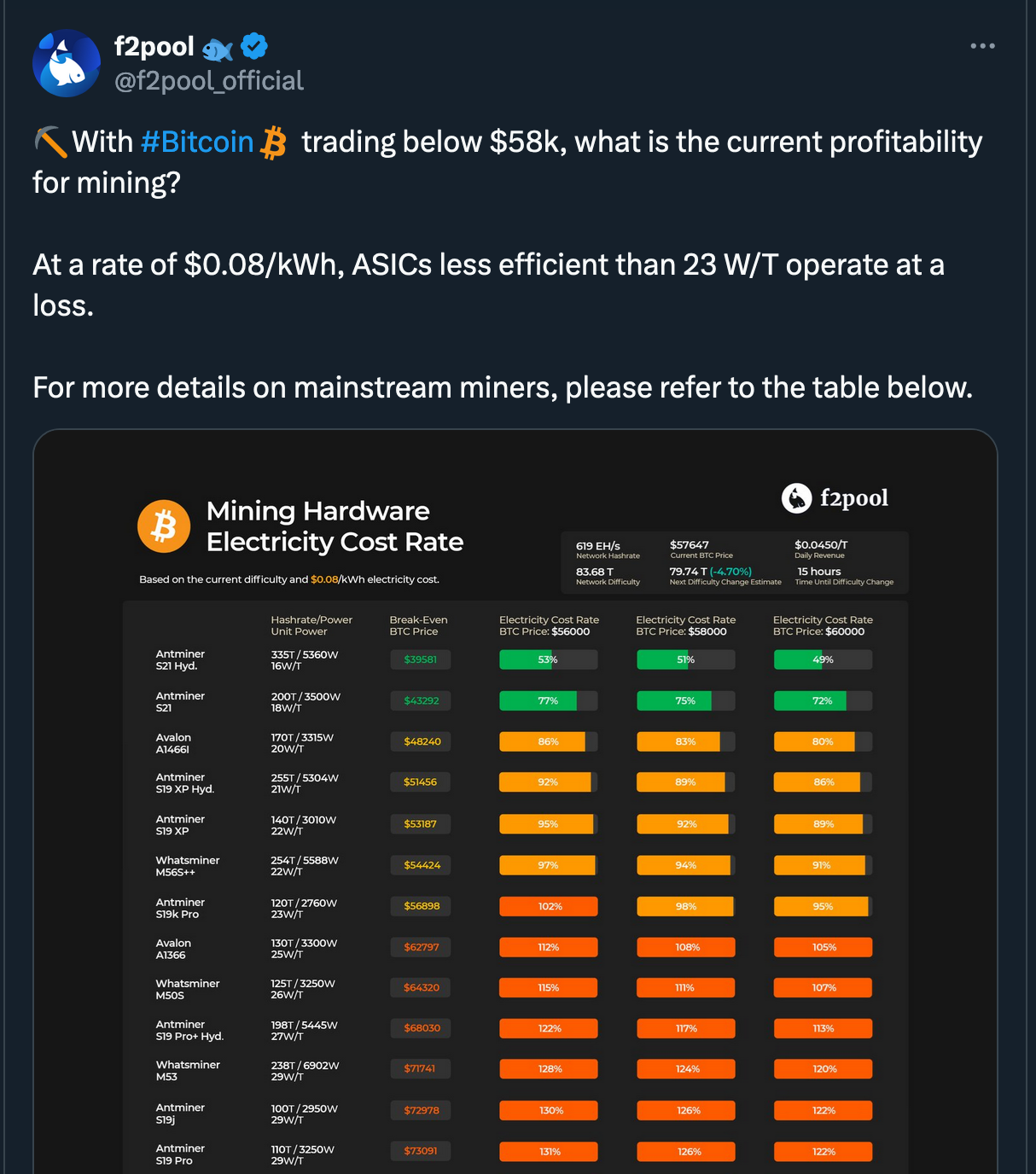

At a rate of $0.08/kWh, ASICs less efficient than 23 W/T operate at a loss, as mining giant F2Pool stated on X. F2Pool’s graph shows that four of Antminer’s various rigs and one Avalon rig are profitable as long as prices are above $53,100. However, all other miners now cost more to run than the rewards received by operators.

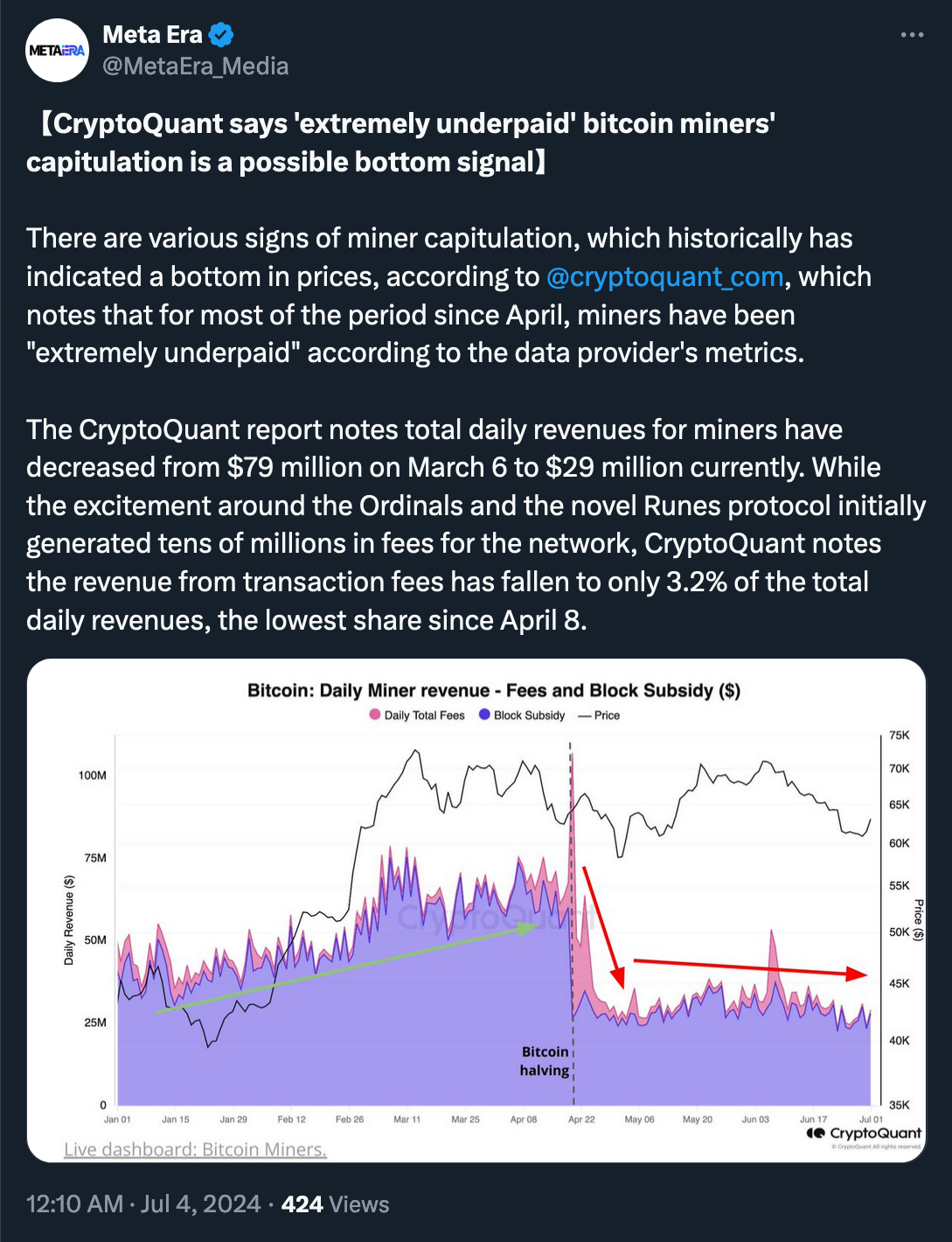

Miners reportedly constituted a significant source of Bitcoin selling pressure in June, liquidating over $1 billion worth of BTC within a two-week period as prices fluctuated between $65,000 and $70,000.

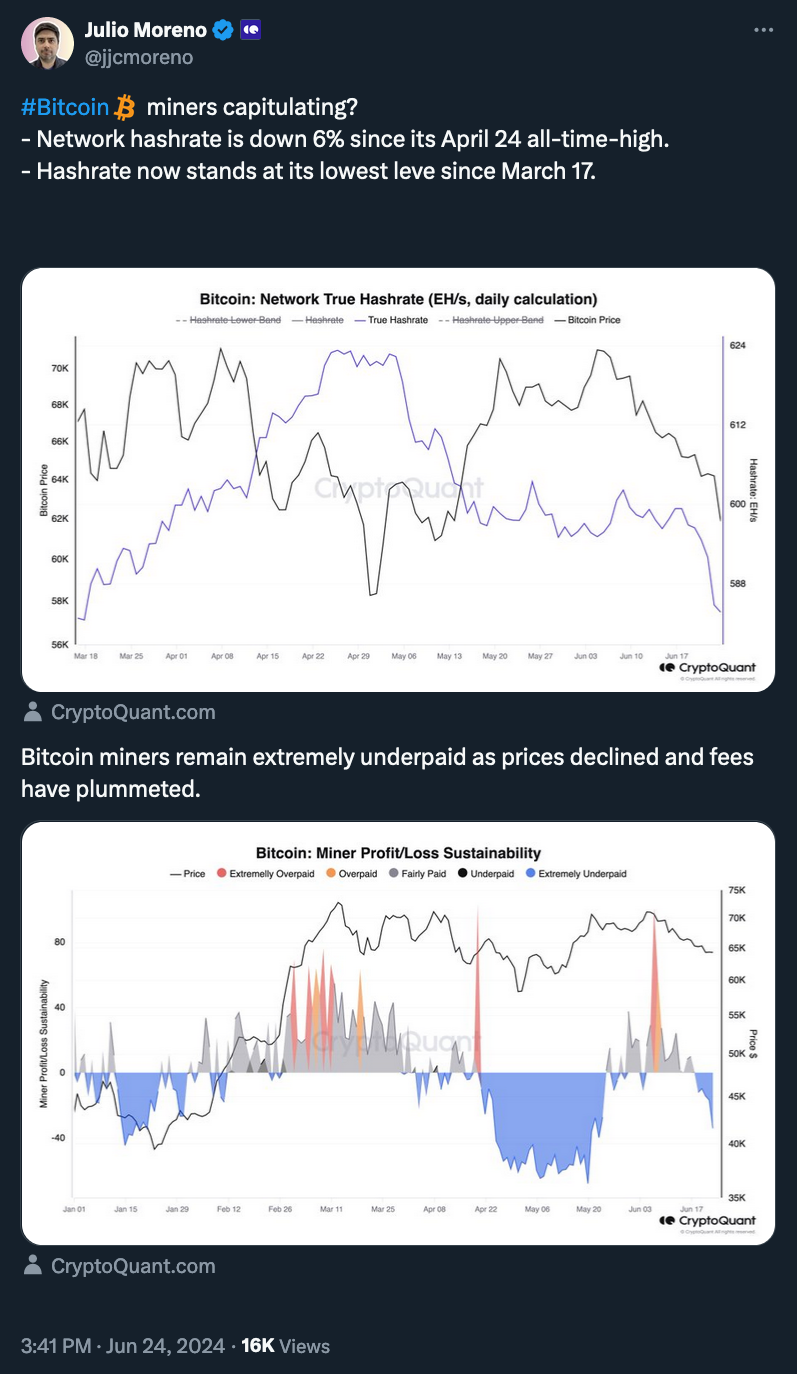

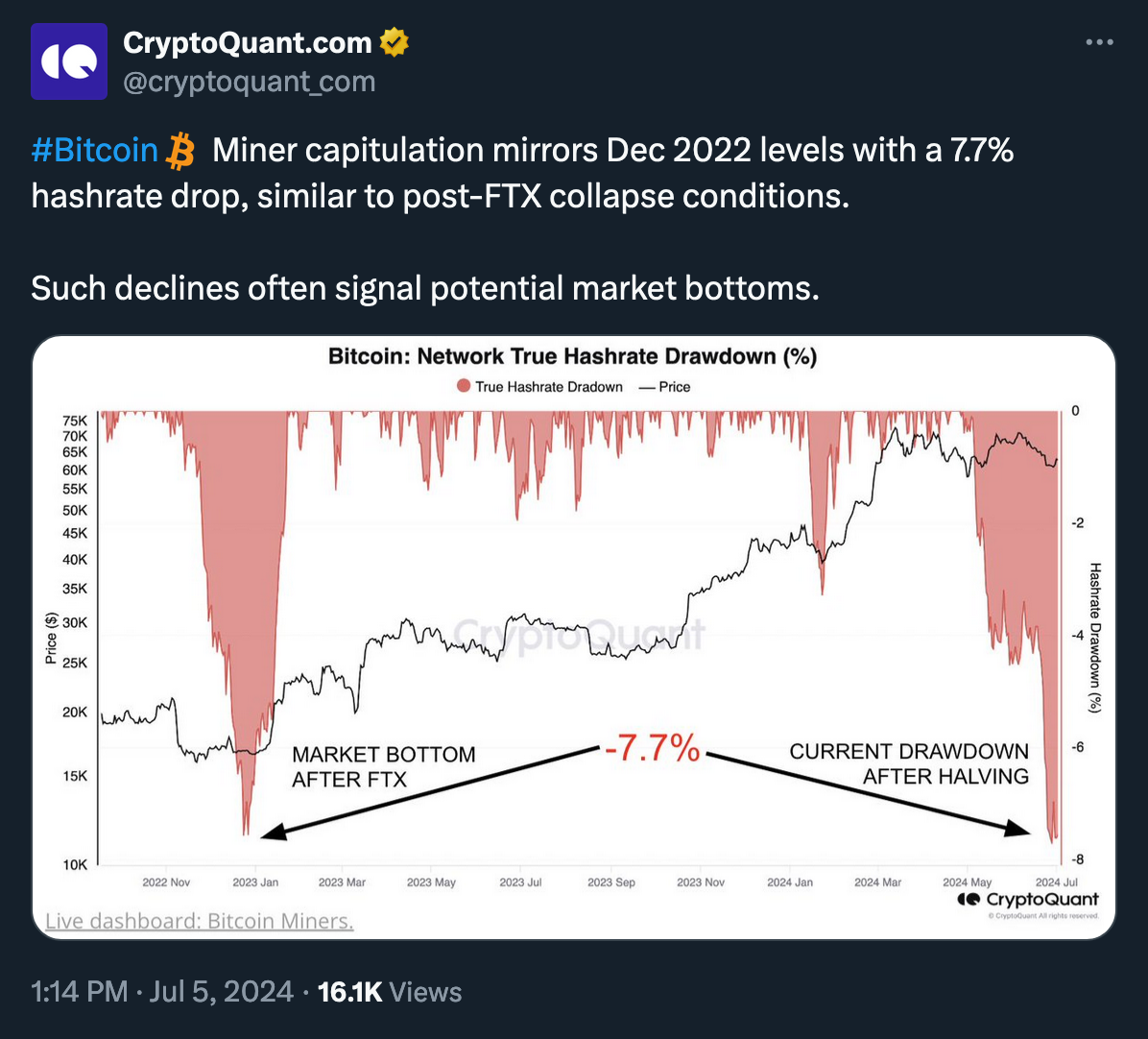

The BTC network, meanwhile, faces challenges with a significant drop in hashrate, which measures the total computational power used to mine and process transactions. This reduction can be partly attributed to less efficient miners shutting down or downsizing their operations in response to reduced rewards following BTC's latest halving event.

Amid the challenges faced by miners, a proposal emerged suggesting the implementation of a so-called HODL_FEE for Bitcoin hodlers — the concept wherein dormant Bitcoin wallets, often referred to as HODLers, are somehow magically 'taxed' to subsidize miners.

"From the start, the bitcoin ethos is that those who use the network must work at it. Having ownership or stake confers no special privileges. Proof of Work vs Proof of Stake.

Unfortunately, HODLers are not working. HODLers are expecting that others will be compensating miners so that the HODLers’ stake will maintain its value. In today’s design and perhaps inadvertently, HODLers are not living up to the bitcoin ethos." (Read the full article here)

To many Bitcoin enthusiasts, however, this proposal sounds rather ironic, given that the genesis block contains the encoded message “Chancellor on the brink of second bailout for banks.”

(from the Bitcoin Magazine article)

"Do you want to steal Satoshi's dormant coins and give them to miners? We've heard this argument before and it's 100% insane and 110% plain stupid." (DJ ₿ooth on X)

Meanwhile, some market observers suggest miners' 'capitulation,' as unprofitable machines are switched off, could indicate a local bottom due to reduced selling pressure.

At the same time, on Friday, a negative difficulty adjustment of 5% was implemented, marking the second-largest decrease since the FTX collapse. This adjustment directly responds to the decreased competition and helps stabilize mining revenues for those still participating, contributing to the formation of a base for recovery, whether from $52k or $44k.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.