Bitcoin has rallied to an all-time high area, but how sustainable is this move at this moment?

(Source: Blockworks)

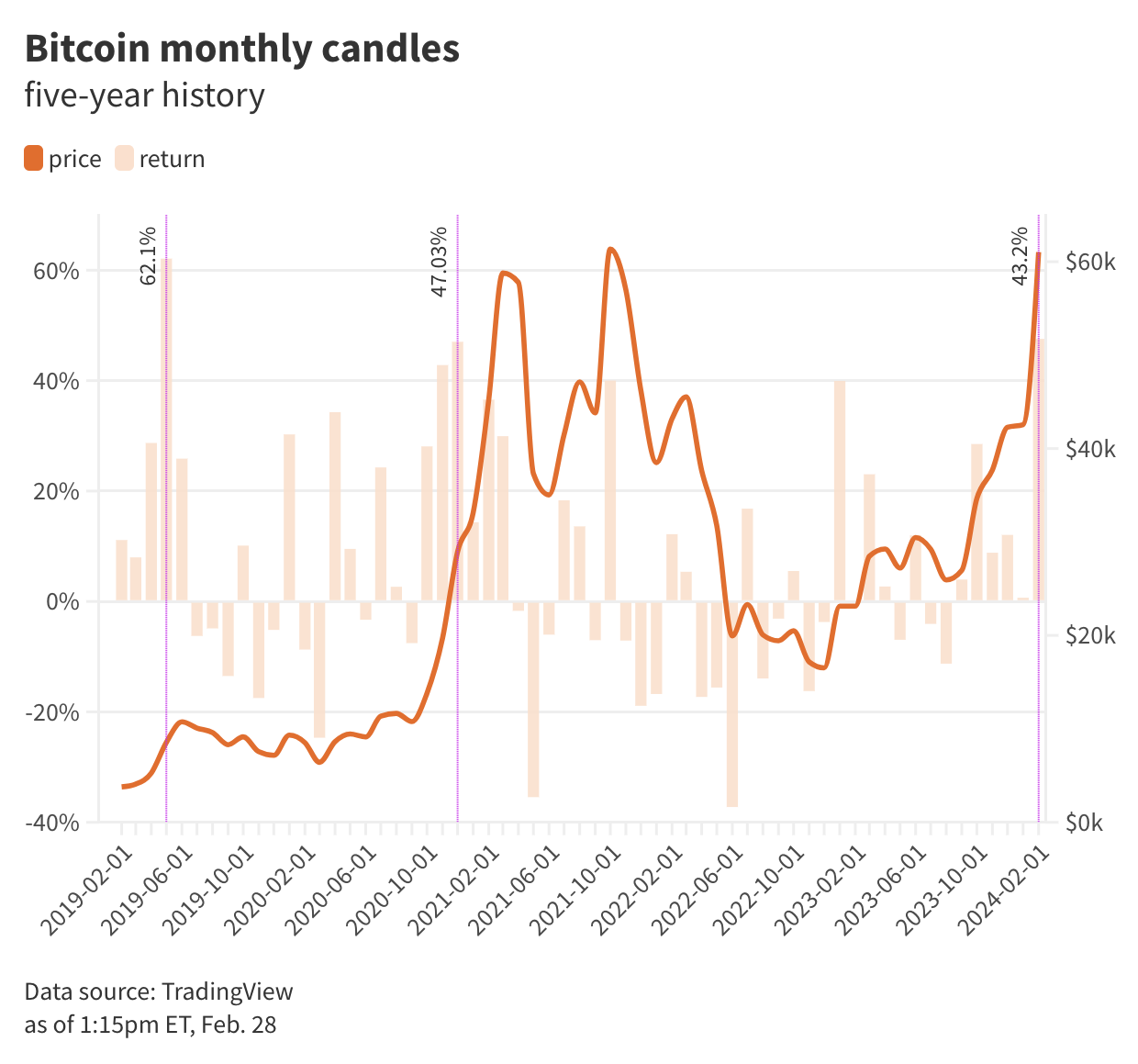

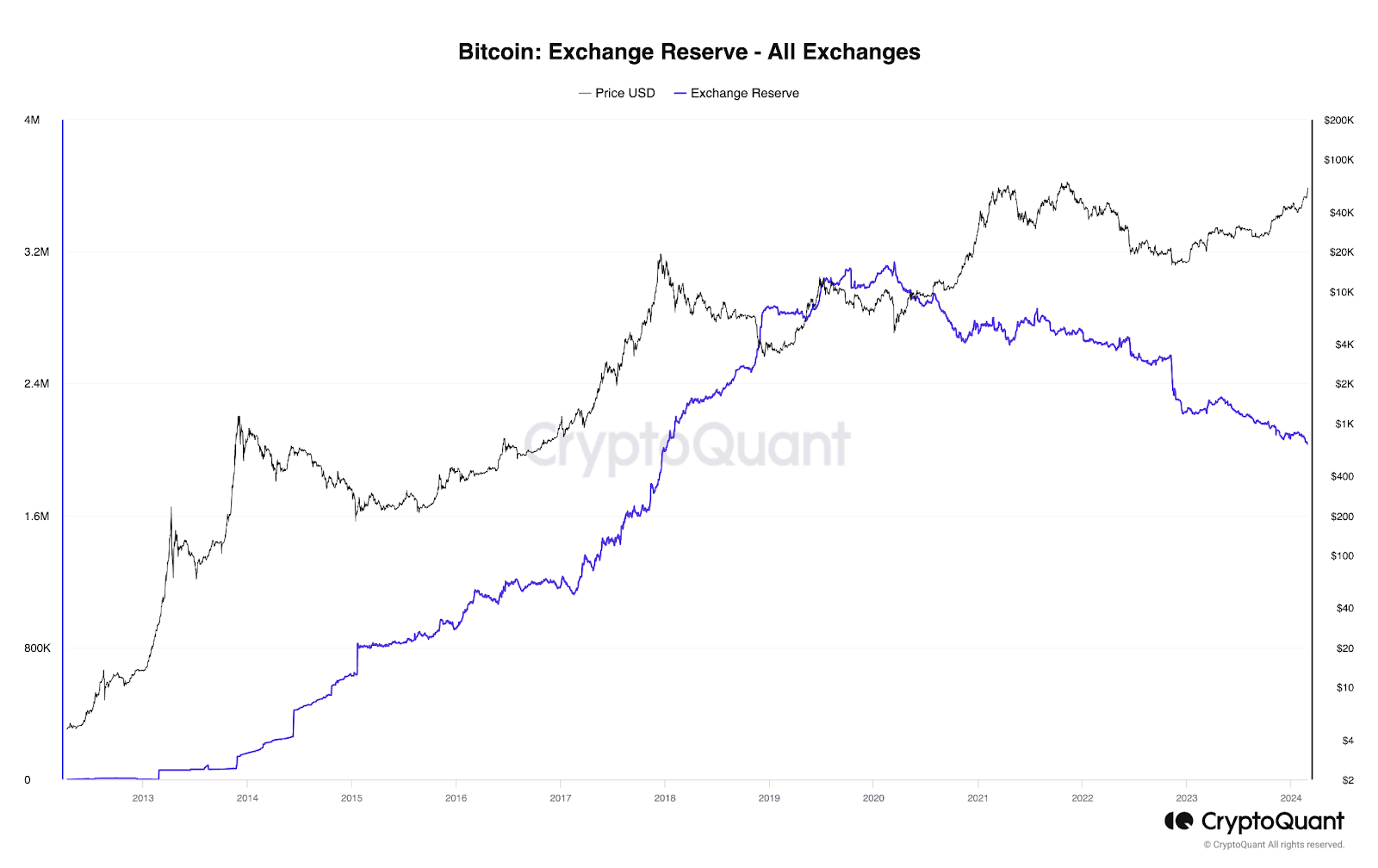

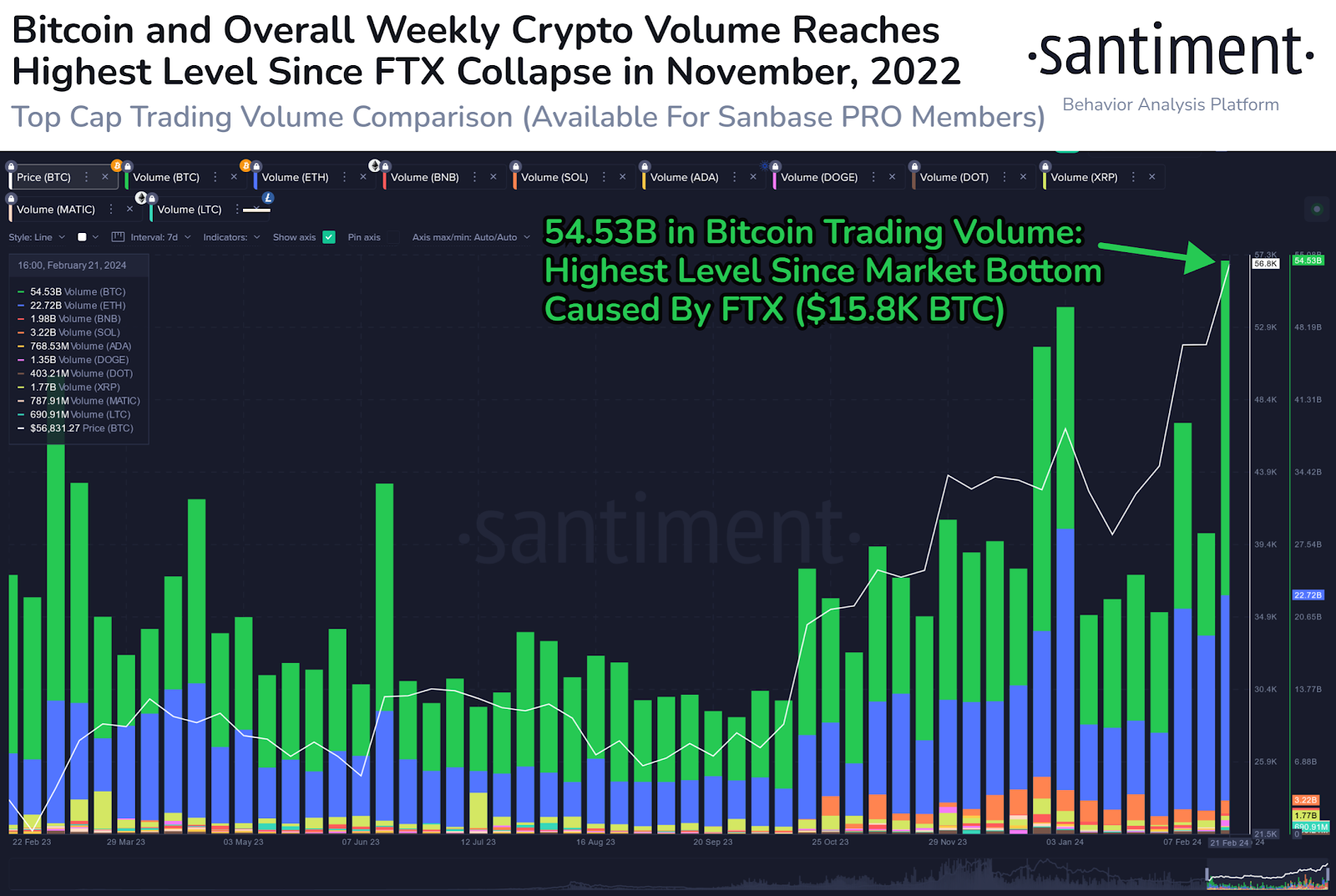

Bitcoin has its best numbers in years, with the price exploding by 43% a month. Today's crypto market, however, is markedly different, characterized by record-high volumes of spot Bitcoin ETFs and a years-long trend of pulling coins off exchanges. Now, exchange reserves are on track to dip below 2 million BTC, a level last observed in December 2017 when Bitcoin reached an all-time high of $20,000.

(Source: Blockworks)

A breakthrough above the previous all-time high level could spark renewed FOMO (fear of missing out) in the market, potentially propelling prices even higher. However, rather than chasing the market at these elevated levels, a more reasonably cautious approach may be to wait for short-term pullbacks for buying opportunities, with the $52k being a potentially significant support level to watch in that case, as highlighted by the Swissblock report.

(Source: Santiment)

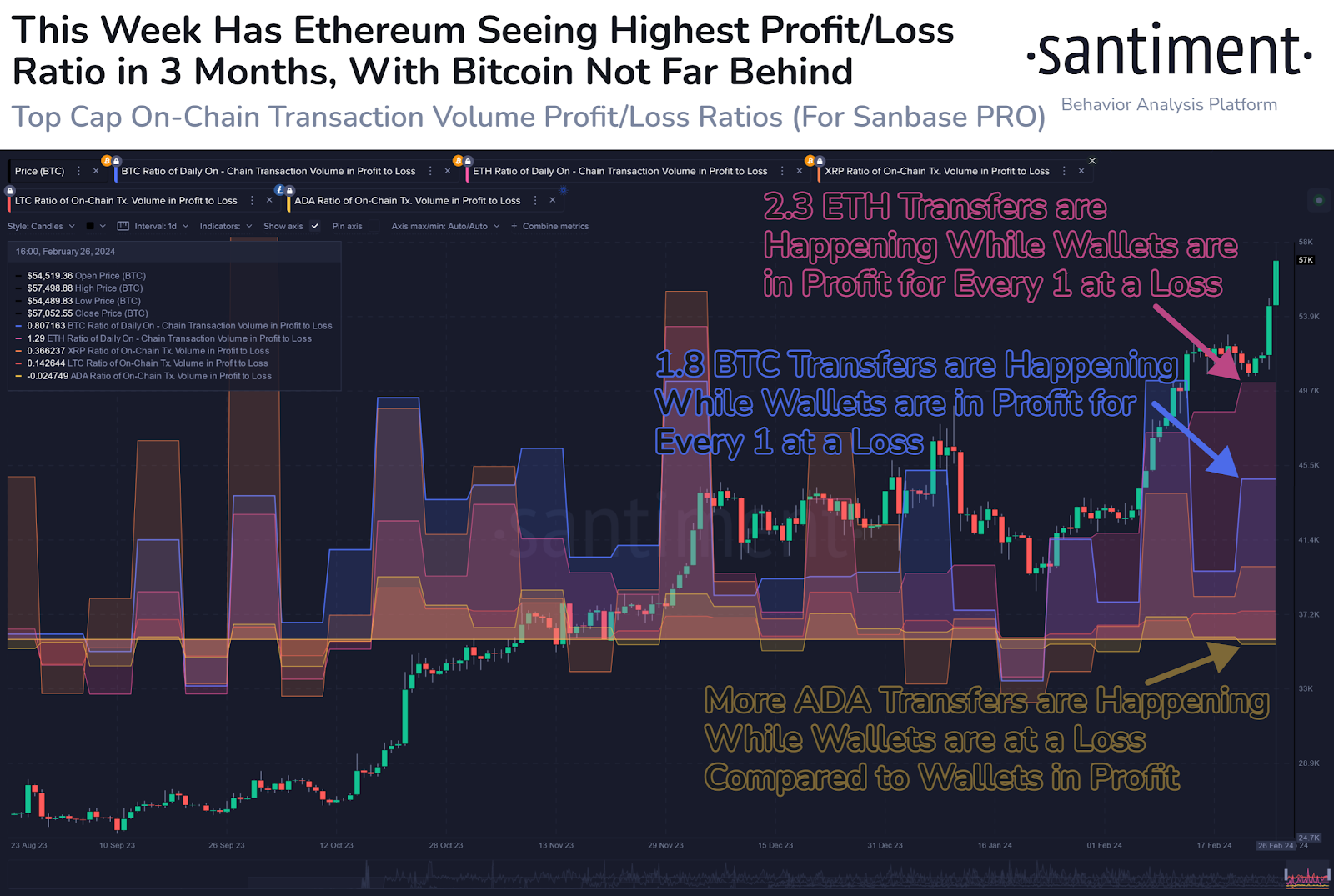

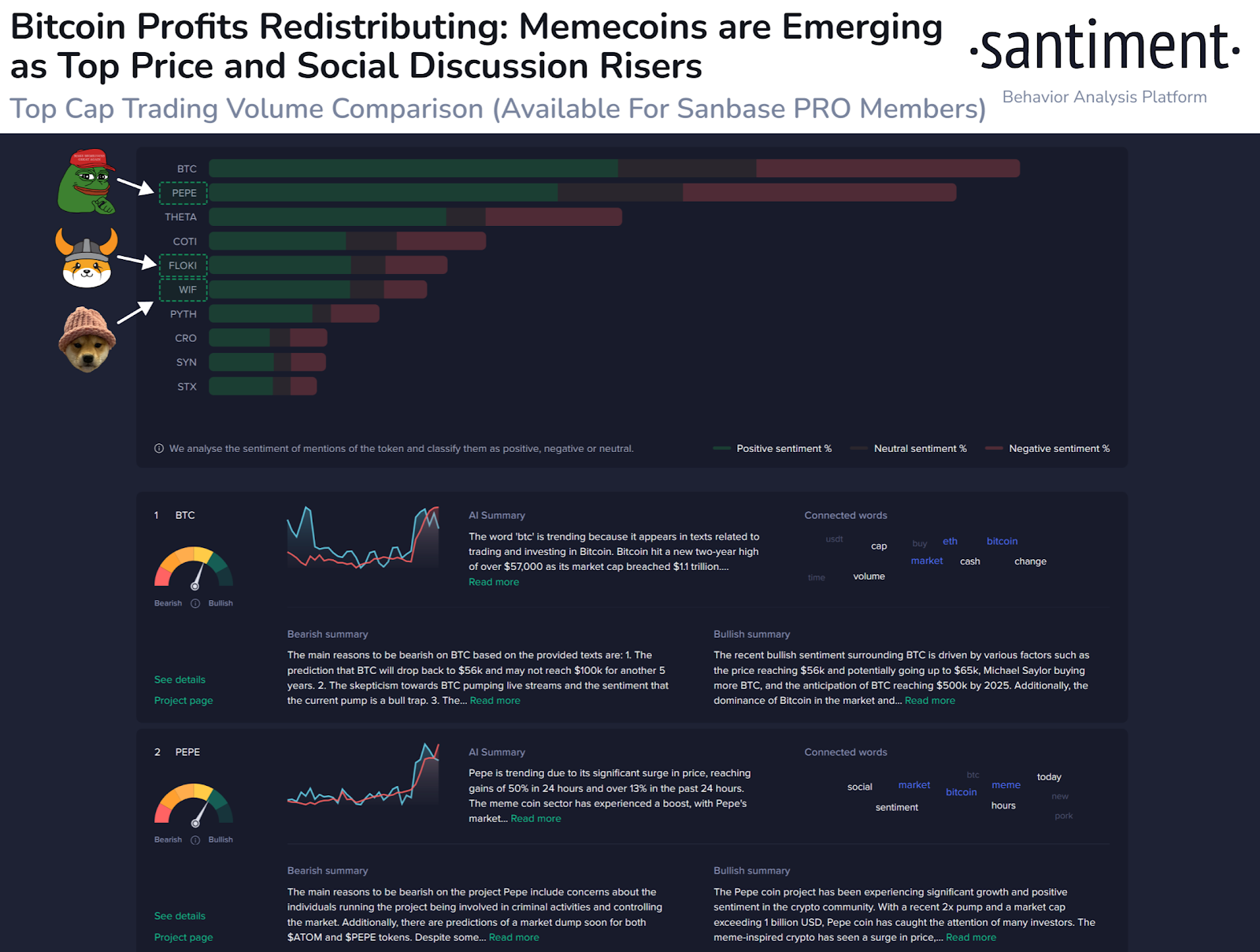

Current on-chain transaction volumes suggest significant profit-taking in both Ethereum and Bitcoin this week, as indicated by Santiment data, with on-chain activity on the leading crypto network already exceeding levels not seen since 2022. Typically, such heightened profit-taking serves as a decent mid-term signal for local tops potentially being on the horizon.

(Source: Santiment)

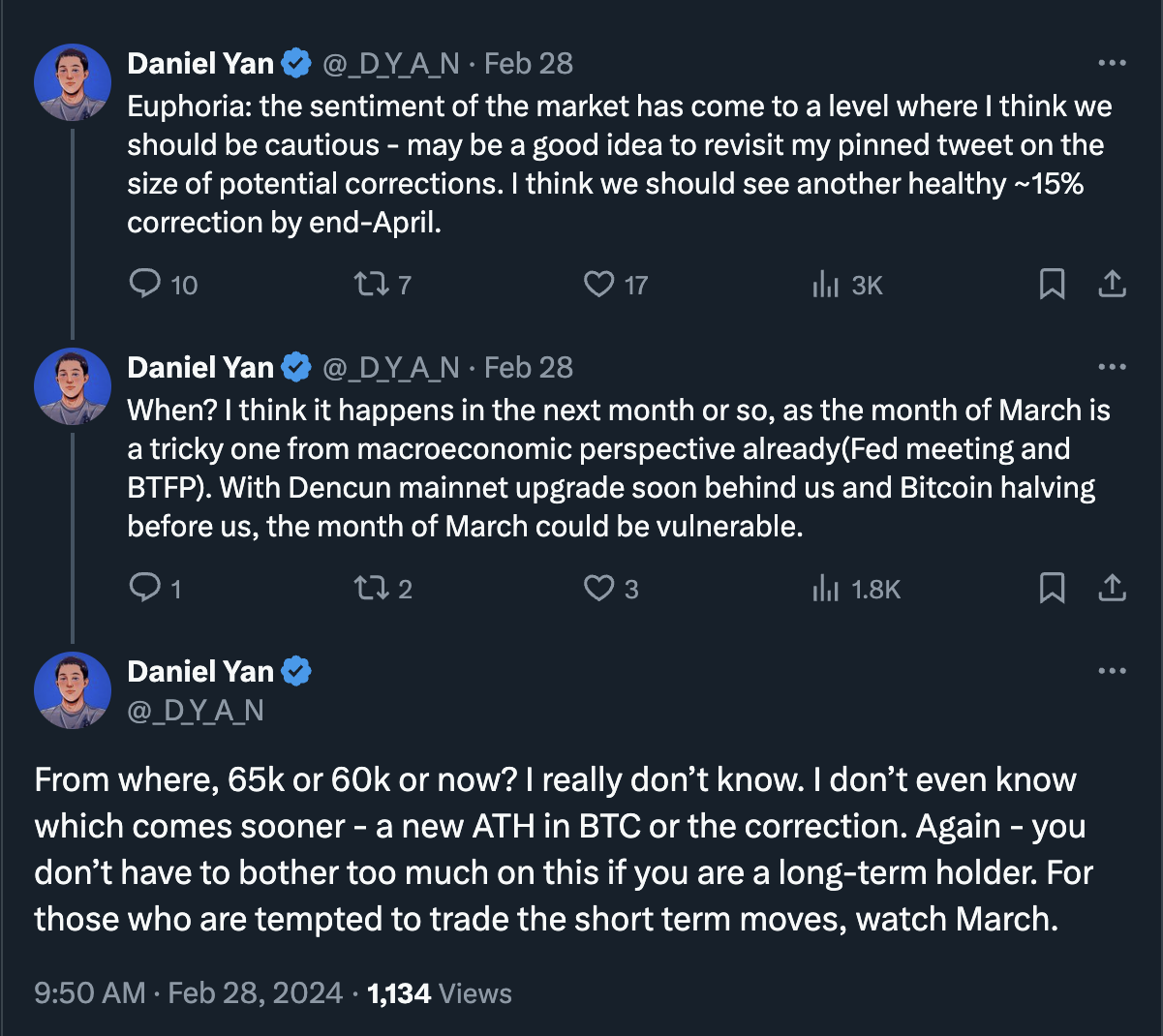

Bitcoin derivatives traders reportedly are not betting on further gains, too. So does Daniel Yan of Matrixport, a Singaporean crypto services firm backed by Jihan Wu, believing a market correction is imminent following Bitcoin reaching its highest price since 2021.

Santiment’s analysts also point out that memecoins rallying may signal crowd overextending, as “FOMO toward assets like these is caution flags for crypto markets.”

(Source: Santiment)

Although some decent signs of a local top forthcoming in the crypto market, the impact of ETFs and distinct market conditions—contrasting with those of Bitcoin in 2021—may soften any potential decline. This could result in a more gradual correction in the coming months, setting the stage for implied continuation.

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.