Although $50k was close to the 2021 peak, the current market environment suggests that this time, $50k could mark the beginning of an extraordinary bull run, not the end, as per the Swan Bitcoin report.

(Source: Swan Bitcoin)

Today, Bitcoin differs significantly from the asset it was back in 2021 despite its core fundamentals remaining unchanged. It has matured in many ways since then. A recent report by Swan Bitcoin highlights five key distinctions between BTC at $50,000 then and now.

- New retail investors are not here… yet

- Anticipation of the Fed’s flip to quantitative easing again (dovish Fed = good for Bitcoin; hawkish Fed = bad for Bitcoin)

Bitcoin fundamentals never actually went into a bear market

The halving is in front of us, not behind us

(Source: Swan Bitcoin)

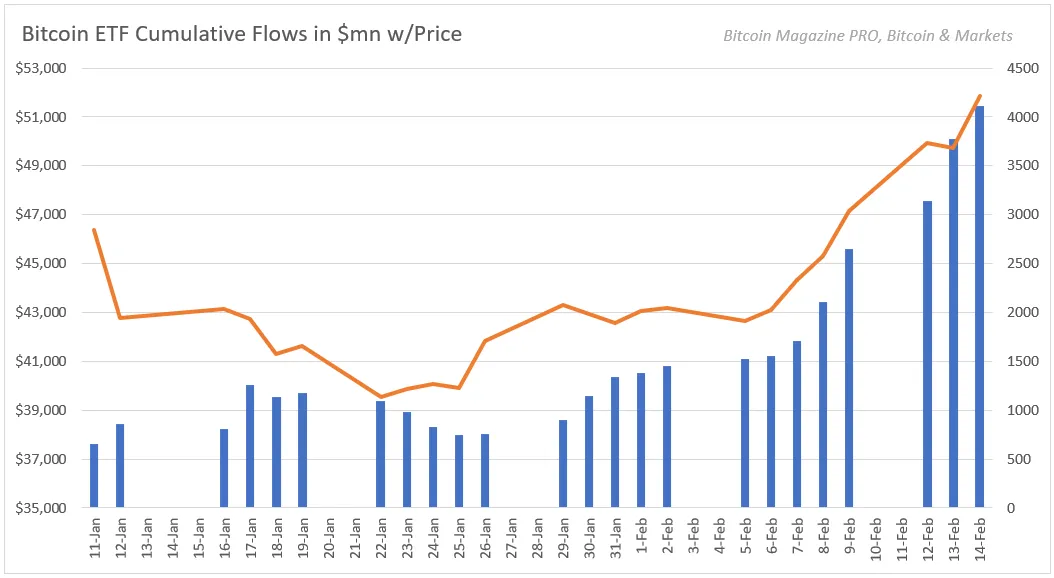

At the same time, the grown-ups are here for sure: institutional adoption, of which there has been so much talk all these years, is definitely here and accelerating, with Wall Street now the single-largest owner of Bitcoin that isn't Satoshi, sucking up 10x more BTC than miners can produce.

(Source: Bitcoin Magazine Pro)

Meanwhile, from a macro perspective, Bitcoin price action is aligning with pre-halving rally conditions, as Bitfinex’s Head of Derivatives Jag Kooner noted:

“The current market movement aligns with a pre-halving rally, a trend observed in previous bitcoin cycles. This rally has the potential to push prices beyond previous cycle highs, as notably, the past week marked bitcoin's re-emergence as a trillion-dollar asset, largely driven by spot bitcoin ETF inflows.” (Jag Kooner for The Block)

“Think of the ETF launch as Bitcoin’s IPO in the U.S. market,” says Bitwise Chief Investment Officer Matt Hougan. “It has just unleashed a huge wave of interest from traditional finance, and it has exceeded my expectations.”

Although ETFs are now available, not all financial institutions have access to them, with much of the trading conducted by retail investors. Banks and wirehouses remain some distance from participating. However, this delay is anticipated because these institutions undertake thorough due diligence on every ETF before offering them to their clients.

“There’s been a ‘step-function’ change in the level of attention that Wall Street is now paying to Bitcoin, and I don’t think that genie will go back into the bottle.” (Matt Hougan for Decrypt)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.