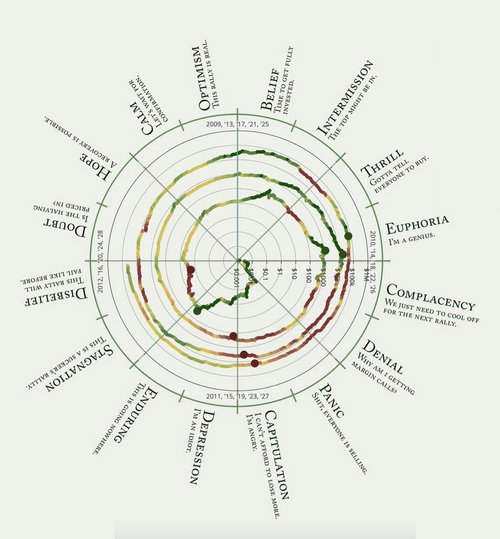

Bitcoin's 4-year cycles exhibit an interesting pattern, as @therationalroot, a prominent analyst, noted. He shared the chart that breaks down the phases the cryptocurrency’s price has gone through over the different 4-year market cycles.

Interestingly, the visualization above shows that, excluding Bitcoin's initial years, the bull market peaks and bear market bottoms have occurred quite close to each other.

Bullish and bearish periods here are separated by the Short-term Holder Cost Basis on-chain indicator. This indicator reflects the average price at which coins moved within the last 155 days were acquired on-chain, highlighting the coins most likely to be spent on any given day.

This implies that when the asset's spot price drops below this level, the average investor in this cohort faces losses. Similarly, a break above the cost basis indicates the average short-term holder is back in profit.

The chart indicates Bitcoin is currently in the 'disbelief' phase, characterized by investor skepticism about the rally's sustainability. Based on historical patterns, there is still some time before the Bitcoin bull run fully commences in the current cycle, with the potential peak projected to form around 2025.

Notably, the current rally is following quite closely to previous pre-halving rallies.

(Thread)

This doesn't exclude the possibility of a prolonged period of price consolidation or even the likelihood of downward volatility in the shorter term. Such a development would also align with historical patterns and would not be surprising from a TA perspective.

Meanwhile, other analysts have pointed out that a period of heavy accumulation for both Bitcoin and Ethereum is underway. So, chances are the next best buying opportunity is occurring right now.

(Source: Jarvis Labs' Espresso)

There are 'no excuses' for not to long crypto.

How Not To Suck At Trading

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.