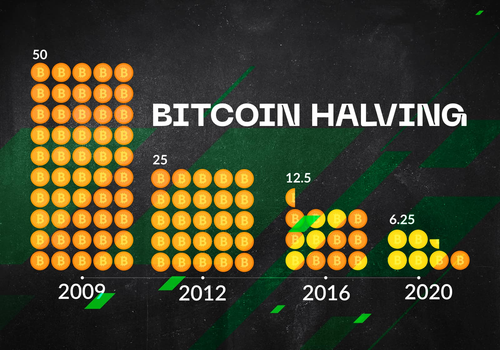

The next Bitcoin halving event is anticipated around mid-April 2024. Considering all the wild rides in the asset’s value around its previous three halvings, there is much speculation about potential market dynamics in the next year or so.

Bitcoin’s price has been climbing steadily over the past few months, reaching an 18-month high of over $44,000 last week – about a 158% rise YTD. Many analysts now expect that Bitcoin may undergo a significant retracement soon, with a bunch of potential triggers for this pullback.

[points in favor of retracement]

Bitcoin dominance index confirms a ‘likely top,’ as analysts have reported, and a substantial net inflow to exchanges, amounting to no less than $900 million in BTC, has been observed, which suggests the potential for an upcoming dip in Bitcoin’s price.

From the perspective of on-chain fundamentals, however, the current rally doesn’t appear to be overextended, with Bitcoin now trading basically by the ‘fair price,’ as per @therationalroot’s analysis.

(Source: Bitcoin Strategy)

Historically, any deeper retracements occurring during these last months before halving typically yielded investors a ‘fantastic Return On Investment’ in the following months and years. This counts as the first ‘pre-halving’ phase in @rektcapital’s classification.

(Source: @rektcapital)

In about 60 days before the halving, a pre-halving rally typically occurs (light blue on the chart above), representing the second phase of the cycle.

A pre-halving retrace often occurs around the halving event itself (dark blue circle). 2016, this retrace was -38% deep and -20% in 2020. This pre-halving retracement makes investors question whether the halving was a bullish catalyst for the price this time or was it already ‘priced in’ as a ‘sell the news’ event.

The pre-halving retrace is followed by a multi-month re-accumulation phase, where many investors get shaken out due to boredom, impatience, and disappointment with the lack of significant immediate returns on their Bitcoin investments.

Finally, Bitcoin breaks out from the re-accumulation area into a parabolic uptrend (green zones on the chart above). It is during this phase that Bitcoin experiences accelerated growth on its way to new all-time highs.

So, from a historical perspective, any substantial retracement within the next ~130 days will likely represent an outsized investment opportunity for the next few years. Once the dust settles, the halving is history, and the reaccumulation phase is complete, comes the sweetest part – the parabolic price increases.

(Source: Ecoinometrics)

How Not To Suck At Trading

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.