The ether (ETH) surpassed the $3,000 mark for the first time since April 2022 on Tuesday, driven by the market's optimism about the potential approval of the first U.S. spot ETH exchange-traded funds (ETFs).

Over the past week, ether's price has risen over 12%, outperforming other cryptocurrencies.

Overall, the crypto market has had a green 2024 so far, with major token prices significantly higher than their levels in 2023. ETH surged by nearly 30% YTD, outperforming BTC's 22% rise.

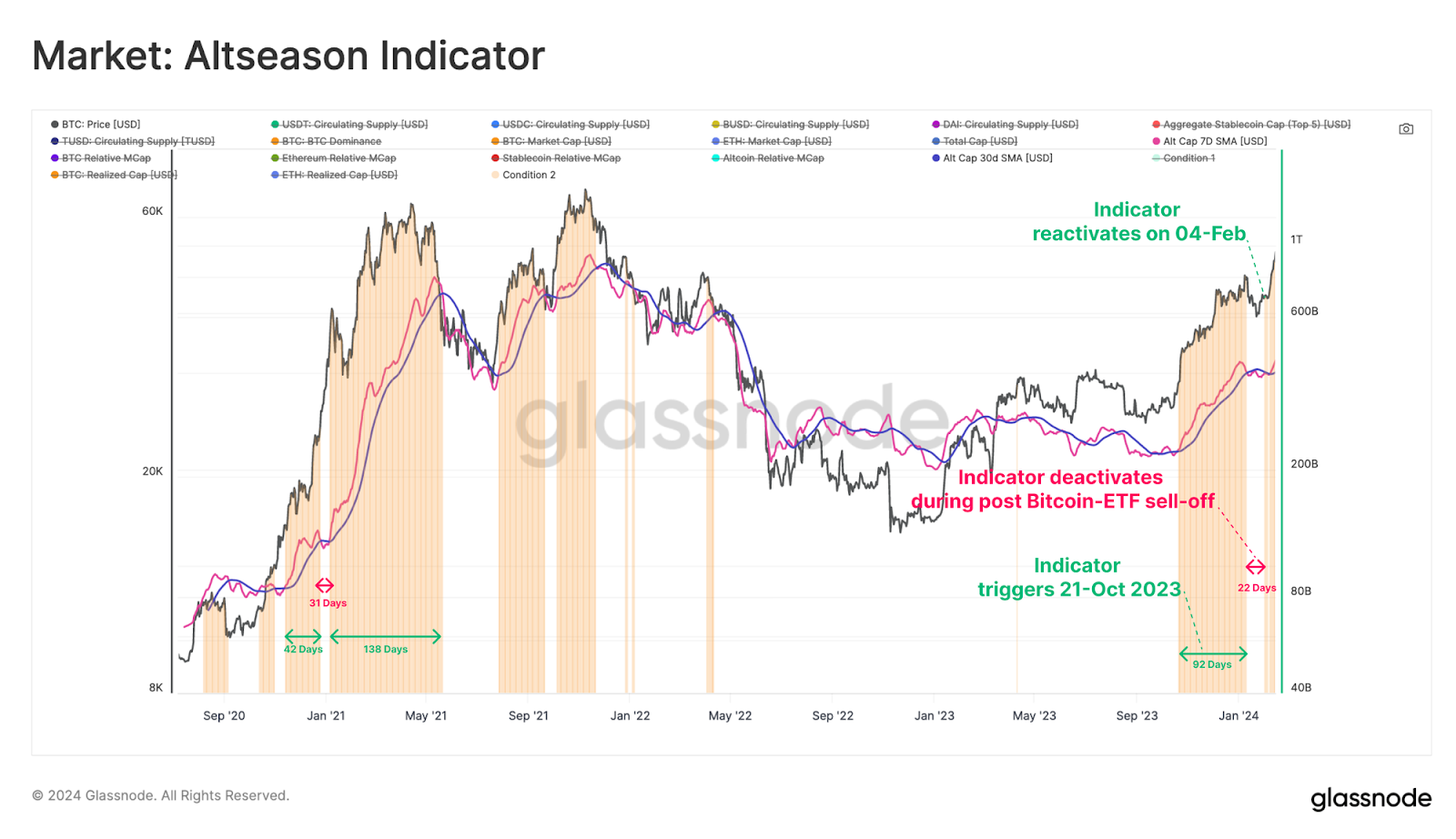

Amid the strong momentum generated by Bitcoin spot ETFs and the market reaction to their launch, several indicators hint at early signs of investor capital moving further on the risk curve, as detailed in Glassnode's latest report.

(Source: Glassnode’s The Week On-chain)

“Since October last year, our Altseason Momentum Indicator has flagged a growing appetite from investors to move capital further out on the risk curve. Whilst Bitcoin dominance remains significant, there are early signs of more capital rotation into the Ethereum, Solana, Polkadot, and Cosmos ecosystems.” (Glassnode’s The Week On-chain)

(X post)

ETH's rally might persist, with traders targeting $3,500 as the next significant resistance level, anticipating that spot ETH ETFs could be the next to receive U.S. regulators’ approval.

(X post)

Such approval is likely to boost ETH's appeal among more conservative institutional investors, akin to the successful launch of new Bitcoin ETFs, which have attracted massive allocations.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.