Over the past 30 days, the combined growth of $USDT and $USDC stablecoins has exceeded $10 billion, twice the inflows of all Bitcoin ETFs, yet garnering little to no attention. Meanwhile, stablecoins may be a better signal for crypto demand than bitcoin ETF inflows, as they do not involve arbitrage opportunities and might serve as a dry powder in the crypto bull market, says Markus Thielen of 10x Research.

This year, crypto market analysts have largely fixated on spot Bitcoin ETFs as a measure of digital asset demand. However, monitoring the supply of stablecoins could provide a more reliable indicator for crypto demand, and its rapid expansion suggests the transitory nature of the current correction, as 10x Research noted in a Monday report.

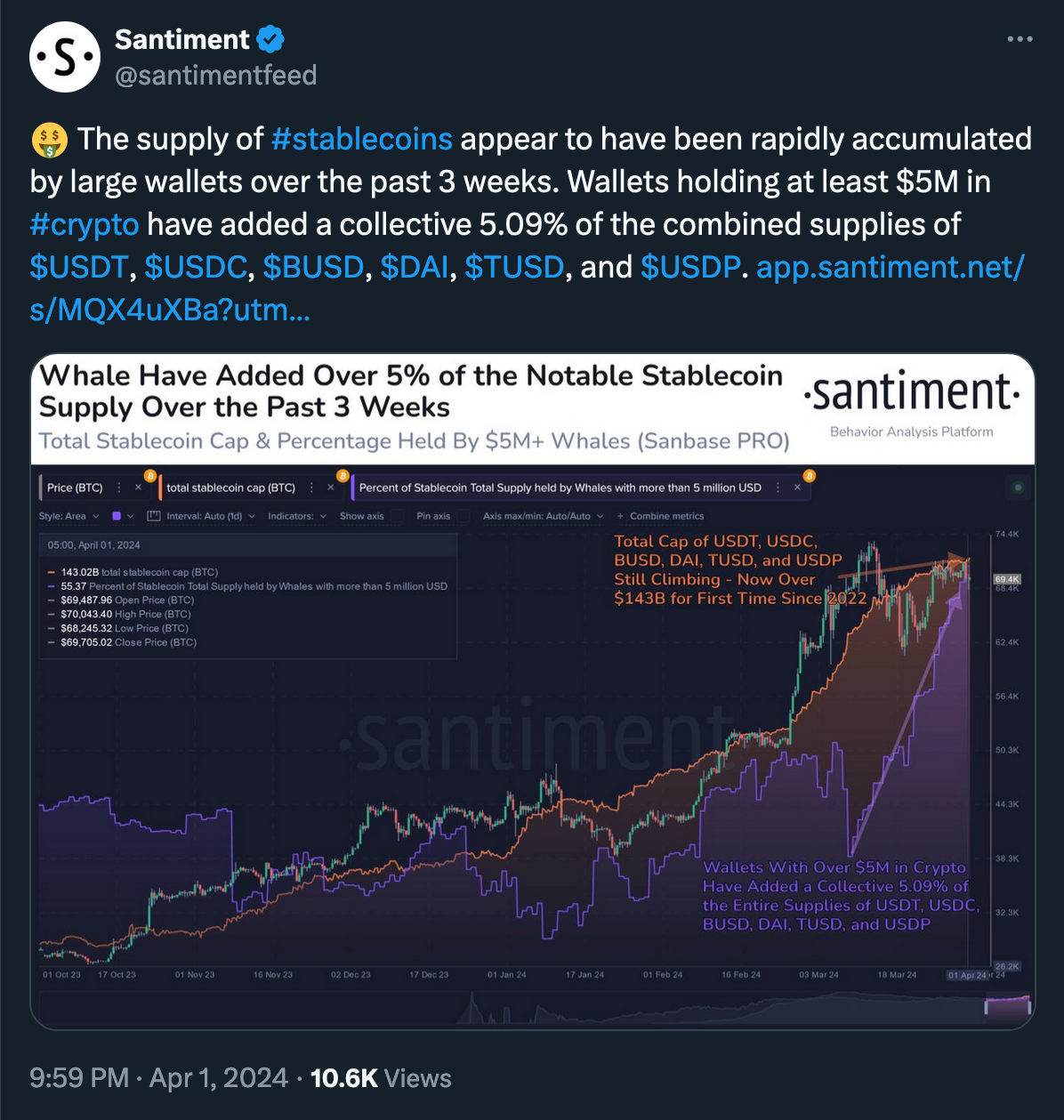

The supply of Tether's USDT and Circle's USDC, the two largest stablecoins, increased by nearly $10 billion over the past 30 days. USDT alone grew by $2.4 billion in a week, marking one of the highest weekly increases during this bull market.

The rapid expansion of the stablecoin supply indicates that "fiat money is being moved into crypto at an accelerated pace," 10x Research's Markus Thielen notes.

"We suggest paying less attention to the bitcoin ETF flows. Stablecoin issuers are the new sheriff in town, driving this market higher. The minting from stablecoins is twice as large and might be long-only exposure, contrary to the ETFs." (Markus Thielen, Coindesk)

His main argument is that some ETF flows represent a savvy market strategy where investors exploit elevated futures funding rates through a carry trade. In short, this involves buying spot BTC or shares in spot-based ETFs and simultaneously selling an equal amount of BTC futures to maintain a market-neutral position while earning the difference in spot and futures prices as a yield. In contrast, stablecoins minting does not provide such arbitrage opportunities and might only be a long exposure.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.