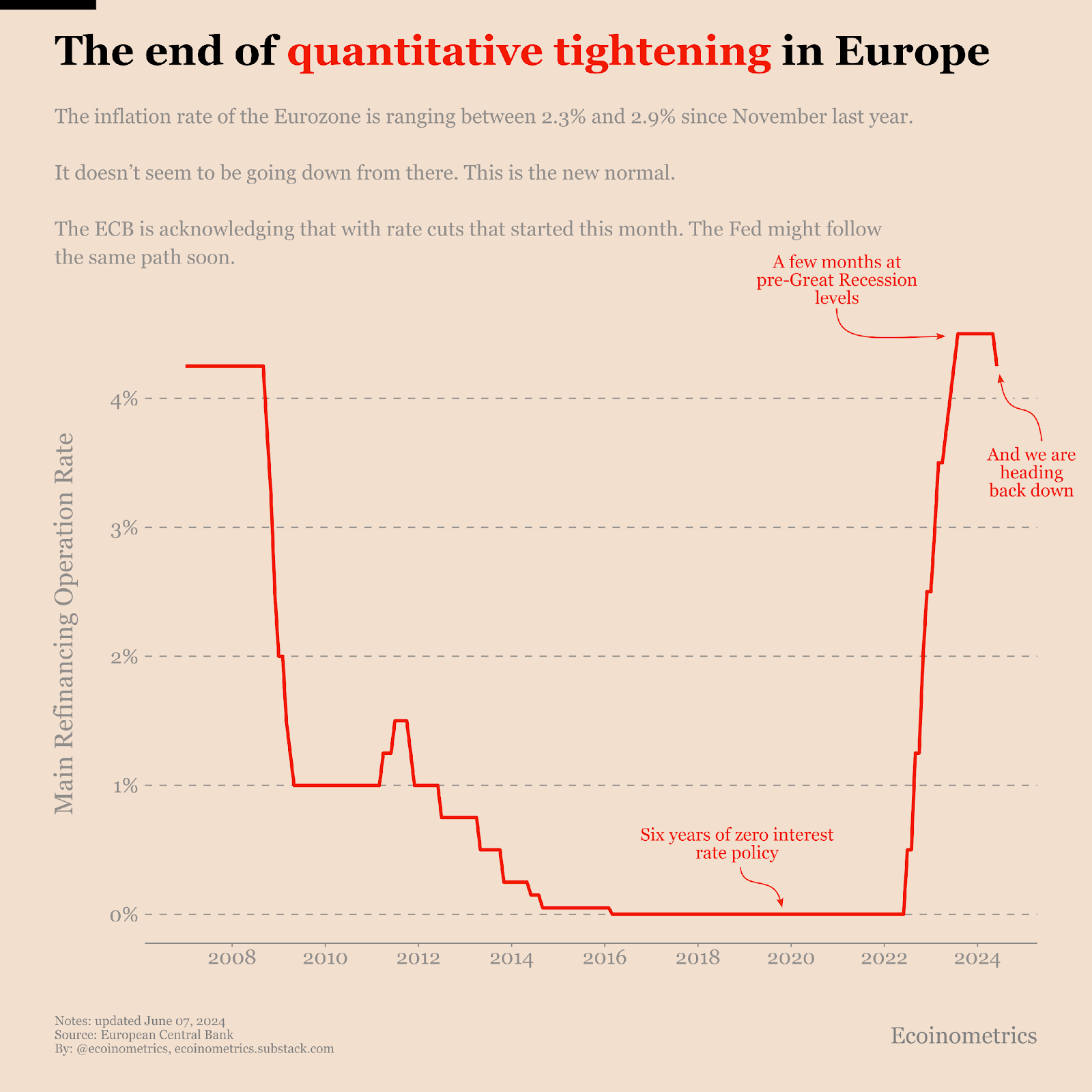

The European Central Bank has followed the Bank of Canada this week in cutting its key interest rate despite ongoing inflationary pressures. Analysts suggest these cuts may signal a coordinated shift in monetary policy from fighting inflation to addressing slowdowns, benefiting all risk assets, including crypto. The elephant in the room, however, is the U.S. Federal Reserve: will it follow along with a rate cut this week?

The Bank of Canada was the first G7 nation to cut interest rates from 5% to 4.75% this week. This European Central Bank followed the next day by cutting its key interest rate from 4% to 3.75%, persistent inflation in the eurozone.

(Source: Ecoinometrics)

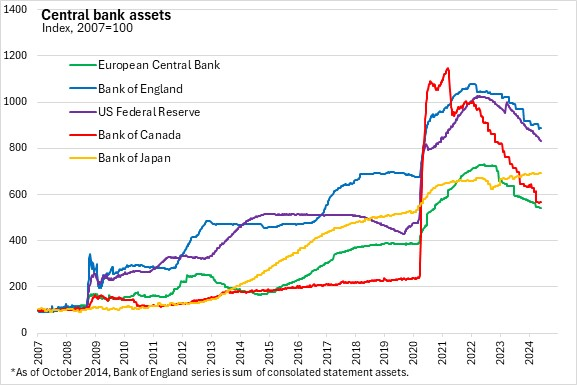

Source: Nova Scotia Bank

Both central banks assert that their inflation rates will continue to fall but notably prioritize economic slowdowns over inflation as their primary concern—Ansel Lindner highlights it as a coordinated shift in monetary policy in his post for Bitcoin Magazine Pro.

"It is safe to say that BoC and ECB are working in close coordination still, as large globalist banks, and you can expect the Bank of England to follow suit this month with their own cut. Overall, we are beginning a period of less global central bank coordination." (Ansel Lindner for BMPro)

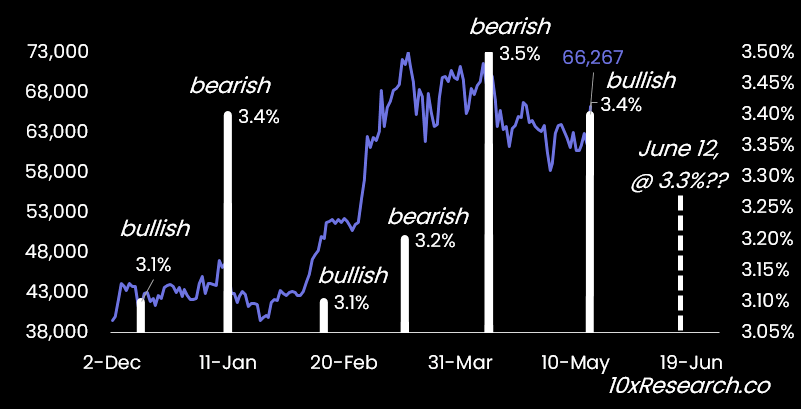

The focus is now on the U.S. Federal Reserve. Whether Chairman Powell will consider a rate cut this week depends heavily on the CPI released on Wednesday, June 12. As we wrote earlier, a CPI of 3.3% or lower could potentially boost Bitcoin to new all-time highs.

Bitcoin changes direction based on CPI higher/lower than the previous month (higher CPI, bearish Bitcoin, lower bullish) (Source)

Moody’s Analytics chief economist Mark Zandi mentioned in an interview with Bloomberg that he believes the Fed should be looking to cut interest rates, given the considerable financial conditions achieved to date along with the unemployment data. These interest rates significantly impact the crypto market since lower interest rates generally boost investors’ confidence to invest in risk assets, including cryptocurrencies.

The U.S. Fed’s Federal Open Market Committee (FOMC) will meet on June 12 and 13 to decide on interest rates. Data from The CME FedWatch Tool indicates a 99.4% probability that the Federal Reserve will keep interest rates unchanged.

"The market will digest CPI figures as it typically does, with a lower-than-expected inflation read sending prices higher and a higher inflation print sending prices lower. But, the report’s impact will be short-lived since the Fed will reveal their plans before markets close," predicts Tom Essaye of Sevens Report Research in a conversation with Blockworks.

Meanwhile, the global liquidity chart, 'the most important for the Bitcoin bull run,' has already made an all-time high, as the founder of the LookIntoBitcoin data platform noted:

Bitcoin, in the meantime, remains in the longest consolidation phase in its history, awaiting a sufficient positive trigger for new upward momentum.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.