These days, Bitcoin’s price has dropped around 17% from its new all-time highs to trade at nearly $60,000 briefly. The correction was caused by overheated market conditions in what analysts have named a “pre-halving retrace.” However, sharp double-digit corrections are just a part of the game, as data shows BTC remains in a strong bull cycle.

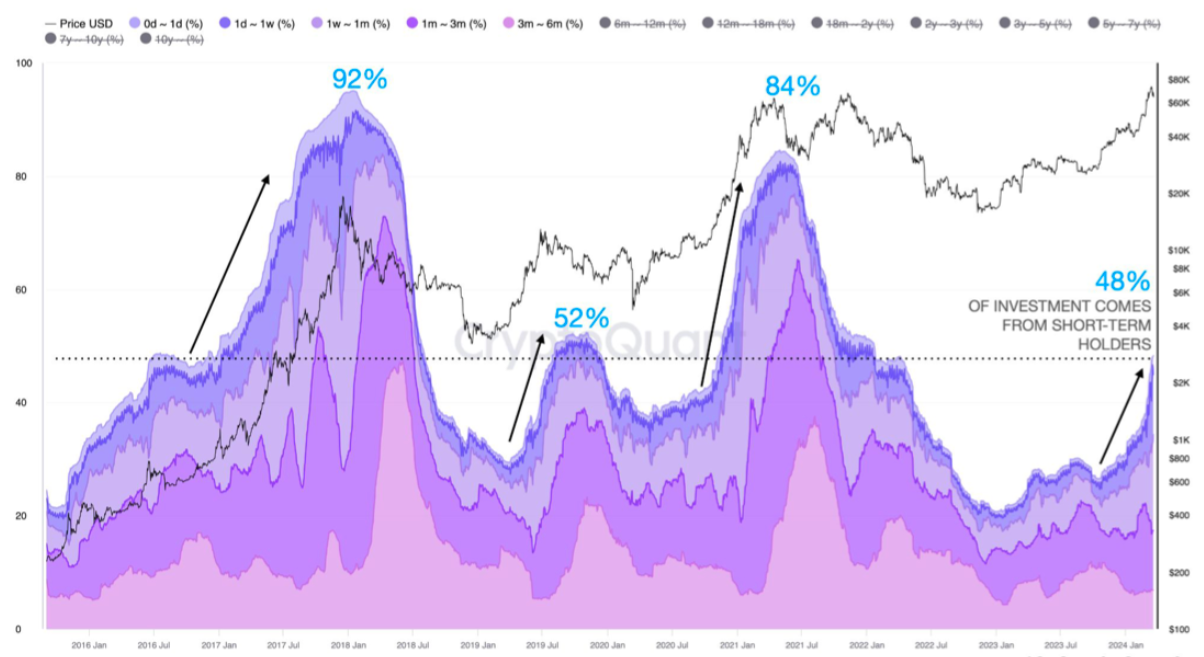

Bitcoin realized cap — OTXO age bands percentage. (Source: CryptoQuant)

According to CryptoQuant’s “Weekly Crypto Report,” 48% of Bitcoin's current investment comes from short-term holders. Historically, bull cycles tend to conclude when this figure reaches 84–92%. Additionally, this metric's alignment with mid-2019 levels—when Bitcoin similarly corrected—suggests we're witnessing comparable market conditions.

BMPro's recent analysis highlights the disparity between STH and LTH Realized Prices, suggesting a dynamic market in which short-term holders are potentially driving the price up. In contrast, a slight decrease in long-term holders' realized prices may signal a market maturation phase, possibly affecting short-term price trends.

Furthermore, Bitcoin’s derivatives market shows the much-anticipated signs of cooling off.

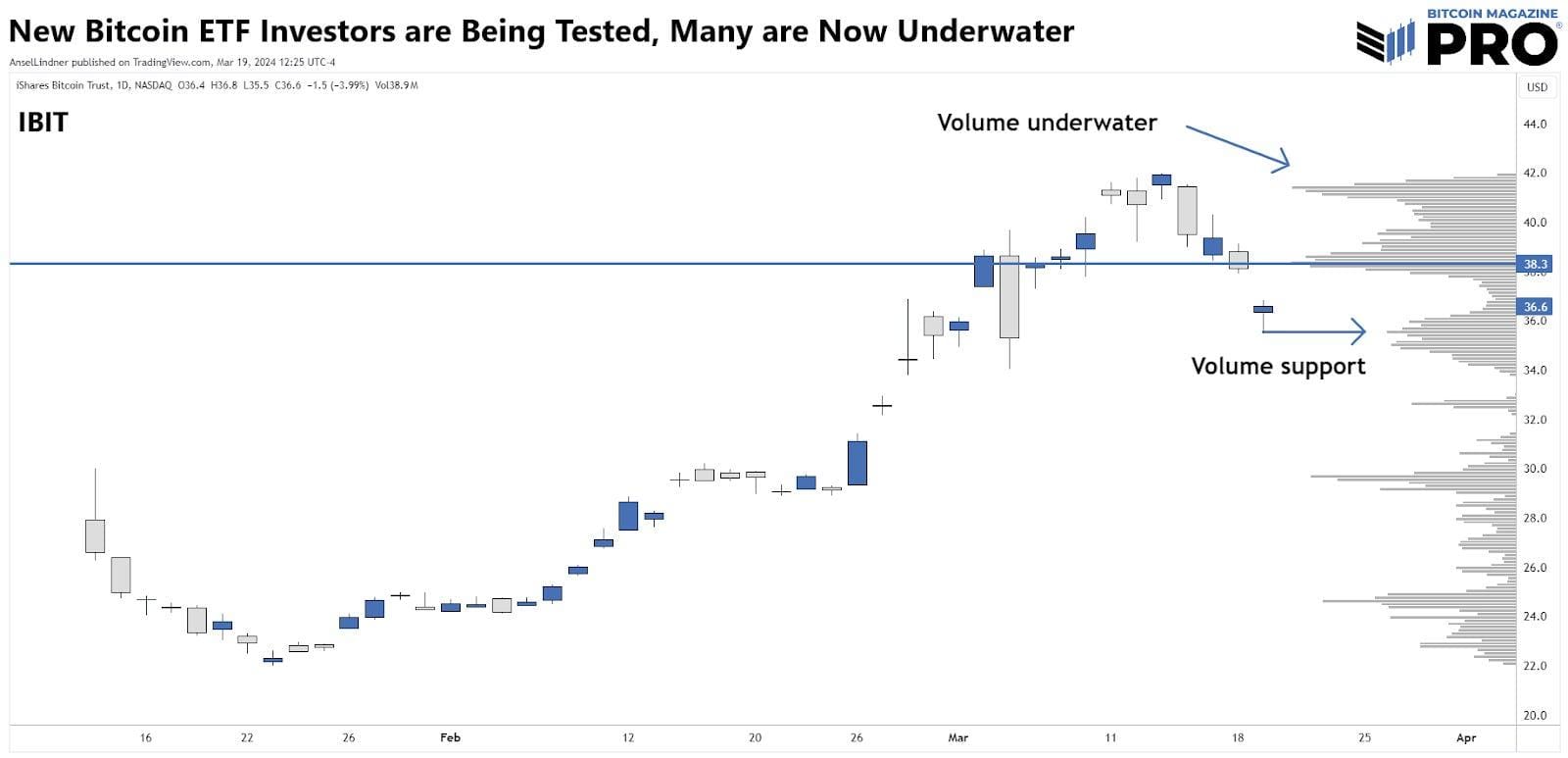

"We went very high very fast, hit overbought levels, and it is only natural to pullback within a broader bull market. ... Our metrics are consistent with a temporary pullback, not a cyclical top. There are signs we are bottoming or close to it.” (BMPro report)

(Source: BMPro)

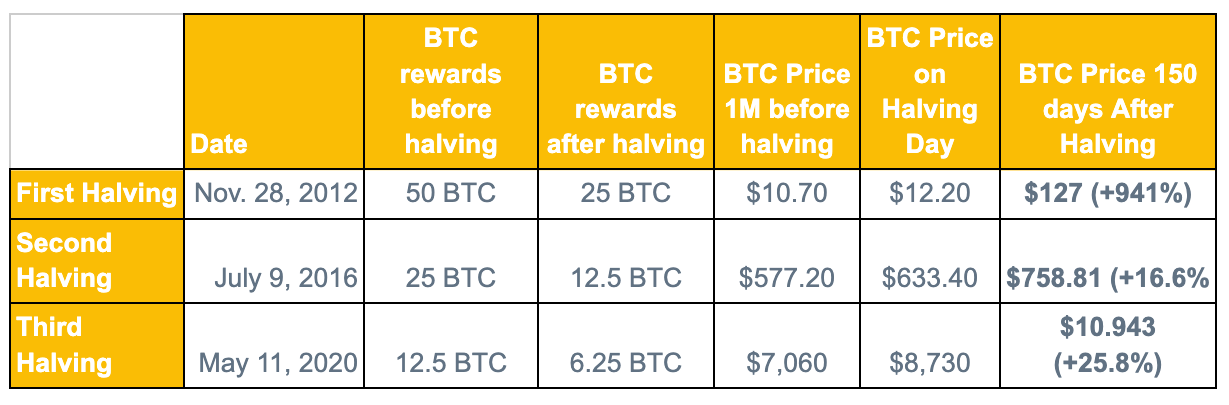

As Cointelegraph noted in the context of the upcoming Bitcoin halving event, expected to take place on April 20,

"There have been three Bitcoin halvings in the past, and one consistent thing the market has witnessed from these previous events is that one month before each halving, the BTC price was lower than it was at the time of the halving (see table below)."

(Source: Cointelegraph)

With the 75% rise from year start to record highs, a memecoin frenzy, and an open interest pattern mirroring the 2021 top, isn’t the Bitcoin halving priced in already? This question has come up in one way or another before every halving, except perhaps the first one. Historically, however, expectations of decreased supply and rising demand have resulted in exponential price growth and positive market sentiment.

(See @rektcapital's X post on 4 phases of the Bitcoin halving cycles)

What the market is going through these days nearly perfectly coincides with the 'Final Pre-Halving Retracement' phase in terms of halving cycles, as per @rektcapital's reading. How long can this phase last? Of course, in today's complicated reality, factors don't work that linearly. Still, it is noticeable that at the current rate of churn, Grayscale, arguably the largest net seller in today's market, reportedly will be out of Bitcoin in 4 months.

(Thread)

Meanwhile, crypto influencers and financial market experts continue to share their predictions for target levels for the current market cycle. Standard Chartered Bank, one of many who shared their forecast, wrote in an investment note to clients on Monday:

“For 2024, given the sharper-than-expected price gains year-to-date, we now see potential for the price to reach the $150,000 level by year-end, up from our previous estimate of $100,000.”

The bank also predicted BTC’s price would reach the cycle top of $250,000 in 2025 before settling at around $200,000.

While not solely based on the halving event or fundamental Bitcoin market indicators, these analyses consider the influence of new market dynamics, such as an impressive performance of Bitcoin exchange-traded funds since January, highlighting the evolving factors shaping Bitcoin's market cycle.

(Peter Brandt on X; see also P.Brandt's paper on Bitcoin halving cycles)

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.