With bitcoin attacking all-time highs amid record-breaking spot ETF inflows, analysts at research and brokerage firm Bernstein anticipate a ‘big bang’ DeFi recovery next.

The Bitcoin rally, attributed primarily to institutional capital inflows in spot ETFs, saw Bitcoin prices soar to an all-time high zone of around $69,000. Following this milestone, a broader market recovery is anticipated, spearheaded by the #DeFi niche.

“We expect a big bang DeFi recovery and the investor narrative to come back as the future of blockchain finance,” Bernstein analysts predict. In a Monday report, they noted that six out of the top ten revenue-generating protocols are DeFi applications: Uniswap, Aave, Maker, GMX, Synthetix, and Sushi.

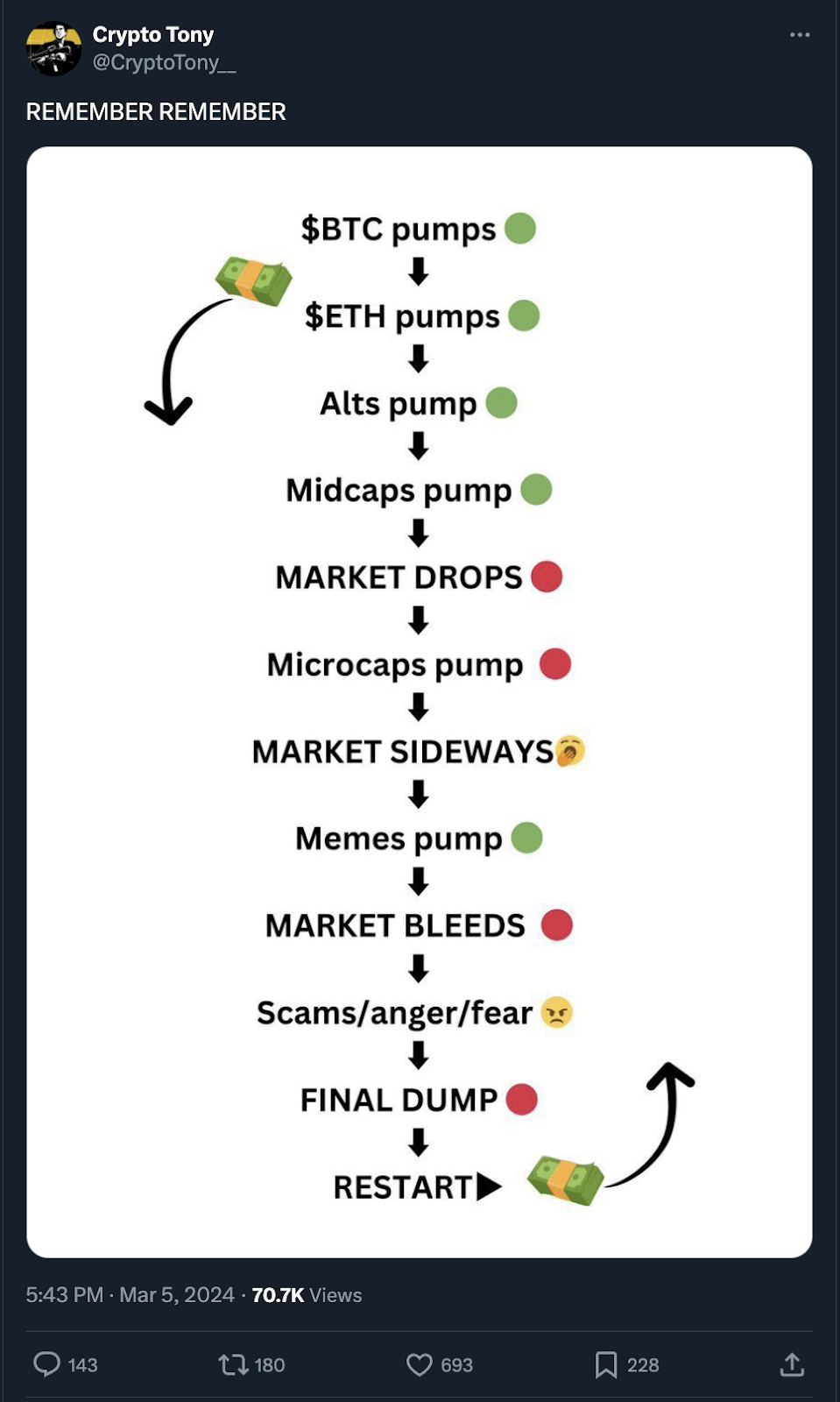

(X post)

During the last market cycle, the DeFi sector got “completely wiped out,” primarily due to unsustainable yields driven by token incentives. The epitome of DeFi’s unsustainability was the Terra ecosystem, where the Anchor protocol had promised 20% yields on its TerraUSD stablecoin, backed by Terra’s governance token Luna. The crash in Luna's token price led to the collapse of the entire Terra ecosystem, resulting in a loss of approximately $40 billion in investor wealth within days.

(Source)

What’s different about this cycle is that the yield is much more sustainable and real, accruing value based on actual fees from the underlying applications. With regulatory clarity, authors suggest, it would not be surprising to see global asset managers considering possible DeFi-focused ETFs and actively managed DeFi funds.

On the other hand, Bernstein analysts noted concerns around the SEC’s stance that all cryptocurrencies, except Bitcoin, might be classified as securities. This perspective contrasts with the crypto industry’s view of these assets as tokens linked to permissionless protocols without explicit investment contracts.

“This is the fundamental question in the Coinbase vs. SEC case, which names 12 tokens as securities, alleging Coinbase is an unregistered securities exchange. As the courts in recent times have typically exercised more nuance than the blanket arguments followed by SEC (as seen in the Ripple vs. SEC case), we believe the crypto industry is sensing an opportunity to change the ‘legal’ narrative on tokens.”

The increasing interest in #DeFi is evidenced by the 50% surge in its total value locked (TVL) year-to-date, as per DefiLlama data, from $55 billion to over $99 billion.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.