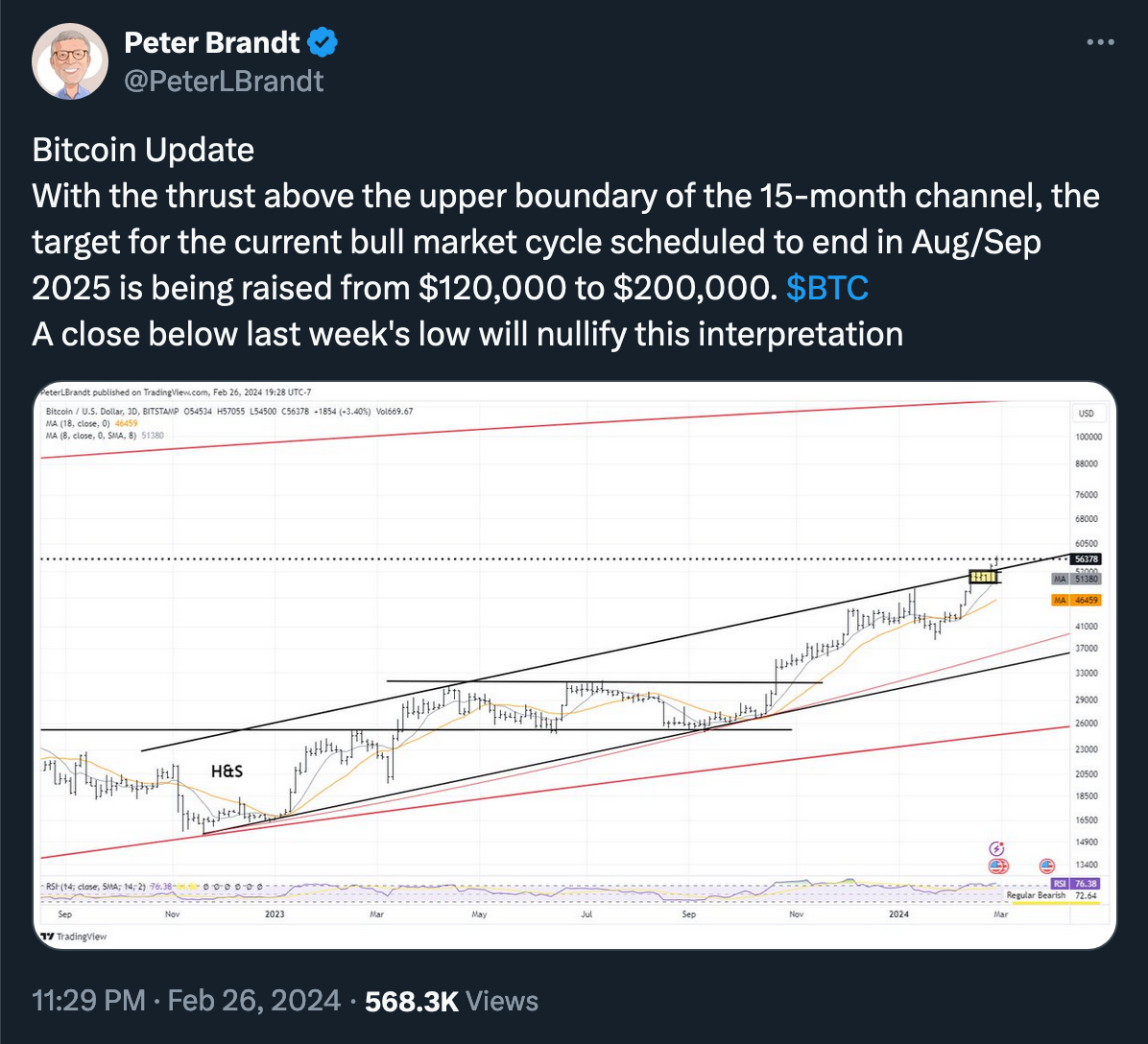

The Bitcoin/Dollar exchange rate continues to move higher, gaining strong momentum from the beginning of Monday’s U.S. trading session. It has now reached the price range high and implied resistance area; however, being bearish near all-time highs is not compelling, given market conditions.

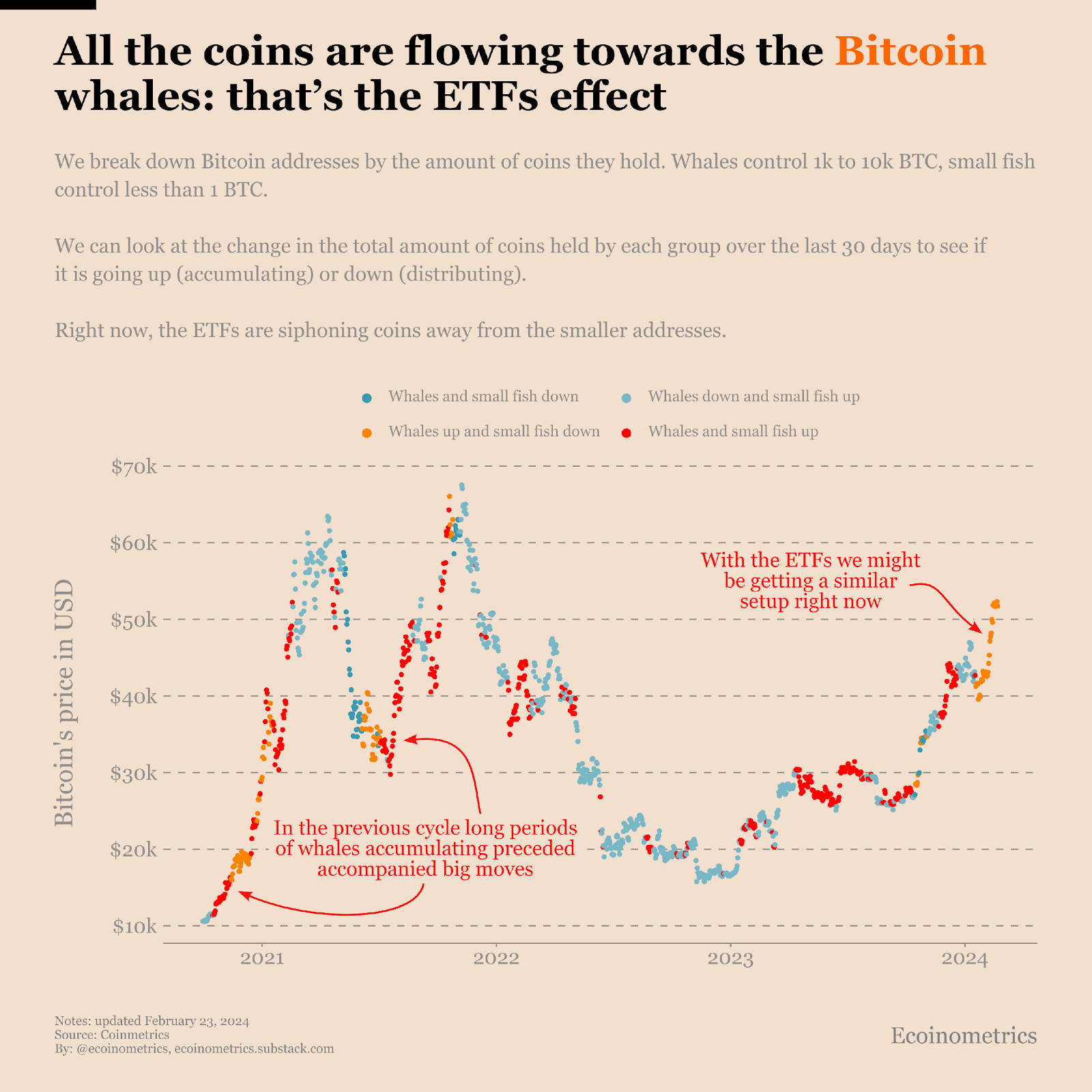

As highlighted by Ecoinometrics, “Every time the whales are accumulating coins (with or without the small fish), Bitcoin’s price is rising significantly.” In recent weeks, there has been a rapid expansion in whale wallets, the fastest since February 2022, as ETFs redirect coins from smaller investors to whales.

(Source: Ecoinometrics)

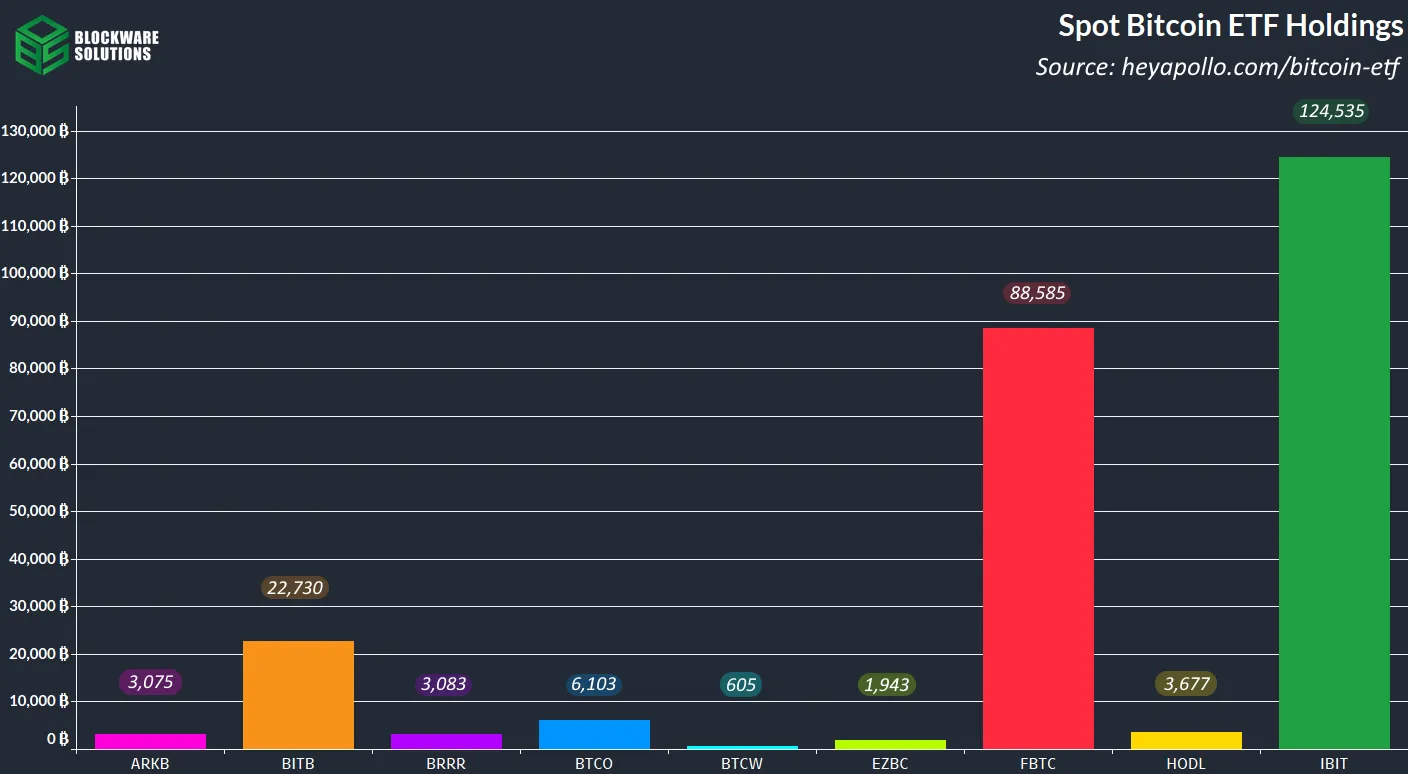

Total spot Bitcoin ETF holdings reportedly have reached ~281,000 BTC (~$16 billion), making Wall Street the single-largest bitcoin owner apart from Satoshi. In their first months, ETFs were sucking up 10x more BTC than miners can produce.

(Source: Blockware Intelligence)

More broadly, Bitcoin’s spot ETFs have continued to perform exceptionally well without any signs of slowing, and after the GBTC’s fire sale ended, this ETF strength began to have a more visible impact on price.

The price has now reached the macro range high, approaching the all-time high "area." This level represents the final meaningful resistance before reaching new all-time highs. Generally, being bearish near all-time highs is not a compelling proposition, as noted by the Technical Roundup newsletter (PDF).

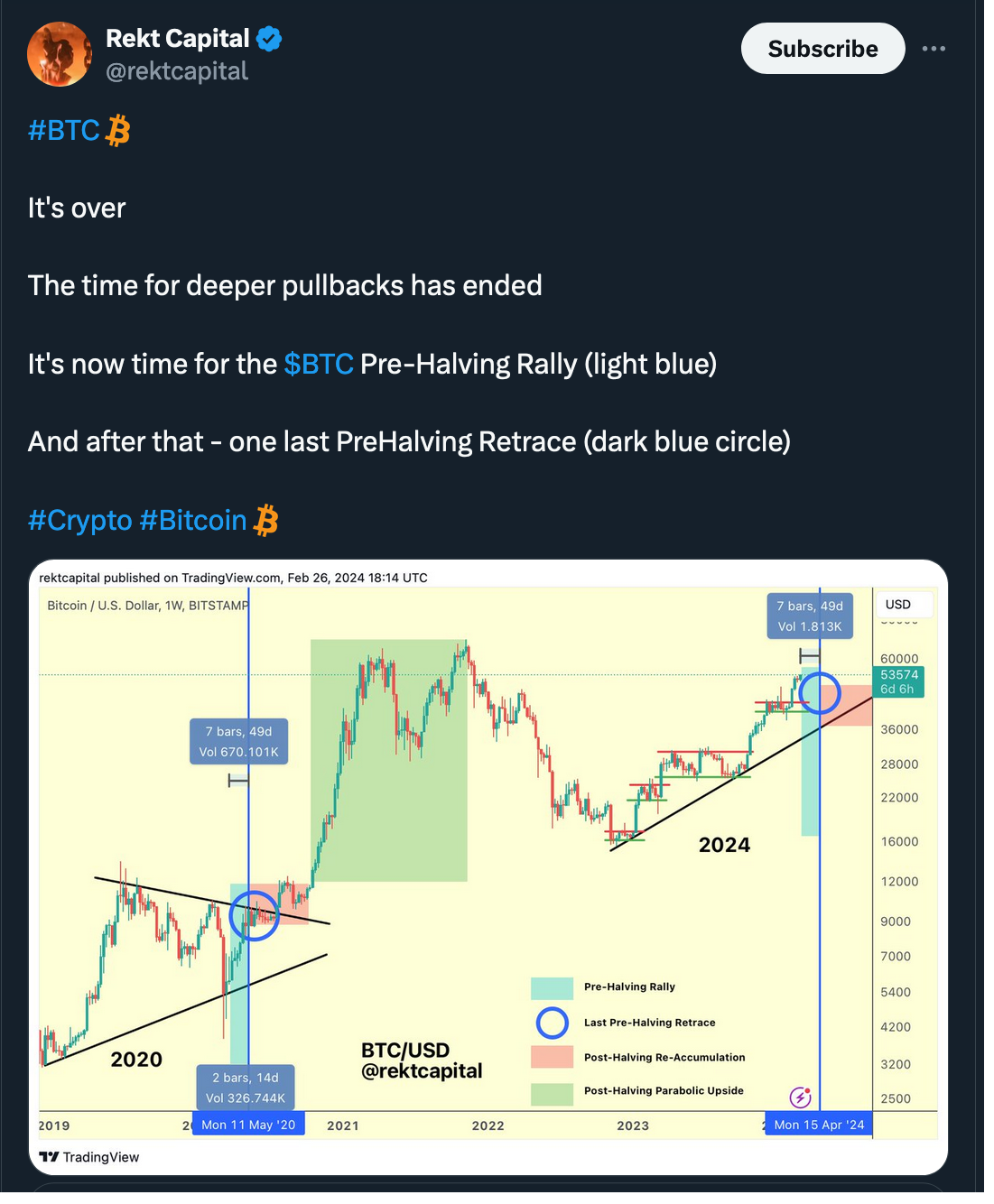

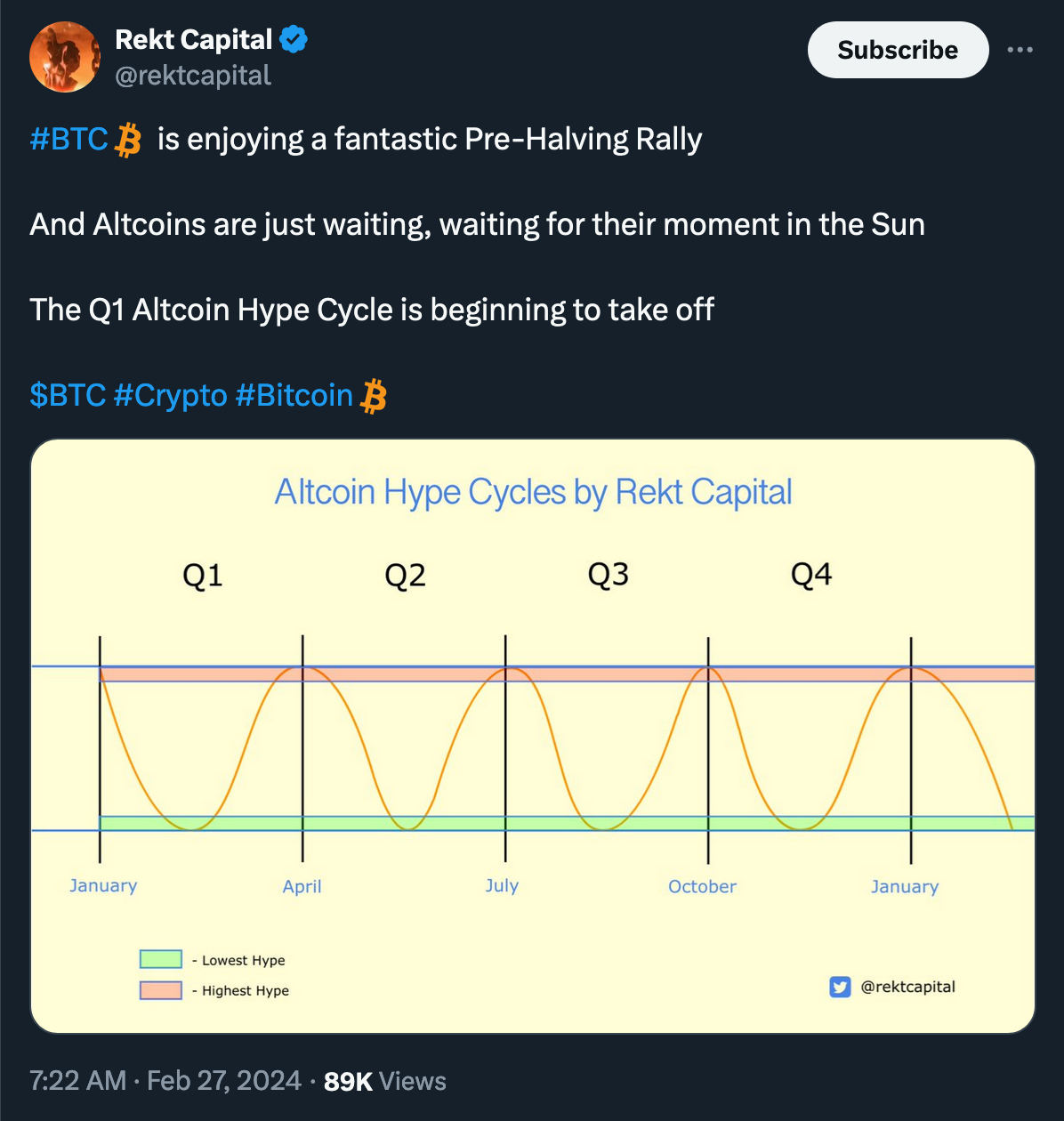

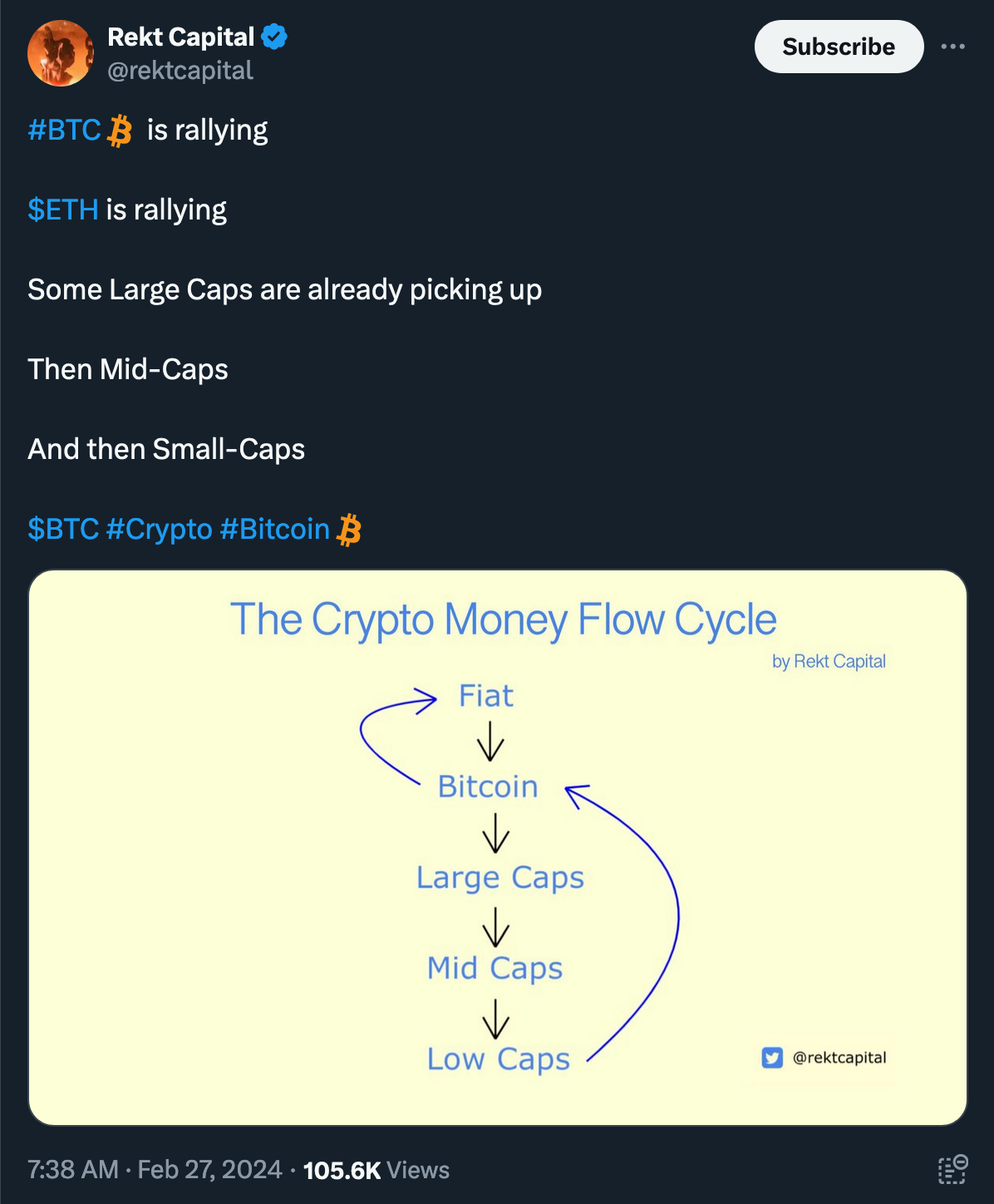

From the perspective of Bitcoin’s halving cycles, the pre-halving rally tends to start around 63 days before the halving event. In the current cycle, it was delivered slightly ahead of schedule. Nonetheless, history has largely followed the same pattern in this respect.

“Right now, ~49 days remain until the April 2024 Halving. … Short-term traders and speculators ‘Buy The Hype’ several weeks before the Halving in anticipation of making a profit from this hype-fuelled rally. Then these speculators ‘Sell The News’ to realise that profit, contributing to a Pre-Halving retrace which occurs only a handful of weeks before the Halving event itself.” (@rektcapital)

The pre-halving retrace mentioned above (-38% deep in 2016 and -20% deep in 2020) can last multiple weeks and is followed by a multi-month re-accumulation period, making investors question whether the halving was a bullish catalyst on price after all.

Once Bitcoin breaks out from the re-accumulation area, it enters a parabolic after-halving uptrend.

Right now, it seems reasonable to ‘assume strength until weakness,’ and the market has not offered any weakness yet.

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.