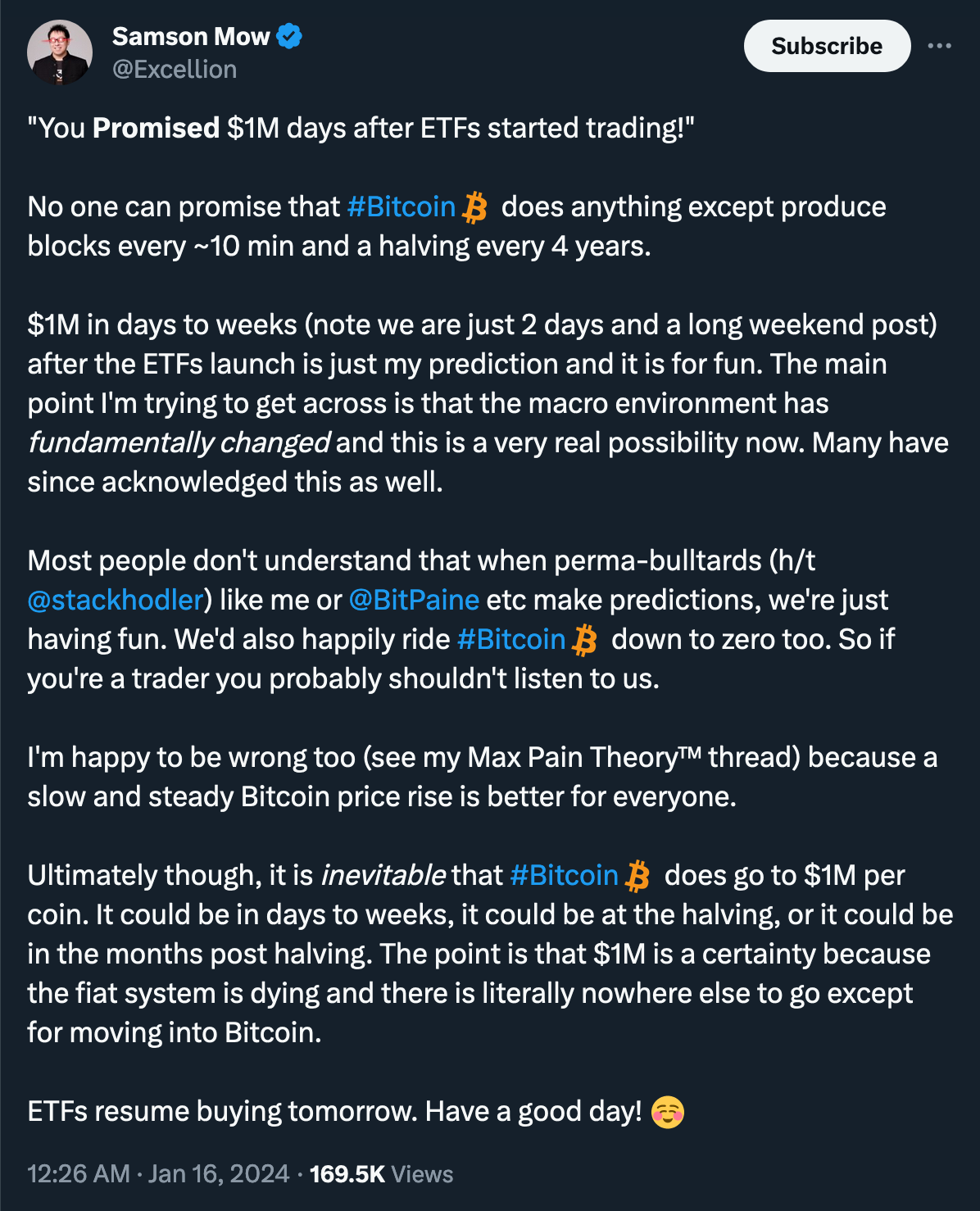

Although some eccentric bulltards suggest Bitcoin's price could skyrocket $1 million ‘in days to weeks,’ many market experts expect a much more turbulent journey for Bitcoin in coming months, with a period of prolonged macro consolidation… which historically sets the stage for altcoins to rally hard.

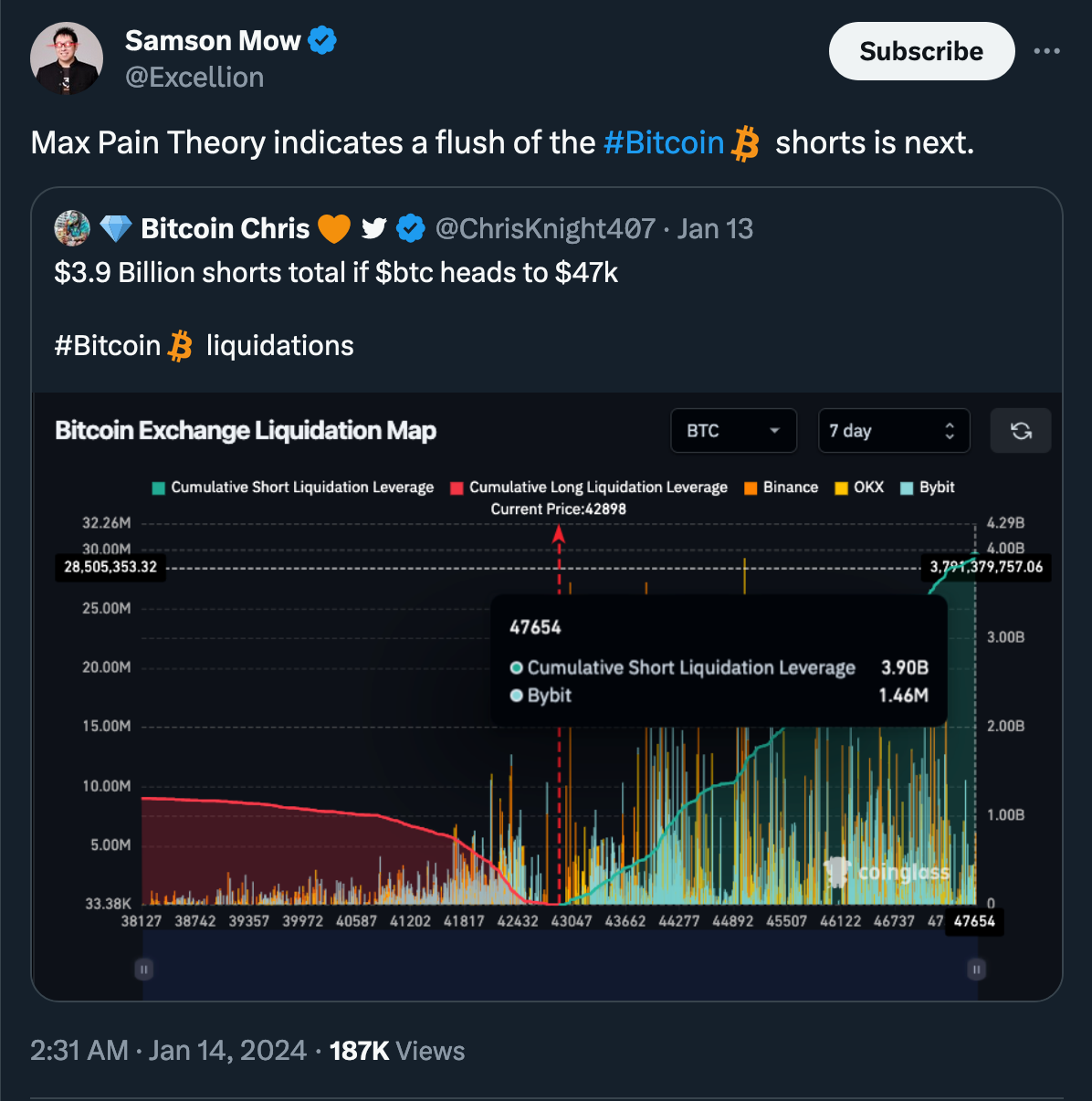

While perma-bulltards have fun making bold predictions about Bitcoin’s value skyrocketing in the near term, other experts have a different outlook on the ‘max pain’ trajectory for the Bitcoin market. Notably, Arthur Hayes, a founder and ex-CEO of BitMEX, while acknowledging that Bitcoin ETFs could potentially attract billions from TradFi, anticipates a turbulent year in 2024, predicting a 30% price crash amid a ‘vicious washout.'

(Source)

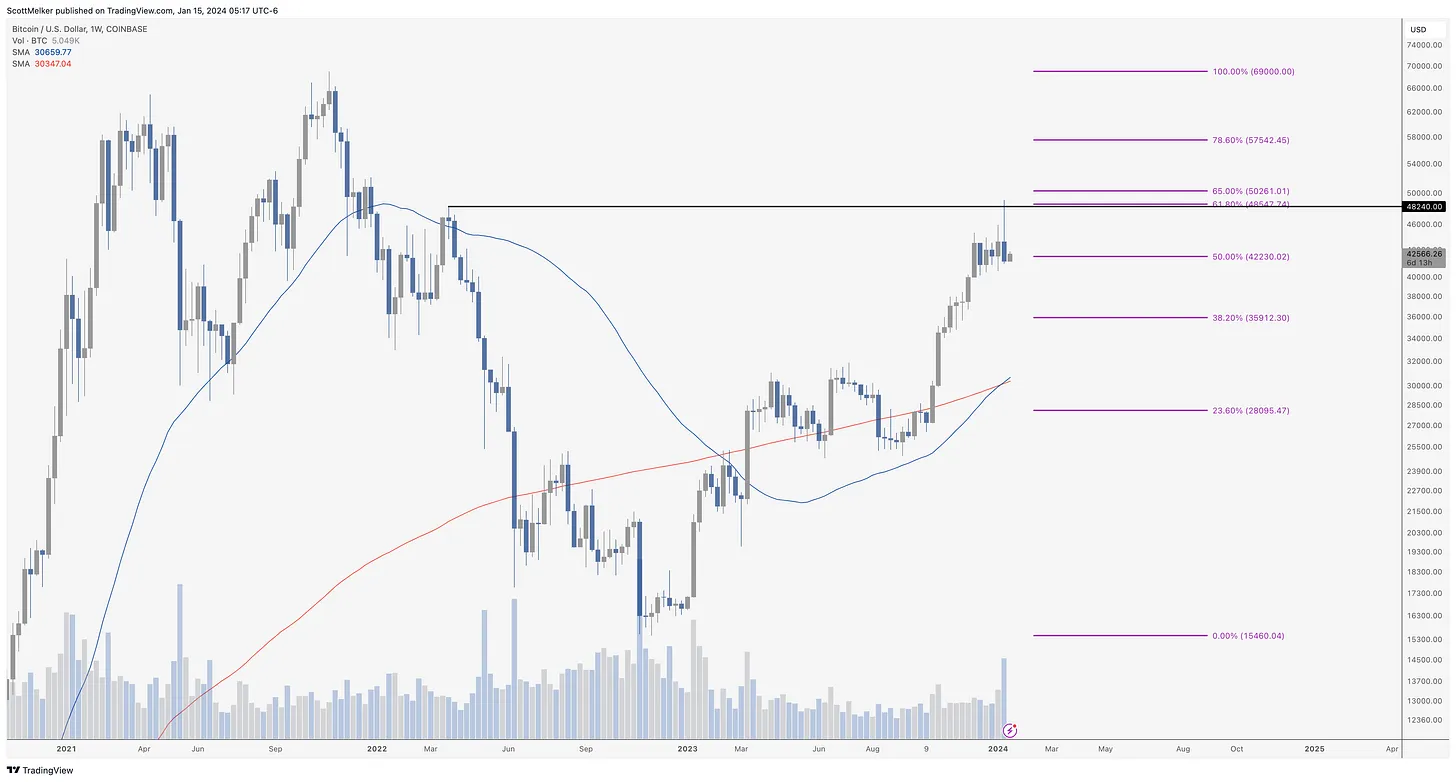

From a technical analysis standpoint, the current price structure of the Bitcoin market, as per 10x Research analysis, seems less than promising, hinting at the likelihood of a deeper pullback.

(Source: 10x Research, Coindesk)

(Source: The Wolf Den newsletter)

“I have no idea what will happen – nobody does. The chart indicates that bears are back in control for the moment. We need to see more downside to confirm the bearish candle from last week, or else the shooting star is not that meaningful. This week will be fun to watch,” — Scott Melker, The Wolf Den.

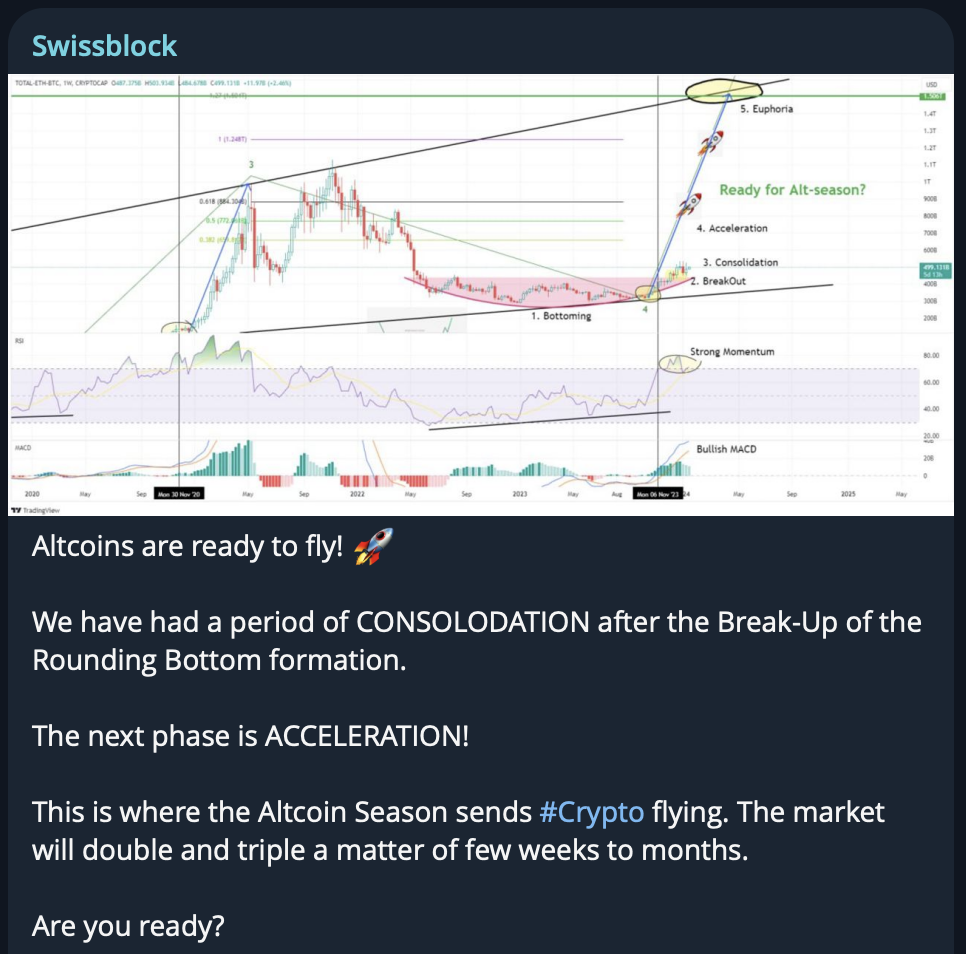

Currently, Bitcoin is primarily in a consolidation phase. If the concerns about a significant drawdown do not materialize, then history suggests that such consolidation periods in Bitcoin often set the stage for alts to thrive. This outlook is supported by the Bitcoin dominance index (BTC.D) chart, which indicates that altcoins may be poised well to capitalize on this opportunity.

Swissblock’s analysts believe that the market has entered a phase of the altcoin season where bullish sentiment and FOMO take over, suggesting that alts are now poised to outperform in the rally that BTC has driven for months. It doesn't imply a top for Bitcoin, however, as there is still plenty of room for Bitcoin to rise in the coming months.

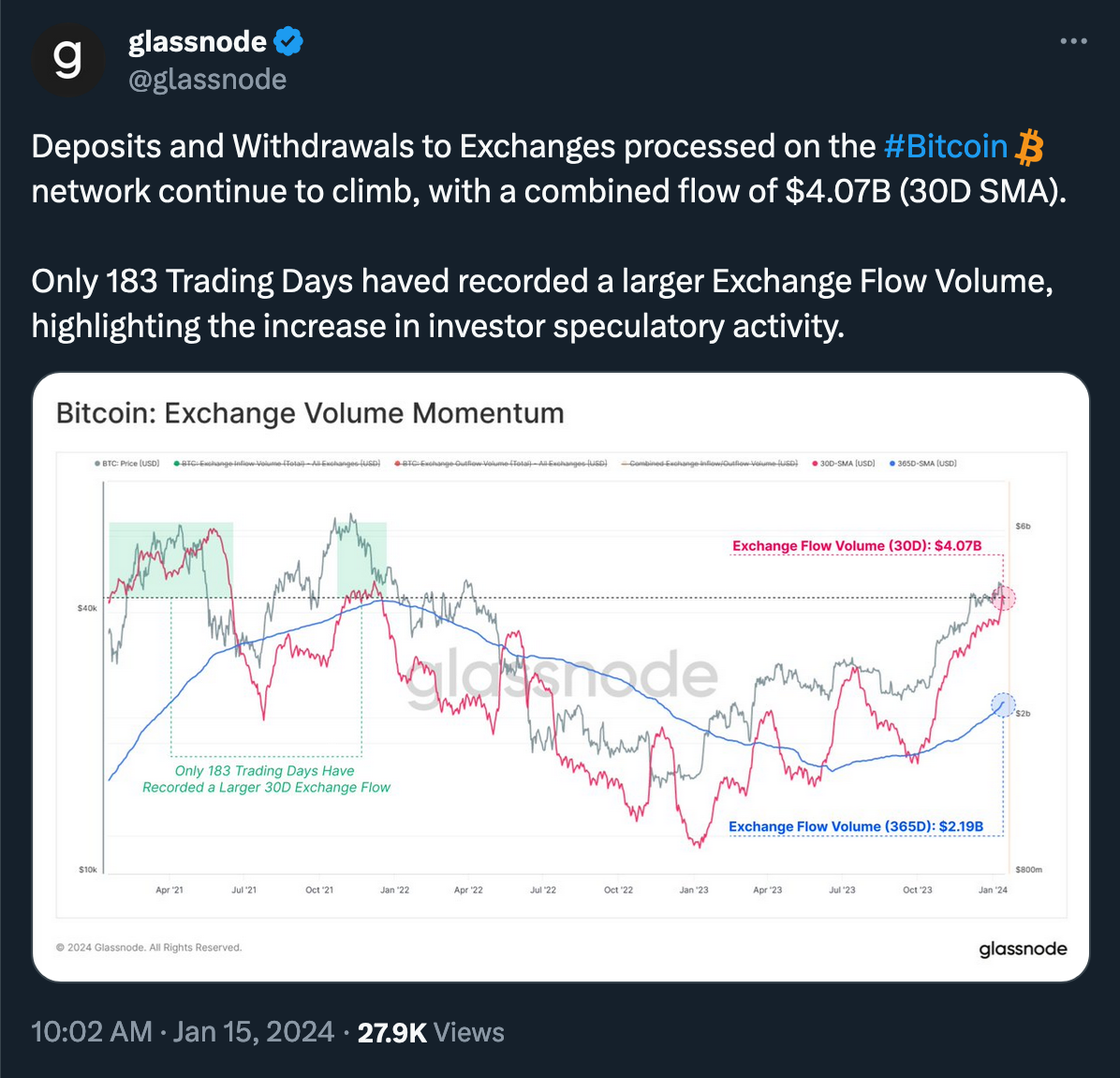

Meanwhile, inflows and outflows from Bitcoin exchanges have reached historical peaks, as per Glassnode’s data. It’s hard to say exactly what impact it might have on prices, but this might be a sign of heightened volatility in the near future.

Tactical trading is hard. Risk management and position sizing are key. Without proper risk management and position sizing, you will suck at trading on a distance.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.