On Monday U.S. Securities and Exchange Commission (SEC) started legal action against Bittrex Global, even though the exchange has no American clients and has never presented itself as operating in the U.S. or with U.S. individuals, having a separate legal entity for operating with U.S. customers, the closing of which the exchange announced earlier. Besides the official press release from Bittrex Global, here's a thread from its CEO Oliver Linch.

In a new lawsuit filed Monday, SEC named as securities six crypto tokens listed on the exchange: DASH, ALGO, OMG, TKN, NGC, and IHT.

#Bittrex has become the latest #Crypto exchange to be charged by the SEC for violating Federal Laws.

— Crypto Rand (@crypto_rand) April 17, 2023

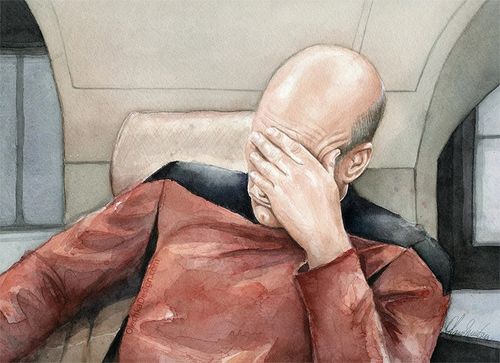

Are there any exchanges left that have not been charged by the SEC for some form of violation? 🤔 pic.twitter.com/OAoucUeLWt

Even Coinbase CEO Brian Armstrong is now talking about the exchange could move away from the U.S. because of the regulatory environment:

"Anything is on the table, including relocating or whatever is necessary," he said. "I think the U.S. has the potential to be an important market for crypto, but right now, we are not seeing that regulatory clarity that we need."

"We actually have contradictory statements from the heads of the CFTC and the SEC coming out almost every few weeks. How's a business going to operate in that environment? We just want a clear rulebook." – Brian Armstrong (Source)

If SEC and CFTC can’t even agree on ETH and USDC, then how the fuck is anyone supposed to analyze the other 1000+ weirder and more obscure assets?

— Erik Voorhees (@ErikVoorhees) April 12, 2023

The law is as clear as @GaryGensler’s ethical compass. https://t.co/v5HcZK1AbK

Meanwhile, SEC chair Gary Gensler says the agency could use more resources to put even more pressure on crypto. He insists: basically any crypto token meets the definition of unregistered securities, including all the DeFi tokens. Reportedly, SEC is ready to revisit the exchange definition as It targets DeFi to push for decentralized finance platforms and digital asset exchanges to register with the agency.

"The SEC is simply seeking to ban DeFi protocols in America," said Jason Gottlieb, a lawyer with crypto clients at Morrison Cohen in New York. "In doing so, the SEC is substituting its own opinions for Congress' prerogative on a major question, central to the future of the American economy."

It's simple 📣#FireGaryGensler

— VivaLaCoin (@VivalaCoinBTC) April 18, 2023

The SEC has been biasedly destroying the US crypto market's ability to grow, blocking spot ETFs, protecting ZERO retail investors, & treating ppl working together on solutions as criminals while refusing to define what laws even apply, or why.

In addition to the annoyance, turning into pure anger, from the crypto community, the SEC's actions have also raised harsh criticism from congressional Republicans.

“Under your leadership, the Commission has proposed more than 50 rules, none of which directly promotes capital formation,” wrote the representatives in their official letter (PDF) last week. “Instead, the Commission has focused on implementing costly regulatory disclosure requirements on topics that go beyond its scope.”

“Failing to act on this important pillar of the SEC’s mission threatens the strength of the U.S. capital markets and jeopardizes American business’ ability to foster domestic economic activity and compete globally,” the reps added.

On Tuesday's House Financial Services Committee hearings, сongressmen had many questions for Gensler about his agency's approach to regulating crypto assets… And even the most obvious ones were not answered clearly.

Rep. McHenry: “Is Ether a security or a commodity?”

— Erik Voorhees (@ErikVoorhees) April 18, 2023

Gensler doesn’t answer, over and over again.

If the law was clear, the answer would be immediate and easy.

@SECGov is not credible or ethical

Chair Gensler earning $100 million from Goldman Sachs, running Hillary’s failed 2016 campaign, and teaching a course on crypto without ever using it is everything you need to know about this SEC’s reckless and random approach to digital assets regulation.

— Ryan Selkis 🪳 (@twobitidiot) April 18, 2023

Many who watched today are likely feeling Congress views Gensler as negligent, incompetent, or at least not fit for his role.

— Ben Lilly (@MrBenLilly) April 18, 2023

Why is nothing done by Congress on changing this? Feels harmful to American capital markets and financial system.

You know what the worst part about this Gensler hearing is?

— The Wolf Of All Streets (@scottmelker) April 18, 2023

None of it will matter. At all.

The SEC protects the system, not you, on which Blockworks makes a detailed argument in this article. But you know what?