The crypto market is in wait mode. Everything appears ready for a strong year-end rally: declining interest rates, money flowing into exchange-traded products (ETPs), growing concerns about the dollar, plus rising tokenization and stablecoins. Yet, we've largely been stuck waiting. Why?

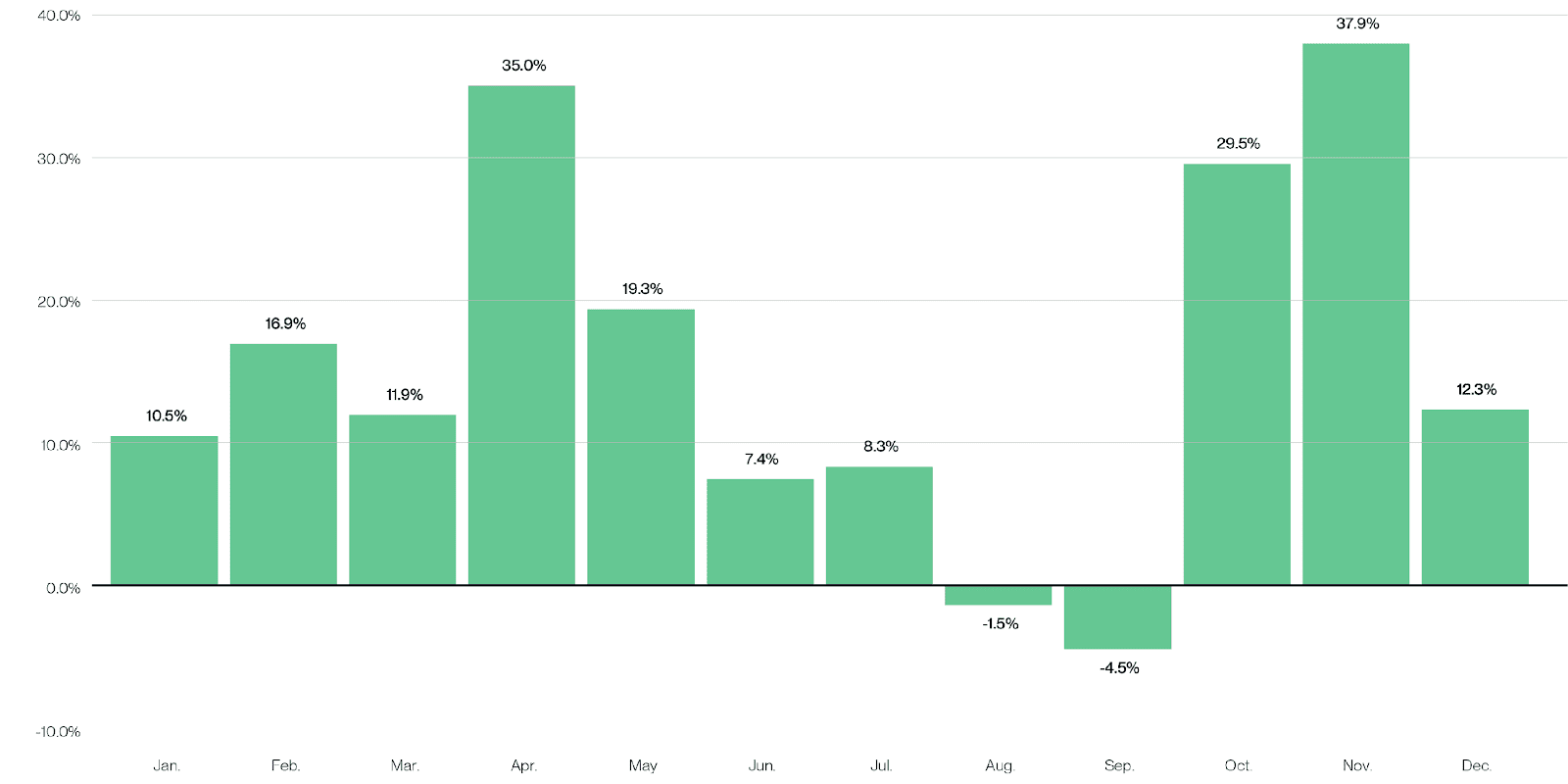

As Bitwise investment director Matt Hougan has noted, historically, August and September are the two worst months of the year for crypto in terms of returns.

At the same time, major events (Bitcoin ETP approvals at major brokers, legislative progress) often need time to translate into market momentum.

(Source: Matt Hougan, Bitwise Investments)

As for the SEC and new ETPs approvals,

"As I see it, the SEC is getting ready to blow the market wide open, [creating generic listing standards for crypto ETPs]," says Hougan.

Until now, the SEC has approved spot crypto ETPs on a case-by-case basis, which takes time to say the least: reviewing each application can take up to 240 days, and even then there's no guarantee of approval.

On Wednesday the SEC took a first important step by approving universal listing standards for commodity-based trusts. But full "generic listing standards" for all crypto ETPs — which could come as early as October, according to Matt Hougan of Bitwise — may go even further: as long as a filing meets certain clearly defined requirements, SEC approval should be nearly guaranteed within 75 days or less.

Regarding the requirements, the SEC is still working on them, gathering input from the industry. Based on current proposals, the list of crypto tokens with ETPs could soon include Solana, XRP, Chainlink, Cardano, Avalanche, Polkadot, Hedera, Dogecoin, Shiba Inu, Litecoin, and Bitcoin Cash, among others.

"The history tells us, the adoption of generic listing standards will likely usher in a ton of new crypto ETPs. And the number of ETF issuers can also be expected to balloon, as it has become push-button easy for companies to launch ETFs. We should see dozens of single-asset crypto ETPs and the rise of index-based crypto ETPs." (Matt Hougan, Bitwise Investments)

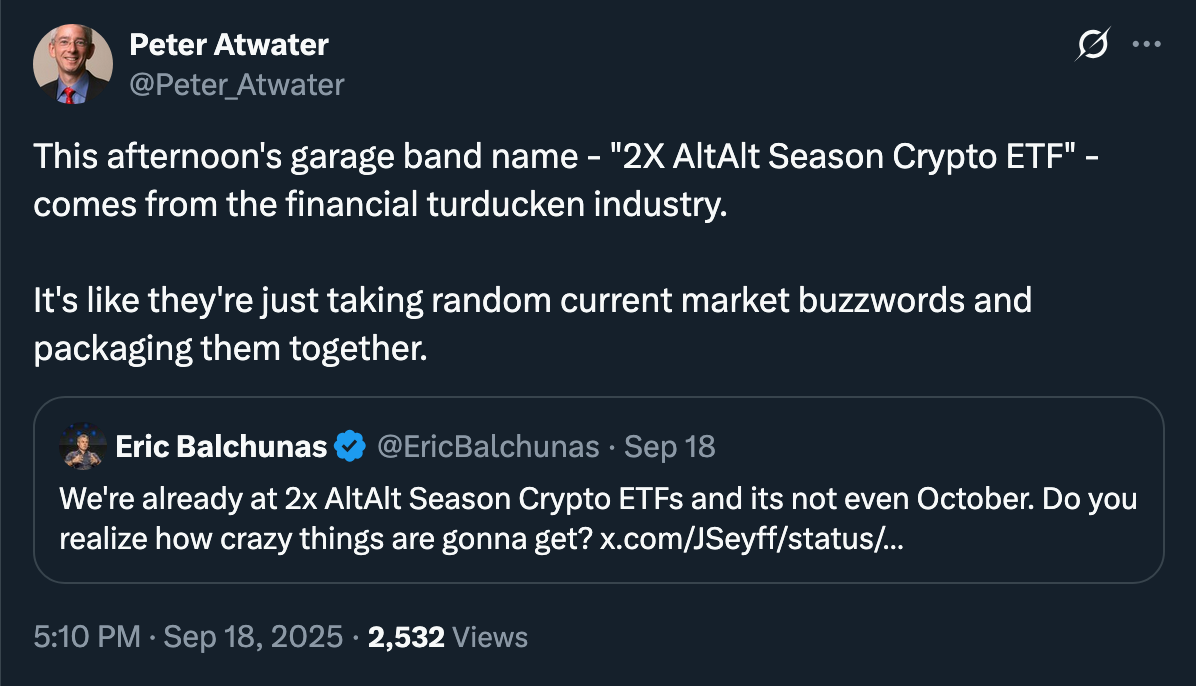

Recent months have seen a surge in increasingly creative ETP applications, as issuers pushing boundaries through leveraged and index-based products covering various altcoins.

(James Seyffart from Bloomberg on X)

Among other applications, Tidal Financial Group filed to create a leveraged "2x AltAlt Season Crypto ETF," along with two other filings on Thursday.

If alt seasons describe periods when Ethereum and other major altcoins outperform Bitcoin — usually after Bitcoin's own rise — then 'altalt' season, in Tidal's logic, refers to the next phase when market activity shifts to mid-cap altcoins and further down the market.

Their AltAlt fund aims to capture this exact dynamic, tracking XRP and Solana performance, while the Alt ETF adds Ethereum to the mix, and the All Cap strategy includes all of these plus Bitcoin.

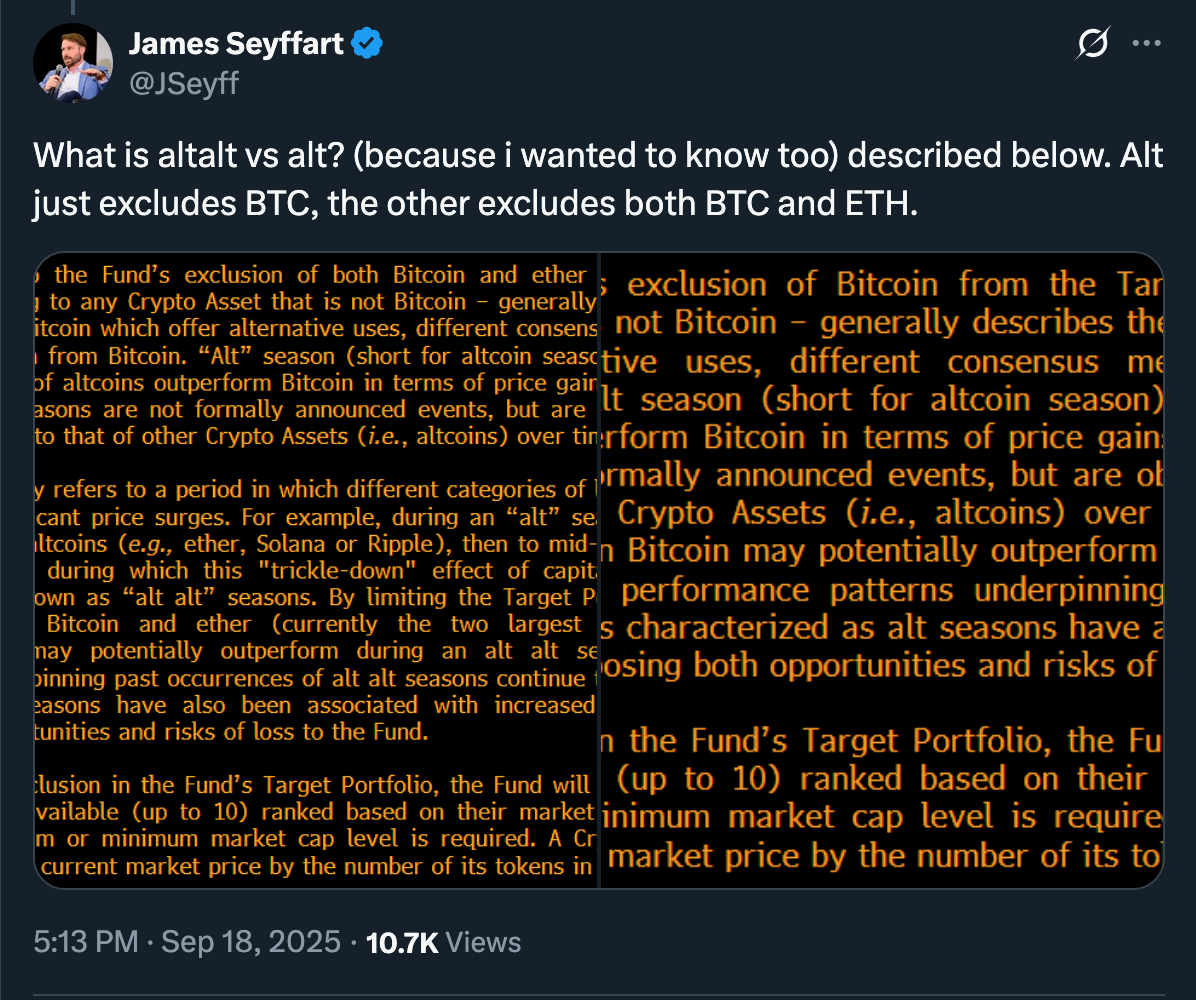

(James Seyffart from Bloomberg on X)

It's clear that just having an ETP doesn't guarantee substantial inflows to any token without genuine investor interest in the asset itself. On the other hand, the recent success of XRP ETFs (best ETF debut in 2025) and DOGE seem like evidence of pent-up demand that will only grow as the approval process becomes easier.

What ETPs mean for crypto is that assets will be more ready for growth — if and when fundamentals begin to improve. After all, most of the world's money is controlled by traditional investors, and ETPs make it much easier for them to allocate in crypto.

There's also another important but less quantifiable but crucial factor: ETPs reduce the mystery factor of crypto, making it less obscure, more visible and more accessible to the average investor.

Chainlink, Avalanche, or Polkadot no longer seem like weird tokens only for crypto enthusiasts with a dozen wallets; they're tickers accessible to anyone with a brokerage account. This brings people closer to cryptocurrency in real life and its countless use cases.

"The SEC adopting generic listing standards is a 'coming of age' moment for crypto, a signal that we've reached the big leagues. But it's also just the beginning," Matt Hougan concludes.

Bloomberg Senior ETF Analyst on X

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.