Stablecoins are becoming one of the biggest financial innovations since electronic payments, positioning themselves as the new infrastructure for global settlements. While crypto-native issuers expand their share of the global payments market, seeking to replace TradFi infrastructure, TradFi players are moving to reclaim control as regulations clarify: SWIFT is moving into blockchain, and banks are preparing their own stablecoins.

Floating Stability

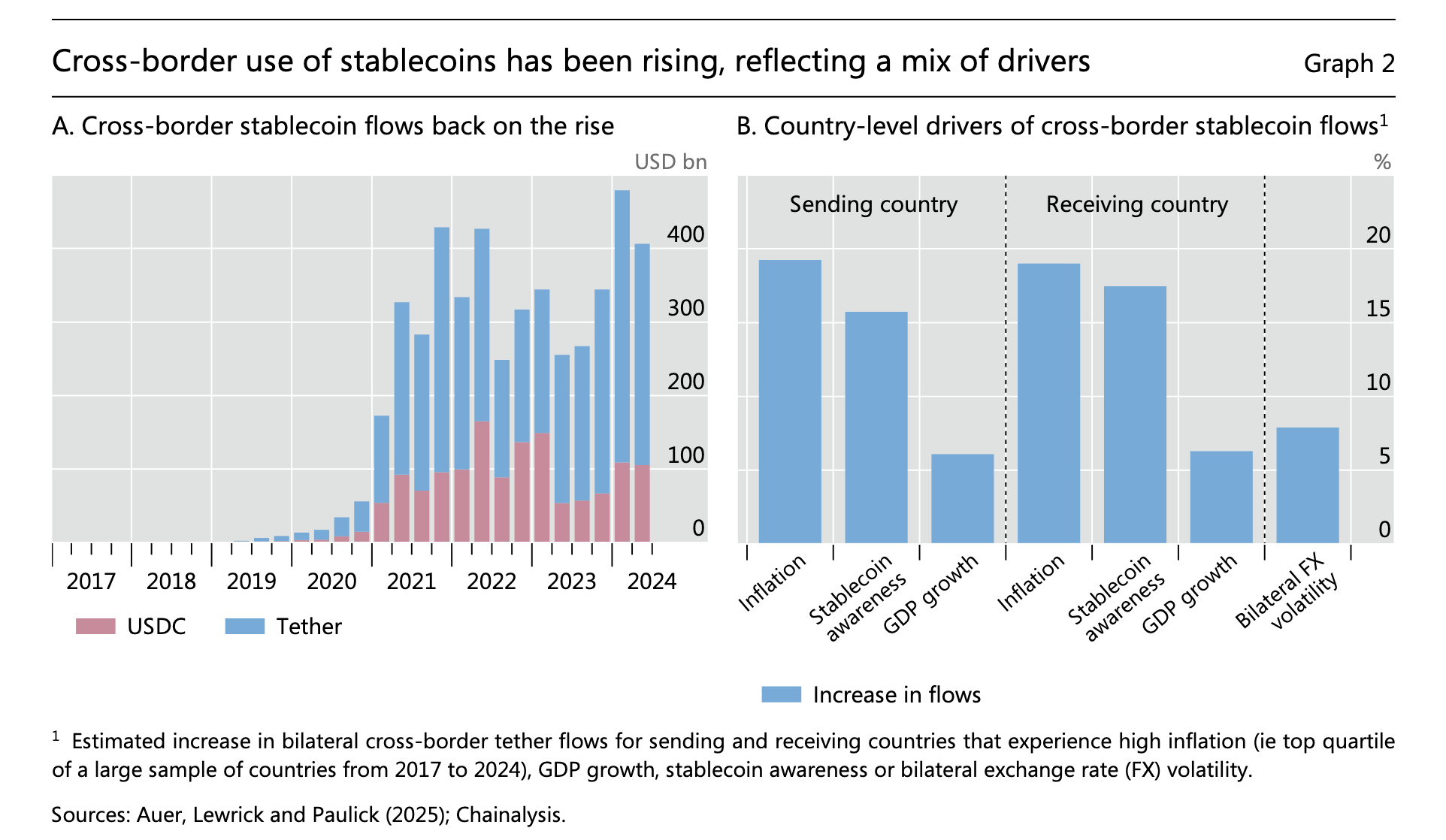

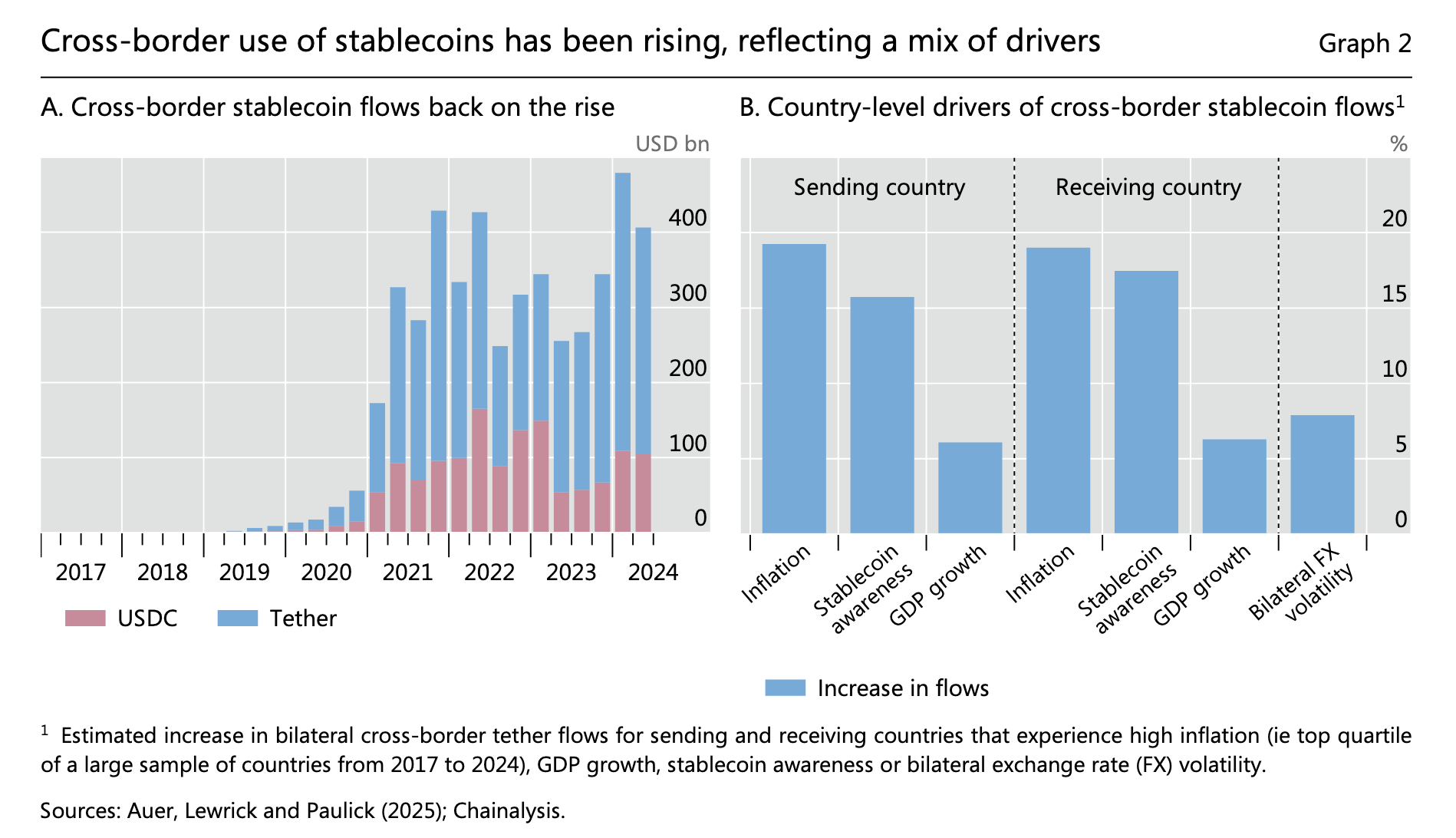

Stablecoin growth still comes mainly from (a) the crypto-native ecosystem, (b) e-commerce and digital companies, and (c) offshore/international demand for holding US dollars.

Source: BIS Annual Economic Report 2025, Chapter III

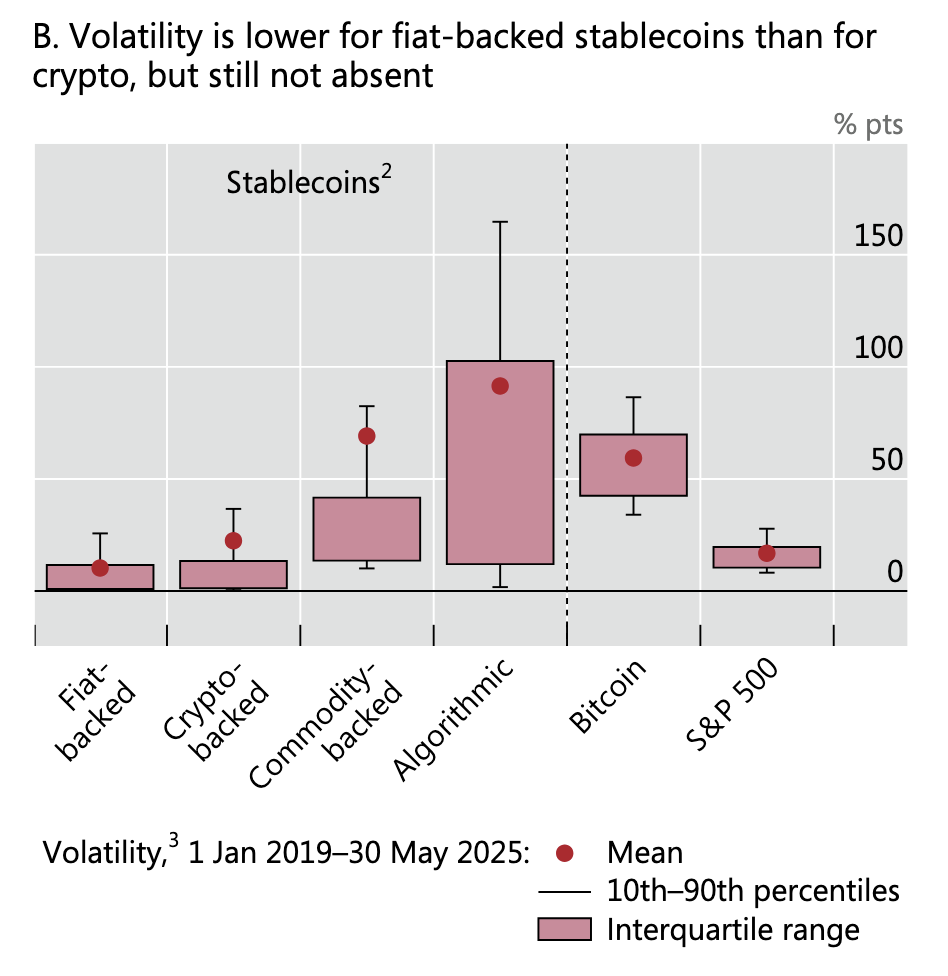

This growth isn't hindered by stablecoins' merely relative price stability, which comes more from market forces and arbitrage opportunities than from any strict "peg."

"Stablecoins are not pegged to $1.00. Period. This is a long-standing market misconception, one that has even made its way into official U.S. legislation. In reality, stablecoins are market-traded instruments whose prices fluctuate around $1.00 due to trading dynamics. Their apparent stability comes from market forces and the appearance of arbitrage, not a fixed peg. Traders buy when prices fall below $1.00 and sell when they rise above it, relying on issuers’ create-and-redeem mechanism[s] to help keep prices anchored near $1.00."— NYDIG Research

Recent volatility confirmed this: during the recent liquidation wave, even reserves-backed USDC and USDT traded at noticeable premiums to $1.00. Meanwhile, algorithmic stablecoins like USDe experienced much more significant depegs — dropping to $0.65 on Binance and causing forced liquidations for traders who used them as collateral.

Source: BIS Annual Economic Report 2025, Chapter III

Regulatory Capture

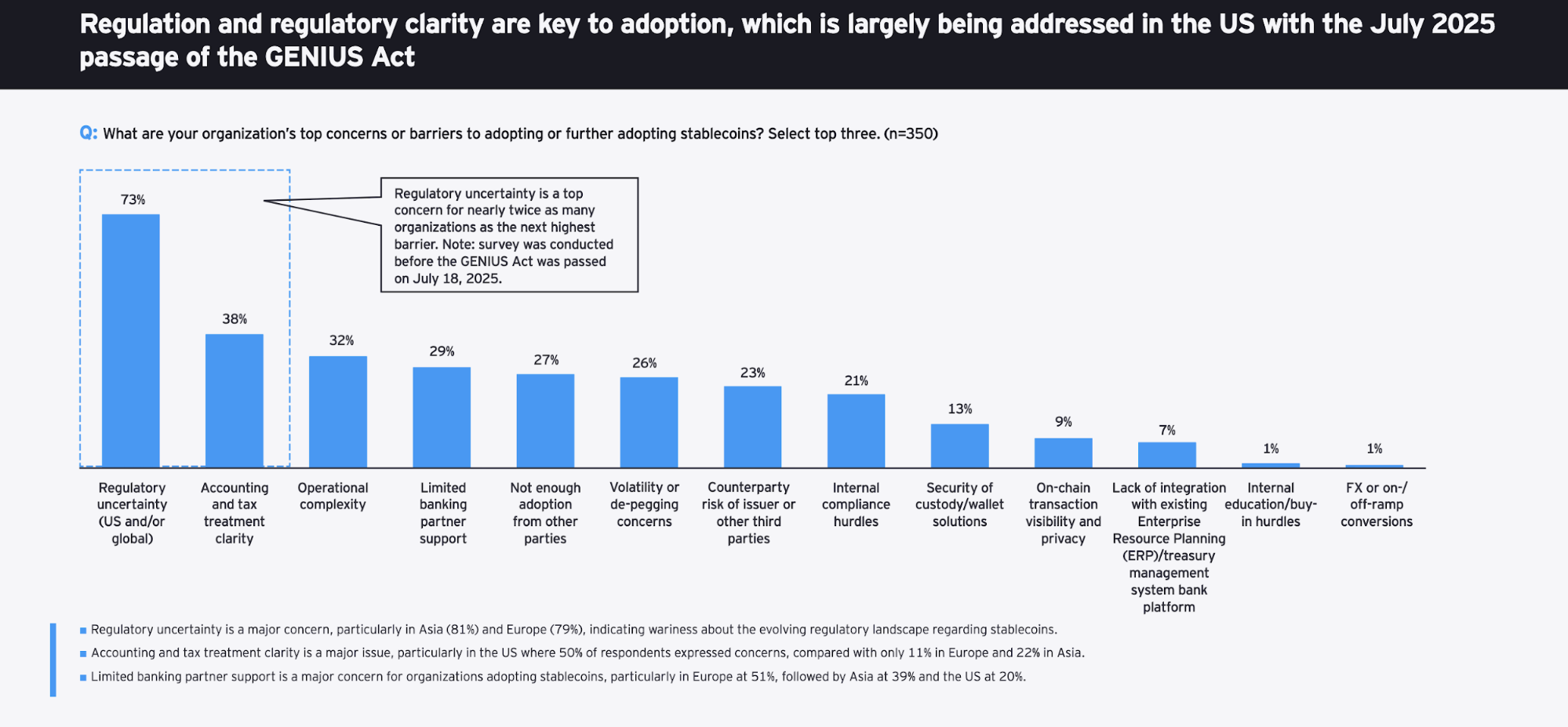

The GENIUS Act established the regulatory clarity needed to accelerate stablecoin adoption and their integration into TradFi.

(Source: EY Parthenon report)

Stablecoins worldwide now fall under a fairly uniform regulatory framework. They must be backed by real high-quality assets, undergo regular audits, and issuers can't pay interest on stablecoin balances.

This restriction appears globally: US regulators codified it in the GENIUS Act, the EU included it into MiCA, and financial hubs like Hong Kong and Singapore adopted similar rules.

(Source: EY Parthenon report)

Experts note the challenge: protecting consumers without turning stablecoins into securities requires blocking workarounds, but decentralized systems make enforcement difficult. So the real test will be how regulators respond to the workarounds companies are already using.

“In a competitive market with others issuing their own stablecoins, you end up in a situation where you’re looking for ways to incentivize users to use your stablecoin. The ability to pay yield would be an important way to do that.”— Will Beeson for Decrypt

Crypto exchanges have found their workaround: "rewards" programs that function much like interest payments on stablecoin holdings — just without the label.

"There is an inherent tension between stablecoins' promise to always deliver par convertibility (ie be truly stable) and the need for a profitable business model that involves liquidity or credit risk."— BIS Annual Economic Report 2025, Chapter III

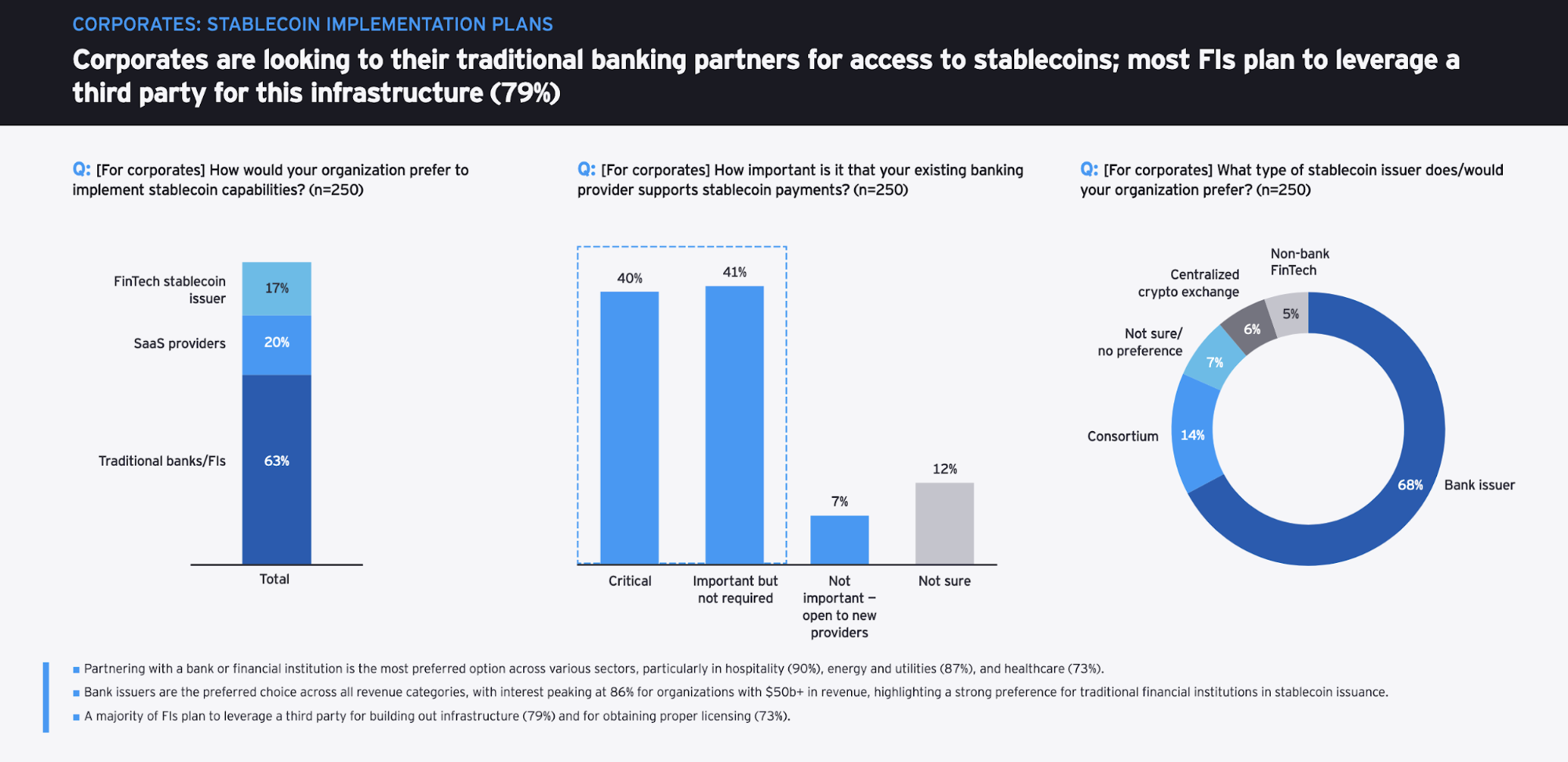

But for large corporations and financial institutions these details take a back seat—they prioritize something else: the scale of savings and speed of implementation.

Stablecoins' ChatGPT Moment

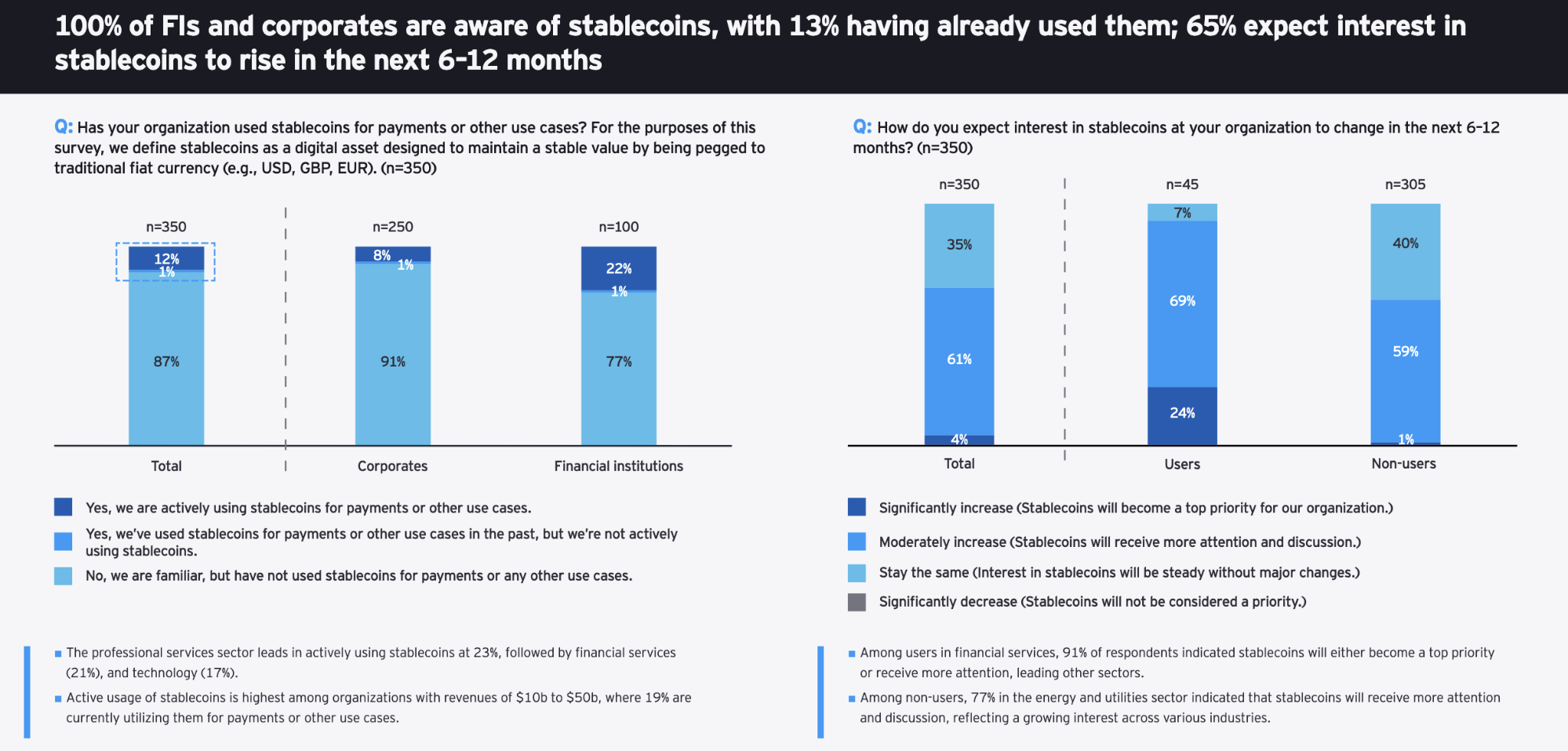

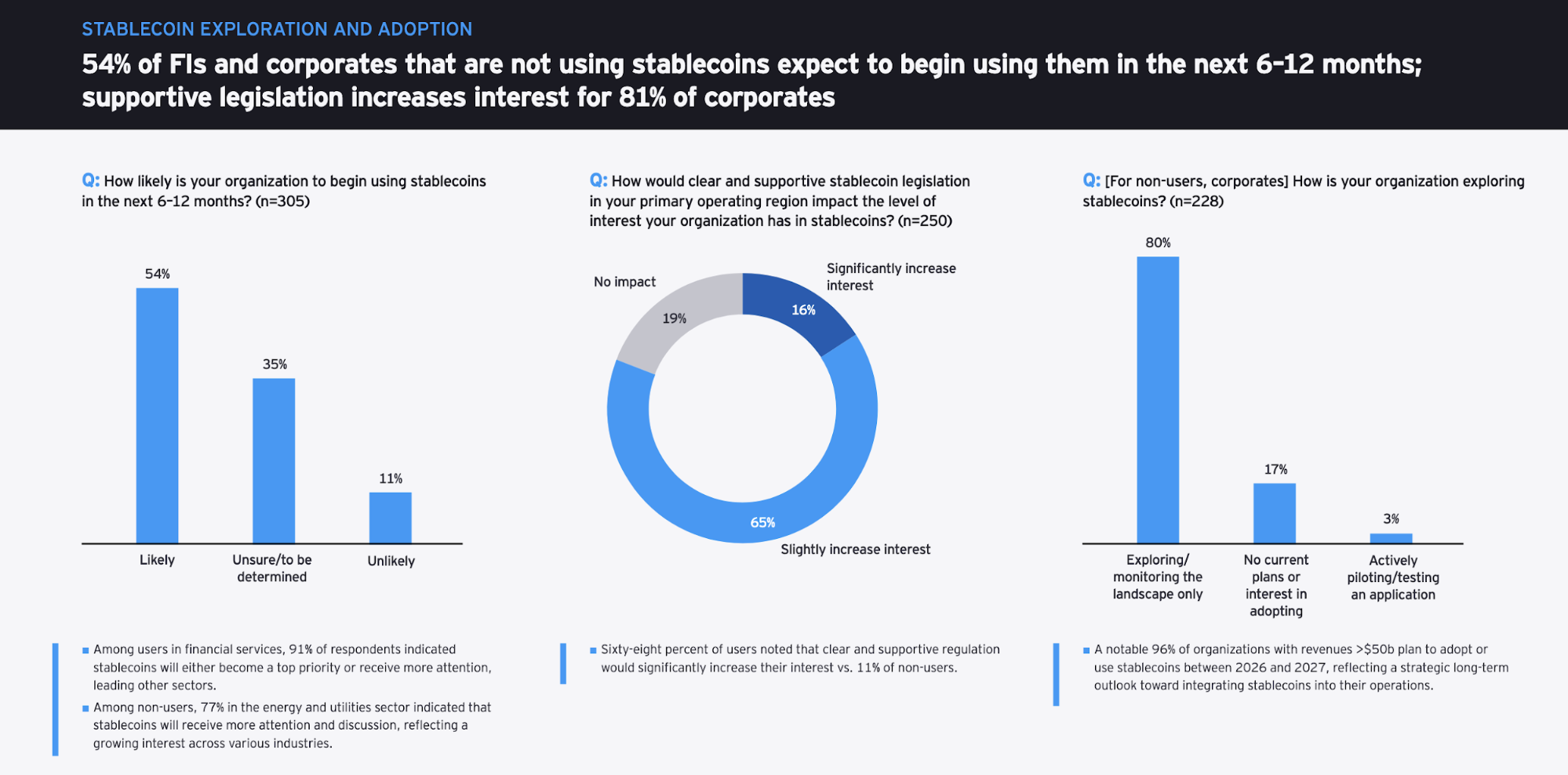

An EY-Parthenon survey of 350 executives found that 13% of companies already use stablecoins, mostly for cross-border payments. Over half of those not yet using them plan to adopt stablecoins within the next 6–12 months. Most respondents believe stablecoins will account for 5–10% of cross-border payments by 2030.

(Source: EY Parthenon report)

"Stablecoins are a catalyst for blockchain’s ChatGPT moment in institutional adoption."— Citigroup stablecoins report

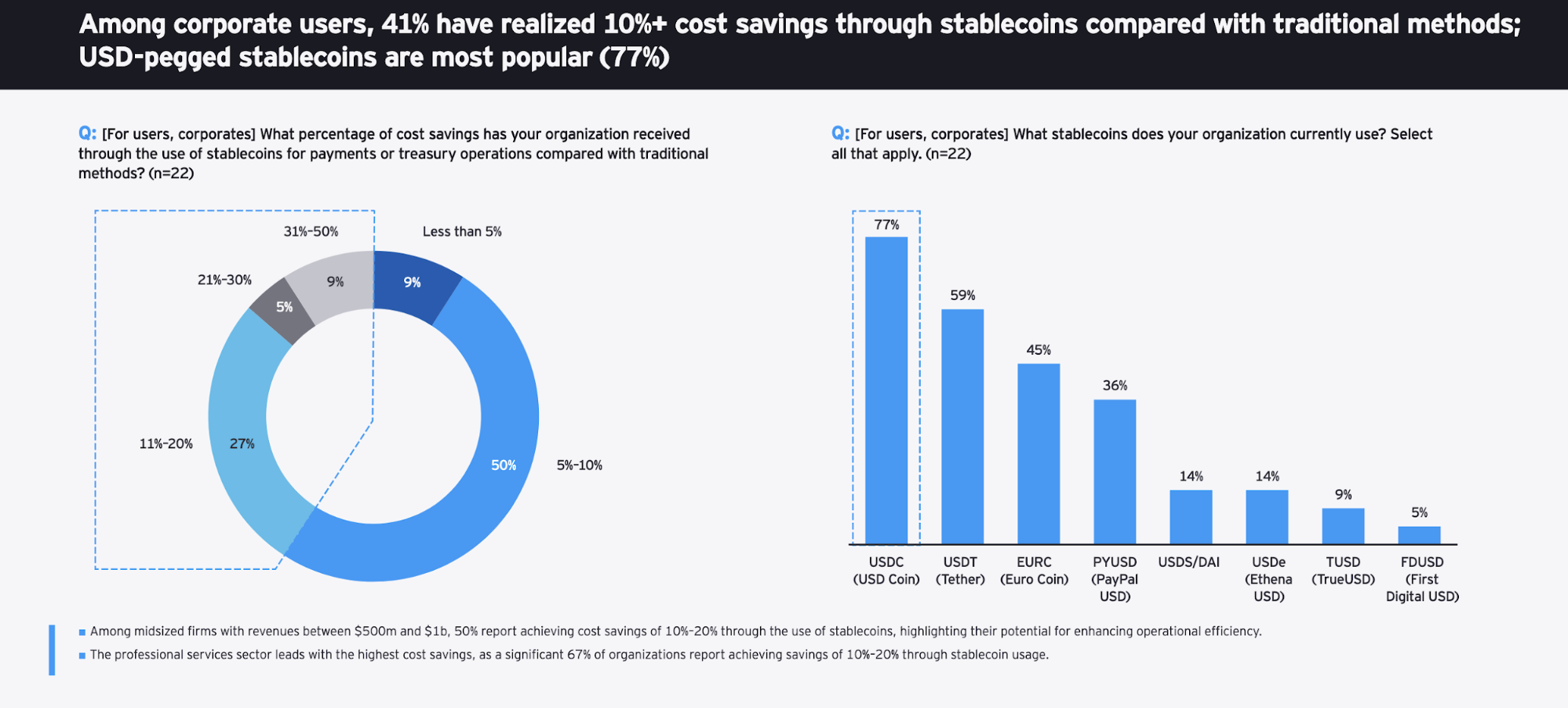

Cost savings and adoption — that's what drives implementation. Among organizations currently using stablecoins, 41% reported reducing costs by at least 10%, primarily on cross-border B2B payments in USD-denominated stablecoins.

(Source: EY Parthenon report)

Banks Launch Their Offensive

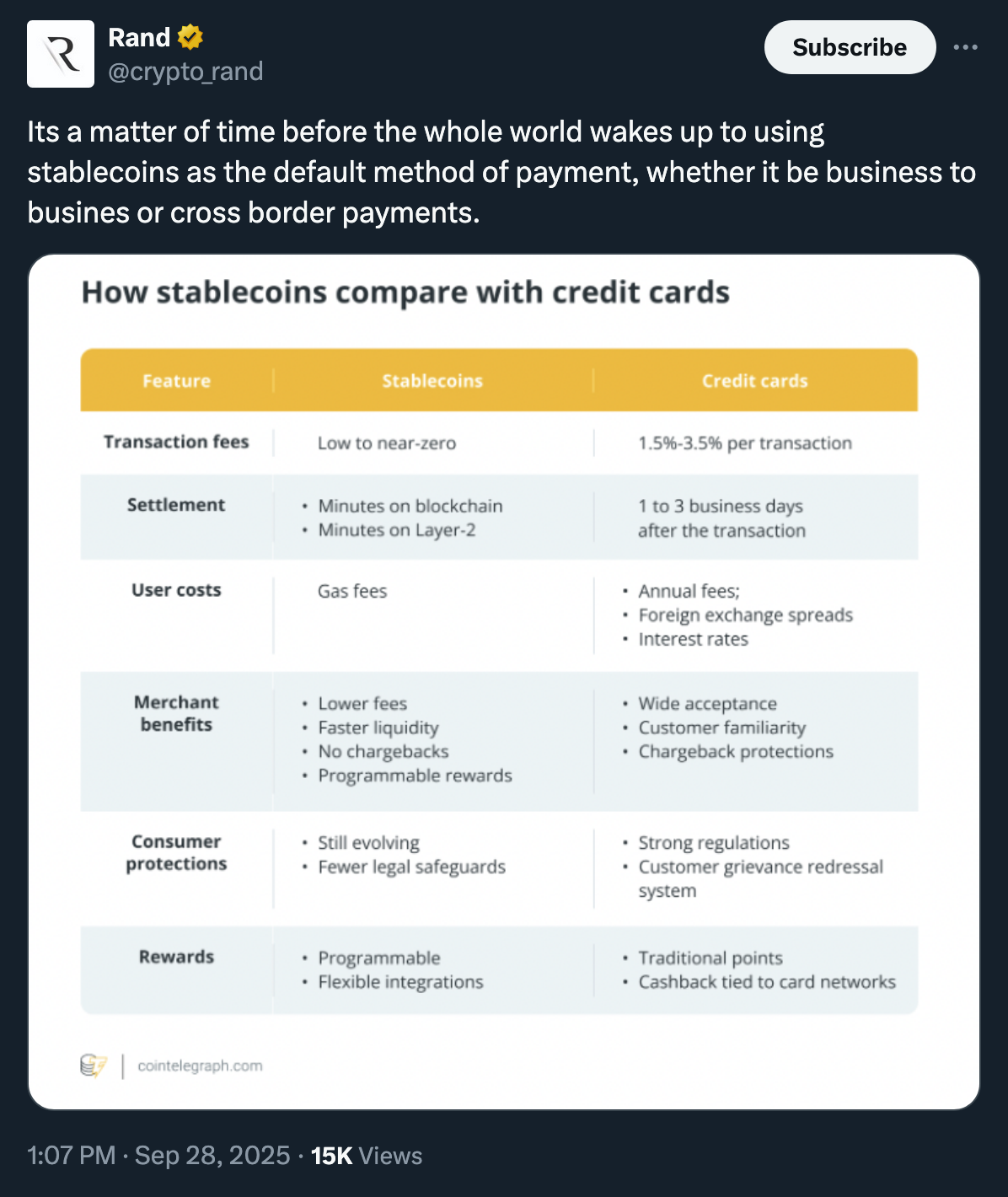

“Yes, we do want to become a super app and provide all types of financial services. We want to become people’s primary financial account and I think that crypto has a right to do that. ... Like, why are we paying two to three percent every time we swipe our credit card? It's just some bits of data flowing over the internet. It should be free or close to it. ... Ultimately, we want to be a bank replacement for people."— Coinbase CEO Brian Armstrong for Fox Business

Coinbase aims to "become a bank." But banks aren't planning to go anywhere. Instead, they've decided to "become the blockchain" themselves — and they have way more resources to achieve this.

(Source: EY Parthenon report)

Crypto-native issuers built stablecoins from the ground up, winning the market through innovation and speed. Now institutions with centuries of history are entering the scene — and they have what startups lack: global infrastructure, regulatory ties and institutional client trust. Gradually, then suddenly, they're starting to seize the initiative to stay relevant.

"We envision a multi-format, monetary ecosystem. Bank tokens... will outpace stablecoins in transaction volume by 2030."— Citigroup analyst Sophia Bantanidis at DAS London (Blockworks)

SWIFT, the backbone of global financial messaging, has taken a step toward becoming a full blockchain infrastructure provider by building a shared ledger platform for settling stablecoin and tokenized asset transactions across multiple blockchains — a major shift for a traditional financial institution with over 50 years of history, known for connecting more than 11,500 banks rather than transferring value itself.

"Is SWIFT necessary in a tokenized financial system? No, it's not — but it does have connections with virtually all global banks."— Noelle Acheson for Coindesk

SWIFT has been exploring distributed ledgers since 2017. Building its own platform is the next step in this shift. Over 30 financial institutions are already involved in the project. But SWIFT isn't alone. Major banks aren't just supporting shared infrastructure — they're actively establishing their own positions in the stablecoin market.

Citigroup invested in BVNK, a startup creating payment infrastructure for stablecoins, and is considering launching its own stablecoin. Other Wall Street giants are moving in the same direction: JPMorgan launched its JPMD token, while Bank of New York Mellon and HSBC are working on products based on tokenized deposits.

Stablecoin startups can speed up how quickly large financial and payments firms enter the market. This is partly because building proper stablecoin tech in-house can be too labor-intensive. Another reason is that stablecoin companies may already have the necessary licenses to operate in the US.

According to sources close to the market, "There's never been a better time to be selling a stablecoin startup. [...] If you can name a company in the space or tangential to the space, they are shopping around."

The Dollar Milkshake Effect

Stablecoins have moved beyond being just fiat emulators for crypto degens; now they're set to become an integral part of the global trade infrastructure.

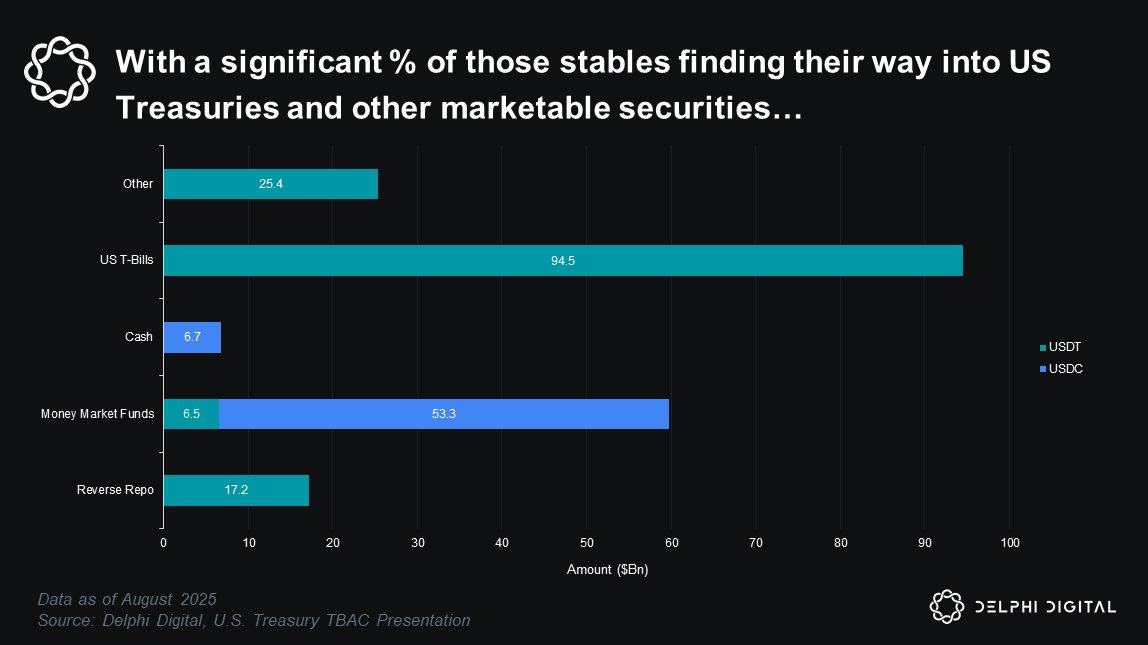

(Source: Delphi Digital)

From a geopolitical perspective, dollar-backed stablecoins naturally tend to strengthen US dollar dominance — it's the 'dollar milkshake' theory in action.

"The stablecoin growth has translated into increased demand for U.S. Treasury Bills, which back leading stablecoins. Although stablecoins’ holdings currently represent just 1.6 percent of outstanding T-bills — compared to over 40 percent held by U.S. money market funds—analysts expect this share to grow as the stablecoin market continues to mature, embedding these instruments more deeply into the traditional financial system."— Crypto-Assets Monitor report by IMF, May 2025

Source: BIS Annual Economic Report 2025, Chapter III

Many regulators in developing markets are responding by launching digital currency pilots and upgrading payment systems. Standard Chartered analysts warn: if local authorities don't adapt quickly enough, "the 'stablecoin summer' could turn into a long winter for emerging-market banks."

“We will increasingly see a bifurcated stablecoin world with regulated stablecoins serving traditional finance and permissioned products like RWA and unregulated stablecoins used for remittances and as a substitute for USD in jurisdictions with currency controls,”— Centrifuge CLO Eli Cohen for Defiant.