The Department of Justice (DOJ) has charged the Seychelles-based crypto exchange KuCoin and its founders, Chun Gan and Ke Tang, with operating an unlicensed money transmitting business and violating the Bank Secrecy Act. These allegations have raised concerns among users and investors, echoing the unease triggered by the FTX collapse.

The official press release by the Southern District of New York highlights KuCoin's failure to implement an adequate anti-money laundering program, verify customer identities, and report suspicious activities. Despite serving over 30 million customers, KuCoin is accused of not implementing a know-your-customer (KYC) or AML program until 2023 – and even then, its KYC program did not apply to existing customers.

KuCoin is accused of facilitating the transfer of over $5 billion in suspicious funds without proper due diligence. Although neither Gan nor Tang has been arrested, the charges underscore severe regulatory lapses.

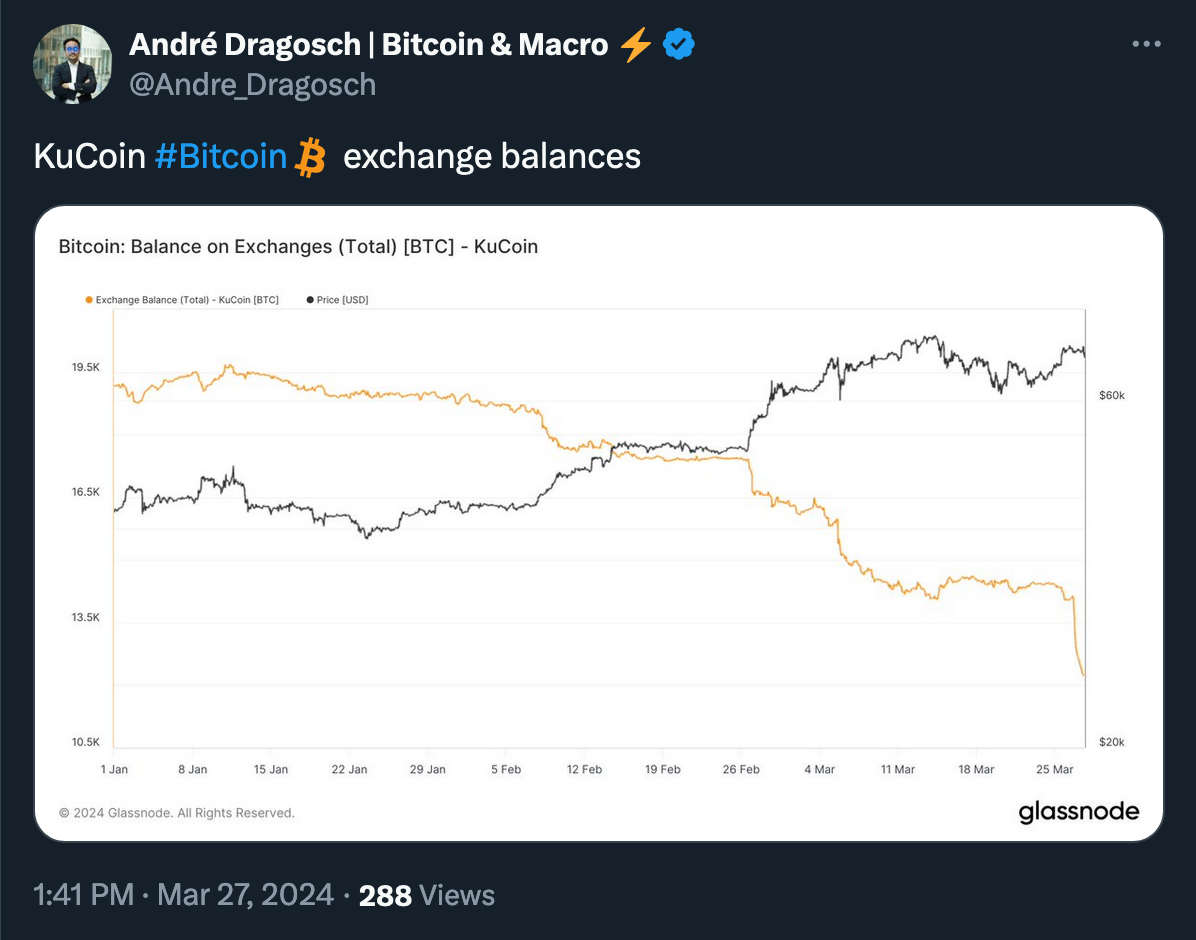

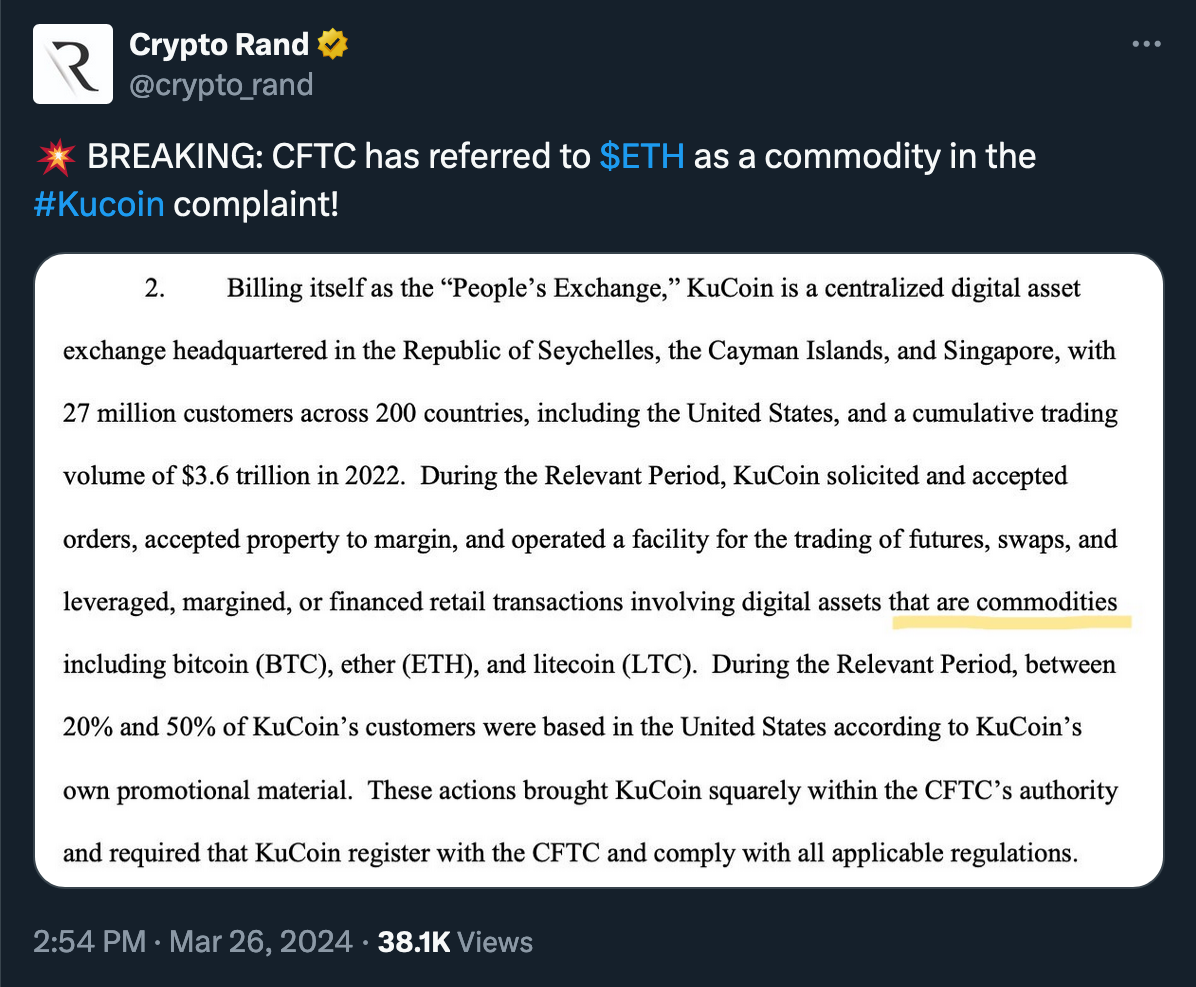

The Commodity Futures Trading Commission (CFTC) has also sued KuCoin for failing to register as a futures commission merchant, among other allegations. Following these charges, KuCoin experienced a significant withdrawal of over $1 billion in crypto over 24 hours and a 20% decrease in assets under management, as Nansen and Arkham Intelligence reported.

When comparing KuCoin's legal predicaments to those of Binance or Coinbase, it's essential to acknowledge each company's distinct legal challenges, suggesting varied outcomes. The distinct nature of the reported violations indicates that consequences will vary with each company's particular legal obstacles.

(Thread)

Although it's regrettable that exchanges face legal hurdles, these incidents are essential for regulatory bodies to enforce compliance and uphold the integrity of financial markets. These developments mark a critical moment for the cryptocurrency industry as it deals with regulatory and legal hurdles, underlining the importance of complying with established financial laws and regulations.

(Thread)

In closing, it's worth acknowledging Jake Chervinsky's emphasis on a crucial aspect of the CFTC's complaint against KuCoin. It seems like the CFTC is unequivocally expressing its stance on the nature of Ethereum to both the public and the SEC:

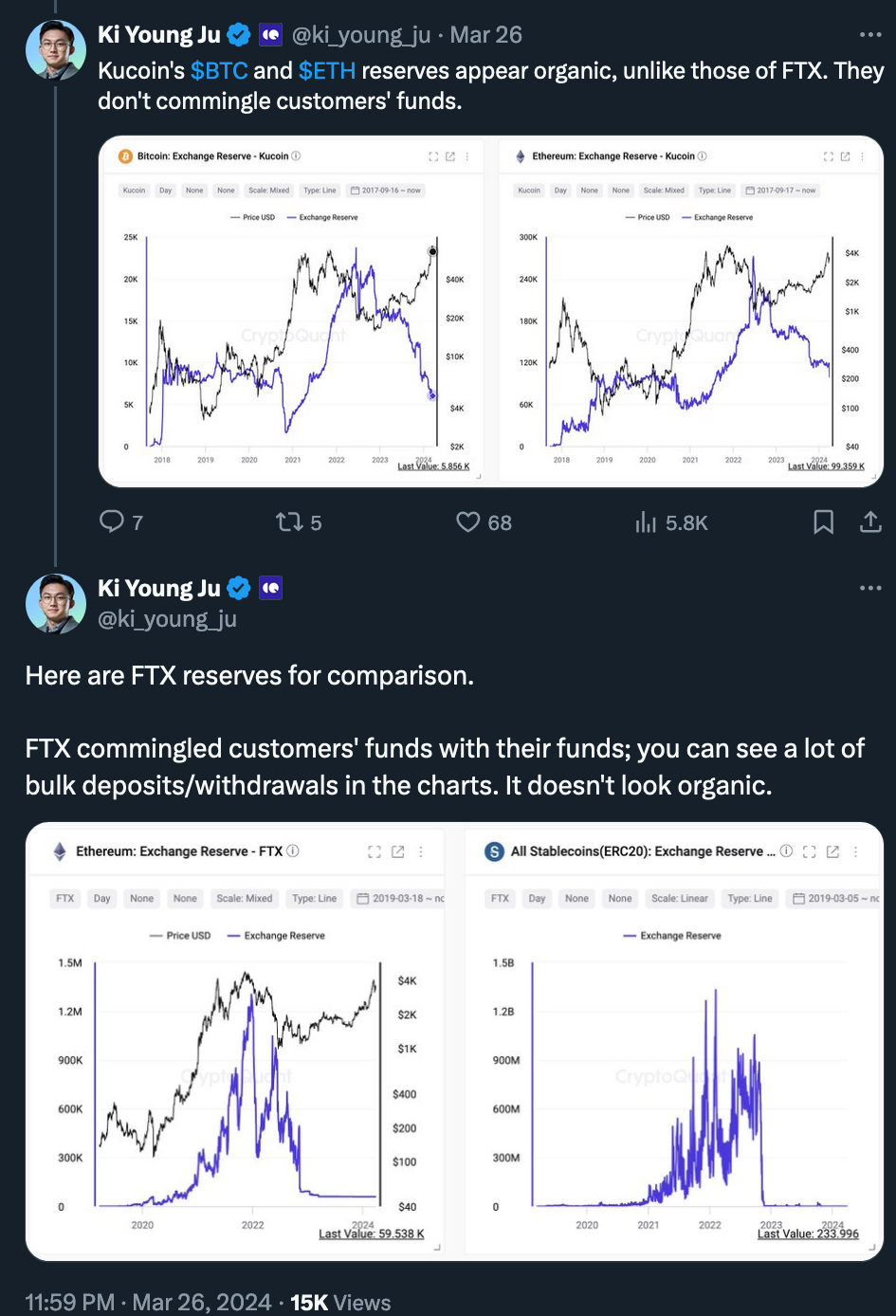

And, of course, there has never been a better time to withdraw your crypto from an exchange.

MetaTalks disclaims responsibility for any investment advice that may be contained in this article. All judgments expressed are solely the personal opinions of the author and the respondents. Any actions related to investing and trading in crypto markets involve the risk of losing funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.