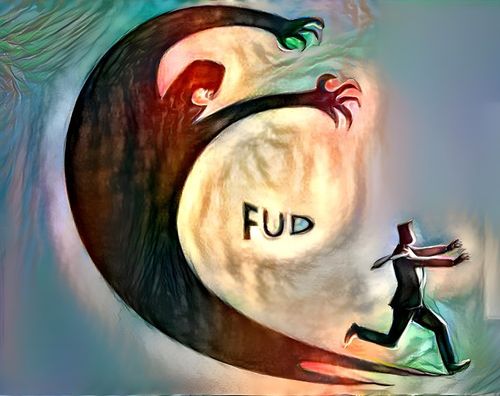

Bitcoin seems unable to overcome the pressure of bears and continues to trade near $20,000, after rumors about repayments from the defunct Mt.Gox spread on social media last week. The information about repayments was dismissed by Mt.Gox creditors, but it was no longer possible to stop bitcoin from falling down.

At the beginning of last week, many world media, including The Wall Street Journal, Investing and Capital, published articles about the forthcoming distribution of 137,000 BTC worth $3 billion to users of the bankrupt Japanese crypto exchange Mt.Gox. Although no specific dates were given in those articles, panic messages began to spread rapidly on social media stating that the distribution would start on August 28. The source of the rumors may have come from a legal filing in which the appointed rehabilitation trustee, Nobuaki Kobayashi, mentions “the end of August” as the time when payments could begin.

The panic was also fueled by alarming statements of the head of the US Federal Reserve, Jerome Powell, about a further increase in the key rate in the US. And the crypto market turned red. Investors were fearful that users of Mt.Gox would rush to sell the received coins, and that would lead to the bitcoin price crash. As a result, on August 26, bitcoin fell from $22,000 to $20,000 on a wave of fears.

The rumors were quickly dismissed. Eric Wall, a Mt.Gox creditor tweeted on August 28:

"MtGox is *NOT* distributing any coins this week, or the next week, or the week after that. Source: I'm a MtGox creditor. The repayment system is not live yet."

PSA: MtGox is *NOT* distributing any coins this week, or the next week, or the week after that.

— Erica Wall (X🏴, X🏴) (@ercwl) August 27, 2022

Source: I’m a MtGox creditor. The repayment system is not live yet.

Next step: Go and block @TheAltcoinHub for spreading this misinfo.

According to Wall, users haven't even given details as to which wallets they would like to receive funds. He also added that payments will be made in tranches, not a single payment. This will ease the pressure on the crypto market.

However, users noticed that on August 28 and 29, 10,000 BTC associated with Mt.Gox started to move. This only increased the panic. Some investors supposed that these coins were moved in the framework of the repayment plan to Mt.Gox users. And bitcoin lost its last chance to quickly recover.

However, later the GFiS Telegram channel reported that, apparently, these 10,000 BTC were stolen from Mt.Gox in the summer of 2011. And the traces of the hackers led to another - also defunct and infamous - BTC-e crypto exchange, whose administrator, Alexander Vinnik, a native of Russia, was arrested in Greece in 2017 at the request of the US authorities. Five years later, Vinnik was extradited to the United States, where he is accused of laundering multibillion criminal proceeds through cryptocurrencies.

"The visualization of the blockchain clearly shows that the wallet (1McU8D7g) appeared in each of the transaction chains associated with both withdrawals, received a large amount (134k BTC) from GOX, just at the time of the described events.

And, as we remember, the founders of the later BTC-E exchange, and later WEX, were also suspected of the subsequent hacker attack."