The Ethereum Foundation, the group responsible for Ethereum’s development, fell victim to a “sandwich attack,” transferring 1,700 Ethereum, worth $2.76 million, to a decentralized exchange for sale. While the amount is magnitudes smaller than previous transfers, historically, such Ethereum Foundation moves have typically been bearish.

The transaction of the Ethereum Foundation was intercepted by a Maximal Extractable Value (MEV) bot designed to maximize profits from transaction fees. In what’s known as a sandwich attack, these bots front-run other network users by placing two transactions — one right before and one right after — the target transaction, which gets sandwiched between them. In that way, the bot inflated the cost that the Ethereum Foundation had to pay for its transaction.

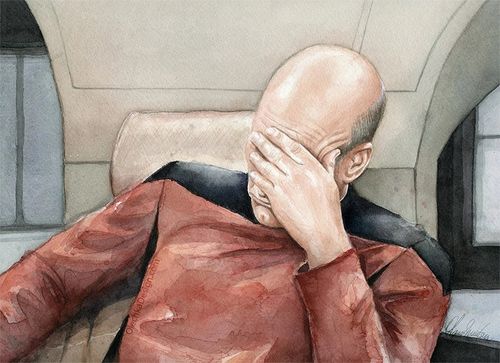

The fact of a sandwich attack on the Ethereum Foundation has elicited mixed reactions within the crypto community, with some viewing it as a form of payback for the heavy downward pressure the Foundation has previously exerted on Ethereum’s market value. Although the scale of this ‘payback’ doesn’t compare in any way to the magnitude of that supposed downward pressure:

Nonetheless, whenever the Ethereum Foundation has offloaded large amounts of ETH, it has typically been followed by a significant market downturn — partly due to the increased selling pressure on ETH price, which often led to local tops and a persistent downtrend.